Key Insights

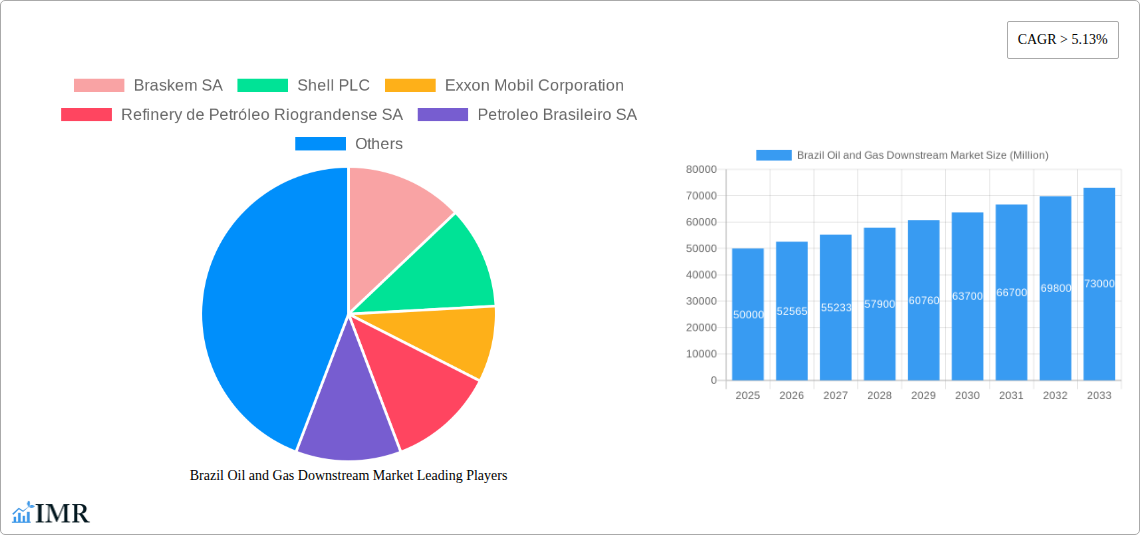

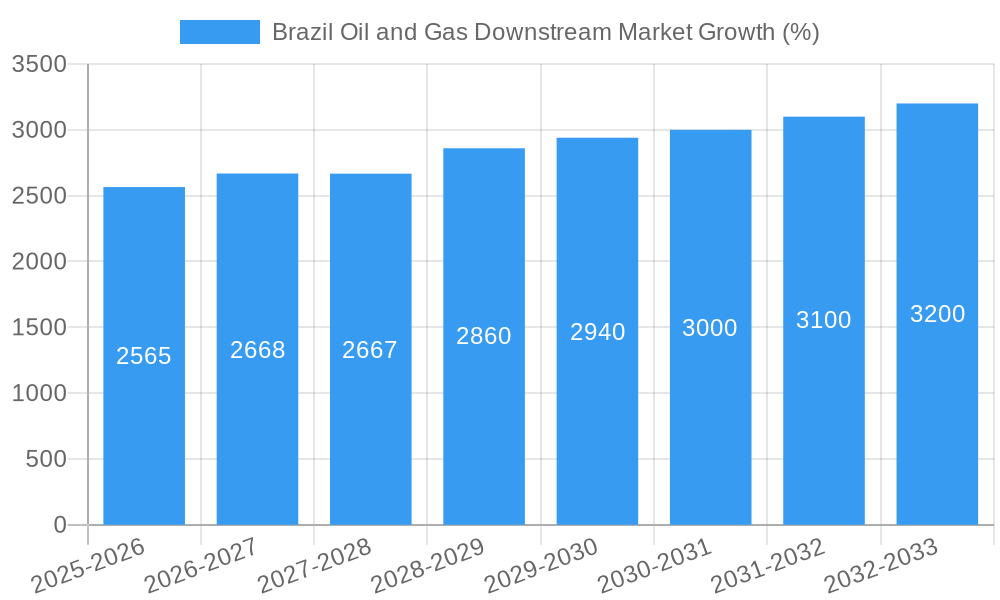

The Brazil oil and gas downstream market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 5.13% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Brazil's burgeoning automotive sector and increasing industrialization are creating significant demand for refined petroleum products. Secondly, rising disposable incomes and population growth are boosting energy consumption in the residential and commercial sectors. The increasing adoption of biofuels, driven by government initiatives promoting renewable energy sources, further contributes to market growth. However, the market also faces challenges. Fluctuations in global crude oil prices pose a significant risk, impacting profitability for downstream players. Furthermore, stringent environmental regulations and growing concerns about carbon emissions are compelling the industry to invest in cleaner technologies and potentially slowing certain segments of the market. The market is segmented by product type (crude oil, refined products, natural gas, biofuels) and end-user (automotive, industrial, residential, commercial). Major players like Braskem SA, Shell PLC, Exxon Mobil Corporation, and Petrobras are actively shaping the market's trajectory through strategic investments and technological advancements. The South American region, particularly Brazil, holds a dominant position due to its substantial oil and gas reserves and growing energy demands.

The forecast period (2025-2033) indicates continued growth, albeit potentially at a slightly moderated pace compared to the historical period (2019-2024) depending on global economic conditions and governmental policies. The market's structure suggests opportunities for both established multinational companies and local players, particularly those focusing on innovative solutions to environmental concerns and diversification within the energy mix. Successful companies will need to demonstrate agility and adaptability to navigate the fluctuating economic climate and evolving regulatory landscape. Focus on efficiency, sustainability, and technological innovation will be crucial for long-term success in the dynamic Brazilian oil and gas downstream market.

Brazil Oil & Gas Downstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil oil and gas downstream market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The report's analysis incorporates data in millions of units.

Brazil Oil & Gas Downstream Market Dynamics & Structure

This section analyzes the competitive landscape of Brazil's oil and gas downstream sector, exploring market concentration, technological innovation, regulatory frameworks, and market trends. The analysis considers the impact of mergers and acquisitions (M&A) activity, examining deal volumes and their effect on market share.

- Market Concentration: The Brazilian downstream market exhibits a moderately concentrated structure, with Petrobras holding a significant market share. However, the presence of international players like Shell and ExxonMobil introduces competitive intensity. xx% of the market is controlled by the top 5 players in 2025.

- Technological Innovation: Biofuel production is a key area of technological focus, driven by government mandates and environmental concerns. However, barriers to innovation include high upfront investment costs and complex regulatory approval processes.

- Regulatory Framework: Government regulations concerning fuel quality, emissions, and environmental protection significantly influence market dynamics. Changes in these regulations can create both opportunities and challenges for market participants.

- Competitive Product Substitutes: The growth of electric vehicles and alternative energy sources poses a long-term threat to the traditional downstream market. The extent of this threat will depend on the pace of adoption and government support for these alternatives.

- End-User Demographics: The market is significantly driven by the automotive sector, followed by industrial and commercial segments. The residential sector also contributes notably to natural gas consumption.

- M&A Trends: The past five years have witnessed xx M&A deals, primarily driven by strategies to consolidate market share and gain access to infrastructure and resources.

Brazil Oil & Gas Downstream Market Growth Trends & Insights

This section examines the historical and projected growth of the Brazilian oil and gas downstream market. Analysis includes detailed market sizing, growth rates (CAGR), adoption rates of new technologies, and changes in consumer behavior. The analysis leverages extensive secondary research and expert interviews to provide a comprehensive understanding of market trends.

(Detailed 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts with specific metrics like CAGR and market penetration will be provided in the full report).

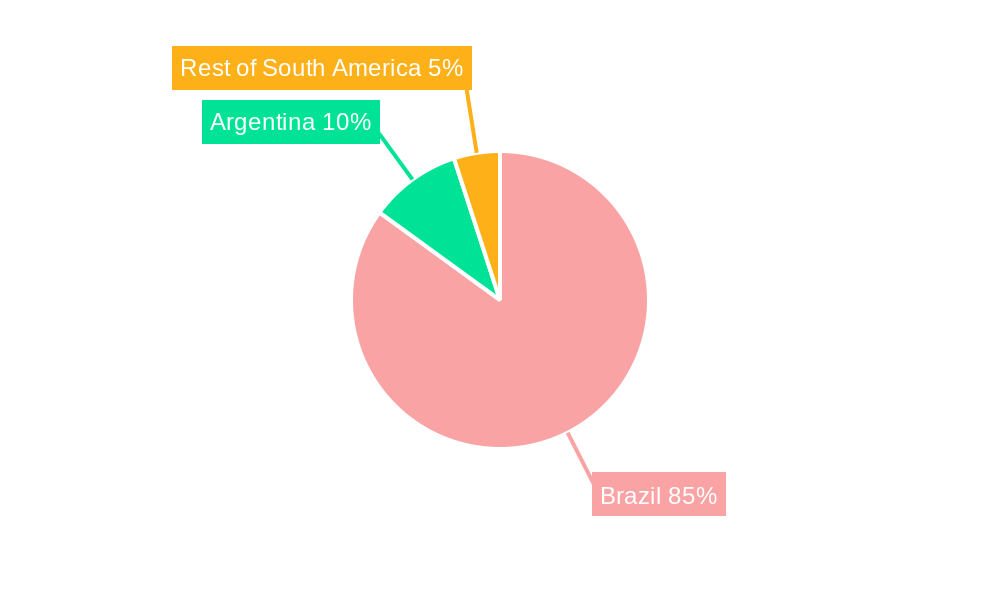

Dominant Regions, Countries, or Segments in Brazil Oil & Gas Downstream Market

This section identifies the leading regions, countries, and segments (both product and end-user) within the Brazilian downstream market, analyzing the factors driving their growth.

- Leading Product Segment: Refined products dominate the market, driven by high demand from the automotive and industrial sectors. Natural gas is a significant segment with considerable growth potential.

- Leading End-User Segment: The automotive sector holds the largest share, influenced by the substantial size of the Brazilian vehicle market. However, the industrial sector is a significant and growing market segment.

- Key Drivers:

- Economic Growth: Brazil's economic performance significantly affects downstream oil and gas demand.

- Infrastructure Development: Investments in refining capacity and transportation infrastructure are vital for market growth.

- Government Policies: Government regulations and incentives concerning biofuels and energy efficiency impact market dynamics.

(Detailed 600-word analysis of dominance factors, including market share and growth potential, will be provided in the full report).

Brazil Oil & Gas Downstream Market Product Landscape

This section describes the current product landscape, including innovations, applications, and performance metrics. The analysis will highlight unique selling propositions and technological advancements in areas like biofuels and improved fuel efficiency.

(Detailed 100-150 word description will be provided in the full report).

Key Drivers, Barriers & Challenges in Brazil Oil & Gas Downstream Market

This section identifies the key factors driving and hindering growth within the Brazilian oil and gas downstream market.

Key Drivers: Increasing demand from growing industrial and automotive sectors, government support for biofuels, and expansion of infrastructure projects are key drivers.

Key Challenges & Restraints: Fluctuating oil prices, regulatory hurdles, and environmental concerns pose challenges. Supply chain disruptions also impact market stability. Competition from renewable energy sources presents a long-term threat.

Emerging Opportunities in Brazil Oil & Gas Downstream Market

This section highlights emerging trends and opportunities, including untapped market segments, innovative applications, and evolving consumer preferences.

(Detailed 150-word analysis will be provided in the full report).

Growth Accelerators in the Brazil Oil and Gas Downstream Market Industry

This section discusses factors accelerating long-term growth, focusing on technological breakthroughs, strategic partnerships, and market expansion strategies.

(Detailed 150-word analysis will be provided in the full report).

Key Players Shaping the Brazil Oil and Gas Downstream Market Market

- Braskem SA

- Shell PLC

- Exxon Mobil Corporation

- Refinaria de Petróleo Riograndense SA

- Petroleo Brasileiro SA

- Chevron Corporation

- Repsol SA

Notable Milestones in Brazil Oil & Gas Downstream Market Sector

- February 2022: Acelen announces a USD 210 million investment in its Brazilian refinery, boosting northeastern refining capacity by over 50% and adding 14% to Brazil's total refining capacity.

- November 2022: Petrobras revises the timeline for commissioning a new natural gas processing unit (UPGN) at the Polo GasLub Itaboraí hub.

In-Depth Brazil Oil & Gas Downstream Market Market Outlook

The Brazilian oil and gas downstream market is poised for continued growth, driven by economic expansion, infrastructure development, and increasing energy demand. Strategic investments in biofuels and refining capacity will further contribute to market expansion. Opportunities exist for companies to capitalize on growing demand, particularly in the industrial and commercial sectors. However, navigating regulatory complexities and addressing environmental concerns will be crucial for long-term success.

Brazil Oil and Gas Downstream Market Segmentation

- 1. Refineries

- 2. Petrochemical Plants

Brazil Oil and Gas Downstream Market Segmentation By Geography

- 1. Brazil

Brazil Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. Refineries Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Plants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Brazil Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Braskem SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Shell PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Exxon Mobil Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Refinery de Petróleo Riograndense SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Petroleo Brasileiro SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Chevron Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Repsol SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Braskem SA

List of Figures

- Figure 1: Brazil Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 4: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2019 & 2032

- Table 5: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 6: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 7: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 18: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2019 & 2032

- Table 19: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 20: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 21: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Oil and Gas Downstream Market?

The projected CAGR is approximately > 5.13%.

2. Which companies are prominent players in the Brazil Oil and Gas Downstream Market?

Key companies in the market include Braskem SA, Shell PLC, Exxon Mobil Corporation, Refinery de Petróleo Riograndense SA, Petroleo Brasileiro SA, Chevron Corporation, Repsol SA.

3. What are the main segments of the Brazil Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemical Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

Refineries Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

In February 2022, Acelen, the owner of a Brazilian refinery, intends to invest roughly USD 210 million. The CEO of the company revealed the details during a presentation at the Rio Oil & Gas conference. The plant has a capacity of over 50% in the northeastern region and 14% of Brazil's total refining capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Brazil Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence