Key Insights

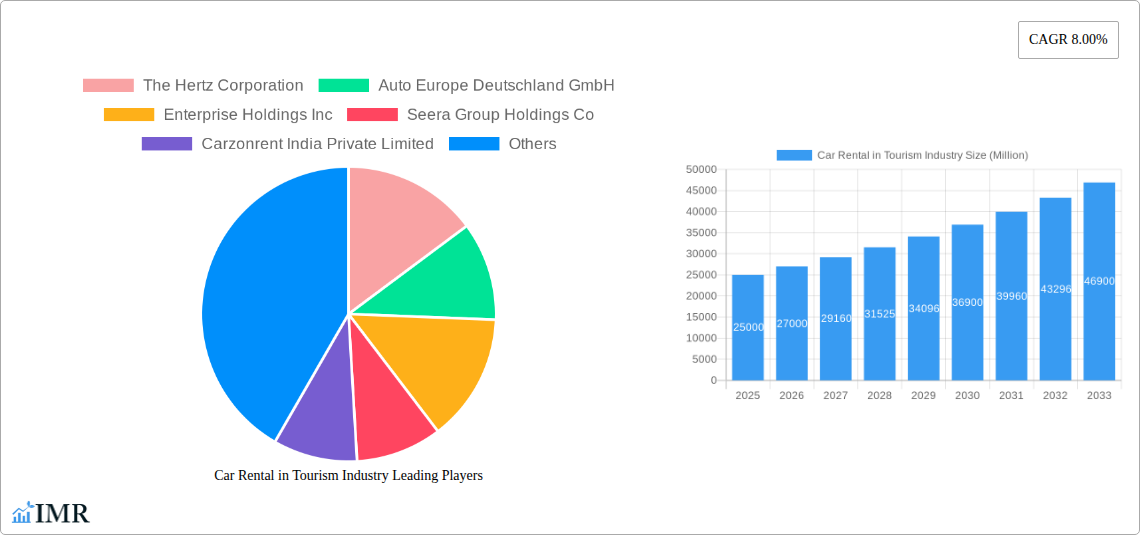

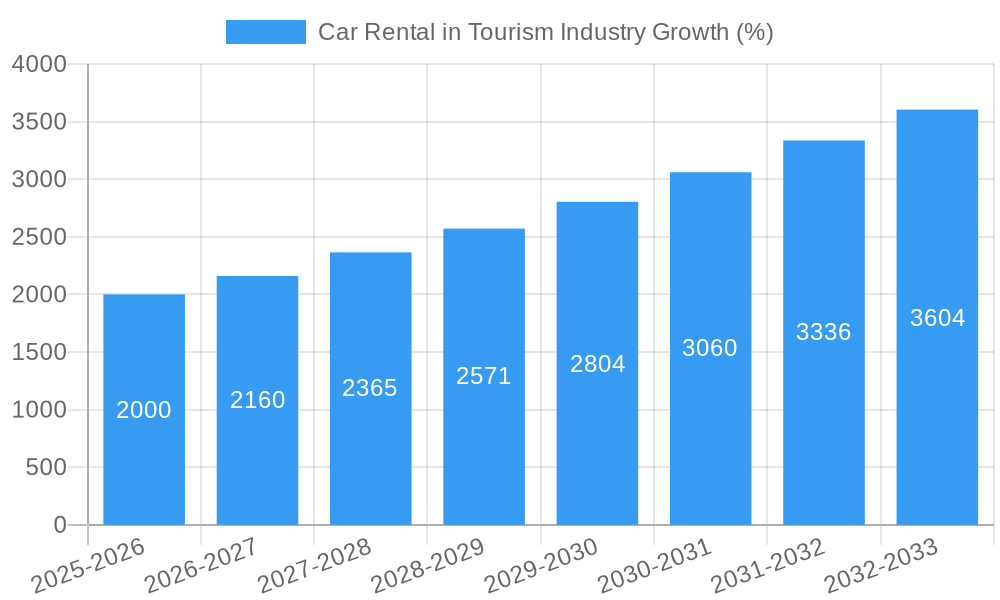

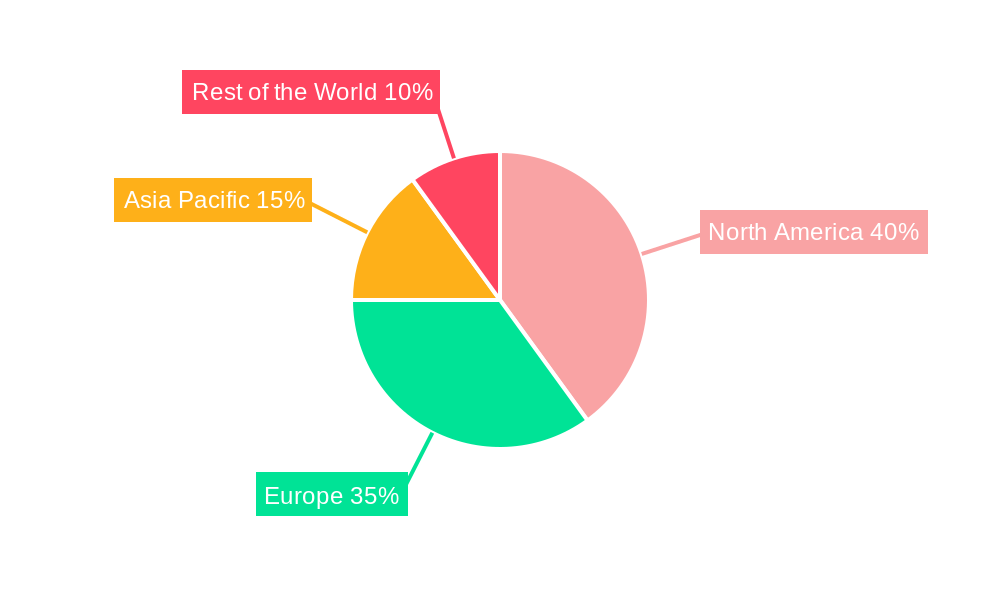

The car rental market within the tourism industry is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 8% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of self-drive vacations, particularly among millennials and Gen Z, is a significant driver. These demographics prioritize flexibility and independence in their travel experiences, making car rentals an attractive option. Furthermore, the increasing affordability of vehicles and the expansion of online booking platforms contribute to market growth. The convenience and ease of comparing prices and booking rentals online significantly enhance the customer experience and drive adoption. The market segmentation reveals a strong preference for online booking, indicating the success of digital marketing strategies employed by rental companies. While the economy segment dominates in terms of volume, the luxury/premium segment is experiencing faster growth, reflecting the increasing disposable incomes and a willingness to spend more for enhanced travel comfort. The growth is geographically diverse, with North America and Europe currently holding significant market shares, while the Asia-Pacific region shows considerable potential for future expansion due to rising tourism and a growing middle class. Rental agencies form a large portion of the market, but the self-drive segment is experiencing a faster growth rate.

However, certain challenges remain. Fluctuations in fuel prices and economic downturns can impact consumer spending and reduce rental demand. Increasing regulations regarding emissions and environmental concerns are also influencing the industry, prompting rental companies to invest in more fuel-efficient vehicles and sustainable practices. Competition within the market is intense, with established players like Hertz, Enterprise, and Avis competing with both local and international companies, leading to price wars and necessitating continuous innovation in service offerings and customer loyalty programs. Addressing these challenges through strategic pricing, sustainable practices, and customer-centric innovations will be crucial for continued success in this dynamic market.

Car Rental in Tourism Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Car Rental in Tourism Industry, offering crucial insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, dominant segments, and key players, equipping you with the knowledge needed to navigate this dynamic sector. The report analyzes a market valued at xx Million in 2024, projected to reach xx Million by 2033.

Car Rental in Tourism Industry Market Dynamics & Structure

The global car rental market, a significant component of the tourism industry, is characterized by moderate concentration, with key players like Hertz, Enterprise, Avis Budget Group, and Europcar holding substantial market share. However, the rise of disruptive players and technological advancements are steadily altering the competitive landscape. The market is segmented by vehicle type (Economy, Luxury/Premium), booking mode (Online, Offline), and end-user (Self-Driven, Rental Agencies).

- Market Concentration: The top 10 players account for approximately xx% of the global market share in 2024.

- Technological Innovation: Mobile apps, online booking platforms, and automated check-in/check-out systems are transforming customer experience and operational efficiency. However, barriers exist in integrating legacy systems and ensuring data security.

- Regulatory Frameworks: Varying regulations across countries regarding licensing, insurance, and taxation significantly impact market operations. Stricter emission standards also drive fleet modernization.

- Competitive Product Substitutes: Ride-hailing services (Uber, Lyft) and car-sharing platforms (Zipcar) pose significant competition, particularly in urban areas.

- End-User Demographics: The market caters to a diverse range of customers, from leisure travelers to business professionals, with varying preferences and budget constraints. Millennials and Gen Z increasingly prefer online booking and self-drive options.

- M&A Trends: Recent years have witnessed significant M&A activity, including Volkswagen's acquisition of Europcar (USD 3.4 Billion), reflecting industry consolidation and expansion strategies. The total value of M&A deals in the sector between 2019-2024 was approximately xx Million.

Car Rental in Tourism Industry Growth Trends & Insights

The car rental market within the tourism sector exhibits robust growth, driven by increasing travel and tourism activities, rising disposable incomes, and the growing preference for self-drive rentals. The market experienced a temporary setback due to the pandemic in 2020, but has shown a strong rebound since 2021. Technological advancements and evolving consumer preferences contribute to significant market transformation. Online booking platforms have substantially increased market penetration, while the emergence of subscription models and peer-to-peer car rentals challenge traditional players.

- Market Size Evolution: The market size expanded from xx Million in 2019 to xx Million in 2024, showing a CAGR of xx%. It is expected to reach xx Million by 2033.

- Adoption Rates: Online booking penetration increased from xx% in 2019 to xx% in 2024, reflecting a shift in consumer behavior.

- Technological Disruptions: The introduction of autonomous vehicles and connected car technology presents both opportunities and challenges for industry players.

- Consumer Behavior Shifts: A preference for luxury and premium vehicles, coupled with a demand for seamless digital experiences, is shaping industry offerings.

Dominant Regions, Countries, or Segments in Car Rental in Tourism Industry

North America and Europe currently dominate the car rental market within the tourism sector, driven by robust tourism industries and well-developed infrastructure. However, Asia-Pacific is exhibiting high growth potential due to rapid economic development and rising tourism numbers.

- Leading Regions: North America (xx% market share in 2024), Europe (xx%), Asia-Pacific (xx%).

- Dominant Segments: The Economy segment holds the largest market share (xx% in 2024) due to price sensitivity, while the Luxury/Premium segment experiences above-average growth (xx% CAGR) driven by increasing disposable incomes and high-end travel. Online booking accounts for the majority of transactions (xx%), though offline remains relevant. Self-driven rentals constitute a significant portion (xx%), and rental agencies serve as a crucial distribution channel.

- Key Drivers: Strong tourism infrastructure, government initiatives to support tourism, and favorable economic policies contribute to regional dominance. High growth potential in developing markets is fueled by increasing disposable incomes and a growing middle class.

Car Rental in Tourism Industry Product Landscape

The car rental industry offers a diverse range of vehicles, catering to various needs and budgets. Innovation focuses on enhancing customer experience through digital platforms, subscription models, and value-added services (e.g., insurance, roadside assistance). Key performance indicators include customer satisfaction scores, fleet utilization rates, and online booking conversion rates. Unique selling propositions include loyalty programs, flexible rental terms, and personalized services.

Key Drivers, Barriers & Challenges in Car Rental in Tourism Industry

Key Drivers:

- Growing tourism sector

- Increased disposable incomes

- Technological advancements (e.g., mobile apps, online booking)

- Expanding fleet options including electric vehicles.

Challenges & Restraints:

- Intense competition from ride-hailing and car-sharing services.

- Fluctuations in fuel prices and insurance costs.

- Regulatory hurdles and varying taxation policies across regions.

- Supply chain disruptions impacting vehicle availability.

Emerging Opportunities in Car Rental in Tourism Industry

- Expansion into untapped markets, particularly in developing countries.

- Development of sustainable and eco-friendly fleet options (EVs, hybrids).

- Integration of advanced technologies (e.g., AI-powered chatbots, autonomous driving).

- Personalized travel packages combining car rentals with other tourism services.

Growth Accelerators in the Car Rental in Tourism Industry Industry

Strategic partnerships between car rental companies and travel agencies are driving market expansion. Technological breakthroughs in areas such as autonomous vehicles and connected car technology are poised to revolutionize the industry. Expansion into new markets and the introduction of innovative business models are also key growth drivers.

Key Players Shaping the Car Rental in Tourism Industry Market

- The Hertz Corporation

- Auto Europe Deutschland GmbH

- Enterprise Holdings Inc

- Seera Group Holdings Co

- Carzonrent India Private Limited

- Sixt SE

- ZoomCar Inc

- Europcar Mobility Group

- Avis Budget Group Inc

Notable Milestones in Car Rental in Tourism Industry Sector

- February 2021: Theeb Rent a Car expands its fleet in Saudi Arabia, adding over 1,700 vehicles.

- July 2021: Europcar Mobility Group's Key'n Go launches a 100% digital booking and pick-up system in Southern Europe.

- November 2021: Hertz partners with Tesla to add 100,000 Model 3s to its fleet.

- December 2021: Volkswagen announces a USD 3.4 billion acquisition of Europcar.

- January 2022: ekar launches car subscription services in Thailand.

In-Depth Car Rental in Tourism Industry Market Outlook

The car rental market within the tourism industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic partnerships. The focus on sustainability and the integration of innovative technologies will shape future market dynamics. Companies that effectively adapt to changing consumer behavior and embrace technological innovation are expected to thrive in this dynamic market. Opportunities exist in expanding into emerging markets and developing new business models to cater to the diverse needs of travelers.

Car Rental in Tourism Industry Segmentation

-

1. Vehicle Type

- 1.1. Economy

- 1.2. Luxury/Premium

-

2. Booking Mode

- 2.1. Online

- 2.2. Offline

-

3. End User

- 3.1. Self Driven

- 3.2. Rental Agencies

Car Rental in Tourism Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Rest of North america

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Norway

- 2.6. Netherlands

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Car Rental in Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Online Booking Expected to Witness Significant Growth during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Economy

- 5.1.2. Luxury/Premium

- 5.2. Market Analysis, Insights and Forecast - by Booking Mode

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Self Driven

- 5.3.2. Rental Agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Economy

- 6.1.2. Luxury/Premium

- 6.2. Market Analysis, Insights and Forecast - by Booking Mode

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Self Driven

- 6.3.2. Rental Agencies

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Economy

- 7.1.2. Luxury/Premium

- 7.2. Market Analysis, Insights and Forecast - by Booking Mode

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Self Driven

- 7.3.2. Rental Agencies

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Economy

- 8.1.2. Luxury/Premium

- 8.2. Market Analysis, Insights and Forecast - by Booking Mode

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Self Driven

- 8.3.2. Rental Agencies

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Economy

- 9.1.2. Luxury/Premium

- 9.2. Market Analysis, Insights and Forecast - by Booking Mode

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Self Driven

- 9.3.2. Rental Agencies

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. North America Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United states

- 10.1.2 Canada

- 10.1.3 Rest of North america

- 11. Europe Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Norway

- 11.1.6 Netherlands

- 11.1.7 Rest of Europe

- 12. Asia Pacific Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Car Rental in Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 The Hertz Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Auto Europe Deutschland GmbH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Enterprise Holdings Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Seera Group Holdings Co

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Carzonrent India Private Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Sixt SE

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 ZoomCar Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Europcar Mobility Group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Avis Budget Group Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Car Rental in Tourism Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Car Rental in Tourism Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 11: North America Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 12: North America Car Rental in Tourism Industry Revenue (Million), by Booking Mode 2024 & 2032

- Figure 13: North America Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2024 & 2032

- Figure 14: North America Car Rental in Tourism Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Car Rental in Tourism Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Car Rental in Tourism Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: Europe Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: Europe Car Rental in Tourism Industry Revenue (Million), by Booking Mode 2024 & 2032

- Figure 21: Europe Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2024 & 2032

- Figure 22: Europe Car Rental in Tourism Industry Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe Car Rental in Tourism Industry Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Car Rental in Tourism Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 27: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 28: Asia Pacific Car Rental in Tourism Industry Revenue (Million), by Booking Mode 2024 & 2032

- Figure 29: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2024 & 2032

- Figure 30: Asia Pacific Car Rental in Tourism Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Car Rental in Tourism Industry Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Rest of the World Car Rental in Tourism Industry Revenue (Million), by Booking Mode 2024 & 2032

- Figure 37: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Booking Mode 2024 & 2032

- Figure 38: Rest of the World Car Rental in Tourism Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Rest of the World Car Rental in Tourism Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Car Rental in Tourism Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Car Rental in Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Car Rental in Tourism Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global Car Rental in Tourism Industry Revenue Million Forecast, by Booking Mode 2019 & 2032

- Table 4: Global Car Rental in Tourism Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Car Rental in Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United states Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North america Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Norway Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherlands Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: South America Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Middle East and Africa Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Car Rental in Tourism Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 28: Global Car Rental in Tourism Industry Revenue Million Forecast, by Booking Mode 2019 & 2032

- Table 29: Global Car Rental in Tourism Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United states Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of North america Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Car Rental in Tourism Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Global Car Rental in Tourism Industry Revenue Million Forecast, by Booking Mode 2019 & 2032

- Table 36: Global Car Rental in Tourism Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 37: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Germany Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: United Kingdom Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Norway Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Netherlands Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Car Rental in Tourism Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 46: Global Car Rental in Tourism Industry Revenue Million Forecast, by Booking Mode 2019 & 2032

- Table 47: Global Car Rental in Tourism Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Car Rental in Tourism Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 55: Global Car Rental in Tourism Industry Revenue Million Forecast, by Booking Mode 2019 & 2032

- Table 56: Global Car Rental in Tourism Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 57: Global Car Rental in Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: South America Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Middle East and Africa Car Rental in Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Rental in Tourism Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Car Rental in Tourism Industry?

Key companies in the market include The Hertz Corporation, Auto Europe Deutschland GmbH, Enterprise Holdings Inc, Seera Group Holdings Co, Carzonrent India Private Limited, Sixt SE, ZoomCar Inc, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Car Rental in Tourism Industry?

The market segments include Vehicle Type, Booking Mode, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand.

6. What are the notable trends driving market growth?

Online Booking Expected to Witness Significant Growth during the Forecast Period.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, ekar, the Middle East's mobility company, launched its operations in Thailand starting with Bangkok and with plans to expand into other countries. ekar is launching its proprietary car subscription service which offers cars from one to nine-month terms for a single monthly subscription cost with no down payments or long-term commitments via the ekar app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Rental in Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Rental in Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Rental in Tourism Industry?

To stay informed about further developments, trends, and reports in the Car Rental in Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence