Key Insights

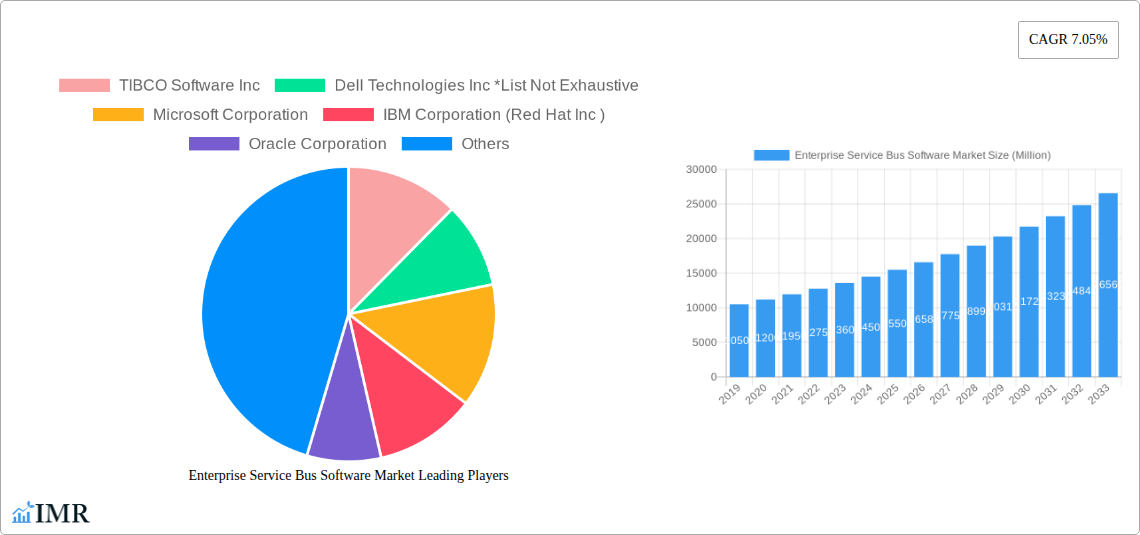

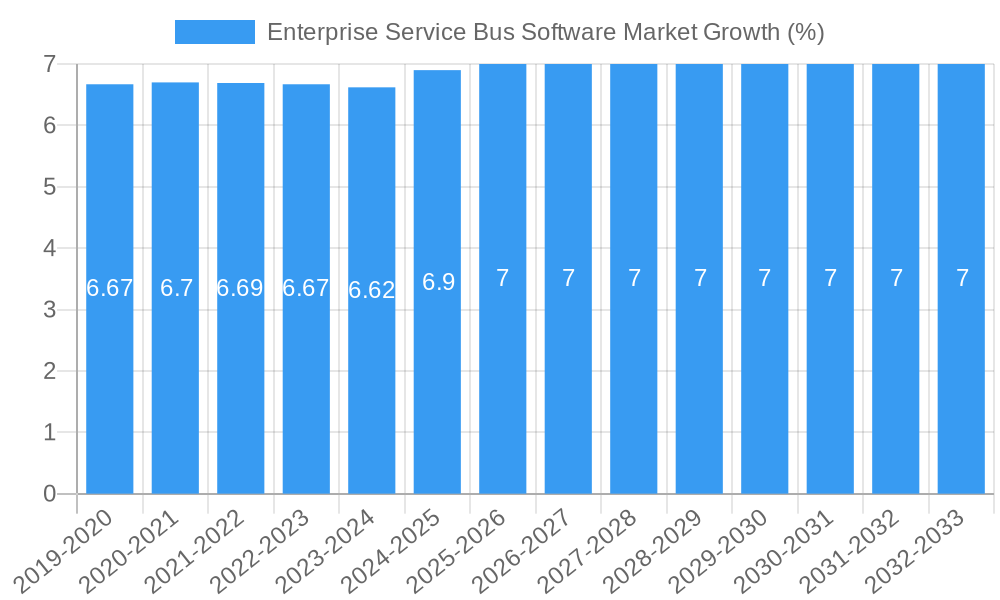

The global Enterprise Service Bus (ESB) Software market is poised for substantial growth, projected to reach a market size of approximately $15,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 7.05% through 2033. This expansion is primarily driven by the escalating need for seamless integration across diverse enterprise applications and data sources, a critical requirement in today's interconnected digital landscape. Businesses are increasingly investing in ESB solutions to streamline their IT infrastructure, enhance operational efficiency, and enable real-time data flow, thereby supporting agile decision-making and improved customer experiences. The "on cloud" deployment model is expected to witness significant traction, reflecting the broader industry shift towards cloud-native architectures and the associated benefits of scalability, flexibility, and cost-effectiveness. Key end-user industries such as IT and Telecom, Retail, Healthcare, and BFSI are at the forefront of ESB adoption, leveraging these solutions to manage complex integration challenges, improve data governance, and drive digital transformation initiatives. The burgeoning digital economy and the proliferation of interconnected devices further amplify the demand for robust ESB capabilities.

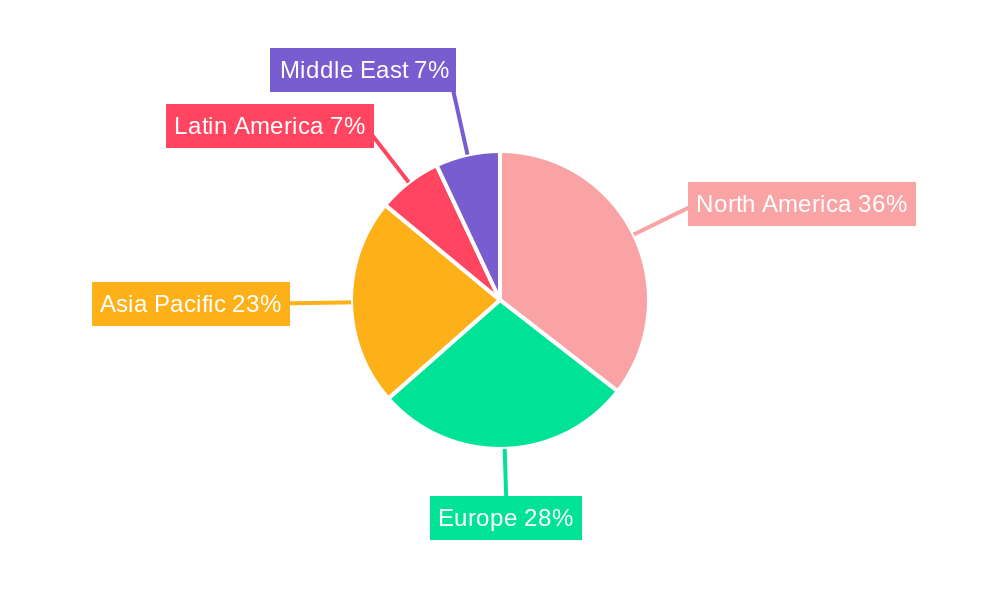

The market is characterized by a dynamic competitive landscape with prominent players like Microsoft Corporation, IBM Corporation (Red Hat Inc.), Oracle Corporation, Salesforce com Inc (MuleSoft Inc.), and SAP SE, alongside TIBCO Software Inc. and Dell Technologies Inc. These companies are continually innovating, offering advanced ESB functionalities that support microservices architectures, API management, and hybrid integration scenarios. While the market benefits from strong growth drivers, certain restraints, such as the complexity of implementing and managing ESB solutions and the availability of alternative integration approaches like iPaaS (Integration Platform as a Service), warrant strategic consideration. However, the inherent advantages of ESB in handling complex, mission-critical integrations, particularly within large enterprises, are likely to sustain its relevance and growth trajectory. North America and Europe are expected to remain dominant regions in terms of market share, owing to established IT infrastructures and early adoption of integration technologies, while the Asia Pacific region presents a significant growth opportunity driven by rapid digital transformation and increasing enterprise investments.

This in-depth report provides a detailed analysis of the global Enterprise Service Bus (ESB) software market, offering critical insights for stakeholders navigating this dynamic sector. Examining market structure, growth trends, regional dominance, product landscape, and key players, this report equips you with the intelligence needed to make informed strategic decisions. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, our analysis covers historical performance, current estimations, and future projections. The report delves into the evolution of ESB software, its adoption drivers, competitive strategies, and emerging opportunities within a landscape increasingly shaped by cloud adoption, data integration needs, and digital transformation initiatives. Quantified data, including market size in Million units, CAGR, and market share percentages, is presented alongside qualitative analysis to provide a holistic view.

Enterprise Service Bus Software Market Market Dynamics & Structure

The Enterprise Service Bus (ESB) software market exhibits a moderately concentrated structure, characterized by the presence of established technology giants and agile innovators. Key market drivers include the escalating demand for seamless data integration across disparate applications and systems within enterprises, alongside the burgeoning need for real-time data processing and API management. Technological innovation is primarily fueled by advancements in cloud-native architectures, microservices, and AI-driven integration capabilities, enabling more flexible and scalable ESB solutions. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are increasingly influencing ESB deployment strategies, pushing for robust compliance features. Competitive product substitutes are emerging from iPaaS (Integration Platform as a Service) solutions and specialized API gateway technologies, posing a potential threat to traditional ESB deployments. End-user demographics are expanding beyond traditional IT departments to encompass business units seeking self-service integration capabilities. Mergers and acquisitions (M&A) trends are evident as larger players seek to consolidate their market positions and acquire specialized integration expertise. For instance, the acquisition of MuleSoft by Salesforce signifies a strategic move to bolster its enterprise integration offerings. The market concentration ratio is estimated at approximately 60% held by the top five players, with a steady volume of M&A deals annually, averaging around 15-20 in the past five years. Innovation barriers primarily revolve around the complexity of legacy system integration and the substantial investment required for developing advanced, AI-powered ESB platforms.

Enterprise Service Bus Software Market Growth Trends & Insights

The Enterprise Service Bus (ESB) software market is poised for robust growth, driven by the imperative for digital transformation and the increasing complexity of enterprise IT environments. The market size is projected to evolve significantly, moving from an estimated $xx Million units in 2024 to approximately $xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around X.X% during the forecast period (2025–2033). Adoption rates are accelerating as organizations across industries recognize the critical role of ESB in enabling interoperability, facilitating agile development, and unlocking business value from their data. Technological disruptions, such as the rise of containerization and microservices, are reshaping ESB architectures, leading to more lightweight, flexible, and cloud-native solutions. Consumer behavior shifts are also playing a crucial role, with an increasing demand for self-service integration tools and business-user friendly interfaces that reduce reliance on IT for every integration task.

The foundational historical period from 2019–2024 witnessed steady adoption, primarily driven by on-premise deployments and the need to connect monolithic applications. As the base year 2025 approaches, the market is seeing a marked acceleration, with the estimated market size for 2025 standing at $xx Million units. This growth is attributed to several factors:

- Cloud Migration: Enterprises are increasingly migrating their applications and data to the cloud, necessitating robust integration solutions like ESB to bridge on-premise systems with cloud-based services and to manage multi-cloud environments. This shift significantly boosts the demand for cloud-native ESB capabilities.

- API Economy: The proliferation of the API economy has made ESB software indispensable for managing, exposing, and consuming APIs securely and efficiently. ESBs act as a central nervous system for API-driven architectures, enabling seamless communication between internal and external applications.

- Data Integration and Analytics: The growing importance of data analytics and business intelligence fuels the demand for ESB solutions that can aggregate, transform, and distribute data from various sources in real-time, enabling organizations to gain actionable insights.

- Internet of Things (IoT): The expanding landscape of IoT devices generates massive volumes of data that need to be integrated with enterprise systems. ESBs play a crucial role in managing this data flow, ensuring connectivity and processing of information from diverse IoT endpoints.

The market penetration of ESB solutions is expected to deepen, with a significant portion of mid-sized to large enterprises adopting advanced ESB platforms to optimize their operations and drive innovation. The evolving technological landscape also favors ESB solutions that offer hybrid integration capabilities, supporting both cloud and on-premise environments, thus catering to the diverse needs of businesses undergoing digital transformation.

Dominant Regions, Countries, or Segments in Enterprise Service Bus Software Market

The Enterprise Service Bus (ESB) software market is experiencing robust growth across several key regions and segments, with specific drivers influencing each. Among the deployment options, On Cloud is emerging as the dominant segment, steadily capturing market share from traditional on-premise solutions. This shift is propelled by the inherent scalability, cost-efficiency, and agility offered by cloud-based ESB platforms. Organizations are increasingly leveraging cloud ESB solutions to integrate their growing portfolio of cloud applications and to facilitate seamless hybrid cloud deployments. The market share for On Cloud deployment is estimated to grow from approximately 55% in 2025 to over 70% by 2033.

Within the end-user industries, the IT and Telecom sector stands out as a primary driver of ESB market growth. This is due to the sector's constant need to integrate a multitude of complex systems, manage vast amounts of data, and rapidly deploy new services. The relentless pace of technological advancement and the competitive landscape in IT and Telecom necessitate agile and efficient integration solutions. The BFSI (Banking, Financial Services, and Insurance) sector also represents a significant and growing market, driven by stringent regulatory requirements, the need for secure data exchange, and the increasing adoption of digital banking services. Healthcare is another crucial segment, with ESB software playing a vital role in integrating disparate patient data systems, electronic health records (EHRs), and administrative platforms, thereby improving patient care and operational efficiency.

Geographically, North America continues to lead the ESB market, fueled by a high concentration of technology companies, early adoption of advanced technologies, and significant investments in digital transformation initiatives. The presence of major technology hubs and a strong ecosystem of cloud service providers contribute to this dominance. Europe follows closely, with a mature IT infrastructure and a growing emphasis on data privacy regulations, which necessitate sophisticated integration solutions. The Asia-Pacific region is exhibiting the fastest growth rate, driven by rapid digitalization, increasing adoption of cloud technologies by SMEs, and the expansion of e-commerce and digital services across its diverse economies. Key drivers for dominance in these regions include:

- Economic Policies: Favorable government initiatives promoting digital infrastructure and innovation in regions like North America and Asia-Pacific.

- Infrastructure: Robust and widespread internet connectivity and cloud computing infrastructure in leading regions.

- Technological Adoption: A culture of early adoption of new technologies and a willingness to invest in advanced integration solutions.

- Regulatory Environment: While sometimes a challenge, specific regulatory requirements in sectors like BFSI and healthcare in mature markets necessitate advanced ESB capabilities for compliance.

The market share within the IT and Telecom sector is estimated to account for roughly 30% of the total ESB market by 2025, with BFSI and Healthcare following at approximately 20% and 15% respectively.

Enterprise Service Bus Software Market Product Landscape

The Enterprise Service Bus (ESB) software product landscape is evolving rapidly, emphasizing modularity, cloud-native architectures, and enhanced connectivity. Innovations are geared towards providing developers and IT professionals with more efficient tools for designing, deploying, and managing integrations. Key advancements include the integration of AI and machine learning for intelligent routing, anomaly detection, and automated error handling. Furthermore, there is a growing focus on low-code/no-code capabilities, enabling business users to participate more actively in integration processes. Performance metrics are increasingly evaluated on aspects like latency, throughput, scalability under high load, and the ease of managing complex API ecosystems. Unique selling propositions often revolve around hybrid integration capabilities, robust security features, and seamless integration with a wide array of applications, databases, and cloud services.

Key Drivers, Barriers & Challenges in Enterprise Service Bus Software Market

Key Drivers:

- Digital Transformation Imperative: The overarching drive for digital transformation across industries necessitates seamless integration of legacy systems with modern applications, cloud services, and IoT devices, making ESB software crucial.

- Growing Data Volume and Complexity: The exponential increase in data generation and the need for real-time analytics across disparate sources propel the demand for robust data integration solutions offered by ESBs.

- API Economy and Microservices Architecture: The widespread adoption of APIs and the shift towards microservices architectures require sophisticated middleware solutions like ESBs to manage inter-service communication and expose functionalities.

- Cloud Adoption and Hybrid Integration Needs: As organizations embrace cloud computing, ESBs are vital for bridging on-premise infrastructure with cloud services and managing complex hybrid environments.

Barriers & Challenges:

- Legacy System Integration Complexity: Integrating older, often monolithic systems with modern ESB platforms can be technically challenging, time-consuming, and costly.

- Talent Shortage: A scarcity of skilled professionals with expertise in ESB technologies and integration strategies can hinder adoption and effective implementation.

- High Initial Investment: Implementing comprehensive ESB solutions, particularly on-premise, can require substantial upfront investment in hardware, software licenses, and skilled personnel.

- Competition from iPaaS and API Gateways: The emergence of more agile and specialized solutions like iPaaS and API Gateways presents competition, particularly for simpler integration needs. For example, the market share loss to iPaaS in specific use cases is estimated at around 10-15% annually for basic integrations.

Emerging Opportunities in Enterprise Service Bus Software Market

Emerging opportunities within the ESB software market are primarily centered around the expansion of AI and machine learning capabilities for smarter integration processes. The growing adoption of the Internet of Things (IoT) presents a significant untapped market, as businesses require robust platforms to manage and integrate data from a vast number of connected devices. Furthermore, the increasing demand for real-time data analytics and the rise of edge computing create new avenues for ESB solutions that can process and integrate data closer to its source. The development of ESB platforms that offer enhanced support for blockchain technologies for secure and transparent data exchange also represents a promising growth area.

Growth Accelerators in the Enterprise Service Bus Software Market Industry

Long-term growth in the ESB software market will be significantly accelerated by continued technological breakthroughs in areas like serverless computing and event-driven architectures, which complement ESB capabilities. Strategic partnerships between ESB vendors and cloud providers (e.g., AWS, Azure, GCP) are crucial for expanding market reach and offering integrated solutions. Market expansion strategies focusing on emerging economies and specific industry verticals with high integration needs, such as the Industrial Internet of Things (IIoT) and smart cities, will further fuel growth. The increasing focus on automation and low-code/no-code integration platforms will also democratize access to ESB capabilities, broadening the user base.

Key Players Shaping the Enterprise Service Bus Software Market Market

- TIBCO Software Inc

- Dell Technologies Inc

- Microsoft Corporation

- IBM Corporation (Red Hat Inc )

- Oracle Corporation

- Salesforce com Inc (MuleSoft Inc )

- SAP SE

Notable Milestones in Enterprise Service Bus Software Market Sector

- October 2022: Red Hat's Openshift Dedicated Solution, operating on the AWS cloud, was adopted by Westech, a UK-based digital marketing agency. This adoption, marked by a three-day hackathon involving Westech employees and Red Hat programmers, enabled Westech to efficiently meet new market demands, leveraging innovative concepts for rapid and cost-effective handling of high traffic.

- February 2023: Pimly, a Chicago-based startup offering product information management, invested $5 million to dismantle data silos. By establishing Salesforce as the primary source for crucial product information, Pimly empowered its staff, prospects, partners, and clients to become subject matter experts, enhancing data accessibility and utilization.

In-Depth Enterprise Service Bus Software Market Market Outlook

The future outlook for the Enterprise Service Bus (ESB) software market is exceptionally promising, driven by ongoing digital transformation initiatives and the relentless pursuit of data-centric business strategies. Growth accelerators will center on the increasing integration of AI and machine learning for predictive analytics and intelligent automation within integration workflows. The expansion of the Internet of Things (IoT) will create new demand for robust ESB solutions capable of handling the massive influx of data from connected devices. Strategic partnerships between ESB providers and major cloud service providers will continue to solidify market positions and enhance service offerings. Emerging opportunities lie in specialized industry applications and the development of more intuitive, low-code integration platforms that empower a broader range of users. The market is set for sustained expansion as organizations prioritize agility, scalability, and seamless data flow to remain competitive.

Enterprise Service Bus Software Market Segmentation

-

1. Deployment

- 1.1. On Cloud

- 1.2. On-premise

-

2. End-user Industry

- 2.1. IT and Telecom

- 2.2. Retail

- 2.3. Healthcare

- 2.4. BFSI

- 2.5. Other En

Enterprise Service Bus Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Enterprise Service Bus Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud-based Solutions; Rising Development of IoT Projects

- 3.3. Market Restrains

- 3.3.1. High Installation Cost to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Development of IoT Projects Boosting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT and Telecom

- 5.2.2. Retail

- 5.2.3. Healthcare

- 5.2.4. BFSI

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT and Telecom

- 6.2.2. Retail

- 6.2.3. Healthcare

- 6.2.4. BFSI

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT and Telecom

- 7.2.2. Retail

- 7.2.3. Healthcare

- 7.2.4. BFSI

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT and Telecom

- 8.2.2. Retail

- 8.2.3. Healthcare

- 8.2.4. BFSI

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT and Telecom

- 9.2.2. Retail

- 9.2.3. Healthcare

- 9.2.4. BFSI

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. IT and Telecom

- 10.2.2. Retail

- 10.2.3. Healthcare

- 10.2.4. BFSI

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. North America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Enterprise Service Bus Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TIBCO Software Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Dell Technologies Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Microsoft Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 IBM Corporation (Red Hat Inc )

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Oracle Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Salesforce com Inc (MuleSoft Inc )

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SAP SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.1 TIBCO Software Inc

List of Figures

- Figure 1: Global Enterprise Service Bus Software Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 13: North America Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: North America Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 19: Europe Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 20: Europe Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Latin America Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Enterprise Service Bus Software Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Middle East Enterprise Service Bus Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East Enterprise Service Bus Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East Enterprise Service Bus Software Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Enterprise Service Bus Software Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Enterprise Service Bus Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 19: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global Enterprise Service Bus Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Enterprise Service Bus Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Service Bus Software Market?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Enterprise Service Bus Software Market?

Key companies in the market include TIBCO Software Inc, Dell Technologies Inc *List Not Exhaustive, Microsoft Corporation, IBM Corporation (Red Hat Inc ), Oracle Corporation, Salesforce com Inc (MuleSoft Inc ), SAP SE.

3. What are the main segments of the Enterprise Service Bus Software Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud-based Solutions; Rising Development of IoT Projects.

6. What are the notable trends driving market growth?

Rising Development of IoT Projects Boosting the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Cost to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Red Hat's Openshift Dedicated Solution, which operates on the AWS cloud, was adopted by Westech, a digital marketing agency in the UK. 50 Westech employees and two Red Hat programmers finished a three-day Open Shift hackathon in a trail race. Westech will be able to meet new market demands with the aid of this solution and its innovative and astute concepts. High traffic demands may be met quickly and affordably.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Service Bus Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Service Bus Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Service Bus Software Market?

To stay informed about further developments, trends, and reports in the Enterprise Service Bus Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence