Key Insights

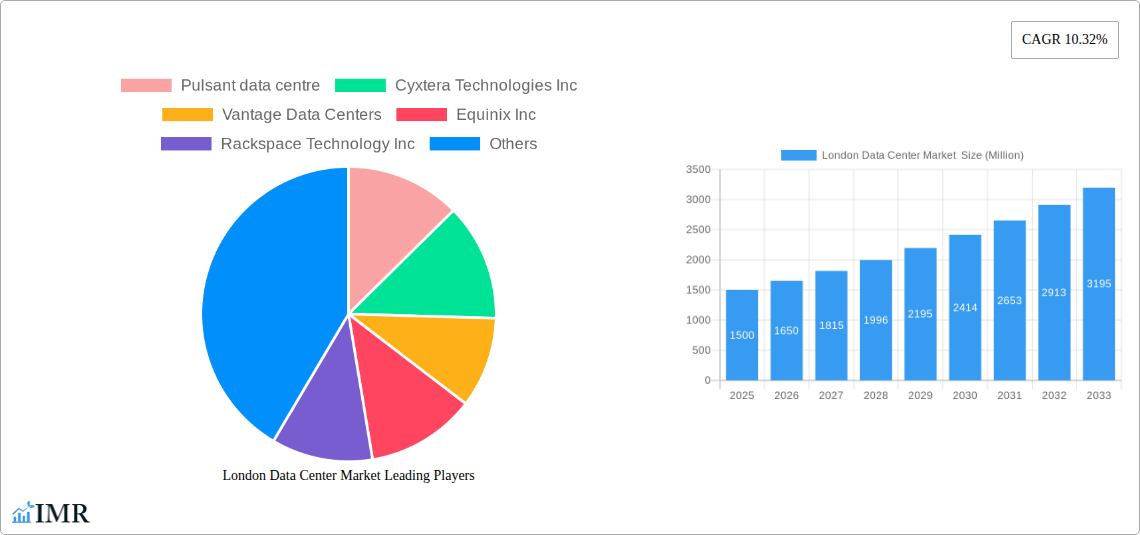

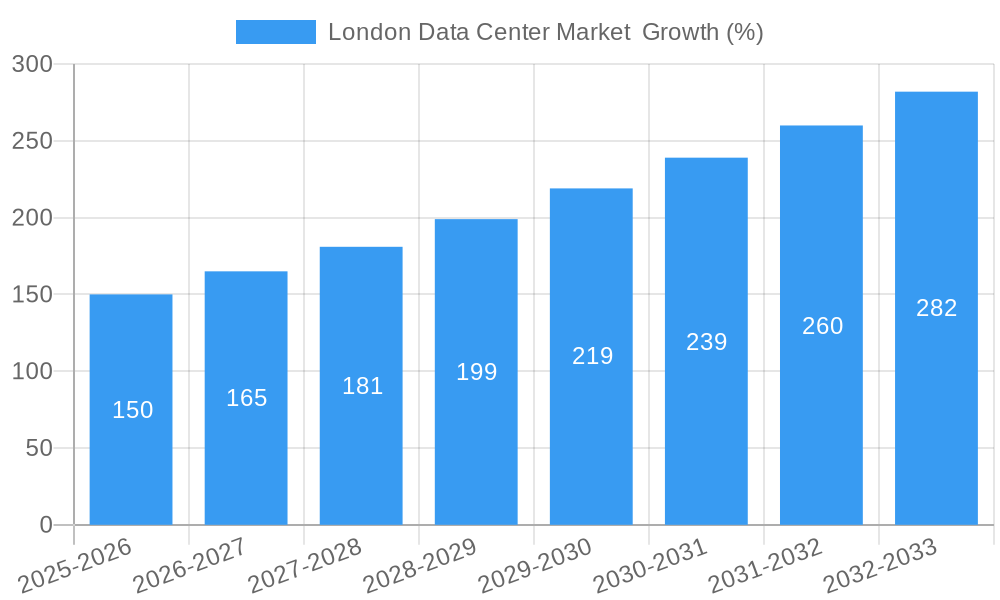

The London data center market is experiencing robust growth, fueled by increasing demand for cloud services, the rise of big data analytics, and the expanding digital economy. The market's compound annual growth rate (CAGR) of 10.32% from 2019 to 2024 suggests a significant expansion, and this trajectory is expected to continue through 2033. Several key drivers contribute to this growth. Firstly, London's established position as a global financial hub and a major center for technology and media companies creates a high concentration of data center users. Secondly, robust government investment in digital infrastructure and favorable regulatory policies are encouraging further development. Thirdly, the increasing adoption of hyperscale data centers by major cloud providers is a significant driver of market expansion. Segmentation analysis reveals a strong presence of large and mega data centers, indicating a preference for substantial capacity and scalability among businesses. The wholesale colocation segment is likely dominant, given the scale of operations of many London-based organizations. While challenges exist, such as limited energy resources and land availability, the strategic importance of London in global connectivity and its skilled workforce mitigate these constraints.

The competitive landscape is characterized by a mix of global giants like Equinix and Digital Realty, alongside regional players like Pulsant and Kao Data. This competition fosters innovation and keeps pricing competitive. The market is segmented by data center size (small to mega), tier type (Tier 1-4), absorption rate (utilized vs. non-utilized), colocation type (retail, wholesale, hyperscale), and end-user industry. While precise figures for each segment are unavailable, it's plausible to assume a significant proportion of the market is occupied by large and mega data centers serving the finance, cloud & IT, and media & entertainment sectors. Future growth hinges on addressing sustainability concerns through the adoption of green energy solutions and optimizing energy efficiency. Further expansion is likely to focus on optimizing infrastructure to meet the surging demand for edge computing and 5G network deployments.

London Data Center Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the London data center market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by DC size (Small, Medium, Large, Mega, Massive), Tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (Utilized, Non-Utilized), colocation type (Retail, Wholesale, Hyperscale), and end-user (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other).

London Data Center Market Dynamics & Structure

The London data center market is characterized by a high level of concentration among key players, alongside considerable technological innovation and evolving regulatory frameworks. The market witnesses continuous M&A activity, shaping the competitive landscape. The report analyzes these factors, providing quantitative data on market share and M&A deal volumes, alongside qualitative assessments of innovation barriers and competitive dynamics. The total market size in 2025 is estimated at xx Million.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on increased energy efficiency, AI-driven management systems, and edge computing are key drivers.

- Regulatory Framework: Stringent data privacy regulations and environmental concerns influence data center development and operations.

- Competitive Substitutes: Cloud services and distributed computing pose a competitive threat, though colocation remains vital.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024, with a projected increase in the forecast period.

- End-User Demographics: The Cloud & IT sector dominates end-user demand, followed by Telecom and Media & Entertainment.

London Data Center Market Growth Trends & Insights

The London data center market exhibits robust growth, driven by increasing data consumption, digital transformation initiatives, and the expansion of cloud computing. This section analyzes market size evolution (reaching xx Million by 2033), adoption rates across segments, technological disruptions impacting market dynamics, and shifts in consumer behavior. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Factors like rising demand for digital services and government initiatives supporting digital infrastructure are pivotal to this growth.

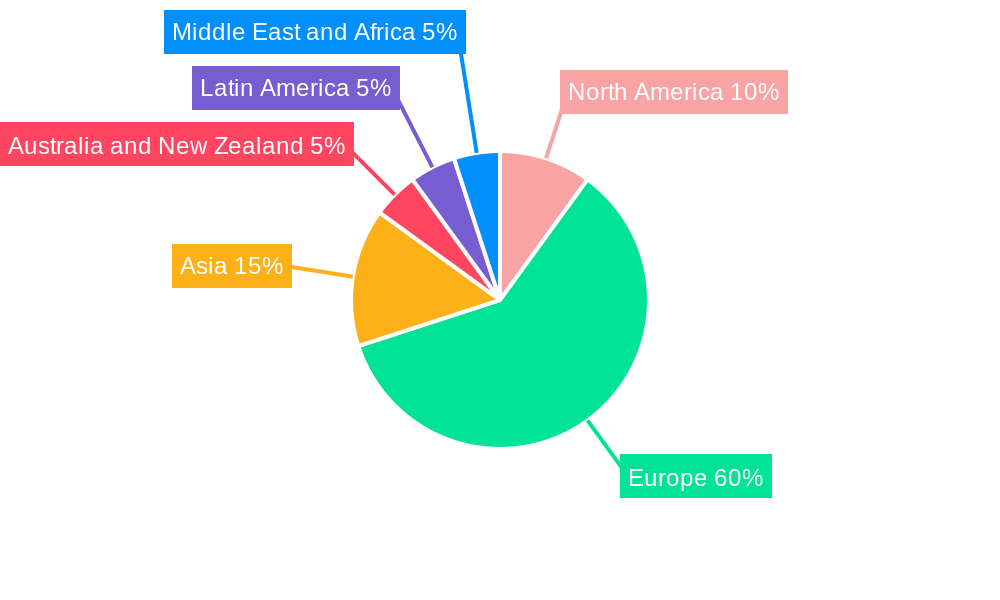

Dominant Regions, Countries, or Segments in London Data Center Market

The report identifies the leading segments within the London data center market and analyzes the factors contributing to their dominance. The analysis considers market share, growth potential, economic policies, and infrastructure development. The utilized capacity segment shows the strongest growth with a projected market value of xx Million by 2033.

- Dominant Segment: The Hyperscale Colocation type segment shows the highest growth potential due to the increased adoption of cloud services by hyperscale providers.

- Key Drivers: Strong digital economy, government support for infrastructure development, and strategic investments by major players contribute significantly.

- Market Share & Growth Potential: The Cloud & IT end-user segment commands the largest market share, with projected growth fueled by increased cloud adoption and data analytics.

London Data Center Market Product Landscape

The London data center market showcases a diverse product landscape, characterized by ongoing innovation in areas like energy efficiency, modular design, and advanced security features. Data centers are increasingly adopting sustainable technologies and advanced cooling systems to reduce environmental impact while optimizing performance. This evolution enhances energy efficiency and reduces operational costs.

Key Drivers, Barriers & Challenges in London Data Center Market

Key Drivers:

- Increased demand for cloud services and data storage.

- Growth in digital transformation initiatives across industries.

- Government policies promoting digital infrastructure development.

Challenges & Restraints:

- High initial investment costs for data center construction and maintenance.

- Limited availability of suitable land and power infrastructure.

- Stringent environmental regulations and sustainability concerns.

Emerging Opportunities in London Data Center Market

- Expansion into edge computing infrastructure to meet the growing demand for low-latency applications.

- Development of specialized data centers to cater to specific industry needs like AI and healthcare.

- Increased adoption of sustainable technologies and energy-efficient solutions in data center operations.

Growth Accelerators in the London Data Center Market Industry

The London data center market is poised for sustained growth, propelled by technological advancements like AI-powered infrastructure management, the expansion of 5G networks and IoT deployments, and strategic partnerships among data center operators and cloud providers. These factors unlock new capabilities and expand market reach.

Key Players Shaping the London Data Center Market Market

- Pulsant data centre

- Cyxtera Technologies Inc

- Vantage Data Centers

- Equinix Inc

- Rackspace Technology Inc

- 4D Data Centres Ltd (Redcentric plc)

- Serverfarm LLC

- Iron Mountain Incorporated

- Kao Data Ltd

- CyrusOne Inc

- Colt Technology Services Group Limited

- Digital Realty Trust Inc

- Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres)

- Telehouse (KDDI Corporation)

- NTT Ltd

Notable Milestones in London Data Center Market Sector

- November 2022: Proposal for a new 30MW data center as part of a larger mixed-use development in east London.

- March 2022: CloudHQ announces a GBP 700 Million investment in an 81MW hyperscale data center campus near Didcot.

In-Depth London Data Center Market Market Outlook

The London data center market is poised for significant growth, driven by ongoing digital transformation and the expanding needs of cloud providers and hyperscale operators. Strategic investments in sustainable infrastructure, coupled with government support, will fuel further market expansion, creating lucrative opportunities for established players and new entrants. The market is expected to reach xx Million by 2033, showcasing immense potential for growth and innovation.

London Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

London Data Center Market Segmentation By Geography

- 1. London

London Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Regulatory and Compliance Mandates; Growth of Data Volume

- 3.3. Market Restrains

- 3.3.1. Varying Structure of Regulatory Policies and Data Address Validation

- 3.4. Market Trends

- 3.4.1. Mega Size Data Center are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. London

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Pulsant data centre

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cyxtera Technologies Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vantage Data Centers

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Equinix Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 4D Data Centres Ltd (Redcentric plc)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Serverfarm LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Iron Mountain Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kao Data Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CyrusOne Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Colt Technology Services Group Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Digital Realty Trust Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Telehouse (KDDI Corporation)

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 NTT Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Pulsant data centre

List of Figures

- Figure 1: London Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: London Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: London Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: London Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: London Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: London Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: London Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: London Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: London Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: London Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the London Data Center Market ?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the London Data Center Market ?

Key companies in the market include Pulsant data centre, Cyxtera Technologies Inc, Vantage Data Centers, Equinix Inc, Rackspace Technology Inc, 4D Data Centres Ltd (Redcentric plc), Serverfarm LLC, Iron Mountain Incorporated, Kao Data Ltd, CyrusOne Inc, Colt Technology Services Group Limited, Digital Realty Trust Inc, Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres), Telehouse (KDDI Corporation), NTT Ltd.

3. What are the main segments of the London Data Center Market ?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Regulatory and Compliance Mandates; Growth of Data Volume.

6. What are the notable trends driving market growth?

Mega Size Data Center are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Varying Structure of Regulatory Policies and Data Address Validation.

8. Can you provide examples of recent developments in the market?

November 2022: A new data center is being proposed in east London, UK. The planning proposal proposes demolishing the existing office buildings and constructing a 30-story residential structure, a 36-story student residential building, a data center, and a facility to provide flexible workspace, community use space, and a swimming pool. EID (General Partner) LLP is the project's applicant, with Simpson Haugh/Nicholas Webb/Savills acting as architects and agents. The eight-story complex might have a potential IT power of 30MW and six 1,200 sqm (12,900 sq ft) halls. According to the petition, the facility would require a backup power source "in the form of 18 diesel-fueled generators of 3.3 MW."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "London Data Center Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the London Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the London Data Center Market ?

To stay informed about further developments, trends, and reports in the London Data Center Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence