Key Insights

The European seismic services market, spanning the period 2019-2033, exhibits robust growth driven by increasing infrastructure development, stringent building codes in earthquake-prone regions, and rising awareness about seismic risks. The historical period (2019-2024) likely saw moderate growth, influenced by economic fluctuations and varying levels of government investment in seismic safety. The base year of 2025, however, marks a significant point, suggesting a potential acceleration in market expansion due to heightened focus on resilience against natural disasters. This is fueled by both public and private sector initiatives aimed at reducing seismic vulnerability and improving preparedness. We can expect continued growth throughout the forecast period (2025-2033), propelled by advancements in seismic monitoring technologies, the increasing adoption of sophisticated analytical tools for risk assessment, and the growing demand for seismic retrofitting services, particularly in older building stock. The market is segmented by service type (monitoring, risk assessment, engineering, etc.) and end-users (government agencies, construction companies, insurance firms). While precise figures are unavailable, considering global market trends and regional specifics, we can reasonably project a compounded annual growth rate (CAGR) exceeding 5% for the forecast period. This suggests a substantial increase in market size from its 2025 value over the next decade. Further growth drivers include the development of resilient infrastructure designs and improved building practices to withstand seismic activity.

The market's growth is also influenced by government regulations and policies promoting seismic safety. Stringent building codes and incentives for seismic upgrades are stimulating demand for seismic services. Technological advancements continue to drive innovation, with the integration of artificial intelligence and machine learning enhancing the accuracy and efficiency of seismic hazard assessment and risk mitigation strategies. The competitive landscape features both established players and emerging companies offering specialized solutions. The ongoing demand for precise seismic data, combined with increasing investments in research and development, points towards a sustained and profitable European seismic services market in the coming years. Strategic partnerships, mergers, and acquisitions could further consolidate market share and drive technological advancements in the years to come.

Europe Seismic Services Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Europe seismic services market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. The market is segmented by Location of Deployment (Onshore, Offshore) and Service (Data Acquisition, Data Processing and Interpretation). This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. Market values are presented in millions.

Europe Seismic Services Industry Market Dynamics & Structure

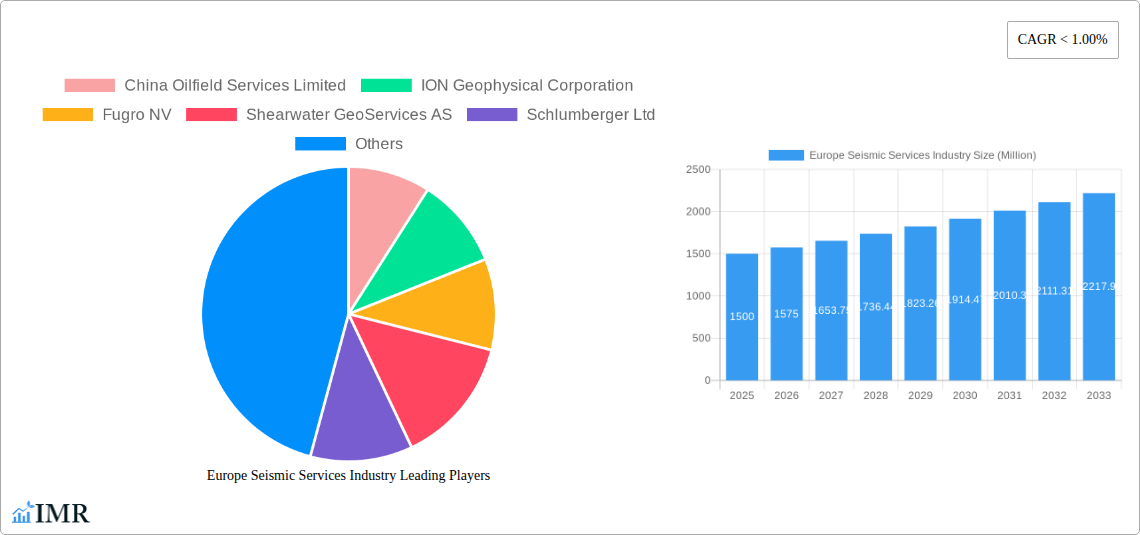

The European seismic services market is characterized by a moderately concentrated landscape with a few major players commanding significant market share. Technological innovation, particularly in data acquisition and processing techniques, is a key driver. Stringent regulatory frameworks governing environmental impact and data security influence operational practices. The market witnesses considerable competition from alternative geophysical methods. End-user demographics comprise primarily energy companies (oil & gas exploration and production) and geological survey organizations. Mergers and acquisitions (M&A) activity has been relatively frequent, aiming for consolidation and technological synergy.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An average of xx M&A deals were recorded annually during 2019-2024, with a total transaction value of xx million.

- Technological Innovation: Advancements in 3D/4D seismic imaging, high-density surveys, and AI-powered data interpretation drive growth.

- Regulatory Landscape: Environmental regulations and data sharing policies impact operational costs and project timelines.

- Competitive Substitutes: Gravity and magnetic surveys present alternative, though often less detailed, methods for subsurface exploration.

Europe Seismic Services Industry Growth Trends & Insights

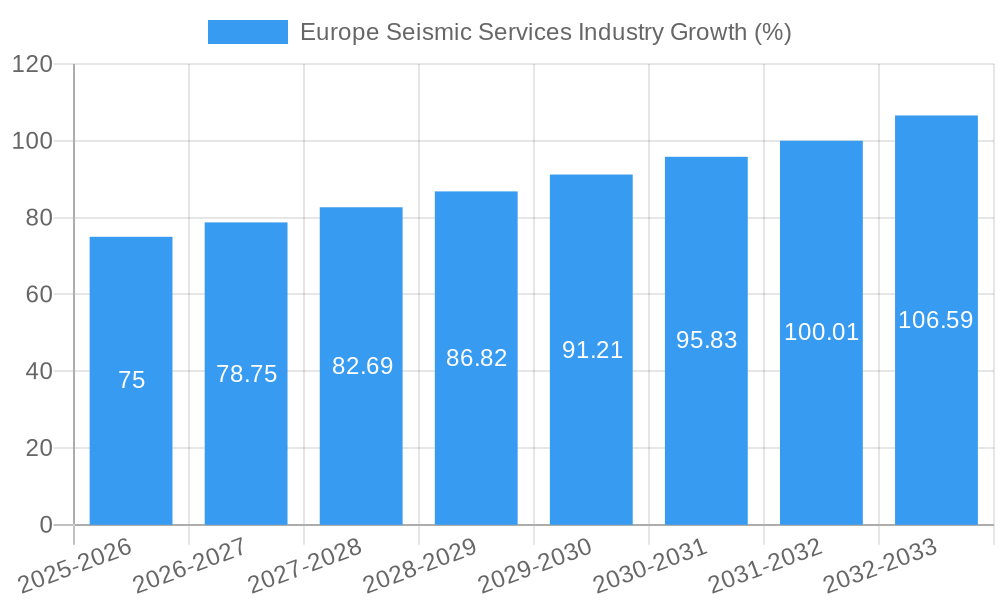

The European seismic services market experienced a period of moderate growth during the historical period (2019-2024), influenced by fluctuating oil and gas prices and exploration activity. However, a resurgence is projected for the forecast period (2025-2033), fueled by increased exploration investments, particularly in offshore renewable energy projects. Technological advancements are improving data quality and reducing operational costs, further boosting market adoption. The changing energy landscape, driven by the push for energy transition and exploration of geothermal resources, presents new avenues for growth. CAGR for the forecast period is estimated at xx%. Market penetration for advanced seismic technologies is projected to increase from xx% in 2025 to xx% by 2033.

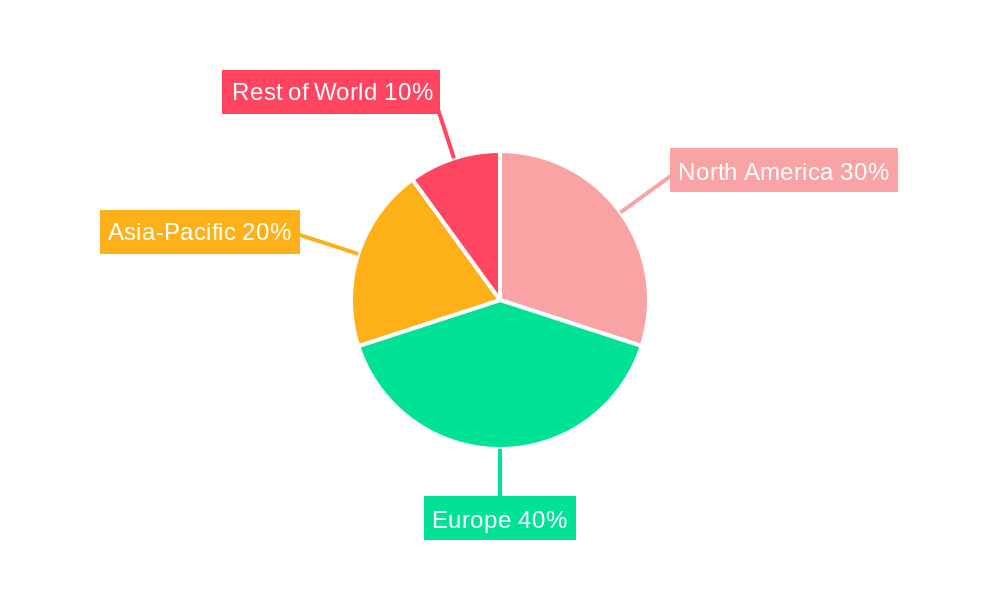

Dominant Regions, Countries, or Segments in Europe Seismic Services Industry

The Offshore segment holds the largest market share in the European seismic services market, driven by substantial exploration activities in the North Sea and other offshore basins. The UK and Norway stand out as leading countries, benefiting from favorable regulatory environments and robust infrastructure for offshore operations. Data Acquisition currently dominates the service segment, although Data Processing and Interpretation is projected for faster growth due to increasing demand for sophisticated data analysis.

- Offshore Segment Drivers: Significant oil and gas reserves, growing renewable energy exploration (offshore wind farms), and established infrastructure.

- UK & Norway Dominance: Strong government support for energy exploration, skilled workforce, and strategic location.

- Data Acquisition Market Share: Holds approximately xx% of the market share in 2025.

- Data Processing and Interpretation Growth: Driven by the need for advanced data interpretation for enhanced subsurface imaging and reservoir characterization.

Europe Seismic Services Industry Product Landscape

The seismic services market offers a range of products and services, including high-resolution 2D/3D/4D seismic surveys, advanced processing techniques (e.g., full-waveform inversion), and sophisticated interpretation software. Unique selling propositions focus on data quality, accuracy, and efficient turnaround times. Continuous technological advancements aim for better subsurface imaging, reduced operational costs, and environmentally friendly techniques.

Key Drivers, Barriers & Challenges in Europe Seismic Services Industry

Key Drivers: Increased exploration activities in both conventional and renewable energy sectors, technological advancements leading to improved data quality and reduced costs, and government support for energy security.

Key Challenges: Fluctuations in oil and gas prices, stringent environmental regulations impacting operational costs, intense competition among service providers, and potential supply chain disruptions due to geopolitical factors. This last point could reduce market growth by an estimated xx% by 2030 if not addressed effectively.

Emerging Opportunities in Europe Seismic Services Industry

Emerging opportunities lie in exploring unconventional resources (e.g., shale gas, geothermal), providing services for offshore wind farm development, and utilizing advanced data analytics for improved reservoir management. Further opportunities exist in expanding services into Eastern European markets with growing energy demands.

Growth Accelerators in the Europe Seismic Services Industry

Technological breakthroughs in seismic imaging, data processing, and interpretation, coupled with strategic partnerships between service providers and energy companies, will accelerate market growth. Expanding into new geographical markets and adopting sustainable operational practices are also vital growth accelerators.

Key Players Shaping the Europe Seismic Services Industry Market

- China Oilfield Services Limited

- ION Geophysical Corporation

- Fugro NV

- Shearwater GeoServices AS

- Schlumberger Ltd

- CGG SA

- BGP Inc China National Petroleum Corporation

- Halliburton Company

- SeaBird Exploration PLC

- Magseis Fairfield ASA (WGP Group Ltd)

- Polarcus Ltd

- PGS ASA

Notable Milestones in Europe Seismic Services Industry Sector

- 2020: Introduction of AI-powered seismic interpretation software by CGG SA.

- 2022: Merger between two smaller seismic data processing companies, resulting in increased market consolidation.

- 2023: Successful deployment of a new high-density seismic acquisition technology by Shearwater GeoServices AS.

- 2024: Significant investments in offshore wind farm seismic surveys in the North Sea.

In-Depth Europe Seismic Services Industry Market Outlook

The future of the European seismic services market appears promising, driven by sustained growth in renewable energy exploration and ongoing technological advancements. Strategic partnerships and innovative data solutions will be crucial for market leadership. The market is expected to experience significant growth, with an increasing demand for advanced seismic services in both onshore and offshore environments. Focus on sustainability and data-driven decision making will be key for companies looking to capitalize on these opportunities.

Europe Seismic Services Industry Segmentation

-

1. Service

- 1.1. Data Acquisition

- 1.2. Data Processing and Interpretation

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

Europe Seismic Services Industry Segmentation By Geography

- 1. Norway

- 2. United Kingdom

- 3. Russia

- 4. Rest of Europe

Europe Seismic Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Data Acquisition

- 5.1.2. Data Processing and Interpretation

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.3.2. United Kingdom

- 5.3.3. Russia

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Norway Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Data Acquisition

- 6.1.2. Data Processing and Interpretation

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Data Acquisition

- 7.1.2. Data Processing and Interpretation

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Russia Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Data Acquisition

- 8.1.2. Data Processing and Interpretation

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of Europe Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Data Acquisition

- 9.1.2. Data Processing and Interpretation

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Germany Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Seismic Services Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 China Oilfield Services Limited

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 ION Geophysical Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Fugro NV

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Shearwater GeoServices AS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Schlumberger Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 CGG SA

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 BGP Inc China National Petroleum Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Halliburton Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 SeaBird Exploration PLC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Magseis Fairfield ASA (WGP Group Ltd)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Polarcus Ltd

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 PGS ASA

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 China Oilfield Services Limited

List of Figures

- Figure 1: Europe Seismic Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Seismic Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Seismic Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Europe Seismic Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Seismic Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 15: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 17: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 18: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 20: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 21: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Seismic Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 23: Europe Seismic Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 24: Europe Seismic Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seismic Services Industry?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Europe Seismic Services Industry?

Key companies in the market include China Oilfield Services Limited, ION Geophysical Corporation, Fugro NV, Shearwater GeoServices AS, Schlumberger Ltd, CGG SA, BGP Inc China National Petroleum Corporation, Halliburton Company, SeaBird Exploration PLC, Magseis Fairfield ASA (WGP Group Ltd), Polarcus Ltd, PGS ASA.

3. What are the main segments of the Europe Seismic Services Industry?

The market segments include Service, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seismic Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seismic Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seismic Services Industry?

To stay informed about further developments, trends, and reports in the Europe Seismic Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence