Key Insights

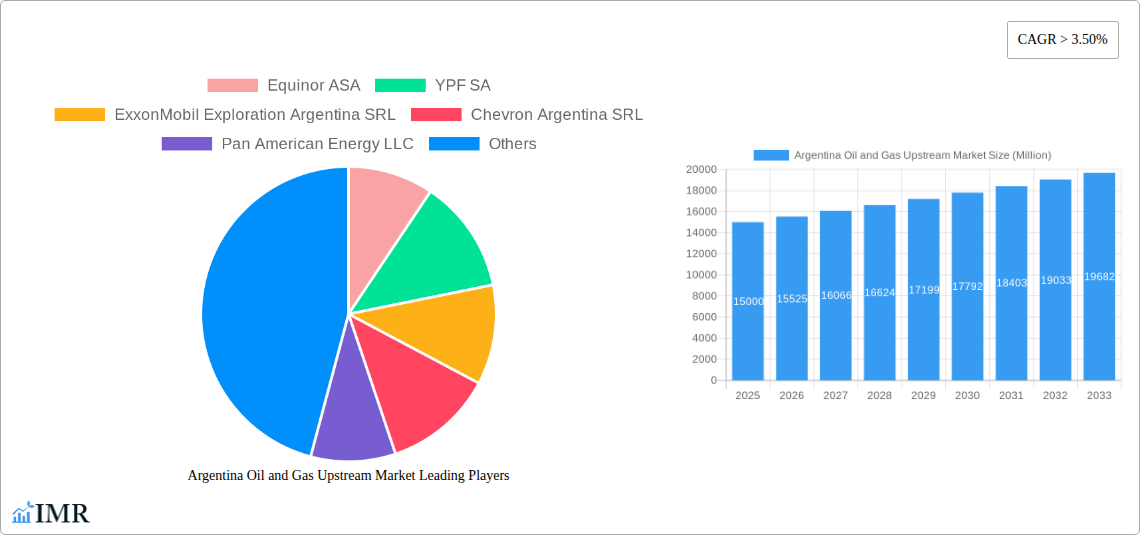

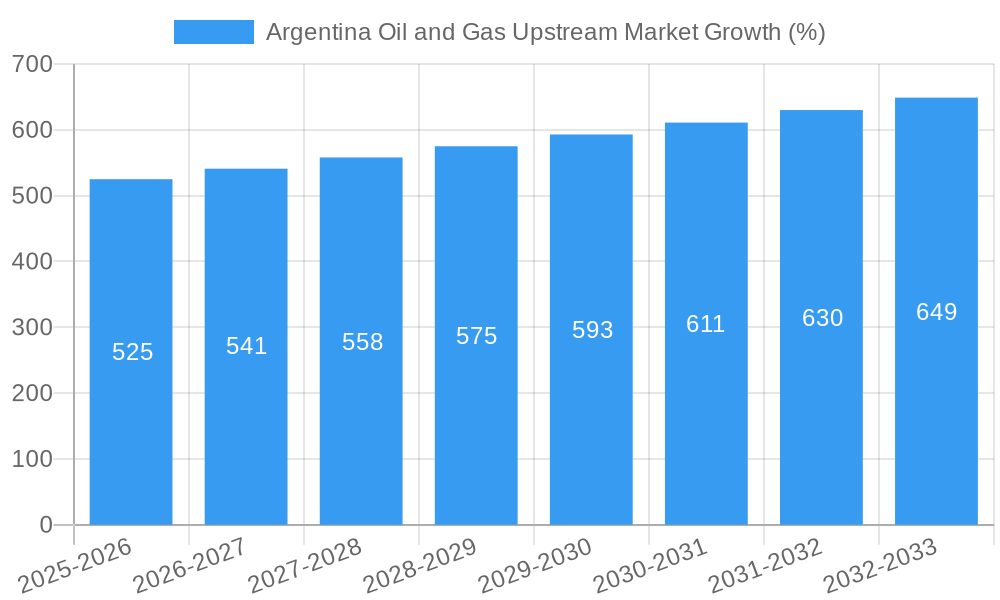

The Argentina Oil and Gas Upstream Market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is driven primarily by increasing domestic energy demand fueled by economic growth and industrialization. Furthermore, ongoing exploration activities targeting both conventional and unconventional oil and natural gas reserves, particularly in shale formations, contribute significantly to the market's dynamism. Government incentives aimed at attracting foreign investment and fostering technological advancements in extraction techniques further bolster market prospects. However, the market faces challenges including regulatory complexities, infrastructure limitations, and potential volatility in global oil and gas prices. The segment breakdown reveals substantial contributions from both conventional and unconventional oil production, with power generation and industrial use as major end-use applications. Key players like Equinor ASA, YPF SA, ExxonMobil, and Chevron are actively shaping the market landscape through their exploration, production, and investment activities.

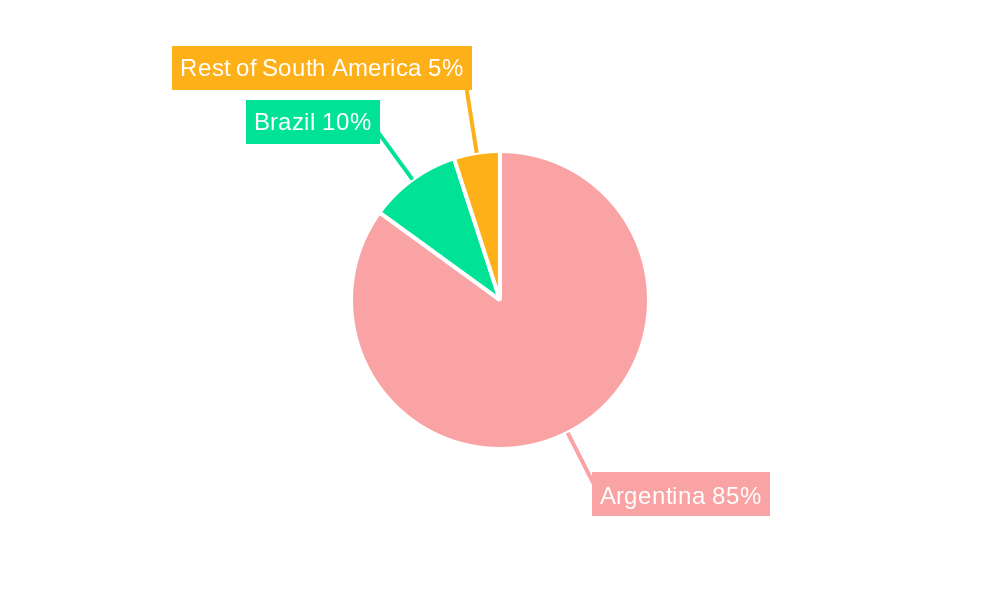

The South American region, particularly Argentina, is strategically important due to its considerable reserves and ongoing efforts to modernize its energy infrastructure. The market segmentation by resource type (conventional oil, unconventional oil, natural gas) and end-use application (power generation, industrial use, transportation) provides a detailed understanding of market dynamics and opportunities. The historical period (2019-2024) serves as a valuable benchmark for analyzing past performance and trends, informing projections for the forecast period (2025-2033). Competition among major international and national oil and gas companies is fierce, with each player striving to optimize its operations and expand its market share. Future growth will likely be influenced by government policies, technological breakthroughs, and global economic conditions.

Argentina Oil and Gas Upstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Argentina oil and gas upstream market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and incorporates expert insights to provide a robust understanding of this dynamic market. The parent market is the broader Argentinian energy sector, while the child market focuses specifically on upstream activities.

Argentina Oil and Gas Upstream Market Dynamics & Structure

The Argentinian oil and gas upstream market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is moderate, with a few major international and domestic players holding significant market share. YPF SA holds the largest share, followed by companies like Equinor ASA, ExxonMobil Exploration Argentina SRL, and Chevron Argentina SRL. However, the presence of numerous smaller independent operators contributes to a relatively competitive landscape. Technological innovation, particularly in unconventional resource extraction (Vaca Muerta shale formation), is a key driver, while regulatory frameworks and government policies play a crucial role in shaping investment and production levels. Substitutes, primarily renewable energy sources, are gaining traction, albeit slowly, posing long-term challenges to conventional oil and gas production. M&A activity has been moderate in recent years, primarily involving smaller companies.

- Market Concentration: Moderate, with YPF SA holding a leading position.

- Technological Innovation: Focused on unconventional resources (e.g., Vaca Muerta shale).

- Regulatory Framework: Government policies impact investment and production.

- Competitive Substitutes: Renewable energy sources are emerging as competitors.

- M&A Activity: Moderate levels, primarily involving smaller players; xx deals in the past 5 years.

- End-User Demographics: Primarily focused on domestic energy consumption and export markets.

Argentina Oil and Gas Upstream Market Growth Trends & Insights

The Argentinian oil and gas upstream market is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Increased investment in unconventional resources, particularly in the Vaca Muerta shale formation, is a significant contributor. Government incentives and supportive regulatory measures are also bolstering exploration and production activities. However, fluctuating global oil and gas prices and macroeconomic instability present challenges to sustained growth. Technological advancements, such as improved drilling techniques and enhanced oil recovery methods, are enhancing efficiency and increasing production yields. Market penetration of unconventional resources is expected to increase substantially, while the adoption of new technologies is projected at xx% by 2033.

Dominant Regions, Countries, or Segments in Argentina Oil and Gas Upstream Market

The Vaca Muerta shale formation in Neuquén province is the dominant region driving growth in the Argentinian oil and gas upstream market. This area holds substantial reserves of unconventional oil and gas, attracting significant investment and production activity. Unconventional oil and natural gas are the key segments driving growth, surpassing conventional oil production in terms of volume and investment. The industrial and power generation sectors are major end-use applications, with transportation accounting for a xx% share.

- Vaca Muerta Shale Formation (Neuquén Province): Key driver due to large unconventional reserves.

- Unconventional Oil & Gas: Fastest-growing segments, surpassing conventional oil.

- Industrial and Power Generation: Major end-use applications.

- Economic Policies: Government incentives and investment promotion schemes supporting growth.

- Infrastructure Development: Ongoing improvements in infrastructure supporting production and transportation.

Argentina Oil and Gas Upstream Market Product Landscape

The Argentinian oil and gas upstream market showcases a range of products and services, including advanced drilling technologies, enhanced oil recovery techniques, and sophisticated exploration methodologies. Product innovation focuses on improving efficiency, reducing environmental impact, and optimizing resource extraction from unconventional reservoirs. The emphasis on technologically advanced equipment and processes is a key selling proposition in attracting investment and fostering competition.

Key Drivers, Barriers & Challenges in Argentina Oil and Gas Upstream Market

Key Drivers:

- Increased investment in Vaca Muerta.

- Government support for unconventional resource development.

- Technological advancements in exploration and production.

Key Barriers & Challenges:

- Macroeconomic instability and inflation affecting investment decisions.

- Fluctuations in global oil and gas prices impacting profitability.

- Regulatory hurdles and bureaucratic processes slowing down project approvals. This adds approximately xx Million USD in annual project delays.

- Supply chain constraints affecting access to essential equipment and materials.

Emerging Opportunities in Argentina Oil and Gas Upstream Market

Emerging opportunities include further exploration and development of the Vaca Muerta shale formation, expansion into offshore exploration, and adoption of carbon capture and storage technologies to mitigate environmental impact. The growth of renewable energy sources presents both a challenge and an opportunity for diversification and integration of resources. Focusing on technological innovation and creating strategic partnerships are key to seizing these opportunities.

Growth Accelerators in the Argentina Oil and Gas Upstream Market Industry

Long-term growth will be accelerated by continued investment in exploration and production technologies, strategic partnerships between international and domestic companies, and a stable macroeconomic environment. The successful implementation of government policies aimed at boosting investment and improving infrastructure will be crucial for sustaining growth in the long term. Efficient management of resources and environmental considerations are vital for responsible development.

Key Players Shaping the Argentina Oil and Gas Upstream Market Market

- Equinor ASA

- YPF SA

- ExxonMobil Exploration Argentina SRL

- Chevron Argentina SRL

- Pan American Energy LLC

- Techint Group

- TotalEnergies SE

- Tullow Oil PLC

Notable Milestones in Argentina Oil and Gas Upstream Market Sector

- October 2022: Vista Energy and Trafigura Argentina invest USD 150 million in Vaca Muerta.

- September 2022: TotalEnergies approves USD 706 million FID for Fenix gas development project.

In-Depth Argentina Oil and Gas Upstream Market Market Outlook

The Argentinian oil and gas upstream market holds significant long-term growth potential, driven by the vast reserves in the Vaca Muerta formation and ongoing technological advancements. Strategic partnerships, efficient resource management, and a supportive regulatory environment are crucial for realizing this potential. The market's future trajectory will depend on navigating the challenges of macroeconomic instability and global energy market fluctuations. Successful exploitation of Vaca Muerta and strategic diversification will be key factors shaping future growth.

Argentina Oil and Gas Upstream Market Segmentation

- 1. Onshore

- 2. Offshore

Argentina Oil and Gas Upstream Market Segmentation By Geography

- 1. Argentina

Argentina Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Brazil Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Equinor ASA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 YPF SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ExxonMobil Exploration Argentina SRL

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Chevron Argentina SRL

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Pan American Energy LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Techint Group*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 TotalEnergies SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tullow Oil PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Equinor ASA

List of Figures

- Figure 1: Argentina Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2019 & 2032

- Table 5: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2019 & 2032

- Table 7: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 9: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 11: Brazil Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 13: Argentina Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 17: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 18: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2019 & 2032

- Table 19: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 20: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2019 & 2032

- Table 21: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Oil and Gas Upstream Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Argentina Oil and Gas Upstream Market?

Key companies in the market include Equinor ASA, YPF SA, ExxonMobil Exploration Argentina SRL, Chevron Argentina SRL, Pan American Energy LLC, Techint Group*List Not Exhaustive, TotalEnergies SE, Tullow Oil PLC.

3. What are the main segments of the Argentina Oil and Gas Upstream Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, Vista Energy and Trafigura Argentina announced that the companies would invest around USD 150 million into the Vaca Muerta Shale formation. This announcement comes after the companies formed a joint venture in 2021 to jointly develop 20 wells in Vista's main oil development concessions in Vaca Muerta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Argentina Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence