Key Insights

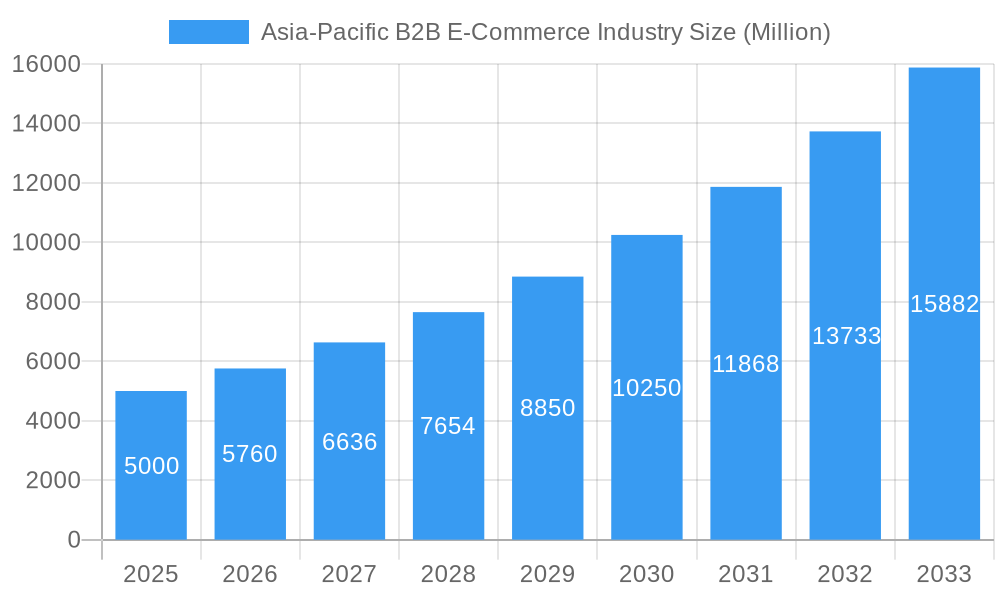

The Asia-Pacific B2B e-commerce market is experiencing robust growth, projected to reach a significant size driven by increasing internet and smartphone penetration, coupled with the region's burgeoning digital economy. The 15.20% CAGR from 2019 to 2024 indicates a strong upward trajectory, likely fueled by factors like improved logistics infrastructure, government initiatives promoting digitalization, and the growing adoption of e-procurement solutions by businesses of all sizes. Key drivers include the rising preference for efficient and transparent procurement processes, the need to access wider supplier networks, and the cost-effectiveness of online transactions compared to traditional methods. The market is segmented by sales channels, with direct sales and marketplace sales representing significant segments. Major players like Alibaba, Amazon, and Flipkart, alongside regional giants like IndiaMart, are actively shaping the market landscape through innovative platforms and services. The competitive intensity is high, driving innovation in areas such as payment gateways, logistics, and customer service. While challenges remain – including digital literacy gaps in some regions and cybersecurity concerns – the overall outlook for the Asia-Pacific B2B e-commerce market remains positive.

Asia-Pacific B2B E-Commerce Industry Market Size (In Billion)

Growth is particularly pronounced in countries like China, India, and Japan, reflecting their substantial economic activity and technological advancement. The "Rest of Asia-Pacific" segment also demonstrates significant potential, as smaller economies embrace digital transformation. Market trends indicate a shift toward mobile commerce, the increasing integration of artificial intelligence and machine learning for better decision-making and customer experiences, and a growing demand for specialized B2B e-commerce solutions tailored to specific industries. The focus on enhancing cybersecurity and data privacy is also becoming increasingly important, reflecting both regulatory changes and user concerns. Future growth will depend on continued investment in digital infrastructure, the expansion of reliable payment systems, and successful addressing of potential regulatory hurdles. The forecast period (2025-2033) promises further expansion, with the market likely benefiting from sustained economic growth and technological innovation across the Asia-Pacific region.

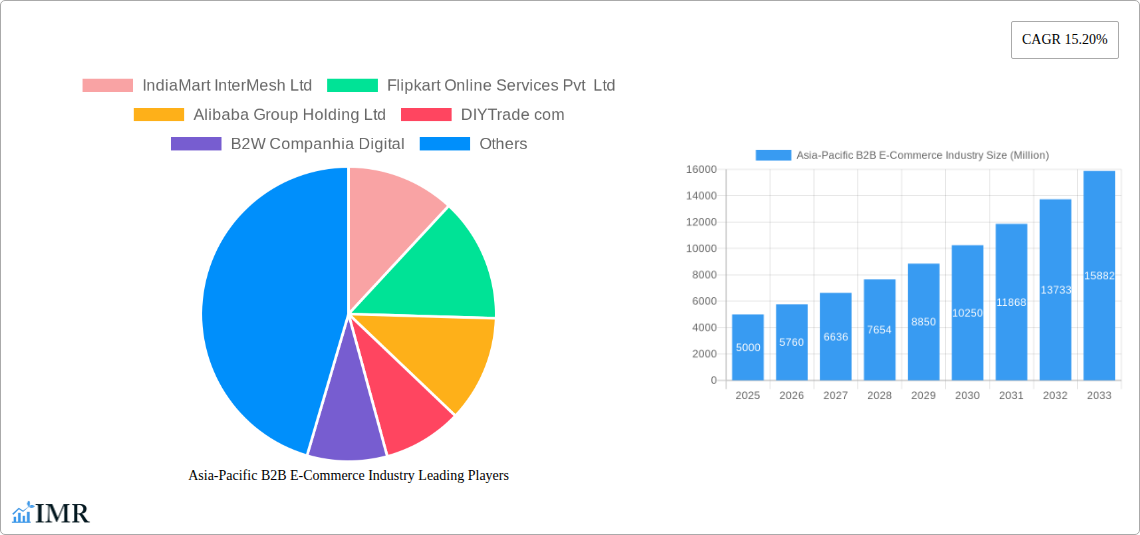

Asia-Pacific B2B E-Commerce Industry Company Market Share

Asia-Pacific B2B E-Commerce Industry: Market Dynamics, Growth & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific B2B e-commerce market, covering market size, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for businesses operating or planning to enter this dynamic market. The report uses Million units as its value unit.

Asia-Pacific B2B E-Commerce Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the Asia-Pacific B2B e-commerce sector. The analysis covers market concentration, highlighting the dominance of key players like Alibaba Group Holding Ltd and Amazon.com Inc, and examining the impact of mergers and acquisitions (M&A) activity. Technological innovation, including the rise of AI-powered platforms and improved logistics, is explored, along with the evolving regulatory frameworks across different Asian countries. The analysis considers the impact of substitute products and services, and how end-user demographics (e.g., SMEs vs. large enterprises) shape market demand.

- Market Concentration: Alibaba and Amazon hold a combined xx% market share in 2025, while regional players like IndiaMart InterMesh Ltd control xx% in their respective markets.

- M&A Activity: The Asia-Pacific region witnessed xx M&A deals in the B2B e-commerce sector between 2019 and 2024, driven primarily by consolidation and expansion strategies.

- Technological Innovation: Adoption of AI-powered recommendation engines and blockchain technology for secure transactions is accelerating.

- Regulatory Landscape: Varying data privacy regulations and cross-border trade policies across countries present both opportunities and challenges.

- Competitive Substitutes: Traditional wholesale channels and physical marketplaces remain significant competitive forces, although their share is gradually declining.

Asia-Pacific B2B E-Commerce Industry Growth Trends & Insights

This section delves into the historical and projected growth trajectory of the Asia-Pacific B2B e-commerce market. Using detailed data analysis and market forecasts, the report provides insights into market size evolution, adoption rates across various segments, and the disruptive influence of technology on business models. Consumer behavior shifts, driven by factors such as increasing internet penetration and digital literacy, are also analyzed. Key metrics like Compound Annual Growth Rate (CAGR) and market penetration rates are presented to provide a granular understanding of market dynamics. The report leverages extensive secondary research and data to deliver this comprehensive analysis. The forecast suggests a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million units by 2033. Market penetration is expected to reach xx% by 2033. Key drivers include expanding digital infrastructure, increasing government support for digitalization, and the growing preference for online procurement among businesses.

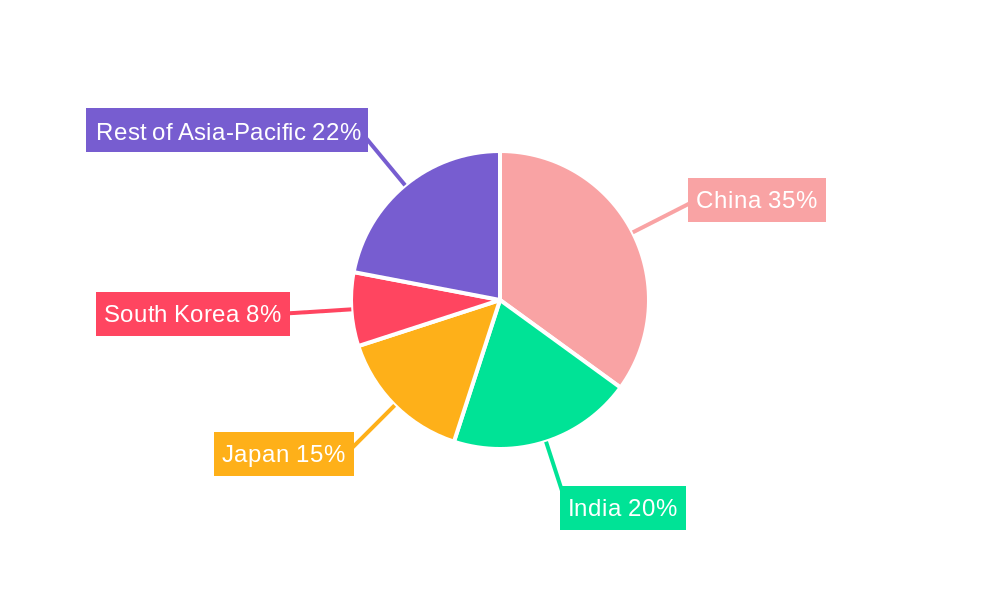

Dominant Regions, Countries, or Segments in Asia-Pacific B2B E-Commerce Industry

This section identifies the leading regions, countries, and market segments (Direct Sales and Marketplace Sales) within the Asia-Pacific B2B e-commerce landscape. Detailed analysis reveals the factors contributing to their dominance, including economic policies favoring e-commerce, robust digital infrastructure, and the presence of strong local players. The report utilizes market share data and growth potential projections to highlight the leading regions and segments.

- Dominant Region: China and India are the dominant regions, accounting for xx% and xx% of the market, respectively, in 2025.

- Dominant Segment: Marketplace Sales is the dominant channel, accounting for xx% of the market, while Direct Sales represents xx%.

- Key Drivers: Strong government support for digital infrastructure and favorable economic policies significantly contributed to the growth in China and India.

Asia-Pacific B2B E-Commerce Industry Product Landscape

This section offers a concise overview of the product landscape within the Asia-Pacific B2B e-commerce industry. It explores product innovations, their applications, and key performance indicators (KPIs). The report focuses on unique selling propositions (USPs) and technological advancements that are shaping the market. This includes advancements such as AI-driven pricing optimization, personalized recommendations, and improved supply chain visibility through blockchain technology.

Key Drivers, Barriers & Challenges in Asia-Pacific B2B E-Commerce Industry

This section identifies both the opportunities and challenges facing growth in this sector.

Key Drivers:

- Increasing internet and smartphone penetration.

- Growing adoption of digital technologies by businesses.

- Government initiatives promoting e-commerce.

Key Barriers & Challenges:

- Cybersecurity threats and data breaches.

- Logistics and delivery infrastructure limitations in certain regions.

- Lack of digital literacy among some businesses.

- Intense competition from established players.

Emerging Opportunities in Asia-Pacific B2B E-Commerce Industry

This section highlights emerging trends and opportunities for growth in untapped markets and new applications for technology, including the increasing demand for specialized B2B e-commerce solutions tailored to specific industries, the potential of cross-border B2B e-commerce in the region, and the growing adoption of innovative technologies such as augmented reality (AR) and virtual reality (VR) for product visualization and customer engagement.

Growth Accelerators in the Asia-Pacific B2B E-Commerce Industry Industry

Technological breakthroughs, such as the improved speed and efficiency of digital payment systems, the development of more sophisticated supply chain management tools, and the use of AI-powered analytics to forecast demand and optimize pricing strategies are key factors in fostering long-term growth. Strategic partnerships between e-commerce platforms and logistics providers, alongside the expansion of e-commerce platforms into new geographic markets, are further contributing to market growth.

Key Players Shaping the Asia-Pacific B2B E-Commerce Industry Market

- IndiaMart InterMesh Ltd

- Flipkart Online Services Pvt Ltd

- Alibaba Group Holding Ltd

- DIYTrade com

- B2W Companhia Digital

- KOMPASS

- ChinaAseanTrade com

- Amazon com Inc

- EWORLDTRADE Inc

- eBay Inc

Notable Milestones in Asia-Pacific B2B E-Commerce Industry Sector

- June 2022: Vertiv launched its official store on Tokopedia, expanding its reach in Southeast Asia.

- June 2022: Ramagya Mart added home appliance categories to its B2B e-commerce platform, onboarding 900 manufacturers.

In-Depth Asia-Pacific B2B E-Commerce Industry Market Outlook

The Asia-Pacific B2B e-commerce market is poised for continued robust growth, driven by increasing digitalization, supportive government policies, and the expanding adoption of innovative technologies. Strategic investments in infrastructure, coupled with the ongoing development of advanced e-commerce solutions, will further unlock significant market potential. The increasing demand for seamless cross-border e-commerce transactions presents a particularly compelling opportunity for businesses to expand their reach and capture a greater market share.

Asia-Pacific B2B E-Commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Regional Market Share

Geographic Coverage of Asia-Pacific B2B E-Commerce Industry

Asia-Pacific B2B E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Advancement in Technologies Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Rest of APAC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Direct Sales

- 8.1.2. Marketplace Sales

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Direct Sales

- 9.1.2. Marketplace Sales

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Rest of APAC Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Direct Sales

- 10.1.2. Marketplace Sales

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IndiaMart InterMesh Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flipkart Online Services Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alibaba Group Holding Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DIYTrade com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B2W Companhia Digital

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KOMPASS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ChinaAseanTrade com

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amazon com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EWORLDTRADE Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 eBay Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IndiaMart InterMesh Ltd

List of Figures

- Figure 1: Asia-Pacific B2B E-Commerce Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific B2B E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 2: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 5: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 8: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 11: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 14: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 17: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific B2B E-Commerce Industry?

The projected CAGR is approximately 15.2%.

2. Which companies are prominent players in the Asia-Pacific B2B E-Commerce Industry?

Key companies in the market include IndiaMart InterMesh Ltd, Flipkart Online Services Pvt Ltd, Alibaba Group Holding Ltd, DIYTrade com, B2W Companhia Digital, KOMPASS, ChinaAseanTrade com, Amazon com Inc, EWORLDTRADE Inc, eBay Inc.

3. What are the main segments of the Asia-Pacific B2B E-Commerce Industry?

The market segments include Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support.

6. What are the notable trends driving market growth?

Advancement in Technologies Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

June 2022 - Vertiv, a provider of critical digital infrastructure and continuity solutions, announced opening its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia, reaching more customers looking to buy small to medium-sized uninterruptible power supply (UPS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific B2B E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific B2B E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific B2B E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific B2B E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence