Key Insights

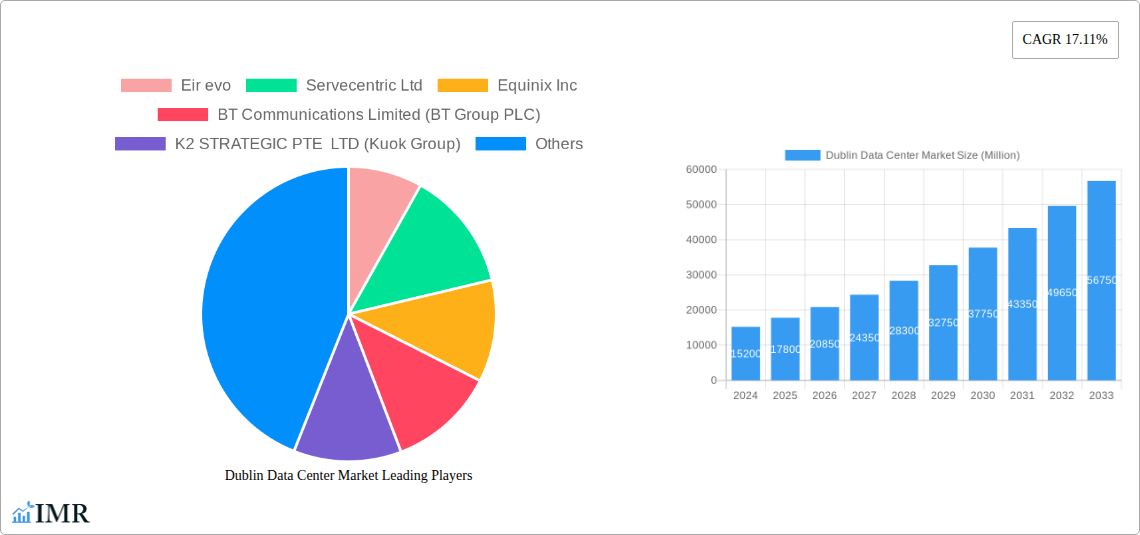

The Dublin data center market is poised for exceptional growth, projected to expand from a market size of approximately USD 15,200 million in 2024 to an estimated USD 48,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 17.11%. This rapid expansion is primarily fueled by the insatiable demand for digital infrastructure driven by cloud computing adoption, the proliferation of AI and machine learning applications, and the increasing data generation from diverse end-user industries. Key growth drivers include the significant investments in hyperscale data centers by major cloud providers seeking to leverage Ireland's favorable corporate tax environment and connectivity. The burgeoning media and entertainment sector, coupled with the expanding telecom infrastructure, also contributes substantially to this upward trajectory. Furthermore, advancements in edge computing are creating new opportunities for localized data processing, further stimulating market development.

Dublin Data Center Market Market Size (In Billion)

The market's growth is further shaped by several emerging trends and strategic considerations. The increasing focus on sustainability and energy efficiency is leading to the development of greener data center designs and the adoption of renewable energy sources, a critical factor for long-term viability. The continuous rise in data absorption, particularly from cloud and IT services, telecom, and BFSI sectors, underscores the critical role of colocation facilities. While the demand for large and massive data center sizes dominates, there is also a growing niche for smaller, distributed edge facilities. However, the market faces certain restraints, including the escalating cost of electricity and the ongoing challenges related to power availability and grid capacity in certain areas. Navigating these power constraints while ensuring reliable and scalable infrastructure will be crucial for sustained growth in the Dublin data center landscape. The competitive landscape is characterized by the presence of established global players and local providers, all vying to capitalize on the region's strong digital economy.

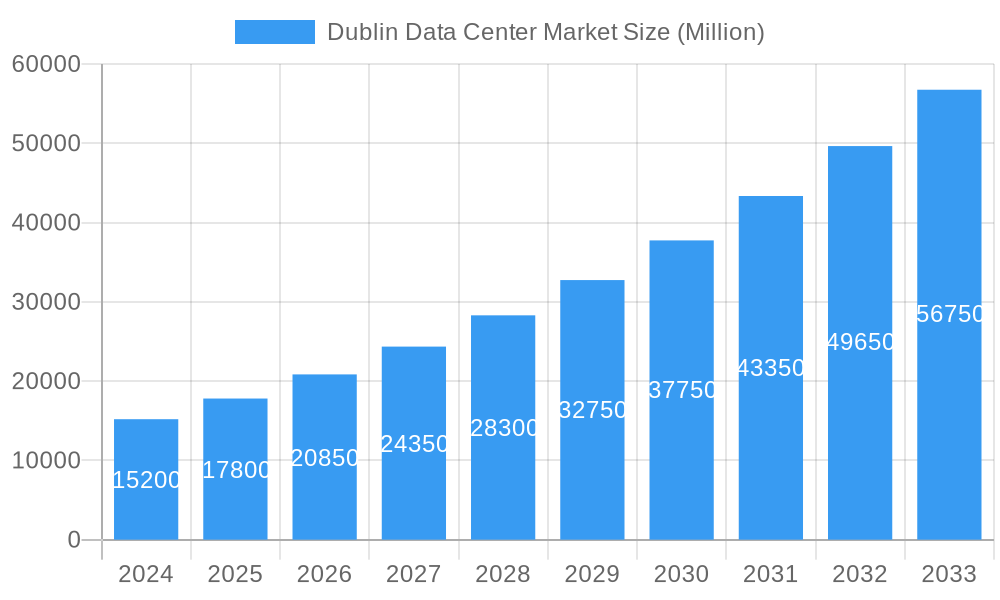

Dublin Data Center Market Company Market Share

Dublin Data Center Market Report: Unlocking Growth and Innovation in Ireland's Digital Hub

This comprehensive report offers an in-depth analysis of the Dublin data center market, a critical hub for digital infrastructure in Europe. Covering the period from 2019 to 2033, with a base year of 2025, the study delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, emerging opportunities, and the competitive environment. We provide quantitative insights, including projected values in million units, and qualitative assessments to guide strategic decision-making for industry professionals, investors, and stakeholders. The report examines the parent market, Ireland, and its key child market, Dublin, to provide a holistic view of the evolving data center ecosystem.

Dublin Data Center Market Market Dynamics & Structure

The Dublin data center market is characterized by a highly dynamic and competitive landscape, driven by robust demand for digital services and a favorable business environment. Market concentration is increasing with major global players establishing significant footprints, though local providers also maintain a presence. Technological innovation is a key driver, with a constant push for higher density, improved power efficiency, and advanced cooling solutions to meet the demands of hyperscale cloud providers and AI workloads. Regulatory frameworks, particularly concerning energy consumption and environmental sustainability, are becoming increasingly influential, shaping development strategies. Competitive product substitutes primarily manifest as alternative cloud solutions and the ongoing evolution of network infrastructure. End-user demographics are shifting towards hyperscale deployments, driven by cloud computing and content delivery networks, with significant contributions from BFSI and e-commerce sectors. Mergers and acquisitions (M&A) activity remains a prominent feature, consolidating market share and expanding service offerings.

- Market Concentration: Increasing, with major global providers dominating hyperscale deployments.

- Technological Innovation Drivers: AI workloads, edge computing, energy efficiency, liquid cooling.

- Regulatory Frameworks: Focus on renewable energy, carbon footprint reduction, and grid capacity.

- Competitive Product Substitutes: Other European data center markets, hybrid cloud solutions.

- End-User Demographics: Dominance of hyperscale, strong presence from Cloud & IT, BFSI, and E-commerce.

- M&A Trends: Ongoing consolidation and strategic acquisitions to gain market share and specialized capabilities.

Dublin Data Center Market Growth Trends & Insights

The Dublin data center market is poised for substantial growth, fueled by its strategic location, robust digital economy, and increasing demand for cloud services. The market size is projected to expand significantly over the forecast period, driven by a Compound Annual Growth Rate (CAGR) of xx%, reflecting sustained investment and development. Adoption rates for colocation services, particularly hyperscale and wholesale, are accelerating as businesses increasingly outsource their IT infrastructure to specialized providers. Technological disruptions, such as the advent of AI and the expansion of 5G networks, are creating new demand pools for high-performance computing and low-latency solutions. Consumer behavior shifts are evident in the growing preference for scalable, flexible, and secure data storage and processing capabilities. The estimated market size for 2025 is valued at €xx million, with projections reaching €xx million by 2033. Market penetration for advanced data center services is expected to rise as businesses embrace digital transformation initiatives.

Dominant Regions, Countries, or Segments in Dublin Data Center Market

Within the Dublin data center market, the Massive and Mega DC Size segments are demonstrating the most significant growth, driven by hyperscale cloud providers and large enterprises. The Tier 3 and Tier 4 Tier Types are dominant, reflecting the critical need for high availability, reliability, and uptime for mission-critical applications. In terms of Absorption, Utilized capacity, particularly Hyperscale colocation, is the leading segment, commanding the largest market share due to the insatiable demand from global cloud giants. The Cloud and IT end-user segment is the primary driver of this demand, followed closely by Telecom and Media and Entertainment. The growth in these segments is supported by Ireland's advantageous corporate tax rates, a skilled workforce, and significant investment in digital infrastructure, making it a prime location for data center development. The Non-utilized capacity, while present, is being rapidly absorbed by new builds and expansions.

- Dominant DC Size: Massive, Mega (driven by hyperscale expansion)

- Dominant Tier Type: Tier 3, Tier 4 (essential for reliability and uptime)

- Dominant Absorption: Utilized – Hyperscale Colocation (catering to global cloud providers)

- Leading End Users: Cloud and IT, Telecom, Media and Entertainment

- Key Drivers of Dominance: Favorable tax environment, strong digital economy, access to subsea cables, government support for digital infrastructure.

- Market Share (Estimated): Hyperscale Colocation: xx%, Wholesale Colocation: xx%, Retail Colocation: xx%

Dublin Data Center Market Product Landscape

The Dublin data center market is characterized by a sophisticated product landscape focused on delivering high-density, efficient, and secure digital infrastructure solutions. Innovations in cooling technologies, including liquid cooling and advanced air management systems, are becoming standard to support power-hungry hardware. High-performance computing (HPC) solutions are increasingly in demand, catering to AI and machine learning workloads. Power delivery systems are evolving to integrate renewable energy sources and optimize energy efficiency, with a focus on achieving sustainability targets. The performance metrics emphasize low latency, high availability (xx.xx% uptime), and scalable capacity to meet the dynamic needs of clients. Unique selling propositions often revolve around connectivity options, hyperscale build-to-suit capabilities, and robust security protocols.

Key Drivers, Barriers & Challenges in Dublin Data Center Market

Key Drivers: The Dublin data center market is propelled by several critical factors. The continued expansion of cloud computing services, the burgeoning demand for AI and machine learning capabilities, and the growth of the digital economy are primary demand generators. Ireland's strategic geographical location, offering excellent connectivity to North America and Europe, alongside its favorable business environment and tax incentives, continue to attract significant foreign direct investment. Government support for digital infrastructure development further bolsters growth.

Barriers & Challenges: Despite the strong growth trajectory, the market faces significant barriers and challenges. Securing adequate and sustainable power supply to meet the escalating energy demands of data centers is a critical concern. Regulatory hurdles related to environmental impact, particularly carbon emissions and water usage, are becoming more stringent. Finding and retaining a skilled workforce to design, build, and operate these complex facilities poses another challenge. Furthermore, supply chain disruptions for critical hardware and construction materials can lead to project delays and increased costs. Competitive pressures from other emerging European data center hubs also necessitate continuous innovation and cost optimization.

Emerging Opportunities in Dublin Data Center Market

Emerging opportunities in the Dublin data center market lie in the expansion of edge computing deployments to serve low-latency applications, the growing demand for specialized data centers for AI and HPC, and the increasing adoption of sustainable and green data center technologies. The development of the Internet of Things (IoT) ecosystem also presents a significant opportunity for localized data processing. Untapped markets within specific industry verticals and the potential for repurposing existing infrastructure for data center use are also areas of interest. Evolving consumer preferences for faster, more responsive digital services will continue to drive the need for distributed and performant infrastructure.

Growth Accelerators in the Dublin Data Center Market Industry

Long-term growth in the Dublin data center market is being accelerated by several key catalysts. Technological breakthroughs in areas such as artificial intelligence, quantum computing, and advanced networking are creating new demand paradigms that data centers must support. Strategic partnerships between data center operators, cloud providers, and energy companies are crucial for ensuring sustainable power solutions and grid stability. Market expansion strategies, including the development of new campuses and the enhancement of existing facilities to meet hyperscale demands, are directly contributing to sustained growth. Furthermore, the increasing focus on sustainability and the development of green data center solutions are not only meeting regulatory requirements but also attracting environmentally conscious clients.

Key Players Shaping the Dublin Data Center Market Market

- Eir evo

- Servecentric Ltd

- Equinix Inc

- BT Communications Limited (BT Group PLC)

- K2 STRATEGIC PTE LTD (Kuok Group)

- Web World Ireland

- Zenlayer Inc

- Viatel Ireland Limited

- Digital Realty Trust Inc (Interxion)

- Keppel DC REIT Management Pte Ltd

- Cyrus One Inc

- Sungard Availability Services LP

- EdgeConneX Inc (EQT Infrastructure)

Notable Milestones in Dublin Data Center Market Sector

- June 2022: Vantage Data Centres Ltd received permission to construct two data centers (total floor space 40,580 sq. m) within Profile Park, "Ireland's Data Centre Cluster." This development signifies expansion within a key data center hub.

- July 2022: ST Engineering's data center pre-cooling technology, the Airbitat DC Cooling System, demonstrated a potential 20% reduction in cooling costs and a 40% decrease in heat load on existing chiller systems, highlighting advancements in energy efficiency.

In-Depth Dublin Data Center Market Market Outlook

The outlook for the Dublin data center market remains exceptionally strong, driven by a confluence of sustained demand and ongoing innovation. Growth accelerators, including the relentless expansion of cloud services, the transformative impact of AI, and the strategic importance of Ireland as a digital gateway, will continue to fuel expansion. Future market potential is immense, with opportunities arising from the increasing need for hyperscale capacity, the development of edge infrastructure, and the integration of advanced cooling and renewable energy solutions. Strategic opportunities include forging deeper partnerships with energy providers to address power constraints, investing in sustainable technologies to meet evolving environmental expectations, and continuously enhancing connectivity to maintain Dublin's competitive edge as a premier European data center destination.

Dublin Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud and IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media and Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-utilized

-

3.1. Utilized

Dublin Data Center Market Segmentation By Geography

- 1. Dublin

Dublin Data Center Market Regional Market Share

Geographic Coverage of Dublin Data Center Market

Dublin Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Mega Size Data Centers are Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dublin Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud and IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media and Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Dublin

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eir evo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Servecentric Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equinix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BT Communications Limited (BT Group PLC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 K2 STRATEGIC PTE LTD (Kuok Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Web World Ireland

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zenlayer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viatel Ireland Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Digital Realty Trust Inc (Interxion)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Keppel DC REIT Management Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cyrus One Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sungard Availability Services LP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 EdgeConneX Inc (EQT Infrastructure)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Eir evo

List of Figures

- Figure 1: Dublin Data Center Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Dublin Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Dublin Data Center Market Revenue Million Forecast, by DC Size 2020 & 2033

- Table 2: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 3: Dublin Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 4: Dublin Data Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Dublin Data Center Market Revenue Million Forecast, by DC Size 2020 & 2033

- Table 6: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 7: Dublin Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 8: Dublin Data Center Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dublin Data Center Market?

The projected CAGR is approximately 17.11%.

2. Which companies are prominent players in the Dublin Data Center Market?

Key companies in the market include Eir evo, Servecentric Ltd, Equinix Inc, BT Communications Limited (BT Group PLC), K2 STRATEGIC PTE LTD (Kuok Group), Web World Ireland, Zenlayer Inc, Viatel Ireland Limited, Digital Realty Trust Inc (Interxion), Keppel DC REIT Management Pte Ltd, Cyrus One Inc, Sungard Availability Services LP, EdgeConneX Inc (EQT Infrastructure).

3. What are the main segments of the Dublin Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Mega Size Data Centers are Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

June 2022: Vantage Data Centres Ltd was granted permission to demolish an abandoned single-story residence and related outbuilding (206 sq. m) to make way for the construction of two data centers. The relevant 8.7-hectare site is located within Profile Park, regarded as "Ireland's Data Centre Cluster," in the townlands of Ballybane and Kilbride. The idea is to construct two two-story data centers with a plant on the roof of each facility and accompanying auxiliary development with a total floor space of 40,580 sq. m. Building 11, the first data center planned, will be built to the south of the property, while Building 12, the second data center, will be located north.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dublin Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dublin Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dublin Data Center Market?

To stay informed about further developments, trends, and reports in the Dublin Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence