Key Insights

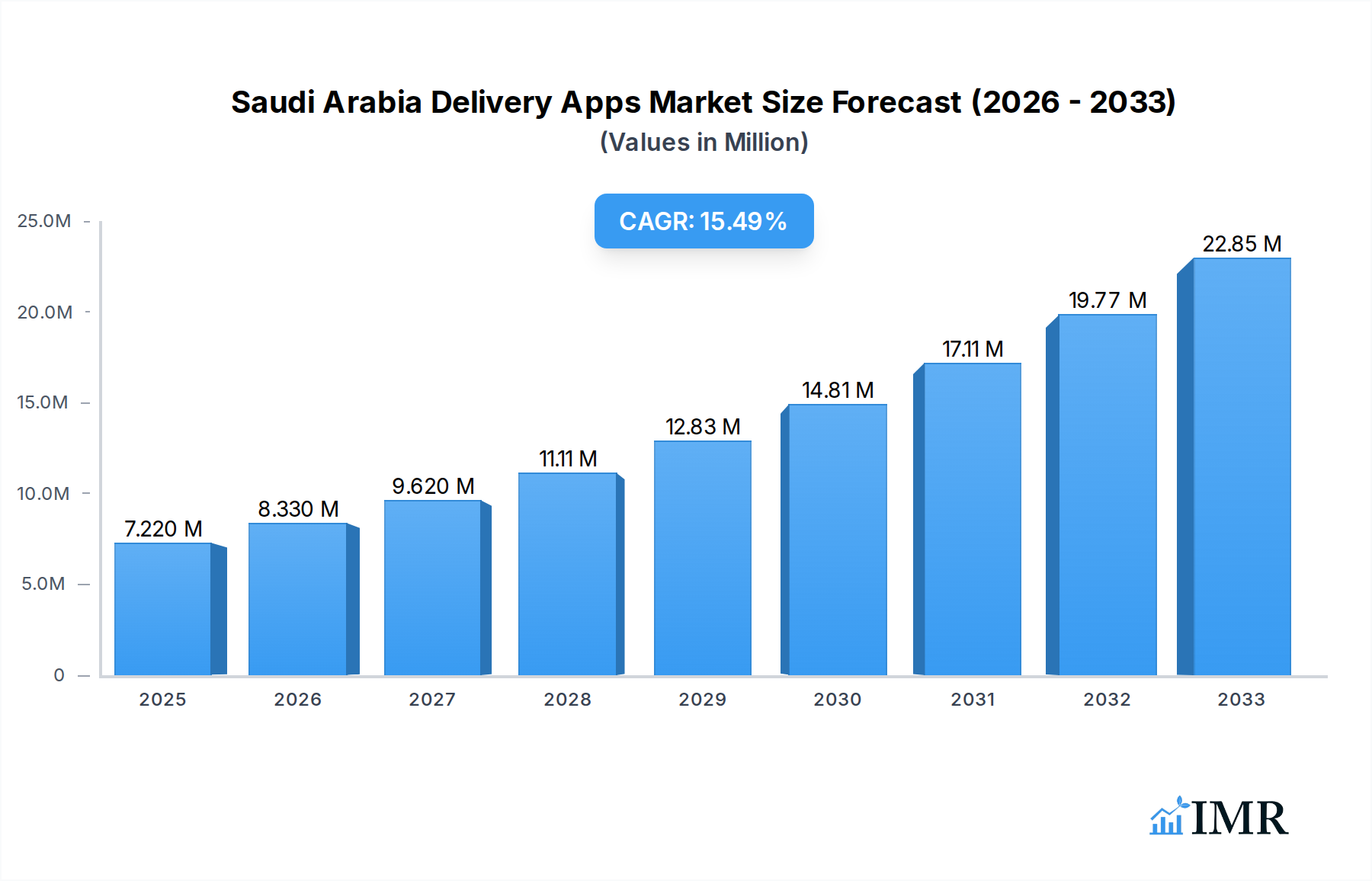

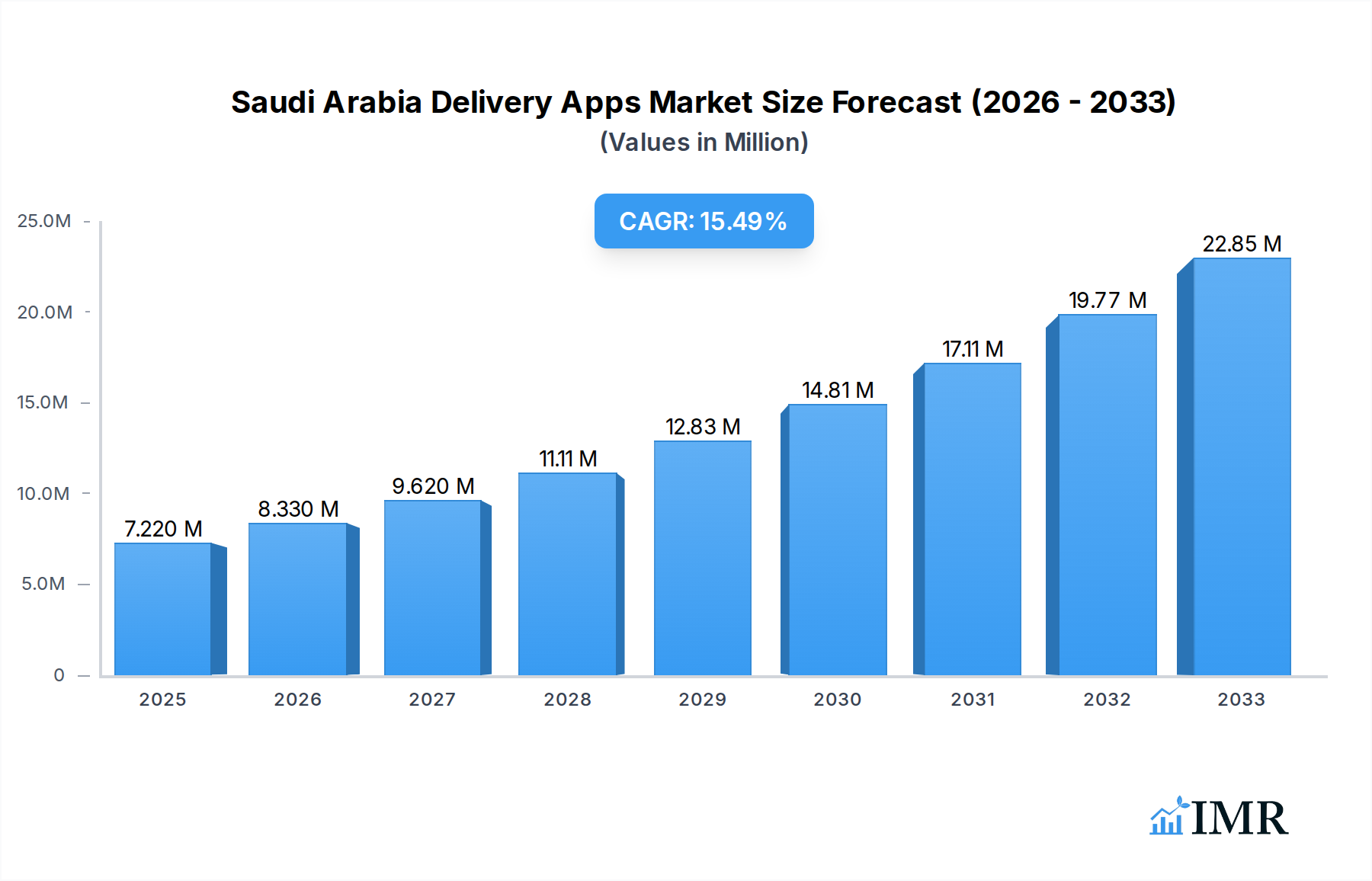

The Saudi Arabia Delivery Apps Market is poised for remarkable expansion, with a current estimated market size of 7.22 Million valued in Million. The sector is projected to grow at a CAGR of 15.40% over the forecast period of 2025-2033. This robust growth is primarily fueled by several key drivers, including the increasing penetration of smartphones and internet connectivity across the Kingdom, a growing young and tech-savvy population with a preference for convenience, and significant investments in digital infrastructure by the Saudi government. The evolving consumer lifestyles, characterized by busy schedules and a rising disposable income, further propel the demand for on-demand delivery services. Furthermore, the supportive regulatory environment and initiatives aimed at fostering digital economies contribute to a favorable landscape for delivery app businesses. The COVID-19 pandemic also acted as a catalyst, accelerating the adoption of delivery services for essential goods and food, a trend that has largely persisted.

Saudi Arabia Delivery Apps Market Market Size (In Million)

The market is segmented across various service types, with Food Delivery Apps leading the charge, followed by Grocery Delivery Apps, Pharmacy Delivery Apps, and Other On-demand Delivery Apps. These segments are experiencing dynamic growth, driven by strategic expansions and innovative service offerings from leading companies such as HungerStation LTD (Delivery Hero SE), Jahez International Company For Information Systems Technology, and Talabat (Delivery Hero SE). The competitive landscape is intense, with established players and emerging startups vying for market share through enhanced user experiences, wider service areas, and competitive pricing. Trends such as the integration of AI for personalized recommendations, the adoption of eco-friendly delivery methods, and the expansion into niche delivery services are shaping the future of this market. However, challenges such as intense competition, rising operational costs, and the need for continuous technological upgrades present potential restraints to sustained growth.

Saudi Arabia Delivery Apps Market Company Market Share

Explore the dynamic Saudi Arabia Delivery Apps Market, a burgeoning sector driven by rapid digital adoption and evolving consumer lifestyles. This comprehensive report, covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, provides an in-depth analysis of market dynamics, growth trends, competitive landscape, and future opportunities. Delve into the parent market of on-demand delivery services and its intricate child markets, including Food Delivery Apps, Grocery Delivery Apps, Pharmacy Delivery Apps, and Other On-demand Delivery Apps. Gain critical insights into market share percentages, M&A deal volumes, and key innovation drivers essential for strategic decision-making.

Saudi Arabia Delivery Apps Market Market Dynamics & Structure

The Saudi Arabia Delivery Apps Market is characterized by a dynamic interplay of technological innovation, evolving consumer demands, and a supportive regulatory environment. Market concentration is increasing, with established players like HungerStation LTD (Delivery Hero SE) and Jahez International Company For Information Systems Technology consolidating their positions. Technological innovation is a primary driver, fueled by advancements in AI for route optimization, real-time tracking, and personalized customer experiences. Robust regulatory frameworks are being developed to ensure fair competition and consumer protection, impacting operational strategies. Competitive product substitutes, while present in traditional retail, are increasingly being challenged by the convenience and speed offered by delivery apps. End-user demographics are shifting towards a younger, tech-savvy population with higher disposable incomes, driving demand for seamless on-demand services. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with significant investments flowing into promising startups and established platforms. For instance, the acquisition of The Chefz by Jahez International Company For Information Systems Technology highlights this trend, aiming to expand market reach and service offerings.

- Market Concentration: Moderate to High, with key players dominating significant market share.

- Technological Innovation Drivers: AI-powered logistics, enhanced user interfaces, predictive analytics, and contactless delivery solutions.

- Regulatory Frameworks: Evolving regulations focusing on data privacy, driver welfare, and platform accountability.

- Competitive Product Substitutes: Traditional brick-and-mortar retail and in-person service providers.

- End-User Demographics: Young, urban, digitally connected population with a preference for convenience.

- M&A Trends: Strategic acquisitions and partnerships aimed at market expansion and service diversification.

Saudi Arabia Delivery Apps Market Growth Trends & Insights

The Saudi Arabia Delivery Apps Market is witnessing an unprecedented growth trajectory, propelled by a confluence of factors including widespread smartphone penetration, increasing internet accessibility, and a cultural shift towards embracing digital solutions. The market size evolution is remarkable, with significant year-on-year growth recorded throughout the Historical Period: 2019–2024. Adoption rates for various delivery services are surging, with Food Delivery Apps leading the charge, followed by a rapid expansion in Grocery Delivery Apps and Pharmacy Delivery Apps. Technological disruptions, such as the integration of AI and machine learning, are revolutionizing logistics and customer service, thereby enhancing operational efficiency and user satisfaction. Consumer behavior shifts are profoundly influencing the market; individuals increasingly prioritize convenience, speed, and a wider selection of products and services readily available at their fingertips. This has fostered a demand for instant gratification, making on-demand delivery indispensable for daily life. The CAGR is projected to remain robust throughout the Forecast Period: 2025–2033, indicating sustained expansion. Market penetration is expected to reach new heights as more consumers across different age groups and socioeconomic strata embrace the convenience of delivery apps. The rise of quick commerce models and the expansion of service offerings beyond food and groceries are key indicators of this sustained growth. The estimated market size in 2025 is projected to be in the XX Million units, with substantial growth anticipated in the subsequent years, driven by continuous innovation and increasing consumer reliance.

Dominant Regions, Countries, or Segments in Saudi Arabia Delivery Apps Market

Within the vibrant Saudi Arabia Delivery Apps Market, the Food Delivery Apps segment stands out as the dominant force, consistently driving market growth and adoption rates. This dominance is attributable to a confluence of cultural factors, lifestyle trends, and infrastructural support that have propelled the segment to the forefront. The strong tradition of food culture in Saudi Arabia, coupled with the increasing demand for convenience among its predominantly young and urban population, creates a fertile ground for food delivery services. Economic policies fostering digital transformation and investments in e-commerce infrastructure have further bolstered this segment's growth. Major cities like Riyadh, Jeddah, and Dammam are epicenters of this activity, showcasing higher market penetration and transaction volumes. The presence of key players like HungerStation LTD (Delivery Hero SE) and Jahez International Company For Information Systems Technology, with their extensive restaurant networks and sophisticated logistics, solidifies the leadership of the food delivery segment.

- Food Delivery Apps: This segment exhibits the highest market share and growth potential due to ingrained consumer habits and the widespread availability of diverse culinary options.

- Key Drivers: Culinary diversity, demand for convenience, widespread restaurant partnerships, and aggressive marketing campaigns by leading platforms.

- Market Share: Projected to hold over 60% of the total delivery app market in 2025.

- Growth Potential: Continuous expansion driven by new restaurant onboarding and innovative service features.

- Grocery Delivery Apps: This segment is experiencing rapid growth, driven by busy lifestyles and the increasing acceptance of online grocery shopping.

- Key Drivers: Time-saving benefits, wider product selection, and partnerships with major supermarket chains like Carrefour KSA (Majid Al Futtaim Retail).

- Market Share: Expected to capture a significant portion of the market, with a projected XX% share in 2025.

- Growth Potential: High, fueled by increasing consumer trust and the expansion of quick commerce models.

- Pharmacy Delivery Apps: This segment, while smaller, is crucial and growing, particularly for essential medications and healthcare products.

- Key Drivers: Urgency for medication, convenience for the elderly or less mobile, and partnerships with major pharmacies like Al Dawaa Medical Services Company and Nahdi Medical Company.

- Market Share: Currently around XX%, with a steady upward trend.

- Growth Potential: Significant, especially with increasing health consciousness and the integration of telemedicine services.

- Other On-demand Delivery Apps: This encompasses a diverse range of services, from courier and parcel delivery to specialized items.

- Key Drivers: Growing e-commerce sector, demand for same-day delivery, and niche service offerings.

- Market Share: Constitutes the remaining portion, with potential for expansion into new verticals.

- Growth Potential: Moderate to high, depending on innovation and market demand for specialized services.

Saudi Arabia Delivery Apps Market Product Landscape

The Saudi Arabia Delivery Apps Market product landscape is defined by an ongoing commitment to enhancing user experience and operational efficiency through continuous innovation. Food delivery platforms are increasingly integrating AI-powered recommendation engines, personalized offers, and seamless payment gateways to retain and attract users. Grocery delivery apps are focusing on expanding their product catalogs, optimizing inventory management, and introducing features like scheduled deliveries and recipe integration. Pharmacy delivery apps are prioritizing secure and timely delivery of medications, often incorporating prescription upload functionalities and pharmacist consultation options. The overarching trend is towards creating an intuitive, reliable, and convenient ecosystem for consumers. Key technological advancements include the implementation of advanced tracking systems, predictive delivery times, and contactless delivery protocols.

Key Drivers, Barriers & Challenges in Saudi Arabia Delivery Apps Market

The Saudi Arabia Delivery Apps Market is propelled by several key drivers. The increasing smartphone penetration and widespread internet access lay the foundation for digital service adoption. Shifting consumer lifestyles, characterized by a preference for convenience and time-saving solutions, are a significant impetus. Government initiatives supporting digital transformation and e-commerce further foster market growth. Technological advancements in logistics and user interface design enhance the appeal of these services.

However, the market faces notable barriers and challenges. Intense competition among numerous players can lead to price wars and pressure on profit margins. Logistical complexities, including traffic congestion and last-mile delivery challenges in dense urban areas, can impact efficiency. Regulatory hurdles, although evolving, can sometimes pose compliance challenges for businesses. Customer acquisition and retention costs are substantial, requiring continuous investment in marketing and service improvement. Supply chain disruptions, as experienced globally, can affect the availability of goods for delivery.

Emerging Opportunities in Saudi Arabia Delivery Apps Market

Emerging opportunities in the Saudi Arabia Delivery Apps Market are diverse and poised for significant growth. The expansion of quick commerce models, offering ultra-fast delivery of essential goods, presents a lucrative avenue. Tapping into underserved geographical areas and smaller cities can unlock new customer bases. Innovative applications in on-demand services beyond food and groceries, such as beauty, wellness, and specialized retail, offer significant untapped potential. Partnerships with local businesses and artisans can create unique value propositions. The increasing demand for sustainable delivery practices also presents an opportunity for eco-friendly logistics solutions.

Growth Accelerators in the Saudi Arabia Delivery Apps Market Industry

Several catalysts are accelerating the growth of the Saudi Arabia Delivery Apps Market Industry. Technological breakthroughs, particularly in AI and data analytics for personalized services and optimized logistics, are key. Strategic partnerships between delivery platforms, retailers, and restaurants are expanding service offerings and reach. Market expansion strategies, including geographical diversification and the introduction of new service categories, are crucial. The growing middle class with increasing disposable income and a strong propensity for digital services further fuels this acceleration. The ongoing Vision 2030 initiatives promoting economic diversification and technological adoption create a favorable environment for the entire digital ecosystem.

Key Players Shaping the Saudi Arabia Delivery Apps Market Market

- Matajer Central Co

- HungerStation LTD (Delivery Hero SE)

- Dailymealz

- Aram Meem LLC

- Shgardi Gate For Information Technology Systems

- The Chefz (Jahez International Company For Information Systems Technology)

- Jahez International Company For Information Systems Technology

- Shatirah House Restaurant Co

- MRSOOL Inc

- Carrefour Ksa (Majid Al Futtaim Retail)

- Lugmety

- Al Dawaa Medical Services Company

- Nahdi Medical Company

- Careem Networks FZ-LLC (Uber Technologies Inc)

- Bindawood Holding

- Talabat (Delivery Hero SE)

Notable Milestones in Saudi Arabia Delivery Apps Market Sector

- 2019: Significant surge in adoption of food delivery apps, driven by increasing smartphone usage.

- 2020: COVID-19 pandemic accelerates demand for grocery and pharmacy delivery services, leading to market expansion.

- 2021: HungerStation and Jahez raise substantial funding, signaling investor confidence and market growth.

- 2022: Expansion of quick commerce models and introduction of specialized delivery services.

- 2023: Increased focus on technological integration for enhanced logistics and customer experience.

- 2024: Continued consolidation through strategic acquisitions, shaping the competitive landscape.

In-Depth Saudi Arabia Delivery Apps Market Market Outlook

The Saudi Arabia Delivery Apps Market is poised for sustained and robust growth, driven by a strong foundation of digital adoption and favorable economic conditions. Growth accelerators such as continuous technological innovation in AI and logistics optimization, coupled with strategic partnerships, will expand service offerings and operational efficiency. The market's future potential lies in its ability to cater to an increasingly convenience-driven populace, with further penetration into underserved segments and the exploration of niche on-demand services. Strategic opportunities include leveraging data analytics for hyper-personalized customer experiences, investing in sustainable delivery solutions, and expanding into emerging Saudi cities. The ongoing digital transformation agenda in Saudi Arabia ensures a supportive environment for the continued evolution and expansion of the delivery apps ecosystem.

Saudi Arabia Delivery Apps Market Segmentation

-

1. Service Type

- 1.1. Food Delivery Apps

- 1.2. Grocery Delivery Apps

- 1.3. Pharmacy Delivery Apps

- 1.4. Other On-demand Delivery Apps

Saudi Arabia Delivery Apps Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Delivery Apps Market Regional Market Share

Geographic Coverage of Saudi Arabia Delivery Apps Market

Saudi Arabia Delivery Apps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Rise in Smartphone Penetration to Fuel the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Food Delivery Apps

- 5.1.2. Grocery Delivery Apps

- 5.1.3. Pharmacy Delivery Apps

- 5.1.4. Other On-demand Delivery Apps

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Matajer Central Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HungerStation LTD (Delivery Hero SE)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dailymealz

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aram Meem LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shgardi Gate For Information Technology Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Chefz (Jahez International Company For Information Systems Technology)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jahez International Company For Information Systems Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shatirah House Restaurant Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MRSOOL Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carrefour Ksa (Majid Al Futtaim Retail)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lugmety

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Al Dawaa Medical Services Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Nahdi Medical Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Careem Networks FZ-LLC (Uber Technologies Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bindawood Holding

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Talabat (Delivery Hero SE)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Matajer Central Co

List of Figures

- Figure 1: Saudi Arabia Delivery Apps Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Delivery Apps Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Delivery Apps Market?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Saudi Arabia Delivery Apps Market?

Key companies in the market include Matajer Central Co, HungerStation LTD (Delivery Hero SE), Dailymealz, Aram Meem LLC, Shgardi Gate For Information Technology Systems, The Chefz (Jahez International Company For Information Systems Technology), Jahez International Company For Information Systems Technology, Shatirah House Restaurant Co, MRSOOL Inc, Carrefour Ksa (Majid Al Futtaim Retail), Lugmety, Al Dawaa Medical Services Company, Nahdi Medical Company, Careem Networks FZ-LLC (Uber Technologies Inc, Bindawood Holding, Talabat (Delivery Hero SE).

3. What are the main segments of the Saudi Arabia Delivery Apps Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia.

6. What are the notable trends driving market growth?

Rise in Smartphone Penetration to Fuel the Growth of the Market.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Delivery Apps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Delivery Apps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Delivery Apps Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Delivery Apps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence