Key Insights

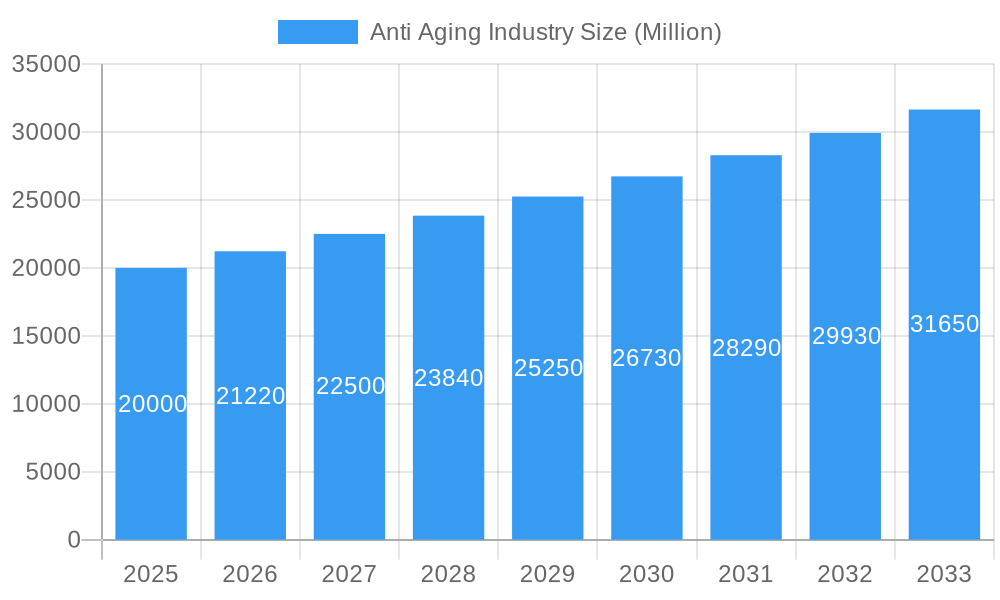

The anti-aging market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is driven by several key factors. Increasing awareness of skincare and anti-aging solutions among consumers, coupled with rising disposable incomes, particularly in developing economies, fuels demand. Technological advancements leading to the development of more effective and safer anti-aging products and procedures, such as minimally invasive treatments and advanced cosmetic dermatology techniques, are significant contributors. The aging global population also presents a substantial market opportunity, with individuals actively seeking to mitigate visible signs of aging. Market segmentation reveals strong growth in anti-wrinkle treatments and skin resurfacing procedures, indicating consumer preference for targeted solutions. While the market faces some restraints, such as potential side effects associated with certain procedures and high costs of advanced treatments, the overall positive trajectory is supported by continuous innovation and increasing accessibility of anti-aging solutions across diverse demographics.

Anti Aging Industry Market Size (In Billion)

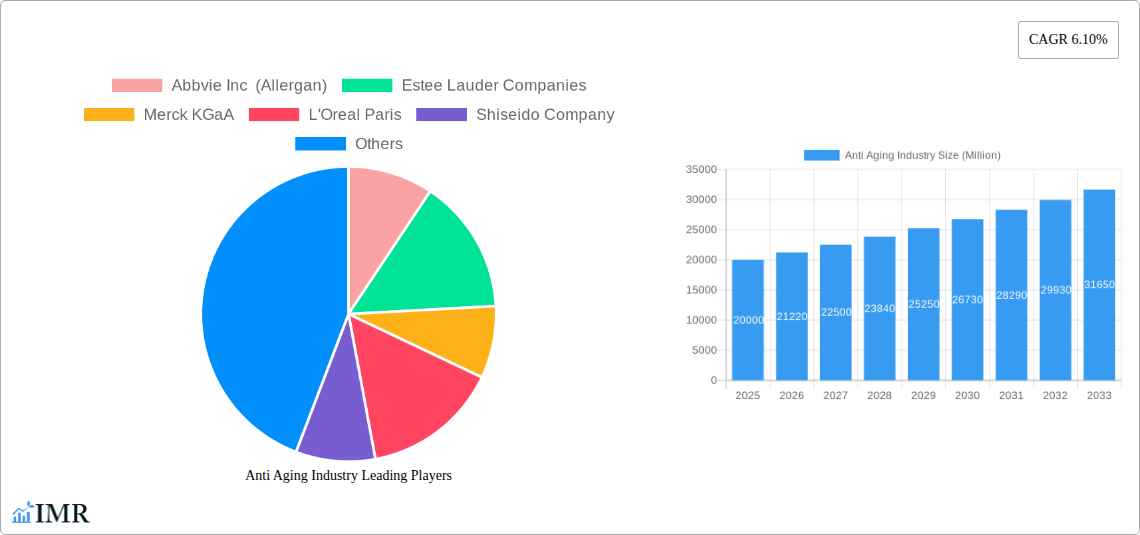

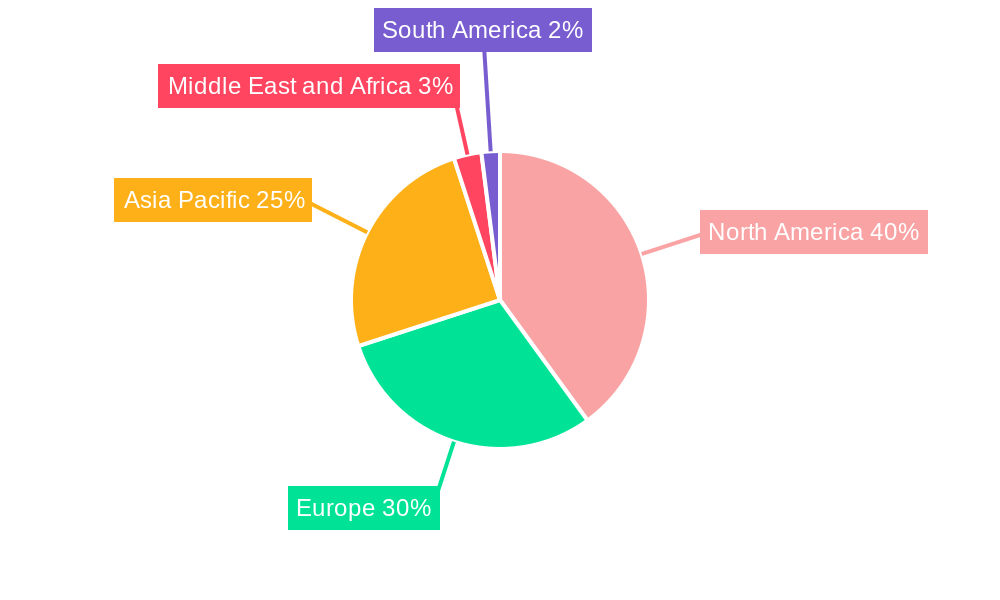

The North American market currently holds a significant share, benefiting from high consumer spending on beauty and personal care products and advanced medical technologies. However, the Asia-Pacific region is expected to witness the most rapid growth in the forecast period, driven by rising disposable incomes and increasing adoption of anti-aging products and services in countries like China and India. Europe is also a key market, showing steady growth spurred by increasing awareness of skin health and the availability of technologically advanced treatments. Key players in the market, including AbbVie Inc (Allergan), Estée Lauder Companies, and L'Oréal Paris, are constantly innovating to meet consumer demands and expand their product portfolios, intensifying competition and furthering market evolution. The industry continues to witness a shift towards natural and organic ingredients, reflecting growing consumer preference for cleaner beauty products. This trend, combined with continued technological innovation and expanding market penetration in emerging economies, ensures sustained growth for the anti-aging market in the coming years.

Anti Aging Industry Company Market Share

Anti-Aging Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the anti-aging industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (cosmetics and personal care) and child markets (anti-wrinkle treatments, anti-pigmentation products, and aesthetic devices), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Anti Aging Industry Market Dynamics & Structure

The global anti-aging market is characterized by moderate concentration, with several multinational corporations holding significant market share. Technological innovation, particularly in non-invasive procedures and advanced skincare formulations, is a key driver. Regulatory frameworks, varying across regions, influence product development and market access. The market faces competition from alternative therapies and lifestyle choices impacting market adoption. Mergers and acquisitions (M&A) activity has been significant, particularly amongst larger players seeking to expand their product portfolios and geographical reach. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on non-invasive procedures (e.g., ultrasound, laser therapies), personalized skincare, and AI-driven diagnostics.

- Regulatory Framework: Stringent regulations in certain regions (e.g., FDA approval in the US) create barriers to entry for new players.

- Competitive Substitutes: Lifestyle changes (diet, exercise), alternative medicine, and minimally invasive surgical procedures represent competitive pressures.

- End-User Demographics: Primarily driven by the growing aging population, increasing disposable income, and a rising focus on aesthetic enhancement amongst consumers.

- M&A Trends: Consolidation expected to continue, with larger players acquiring smaller, specialized firms to expand their product offerings and geographical reach. Estimated xx M&A deals in the last 5 years.

Anti Aging Industry Growth Trends & Insights

The global anti-aging market has witnessed consistent growth over the past decade, fueled by an aging global population, increasing disposable incomes, and rising consumer awareness of anti-aging products and procedures. Technological advancements have played a significant role in driving market expansion, with the introduction of innovative products and minimally invasive techniques offering safer, more effective solutions. The market size is expected to reach xx Million by 2033, with a significant increase in adoption rates across various segments. Consumer behavior has shifted towards preventative anti-aging strategies, driving demand for products that address early signs of aging.

- Market Size Evolution: From xx Million in 2019 to an estimated xx Million in 2025.

- Adoption Rates: Increasing adoption of non-invasive procedures, driven by consumer preference for less downtime and reduced risks.

- Technological Disruptions: Introduction of advanced technologies like HIFU, lasers, and personalized skincare regimens significantly impacting the market.

- Consumer Behavior Shifts: Growing emphasis on preventative anti-aging measures and personalized solutions tailored to individual needs.

Dominant Regions, Countries, or Segments in Anti Aging Industry

North America currently dominates the anti-aging market, followed by Europe and Asia-Pacific. Within applications, anti-wrinkle treatments hold the largest market share, driven by high consumer demand. The devices segment is also experiencing robust growth, propelled by the increasing popularity of non-invasive procedures. Key growth drivers include rising disposable incomes, increasing awareness, and supportive regulatory environments.

- Dominant Region: North America, due to high consumer spending on aesthetic procedures and skincare products.

- Dominant Application: Anti-wrinkle treatments, driven by the prevalence of wrinkles and high demand for effective solutions.

- Dominant Product Type: Products, holding the largest market share due to wider availability and affordability.

- Key Drivers: Increasing disposable incomes, rising awareness of anti-aging solutions, favorable regulatory environments, and technological advancements.

- Growth Potential: Asia-Pacific exhibits significant growth potential driven by the region's large population and increasing consumer spending on beauty and personal care.

Anti Aging Industry Product Landscape

The anti-aging product landscape is diverse, encompassing a wide range of topical creams and serums, injectables (e.g., Botox), laser treatments, and other non-invasive procedures. Product innovation focuses on advanced formulations with potent active ingredients, improved efficacy, and enhanced safety profiles. Technological advancements like personalized skincare regimens, AI-driven diagnostics, and minimally invasive techniques are transforming the industry. Unique selling propositions include scientifically backed formulations, targeted efficacy, and convenient application methods.

Key Drivers, Barriers & Challenges in Anti Aging Industry

Key Drivers:

- Increasing aging population globally.

- Rising disposable incomes in developing economies.

- Growing awareness of anti-aging benefits through media and social influence.

- Technological advancements leading to safer, more effective treatments.

Key Challenges and Restraints:

- High cost of advanced treatments limiting accessibility.

- Stringent regulatory requirements delaying product approvals.

- Potential side effects and risks associated with certain procedures causing consumer hesitation.

- Intense competition among existing players.

Emerging Opportunities in Anti Aging Industry

- Personalized Anti-aging: Tailored solutions based on individual genetics and skin conditions.

- Preventive Anti-aging: Focus on early intervention strategies to delay signs of aging.

- Expansion in Emerging Markets: Untapped potential in developing economies with growing middle classes.

- Technological Advancements: Innovations in non-invasive technologies and AI-powered diagnostics.

Growth Accelerators in the Anti Aging Industry Industry

Technological breakthroughs in non-invasive procedures and advanced skincare formulations are major catalysts for market growth. Strategic partnerships between technology providers and cosmetic companies are fostering innovation. Expansion into emerging markets with growing middle classes and consumer interest in aesthetic enhancement will contribute significantly to long-term growth.

Key Players Shaping the Anti Aging Industry Market

Notable Milestones in Anti Aging Industry Sector

- October 2022: Sofwave launches Synchronous Ultrasound Parallel Beam technology, FDA-approved for facial and neck skin firming.

- October 2022: LR Health and Beauty launches ZEITGARD PRO cosmetic device for home use with anti-aging functionalities.

In-Depth Anti Aging Industry Market Outlook

The anti-aging market is poised for continued expansion, driven by demographic trends, technological advancements, and changing consumer preferences. Strategic partnerships, focused innovation, and expansion into emerging markets will be key to unlocking future market potential. Companies with strong R&D capabilities, diverse product portfolios, and a focus on personalization will be best positioned for success in this dynamic and growing market.

Anti Aging Industry Segmentation

-

1. Type

-

1.1. Product

- 1.1.1. Anti-wrinkle Products

- 1.1.2. Anti-stretch Mark Products

- 1.1.3. Hair Color Products

- 1.1.4. Other Products

-

1.2. Devices

- 1.2.1. Radio-frequency Devices

- 1.2.2. Anti-cellulite Treatment Devices

- 1.2.3. Microdermabrasion Devices

- 1.2.4. Other Devices

-

1.1. Product

-

2. Application

- 2.1. Anti-wrinkle Treatment

- 2.2. Anti-pigmentation

- 2.3. Skin Resurfacing

- 2.4. Other Applications

Anti Aging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anti Aging Industry Regional Market Share

Geographic Coverage of Anti Aging Industry

Anti Aging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Beauty Consciousness in Increasing Aging Population; Easy Accessibility of Products and Services

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Side Effects Associated With the Products

- 3.4. Market Trends

- 3.4.1. Anti-stretch Mark and Anti-wrinkle Products are Projected to Have Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Product

- 5.1.1.1. Anti-wrinkle Products

- 5.1.1.2. Anti-stretch Mark Products

- 5.1.1.3. Hair Color Products

- 5.1.1.4. Other Products

- 5.1.2. Devices

- 5.1.2.1. Radio-frequency Devices

- 5.1.2.2. Anti-cellulite Treatment Devices

- 5.1.2.3. Microdermabrasion Devices

- 5.1.2.4. Other Devices

- 5.1.1. Product

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Anti-wrinkle Treatment

- 5.2.2. Anti-pigmentation

- 5.2.3. Skin Resurfacing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Product

- 6.1.1.1. Anti-wrinkle Products

- 6.1.1.2. Anti-stretch Mark Products

- 6.1.1.3. Hair Color Products

- 6.1.1.4. Other Products

- 6.1.2. Devices

- 6.1.2.1. Radio-frequency Devices

- 6.1.2.2. Anti-cellulite Treatment Devices

- 6.1.2.3. Microdermabrasion Devices

- 6.1.2.4. Other Devices

- 6.1.1. Product

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Anti-wrinkle Treatment

- 6.2.2. Anti-pigmentation

- 6.2.3. Skin Resurfacing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Product

- 7.1.1.1. Anti-wrinkle Products

- 7.1.1.2. Anti-stretch Mark Products

- 7.1.1.3. Hair Color Products

- 7.1.1.4. Other Products

- 7.1.2. Devices

- 7.1.2.1. Radio-frequency Devices

- 7.1.2.2. Anti-cellulite Treatment Devices

- 7.1.2.3. Microdermabrasion Devices

- 7.1.2.4. Other Devices

- 7.1.1. Product

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Anti-wrinkle Treatment

- 7.2.2. Anti-pigmentation

- 7.2.3. Skin Resurfacing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Product

- 8.1.1.1. Anti-wrinkle Products

- 8.1.1.2. Anti-stretch Mark Products

- 8.1.1.3. Hair Color Products

- 8.1.1.4. Other Products

- 8.1.2. Devices

- 8.1.2.1. Radio-frequency Devices

- 8.1.2.2. Anti-cellulite Treatment Devices

- 8.1.2.3. Microdermabrasion Devices

- 8.1.2.4. Other Devices

- 8.1.1. Product

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Anti-wrinkle Treatment

- 8.2.2. Anti-pigmentation

- 8.2.3. Skin Resurfacing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Product

- 9.1.1.1. Anti-wrinkle Products

- 9.1.1.2. Anti-stretch Mark Products

- 9.1.1.3. Hair Color Products

- 9.1.1.4. Other Products

- 9.1.2. Devices

- 9.1.2.1. Radio-frequency Devices

- 9.1.2.2. Anti-cellulite Treatment Devices

- 9.1.2.3. Microdermabrasion Devices

- 9.1.2.4. Other Devices

- 9.1.1. Product

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Anti-wrinkle Treatment

- 9.2.2. Anti-pigmentation

- 9.2.3. Skin Resurfacing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Anti Aging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Product

- 10.1.1.1. Anti-wrinkle Products

- 10.1.1.2. Anti-stretch Mark Products

- 10.1.1.3. Hair Color Products

- 10.1.1.4. Other Products

- 10.1.2. Devices

- 10.1.2.1. Radio-frequency Devices

- 10.1.2.2. Anti-cellulite Treatment Devices

- 10.1.2.3. Microdermabrasion Devices

- 10.1.2.4. Other Devices

- 10.1.1. Product

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Anti-wrinkle Treatment

- 10.2.2. Anti-pigmentation

- 10.2.3. Skin Resurfacing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abbvie Inc (Allergan)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Estee Lauder Companies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Oreal Paris

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shiseido Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bausch & Lomb Incorporated (Solta Medical)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unilever UK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lumenis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Procter & Gamble Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beiersdorf AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Abbvie Inc (Allergan)

List of Figures

- Figure 1: Global Anti Aging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Anti Aging Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Anti Aging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Anti Aging Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Anti Aging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Anti Aging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Anti Aging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Anti Aging Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Anti Aging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Anti Aging Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Anti Aging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Anti Aging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Anti Aging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Anti Aging Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Anti Aging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Anti Aging Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Anti Aging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Anti Aging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Anti Aging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Anti Aging Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East and Africa Anti Aging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Anti Aging Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Anti Aging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Anti Aging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Anti Aging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Anti Aging Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Anti Aging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Anti Aging Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Anti Aging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Anti Aging Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Anti Aging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Anti Aging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Anti Aging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Anti Aging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Anti Aging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Anti Aging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Anti Aging Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Anti Aging Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Anti Aging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Anti Aging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Aging Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Anti Aging Industry?

Key companies in the market include Abbvie Inc (Allergan), Estee Lauder Companies, Merck KGaA, L'Oreal Paris, Shiseido Company, Bausch & Lomb Incorporated (Solta Medical), Unilever UK, Lumenis, Koninklijke Philips NV, Procter & Gamble Company, Beiersdorf AG.

3. What are the main segments of the Anti Aging Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Beauty Consciousness in Increasing Aging Population; Easy Accessibility of Products and Services.

6. What are the notable trends driving market growth?

Anti-stretch Mark and Anti-wrinkle Products are Projected to Have Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Side Effects Associated With the Products.

8. Can you provide examples of recent developments in the market?

In October 2022, the Anti-aging company Sofwave launched anti-aging technology, Synchronous Ultrasound Parallel Beam- based on ultrasound rays and approved by FDA for firming facial and neck skin and for lifting the eyebrows and chin. This was launched at the International Congress on Medical Aesthetics and Anti-aging in Tel Aviv.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Aging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Aging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Aging Industry?

To stay informed about further developments, trends, and reports in the Anti Aging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence