Key Insights

The Mexico electric car market is poised for substantial expansion, projecting a robust CAGR of 28.21% through 2033. Driven by strong government support for sustainable mobility, heightened consumer environmental consciousness, and declining battery costs, the adoption of electric vehicles (EVs) in Mexico is accelerating. The market is segmented by powertrain (BEVs, FCEVs, HEVs, PHEVs) and vehicle type (passenger cars), catering to diverse preferences and technological trends. Key industry players including BMW, Jaguar Land Rover, Mercedes-Benz, Tesla, and Toyota are strategically investing in this dynamic sector.

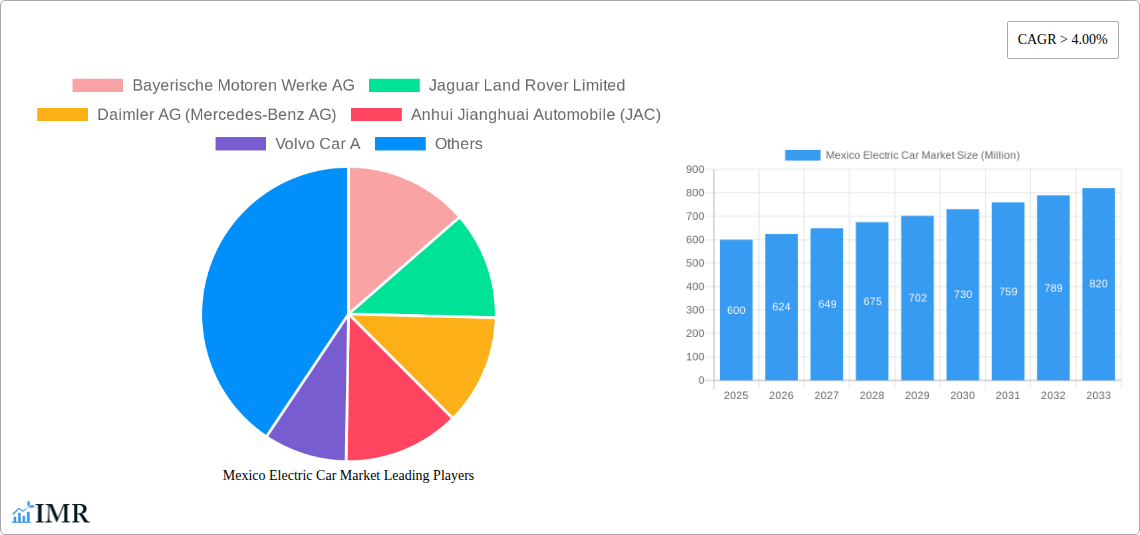

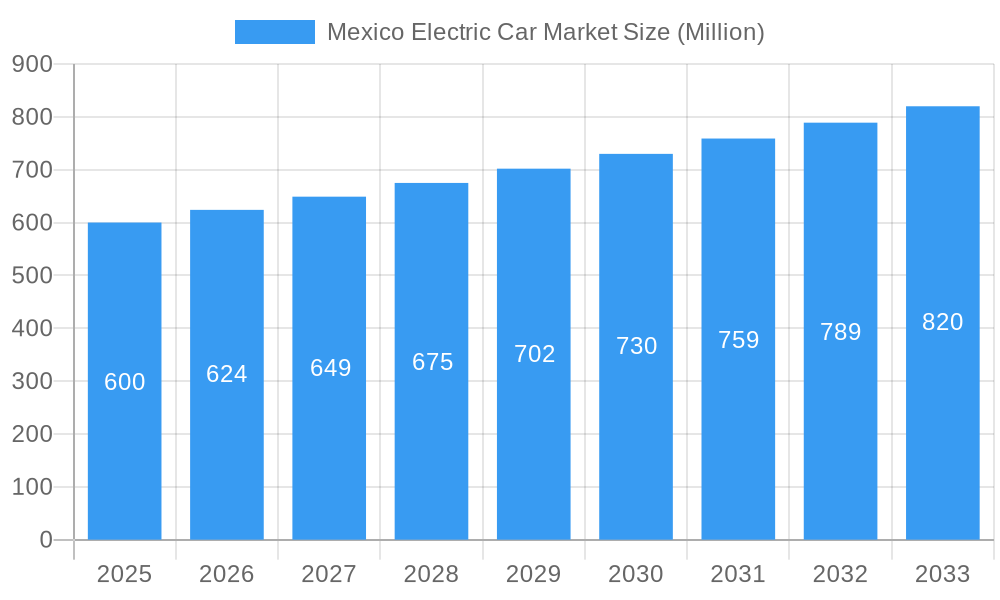

Mexico Electric Car Market Market Size (In Billion)

Passenger cars currently dominate the market, aligning with primary consumer demand. The Mexico electric car market is estimated to reach $1.29 billion in 2025. This growth trajectory is supported by ongoing government incentives, increasing EV affordability, and a growing consumer preference for eco-friendly transportation. Future market evolution will be significantly influenced by advancements in battery technology and the expansion of charging infrastructure across Mexico. Addressing range anxiety and ensuring widespread charging availability are critical to realizing the market's full potential.

Mexico Electric Car Market Company Market Share

Mexico Electric Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico electric car market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It segments the market by fuel category (BEV, FCEV, HEV, PHEV) and vehicle configuration (Passenger Cars), offering granular insights for industry professionals and investors. This report is crucial for understanding the evolving landscape of the Mexican automotive sector and identifying lucrative investment opportunities. High-growth keywords include: Mexico electric vehicle market, Mexican EV market, BEV market Mexico, PHEV market Mexico, Electric car sales Mexico, Mexico automotive market, EV adoption Mexico.

Mexico Electric Car Market Dynamics & Structure

The Mexican electric car market is characterized by increasing market concentration, driven by technological advancements and supportive government regulations. The market is witnessing a rise in mergers and acquisitions (M&A) activity, with larger players consolidating their presence. However, high initial costs and limited charging infrastructure remain significant barriers to widespread adoption. The parent market, the broader Mexican automotive industry, is experiencing a period of transformation influenced by evolving consumer preferences, environmental concerns, and global technological shifts. The child market, specifically electric passenger cars, is the fastest growing segment.

- Market Concentration: xx% market share held by the top 3 players in 2024. This is projected to increase to xx% by 2033.

- Technological Innovation: Significant investments in battery technology and charging infrastructure are driving innovation. However, challenges remain in achieving cost parity with internal combustion engine (ICE) vehicles.

- Regulatory Framework: Government incentives and emission standards are creating a favorable environment for electric vehicle adoption.

- Competitive Substitutes: ICE vehicles and hybrid vehicles still dominate the market, posing a significant challenge to electric vehicle penetration.

- End-User Demographics: The primary target demographic for electric vehicles in Mexico is the upper-middle class and affluent consumers in urban areas.

- M&A Trends: An estimated xx M&A deals related to the electric vehicle sector were concluded in Mexico between 2019 and 2024.

Mexico Electric Car Market Growth Trends & Insights

The Mexico electric car market is expected to witness significant growth over the forecast period. Driven by increasing environmental awareness, government support, and technological advancements, the market size is projected to grow from xx million units in 2024 to xx million units by 2033, representing a Compound Annual Growth Rate (CAGR) of xx%. Market penetration, currently at xx%, is expected to reach xx% by 2033. Consumer behavior is shifting towards environmentally friendly options, driven by increasing fuel prices and concerns about air quality in urban areas. Technological disruptions, such as advancements in battery technology and autonomous driving capabilities, are further fueling market expansion.

Dominant Regions, Countries, or Segments in Mexico Electric Car Market

The major cities of Mexico, including Mexico City, Guadalajara, and Monterrey, are driving market growth, owing to higher consumer awareness, better charging infrastructure, and supportive government policies. The BEV segment currently holds the largest market share among fuel categories, followed by PHEVs. Passenger cars dominate the vehicle configuration segment.

- Key Drivers:

- Government incentives: Tax breaks and subsidies for electric vehicle purchases.

- Growing environmental awareness: Increased public concern about air pollution and climate change.

- Improved charging infrastructure: Expansion of public charging stations in major cities.

- Dominance Factors: Higher disposable income, access to advanced technology, and robust government support contribute to the dominance of major urban centers.

Mexico Electric Car Market Product Landscape

The Mexican electric car market offers a diverse range of models, featuring various battery capacities, charging speeds, and technological features. Key innovations include advanced battery management systems, improved range, and enhanced safety features. The focus is shifting towards increasing affordability, improving charging infrastructure, and incorporating advanced driver-assistance systems (ADAS). Unique selling propositions include features like fast charging, longer range, and superior performance compared to traditional vehicles.

Key Drivers, Barriers & Challenges in Mexico Electric Car Market

Key Drivers: Government incentives, growing environmental concerns, advancements in battery technology, and declining battery costs are propelling market growth. The push towards carbon neutrality by major automakers is another significant driving factor.

Key Challenges: High initial purchase price, limited charging infrastructure outside major cities, and a lack of consumer awareness remain significant barriers. Supply chain disruptions and potential import restrictions could also impact market growth. The dependence on imported components could lead to price volatility and supply chain vulnerability.

Emerging Opportunities in Mexico Electric Car Market

Emerging opportunities include expanding into smaller cities and towns, focusing on fleet sales to businesses and government agencies, and developing innovative financing options to make electric vehicles more accessible. The growing demand for electric commercial vehicles (buses and trucks) represents a significant untapped market. The development of specialized charging solutions for specific sectors could also attract investment.

Growth Accelerators in the Mexico Electric Car Market Industry

Strategic partnerships between automotive manufacturers and energy companies are accelerating the development of charging infrastructure. Technological breakthroughs in battery technology and fast-charging solutions are significantly enhancing the appeal of electric vehicles. The expansion of government incentives and supportive regulatory frameworks further enhances long-term growth potential.

Key Players Shaping the Mexico Electric Car Market Market

Notable Milestones in Mexico Electric Car Market Sector

- December 2023: Launch of the Mustang Mach-E with enhanced features (electric all-wheel drive, heated seats, and steering wheel) – signifying improved product offerings.

- November 2023: JAC Mexico opens its 50th "JAC Store" in Ciudad Juárez – indicating expanding market reach and retail presence.

- November 2023: Ford Motor Company's strategic partnership with its suppliers to achieve CO2 reduction targets aligns with global sustainability initiatives and promotes responsible manufacturing practices within the EV sector.

In-Depth Mexico Electric Car Market Market Outlook

The future of the Mexico electric car market is bright, driven by continued technological advancements, supportive government policies, and rising consumer demand. Strategic partnerships and investments in charging infrastructure will play a crucial role in accelerating market growth. The market is poised for significant expansion, offering attractive opportunities for both established players and new entrants. The focus on sustainable mobility and the growing awareness of environmental issues will continue to drive market expansion.

Mexico Electric Car Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

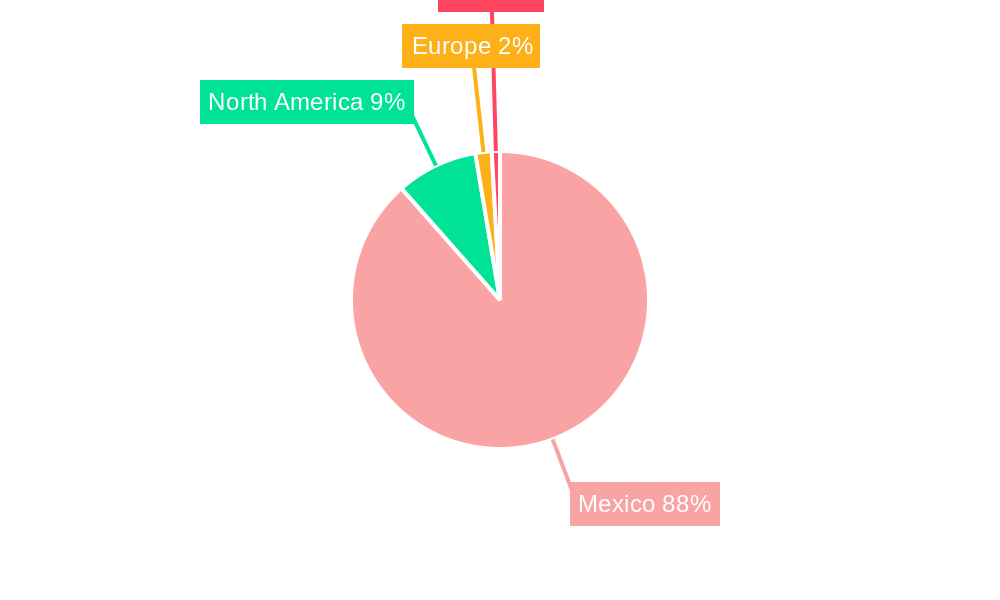

Mexico Electric Car Market Segmentation By Geography

- 1. Mexico

Mexico Electric Car Market Regional Market Share

Geographic Coverage of Mexico Electric Car Market

Mexico Electric Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Electric Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jaguar Land Rover Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler AG (Mercedes-Benz AG)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anhui Jianghuai Automobile (JAC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Car A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kia Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Renault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Audi AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honda Motor Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ford Motor Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Mexico Electric Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Electric Car Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 2: Mexico Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 3: Mexico Electric Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 5: Mexico Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 6: Mexico Electric Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Electric Car Market?

The projected CAGR is approximately 28.21%.

2. Which companies are prominent players in the Mexico Electric Car Market?

Key companies in the market include Bayerische Motoren Werke AG, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Anhui Jianghuai Automobile (JAC), Volvo Car A, Kia Corporation, Tesla Inc, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd, Ford Motor Company.

3. What are the main segments of the Mexico Electric Car Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

December 2023: Mustang Mach-E has electric all-wheel drive and standard heated seats and a steering wheel.November 2023: In 2022, JAC Mexico opens the "JAC Store" number 50 in Ciudad Juárez.November 2023: Ford motors and manufacturers 2030 have entered into a strategic Partnerships to help its suppliers achieve their CO2 reduction targets in line with Ford Motor Co.'s global objective of becoming carbon neutral by 2050.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Electric Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Electric Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Electric Car Market?

To stay informed about further developments, trends, and reports in the Mexico Electric Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence