Key Insights

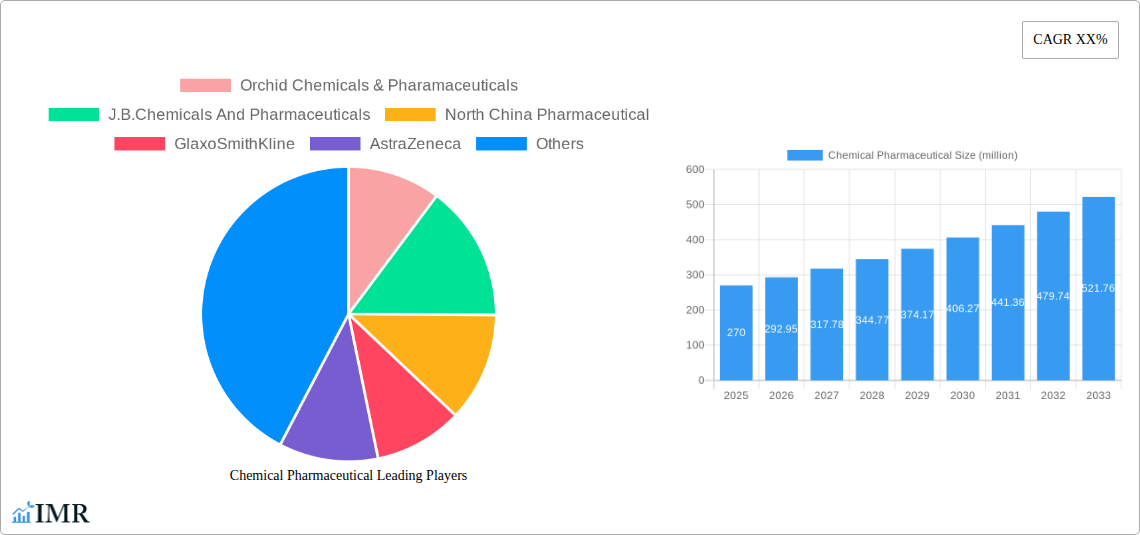

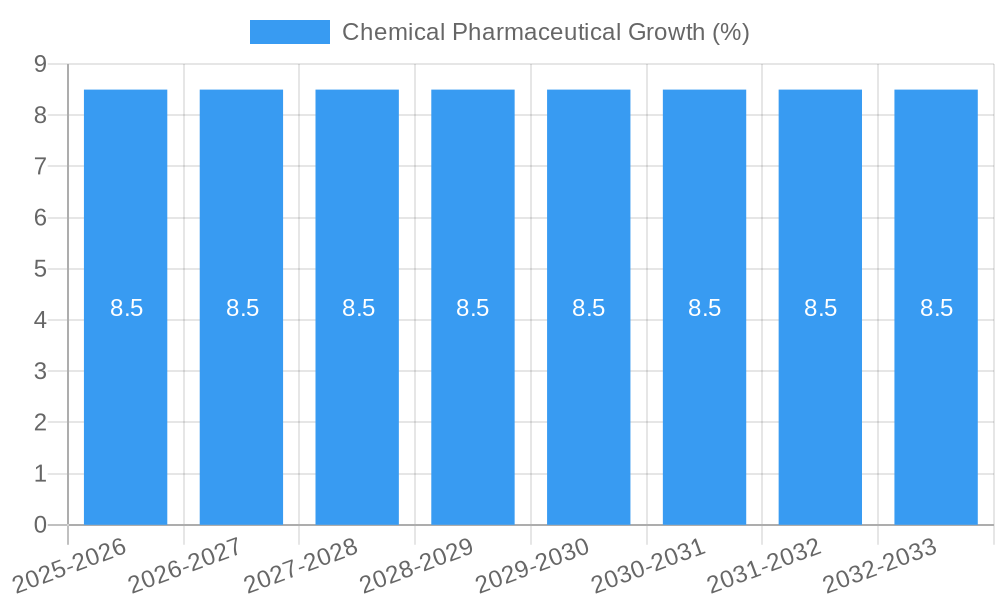

The Chemical Pharmaceutical market is poised for significant expansion, projected to reach a substantial market size of approximately $270 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% expected through 2033. This robust growth is primarily fueled by escalating demand across the pharmaceutical industry, particularly for oral and injectable formulations, driven by the continuous development of novel therapeutics and the increasing prevalence of chronic diseases globally. Research organizations also represent a key segment, investing heavily in chemical pharmaceuticals for drug discovery and development pipelines. Emerging economies, especially in Asia Pacific, are becoming increasingly vital markets due to growing healthcare expenditure and a rising patient population. The development of advanced synthesis techniques and the focus on high-purity chemical compounds are also contributing to market dynamics, enabling pharmaceutical companies to enhance drug efficacy and safety.

The market's trajectory is further shaped by a combination of supportive government initiatives aimed at boosting pharmaceutical manufacturing and research, coupled with strategic collaborations and mergers & acquisitions among key industry players. However, certain restraints such as stringent regulatory hurdles and the high cost associated with research and development of new chemical entities could potentially temper growth. Nevertheless, the relentless pursuit of innovative treatments for conditions like cancer, cardiovascular diseases, and neurological disorders is expected to sustain a positive market outlook. Key players are actively focusing on expanding their product portfolios and geographical reach, underscoring the competitive landscape and the opportunities for further innovation in chemical synthesis and pharmaceutical formulation technologies.

Chemical Pharmaceutical Market Dynamics & Structure

The global Chemical Pharmaceutical market is characterized by a moderately concentrated structure, with key players like Hoffmann-La Roche, GlaxoSmithKline, and AstraZeneca holding significant market shares. Technological innovation, particularly in novel drug delivery systems and personalized medicine, serves as a primary driver. Regulatory frameworks established by bodies such as the FDA and EMA play a crucial role in shaping market access and product development. Competitive product substitutes, while present, are often differentiated by efficacy, safety profiles, and brand reputation. End-user demographics, including an aging global population and increased prevalence of chronic diseases, are significantly influencing demand. Mergers and acquisitions (M&A) remain a strategic trend, with an estimated $5,000 million in M&A deal volumes observed during the historical period, aimed at consolidating portfolios, expanding R&D capabilities, and gaining market access. Innovation barriers include high R&D costs, lengthy clinical trial durations, and stringent regulatory approval processes.

- Market Concentration: Moderately concentrated, with top players dominating market share.

- Technological Innovation: Driven by advancements in drug delivery, generics, and biopharmaceuticals.

- Regulatory Frameworks: Stringent but crucial for product safety and market entry.

- Competitive Substitutes: Differentiation based on efficacy, safety, and brand.

- End-User Demographics: Aging population and chronic disease prevalence drive demand.

- M&A Trends: Active consolidation for portfolio expansion and market access, with an estimated $5,000 million in deal volumes during the historical period.

- Innovation Barriers: High R&D costs, lengthy clinical trials, and complex regulatory hurdles.

Chemical Pharmaceutical Growth Trends & Insights

The Chemical Pharmaceutical market is poised for robust growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is fueled by increasing healthcare expenditures globally, a rising incidence of chronic diseases, and a growing demand for advanced pharmaceutical formulations. The market size, estimated at $150,000 million in the base year of 2025, is anticipated to reach $250,000 million by 2033. Adoption rates for novel therapies and generic medications are steadily increasing, driven by their cost-effectiveness and accessibility. Technological disruptions, such as the integration of artificial intelligence (AI) in drug discovery and development, are accelerating innovation cycles and improving R&D efficiency. Consumer behavior is shifting towards proactive health management and a preference for targeted therapies, further propelling market evolution. The parent market, encompassing all pharmaceutical products, is expected to witness similar growth, with the chemical pharmaceutical segment representing a substantial portion, estimated at 70% of the parent market’s total value. Child markets, such as oral and injectable pharmaceuticals, are also experiencing significant expansion, with oral pharmaceuticals projected to account for $80,000 million and injectable pharmaceuticals for $60,000 million of the total market value by 2025.

The historical period of 2019–2024 saw a steady upward trajectory, with market size growing from $110,000 million to $150,000 million, reflecting underlying demand and consistent innovation. Key growth enablers include the increasing global burden of diseases like cancer, cardiovascular conditions, and diabetes, which necessitates a continuous supply of chemical pharmaceutical products. Furthermore, advancements in chemical synthesis and manufacturing technologies are contributing to improved product quality and cost efficiencies. The penetration of generic drugs, a significant segment within chemical pharmaceuticals, is also a major growth driver, offering affordable treatment options to a wider population. Emerging economies are presenting significant growth opportunities due to improving healthcare infrastructure and increasing disposable incomes, leading to higher demand for a diverse range of pharmaceutical products. The research and development pipeline remains strong, with numerous compounds in various stages of clinical trials, promising future market expansion. The market penetration for essential chemical pharmaceuticals is already high in developed regions, but significant growth potential lies in expanding access to these treatments in developing nations. The interplay between technological advancements, unmet medical needs, and favorable government policies is creating a dynamic and expanding landscape for chemical pharmaceuticals.

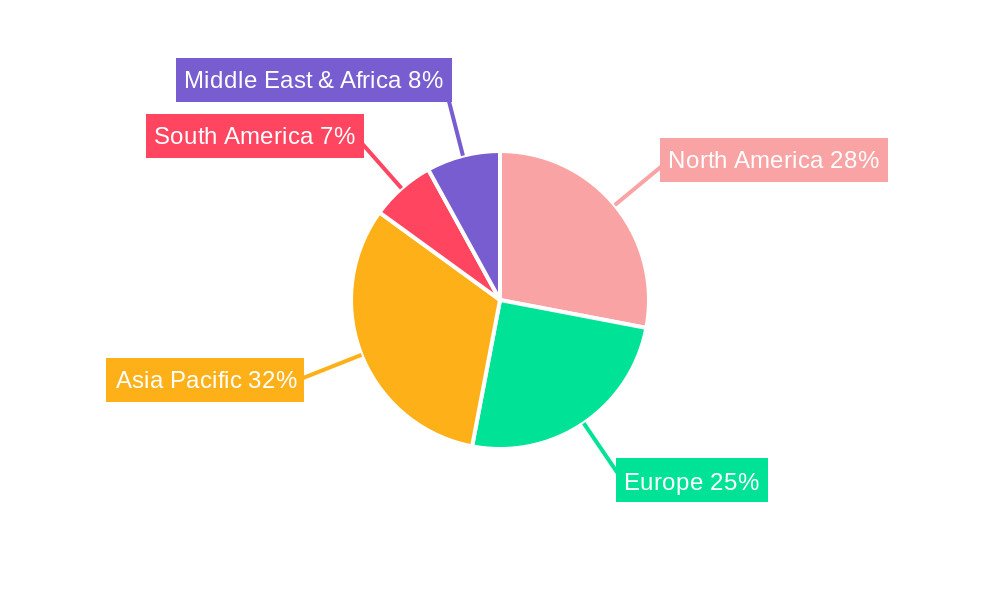

Dominant Regions, Countries, or Segments in Chemical Pharmaceutical

North America, particularly the United States, currently dominates the Chemical Pharmaceutical market, driven by robust R&D investments, a highly sophisticated healthcare infrastructure, and a favorable regulatory environment. The Pharmaceutical Industries application segment is the largest contributor, accounting for an estimated 65% of the total market share in 2025, valued at $97,500 million. This dominance is attributed to the continuous demand for prescription drugs, over-the-counter (OTC) medications, and specialized chemical compounds used in drug manufacturing. The United States alone represents a significant portion of this segment, with an estimated market size of $70,000 million in 2025.

Oral Pharmaceuticals, a key type within the chemical pharmaceutical landscape, holds the largest market share, projected at 50% of the total market value in 2025, amounting to $75,000 million. This prevalence is due to the convenience of administration, patient compliance, and the wide range of therapeutic areas addressed by oral formulations. Leading companies like Abbott Laboratories and Eli Lilly are major players in this segment.

In terms of regional dominance, North America is followed by Europe, which benefits from established healthcare systems and strong pharmaceutical manufacturing capabilities. Asia Pacific is emerging as a significant growth region, driven by increasing healthcare expenditure, a growing pharmaceutical industry, and a large patient population. Countries like China and India are pivotal in this expansion, with companies such as North China Pharmaceutical and Northeast Pharmaceutical playing crucial roles.

The Research Organizations segment, while smaller than Pharmaceutical Industries, is a critical driver of innovation, projected to reach $35,000 million by 2025, with a CAGR of 7.2% during the forecast period. This growth is supported by increasing funding for drug discovery and development. Segments like Injectable Pharmaceuticals are also witnessing substantial growth, estimated at $60,000 million in 2025, with a CAGR of 6.8%, fueled by advancements in biologics and targeted therapies.

Key drivers for North America's dominance include:

- High R&D Expenditure: Significant investment in pharmaceutical research and development.

- Advanced Healthcare Infrastructure: Well-established hospitals, clinics, and distribution networks.

- Favorable Regulatory Environment: Streamlined approval processes and strong intellectual property protection.

- Patient Demographics: Aging population and high prevalence of chronic diseases.

The dominance of Oral Pharmaceuticals is attributed to:

- Patient Convenience: Ease of administration and higher compliance rates.

- Cost-Effectiveness: Generally lower manufacturing costs compared to injectables.

- Wide Therapeutic Applications: Suitable for a broad spectrum of diseases.

The growth potential in the Asia Pacific region is propelled by:

- Growing Healthcare Expenditure: Increased government and private spending on healthcare.

- Expanding Pharmaceutical Industry: Rise of local manufacturers and contract research organizations.

- Large Patient Population: High prevalence of diseases, particularly in China and India.

- Increasing Disposable Incomes: Enabling greater access to pharmaceutical products.

Chemical Pharmaceutical Product Landscape

The Chemical Pharmaceutical product landscape is characterized by continuous innovation aimed at enhancing efficacy, safety, and patient convenience. Key product advancements include the development of novel drug delivery systems, such as extended-release formulations and targeted delivery mechanisms, which improve therapeutic outcomes and reduce side effects. The performance of these products is rigorously measured through clinical trials, focusing on parameters like bioavailability, therapeutic index, and patient adherence. Unique selling propositions often revolve around patented chemical entities, superior manufacturing processes, and robust clinical data. Technological advancements are also driving the development of more complex molecules and personalized medicines, catering to specific patient genetic profiles and disease manifestations. The market sees a steady stream of new chemical entities (NCEs) and improved generic versions of existing drugs, ensuring a dynamic and competitive environment.

Key Drivers, Barriers & Challenges in Chemical Pharmaceutical

Key Drivers:

- Rising Global Healthcare Expenditure: Increased spending on healthcare worldwide directly fuels demand for chemical pharmaceuticals.

- Increasing Prevalence of Chronic Diseases: Conditions like cardiovascular diseases, cancer, and diabetes necessitate ongoing treatment with chemical drugs.

- Technological Advancements in Drug Discovery and Development: Innovations in AI, genomics, and advanced synthesis are accelerating product pipelines.

- Growing Demand for Generic Pharmaceuticals: Cost-effectiveness and accessibility of generics drive market penetration.

- Aging Global Population: An increasing elderly population leads to a higher demand for medications to manage age-related ailments.

- Government Initiatives and Healthcare Reforms: Policies supporting public health and drug accessibility boost the market.

Barriers & Challenges:

- Stringent Regulatory Approval Processes: Lengthy and costly approval pathways can delay market entry for new drugs.

- High Research and Development Costs: Significant investment is required for drug discovery, clinical trials, and regulatory compliance.

- Patent Expirations and Generic Competition: Loss of patent protection leads to price erosion and increased competition from generic manufacturers.

- Supply Chain Disruptions and Raw Material Volatility: Geopolitical factors and global events can impact the availability and cost of key chemical ingredients.

- Increasingly Complex Drug Formulations: Development of novel delivery systems and complex molecules presents manufacturing challenges.

- Ethical Concerns and Public Perception: Issues related to drug pricing, accessibility, and data privacy can influence market dynamics.

Emerging Opportunities in Chemical Pharmaceutical

Emerging opportunities within the Chemical Pharmaceutical market are largely centered around the growing demand for personalized medicine, driven by advancements in genetic sequencing and targeted therapies. The increasing focus on biologics and biosimilars, while a distinct category, often leverages chemical synthesis expertise for specific components and manufacturing processes, presenting collaborative opportunities. Untapped markets in developing economies offer significant potential due to improving healthcare infrastructure and rising disposable incomes. Furthermore, the application of artificial intelligence and machine learning in drug discovery and clinical trial optimization presents a transformative opportunity to accelerate innovation and reduce development costs. Evolving consumer preferences towards preventative healthcare and wellness products also create a niche for specialized chemical formulations.

Growth Accelerators in the Chemical Pharmaceutical Industry

Several catalysts are driving long-term growth in the Chemical Pharmaceutical industry. Technological breakthroughs in drug delivery systems, such as nanotechnology and controlled-release formulations, are enhancing therapeutic efficacy and patient compliance, thereby accelerating adoption. Strategic partnerships between pharmaceutical companies, academic institutions, and biotechnology firms are fostering innovation and expanding R&D capabilities. Market expansion strategies, particularly in emerging economies, are crucial for capitalizing on growing healthcare demands and increasing patient access to essential medications. Furthermore, the continuous development of new chemical entities (NCEs) to address unmet medical needs remains a fundamental growth accelerator. The focus on complex generics and value-added formulations also provides a consistent avenue for market penetration and revenue growth.

Key Players Shaping the Chemical Pharmaceutical Market

- Abbott Laboratories

- AstraZeneca

- Eli Lilly

- GlaxoSmithKline

- Hoffmann-La Roche

- J.B.Chemicals And Pharmaceuticals

- North China Pharmaceutical

- Northeast Pharmaceutical

- Orchid Chemicals & Pharamaceuticals

- Zhejiang Medicine

Notable Milestones in Chemical Pharmaceutical Sector

- 2019: Increased investment in R&D for oncology drugs, leading to several new approvals.

- 2020: Accelerated development and manufacturing of antiviral medications in response to global health crises.

- 2021: Significant advancements in mRNA vaccine technology, impacting the broader pharmaceutical landscape.

- 2022: Growing focus on sustainable manufacturing practices and green chemistry in pharmaceutical production.

- 2023: Rise in partnerships for AI-driven drug discovery and development, accelerating the pipeline.

- 2024: Expansion of biosimilar markets and increased regulatory pathways for these complex generics.

In-Depth Chemical Pharmaceutical Market Outlook

The future of the Chemical Pharmaceutical market is exceptionally promising, driven by sustained innovation and an expanding global demand for healthcare solutions. Growth accelerators such as personalized medicine, advanced drug delivery systems, and AI-driven R&D will continue to shape the industry. Strategic partnerships and market expansion into emerging economies will unlock new revenue streams and broaden patient access. The market's inherent resilience, coupled with its critical role in addressing global health challenges, positions it for continued robust growth and significant contributions to public well-being. The estimated market size of $250,000 million by 2033 underscores the sector's substantial potential.

Chemical Pharmaceutical Segmentation

-

1. Application

- 1.1. Pharmaceutical Industries

- 1.2. Research Organizations

- 1.3. Others

-

2. Types

- 2.1. Oral Pharmaceuticals

- 2.2. Injectable Pharmaceuticals

- 2.3. Topical Pharmaceuticals

- 2.4. Others

Chemical Pharmaceutical Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chemical Pharmaceutical REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical Industries

- 5.1.2. Research Organizations

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Oral Pharmaceuticals

- 5.2.2. Injectable Pharmaceuticals

- 5.2.3. Topical Pharmaceuticals

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical Industries

- 6.1.2. Research Organizations

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Oral Pharmaceuticals

- 6.2.2. Injectable Pharmaceuticals

- 6.2.3. Topical Pharmaceuticals

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical Industries

- 7.1.2. Research Organizations

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Oral Pharmaceuticals

- 7.2.2. Injectable Pharmaceuticals

- 7.2.3. Topical Pharmaceuticals

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical Industries

- 8.1.2. Research Organizations

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Oral Pharmaceuticals

- 8.2.2. Injectable Pharmaceuticals

- 8.2.3. Topical Pharmaceuticals

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical Industries

- 9.1.2. Research Organizations

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Oral Pharmaceuticals

- 9.2.2. Injectable Pharmaceuticals

- 9.2.3. Topical Pharmaceuticals

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Chemical Pharmaceutical Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical Industries

- 10.1.2. Research Organizations

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Oral Pharmaceuticals

- 10.2.2. Injectable Pharmaceuticals

- 10.2.3. Topical Pharmaceuticals

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Orchid Chemicals & Pharamaceuticals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 J.B.Chemicals And Pharmaceuticals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 North China Pharmaceutical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GlaxoSmithKline

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Northeast Pharmaceutical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhejiang Medicine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hoffmann-La Roche

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eli Lilly

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Orchid Chemicals & Pharamaceuticals

List of Figures

- Figure 1: Global Chemical Pharmaceutical Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Chemical Pharmaceutical Revenue (million), by Application 2024 & 2032

- Figure 3: North America Chemical Pharmaceutical Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Chemical Pharmaceutical Revenue (million), by Types 2024 & 2032

- Figure 5: North America Chemical Pharmaceutical Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Chemical Pharmaceutical Revenue (million), by Country 2024 & 2032

- Figure 7: North America Chemical Pharmaceutical Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Chemical Pharmaceutical Revenue (million), by Application 2024 & 2032

- Figure 9: South America Chemical Pharmaceutical Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Chemical Pharmaceutical Revenue (million), by Types 2024 & 2032

- Figure 11: South America Chemical Pharmaceutical Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Chemical Pharmaceutical Revenue (million), by Country 2024 & 2032

- Figure 13: South America Chemical Pharmaceutical Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Chemical Pharmaceutical Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Chemical Pharmaceutical Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Chemical Pharmaceutical Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Chemical Pharmaceutical Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Chemical Pharmaceutical Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Chemical Pharmaceutical Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Chemical Pharmaceutical Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Chemical Pharmaceutical Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Chemical Pharmaceutical Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Chemical Pharmaceutical Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Chemical Pharmaceutical Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Chemical Pharmaceutical Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Chemical Pharmaceutical Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Chemical Pharmaceutical Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Chemical Pharmaceutical Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Chemical Pharmaceutical Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Chemical Pharmaceutical Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Chemical Pharmaceutical Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chemical Pharmaceutical Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Chemical Pharmaceutical Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Chemical Pharmaceutical Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Chemical Pharmaceutical Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Chemical Pharmaceutical Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Chemical Pharmaceutical Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Chemical Pharmaceutical Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Chemical Pharmaceutical Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Chemical Pharmaceutical Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Chemical Pharmaceutical Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Pharmaceutical?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Chemical Pharmaceutical?

Key companies in the market include Orchid Chemicals & Pharamaceuticals, J.B.Chemicals And Pharmaceuticals, North China Pharmaceutical, GlaxoSmithKline, AstraZeneca, Northeast Pharmaceutical, Zhejiang Medicine, Hoffmann-La Roche, Abbott Laboratories, Eli Lilly.

3. What are the main segments of the Chemical Pharmaceutical?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chemical Pharmaceutical," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chemical Pharmaceutical report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chemical Pharmaceutical?

To stay informed about further developments, trends, and reports in the Chemical Pharmaceutical, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence