Key Insights

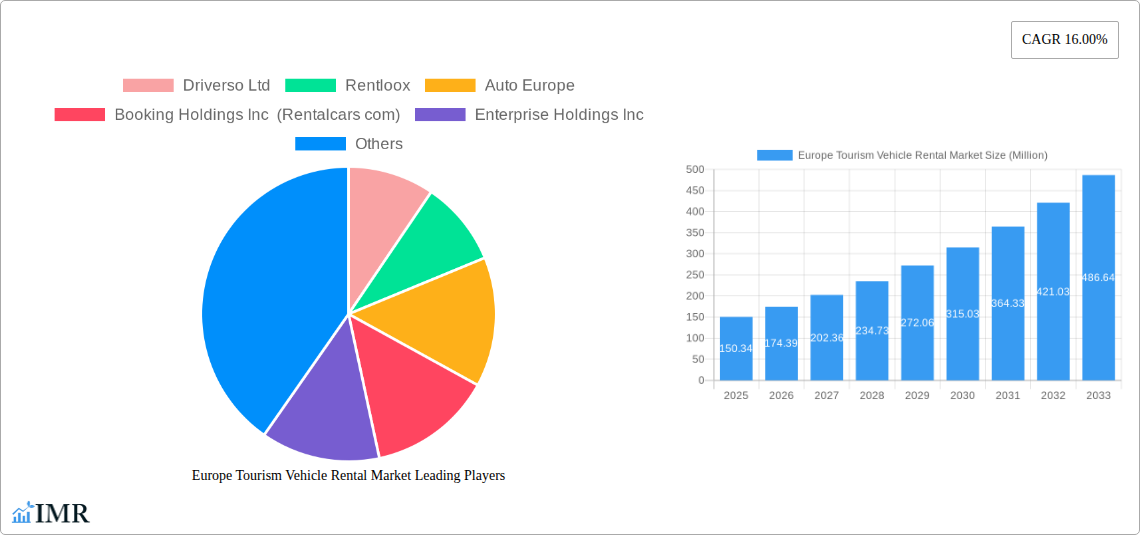

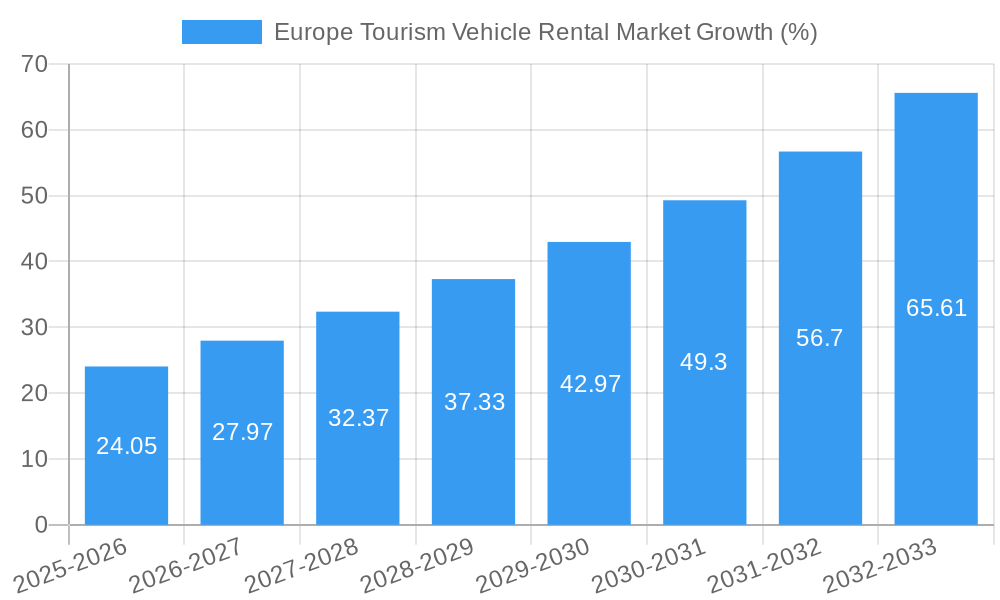

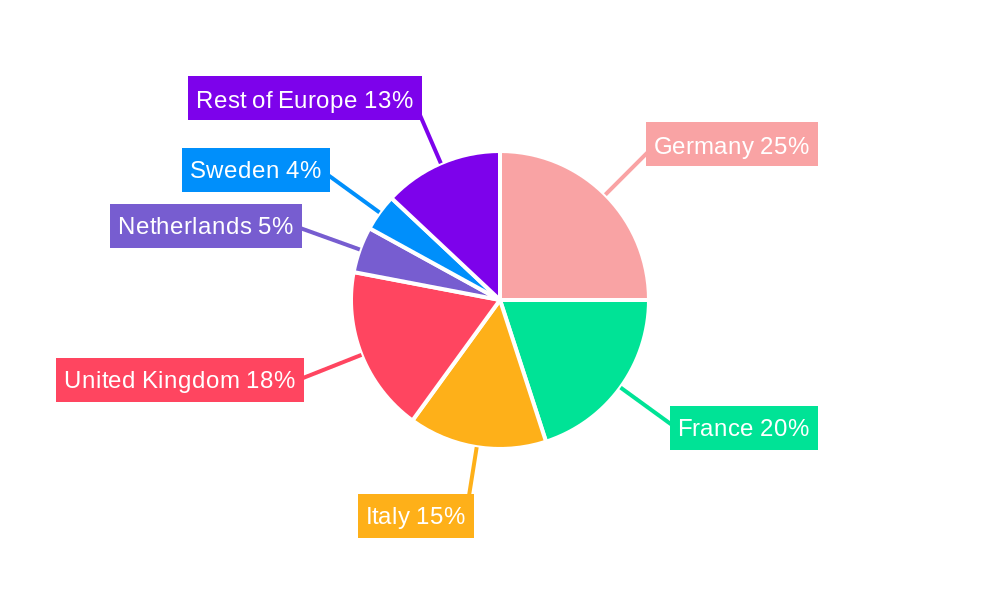

The European tourism vehicle rental market is experiencing robust growth, projected to reach €150.34 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 16% through 2033. This expansion is fueled by several key factors. Increased disposable incomes across Europe, coupled with a rising preference for independent travel experiences, are driving demand for vehicle rentals among tourists. The growth of online travel agencies (OTAs) and the increasing availability of diverse rental options, ranging from short-term car rentals to long-term motorhome rentals, are further stimulating market growth. The convenience and flexibility offered by renting vehicles, particularly for exploring diverse landscapes and less accessible regions, is a significant draw for tourists. Germany, France, Italy, and the United Kingdom represent the largest market segments within Europe, driven by high tourist footfall and well-established tourism infrastructure. However, growth is expected across all listed European countries, driven by increasing tourism and improving infrastructure in regions like Sweden and the Rest of Europe. The competitive landscape is characterized by a mix of established international players like Enterprise Holdings Inc., Avis Budget Group, and Hertz Global Holdings Inc., alongside smaller, specialized companies catering to niche segments like long-term rentals or specific vehicle types.

While the market enjoys significant tailwinds, potential challenges exist. Fluctuations in fuel prices and economic downturns could impact consumer spending on leisure travel, potentially moderating growth. Furthermore, increasing competition necessitates continuous innovation and efficient operational strategies for companies to maintain market share. The ongoing focus on sustainability and the emergence of electric vehicle rental options present both an opportunity and a challenge for market players as they adapt to evolving consumer preferences and environmental regulations. The market's trajectory remains positive, with significant growth potential across various segments and regions, indicating a lucrative prospect for both established and emerging players.

Europe Tourism Vehicle Rental Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Tourism Vehicle Rental Market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market is segmented by application type (Leisure/Tourism, Business), booking type (Online, Offline), and rental duration (Short-term, Long-term). The total market size is projected to reach xx Million units by 2033.

Europe Tourism Vehicle Rental Market Dynamics & Structure

The European tourism vehicle rental market is characterized by a moderately concentrated landscape, with several major players vying for market share. Technological innovation, particularly in areas like electric vehicle (EV) integration and online booking platforms, is a significant driver. Stringent regulatory frameworks regarding emissions, safety, and data privacy influence market operations. The market faces competition from alternative transportation options like ride-hailing services and public transport. End-user demographics, influenced by factors like age, income, and travel preferences, significantly shape demand. Mergers and acquisitions (M&A) activity is relatively frequent, reflecting consolidation within the sector.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Investments in EV fleets and digital platforms are key growth drivers. However, high initial investment costs present a barrier to entry for smaller players.

- Regulatory Framework: EU-wide regulations on emissions and data protection heavily impact market operations.

- Competitive Substitutes: Ride-sharing services and public transportation pose competitive challenges.

- End-User Demographics: Millennials and Gen Z show higher adoption of online booking platforms and short-term rentals.

- M&A Activity: An average of xx M&A deals occurred annually during the historical period (2019-2024).

Europe Tourism Vehicle Rental Market Growth Trends & Insights

The European tourism vehicle rental market exhibits robust growth, driven by increasing tourism, rising disposable incomes, and the growing preference for self-driven travel experiences. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological disruptions, such as the adoption of mobile booking apps and the expansion of EV rental options, which are reshaping consumer behavior. The market penetration of online booking platforms continues to rise, surpassing xx% in 2025. Furthermore, the shift towards sustainable tourism is boosting the demand for eco-friendly rental vehicles, creating new opportunities for market players. The increasing adoption of subscription-based rental models also contributes to market expansion. The impact of macroeconomic factors like fluctuating fuel prices and economic downturns is also analyzed in the report.

Dominant Regions, Countries, or Segments in Europe Tourism Vehicle Rental Market

Western European countries, particularly Germany, France, Spain, and Italy, dominate the market due to robust tourism sectors and well-developed infrastructure. The Leisure/Tourism segment holds the largest market share, fueled by increased holiday travel. Online bookings have become the dominant channel, with a market share exceeding xx% in 2025. Short-term rentals constitute the largest segment by rental duration, reflecting the short-duration nature of most tourist trips.

- Key Growth Drivers:

- Strong tourism infrastructure.

- High tourist arrivals.

- Development of online booking platforms.

- Growing popularity of road trips.

- Dominance Factors:

- High tourist density.

- Well-established rental networks.

- Favorable economic conditions.

- Government support for tourism.

Europe Tourism Vehicle Rental Market Product Landscape

The market offers a diverse range of vehicles, from compact cars to SUVs and luxury vehicles, catering to varied customer needs and budgets. Recent innovations include the integration of advanced driver-assistance systems (ADAS), enhanced online booking interfaces, and the increasing availability of electric vehicles (EVs) within rental fleets. Unique selling propositions include loyalty programs, bundled services (e.g., insurance, GPS), and flexible rental options. Technological advancements focus on improving user experience, fleet management efficiency, and sustainability.

Key Drivers, Barriers & Challenges in Europe Tourism Vehicle Rental Market

Key Drivers:

- Growing tourism sector in Europe.

- Rise in disposable incomes and spending power.

- Increasing preference for road trips and self-drive holidays.

- Technological advancements in vehicle rental platforms and services.

- Expansion of EV fleets and associated government incentives.

Key Challenges:

- Intense competition from established players and emerging startups.

- Fluctuations in fuel prices and economic uncertainty impacting consumer spending.

- Regulatory challenges related to environmental protection and data privacy.

- Supply chain disruptions affecting vehicle availability. The COVID-19 pandemic significantly impacted supply chains, resulting in a xx% decrease in vehicle availability in 2020.

Emerging Opportunities in Europe Tourism Vehicle Rental Market

- Expansion into underserved markets within Eastern Europe.

- Increased adoption of subscription-based rental models.

- Growth in demand for eco-friendly and electric vehicles.

- Development of specialized rental services for niche travel segments (e.g., adventure tourism, cycling tours).

Growth Accelerators in the Europe Tourism Vehicle Rental Market Industry

Strategic partnerships, such as Hertz’s collaboration with Palantir and UFODRIVE, are driving operational efficiency and expanding EV offerings. Technological breakthroughs in areas like autonomous driving and vehicle-to-everything (V2X) communication have the potential to revolutionize the industry. Market expansion into emerging tourism destinations and the development of innovative services, such as peer-to-peer car sharing, are significant growth catalysts.

Key Players Shaping the Europe Tourism Vehicle Rental Market Market

- Driverso Ltd

- Rentloox

- Auto Europe

- Booking Holdings Inc (Rentalcars.com)

- Enterprise Holdings Inc

- Avis Budget Group

- Hertz Global Holdings Inc

- Drivy (Part of Getaround)

- Europe Car Mobility Group

- Fraikin SA

Notable Milestones in Europe Tourism Vehicle Rental Market Sector

- October 2022: Hertz partners with Palantir to enhance operational efficiency and customer experience through data-driven insights.

- February 2022: Hertz invests in UFODRIVE to expand its electric vehicle rental offerings.

- January 2022: SIXT partners with itTaxi to offer on-demand taxi services in Rome.

In-Depth Europe Tourism Vehicle Rental Market Market Outlook

The Europe Tourism Vehicle Rental Market is poised for continued growth, driven by accelerating technological innovation, evolving consumer preferences, and strategic partnerships within the industry. The focus on sustainability, coupled with the expansion of EV fleets and improved digital platforms, will shape future market dynamics. Opportunities abound for companies that can adapt to changing consumer needs and leverage technology to enhance efficiency and customer experience. The market's long-term potential is significant, particularly in regions with burgeoning tourism sectors and supportive regulatory environments.

Europe Tourism Vehicle Rental Market Segmentation

-

1. Application type

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Rental Duration type

- 3.1. Short - term

- 3.2. Long-term

Europe Tourism Vehicle Rental Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

Europe Tourism Vehicle Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Activities is Likely to Drive Demand in the Market

- 3.3. Market Restrains

- 3.3.1. Low Cost of Public Transport May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Rising Tourism Activities is Likely to Drive Leisure/Tourism Application Segment of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application type

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 5.3.1. Short - term

- 5.3.2. Long-term

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application type

- 6. United Kingdom Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application type

- 6.1.1. Leisure/Tourism

- 6.1.2. Business

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 6.3.1. Short - term

- 6.3.2. Long-term

- 6.1. Market Analysis, Insights and Forecast - by Application type

- 7. Germany Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application type

- 7.1.1. Leisure/Tourism

- 7.1.2. Business

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 7.3.1. Short - term

- 7.3.2. Long-term

- 7.1. Market Analysis, Insights and Forecast - by Application type

- 8. Italy Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application type

- 8.1.1. Leisure/Tourism

- 8.1.2. Business

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 8.3.1. Short - term

- 8.3.2. Long-term

- 8.1. Market Analysis, Insights and Forecast - by Application type

- 9. France Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application type

- 9.1.1. Leisure/Tourism

- 9.1.2. Business

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 9.3.1. Short - term

- 9.3.2. Long-term

- 9.1. Market Analysis, Insights and Forecast - by Application type

- 10. Spain Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application type

- 10.1.1. Leisure/Tourism

- 10.1.2. Business

- 10.2. Market Analysis, Insights and Forecast - by Booking Type

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 10.3.1. Short - term

- 10.3.2. Long-term

- 10.1. Market Analysis, Insights and Forecast - by Application type

- 11. Rest of Europe Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application type

- 11.1.1. Leisure/Tourism

- 11.1.2. Business

- 11.2. Market Analysis, Insights and Forecast - by Booking Type

- 11.2.1. Online

- 11.2.2. Offline

- 11.3. Market Analysis, Insights and Forecast - by Rental Duration type

- 11.3.1. Short - term

- 11.3.2. Long-term

- 11.1. Market Analysis, Insights and Forecast - by Application type

- 12. Germany Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Tourism Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Driverso Ltd

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Rentloox

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Auto Europe

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Booking Holdings Inc (Rentalcars com)

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Enterprise Holdings Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Avis Budget Group

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hertz Global Holdings Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Drivy (Part of Getaround)*List Not Exhaustive

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Europe Car Mobility Group

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Fraikin SA

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Driverso Ltd

List of Figures

- Figure 1: Europe Tourism Vehicle Rental Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Tourism Vehicle Rental Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 3: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 4: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 5: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Tourism Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 15: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 16: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 17: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 19: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 20: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 21: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 23: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 24: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 25: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 27: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 28: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 29: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 31: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 32: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 33: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Application type 2019 & 2032

- Table 35: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 36: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Rental Duration type 2019 & 2032

- Table 37: Europe Tourism Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Tourism Vehicle Rental Market?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the Europe Tourism Vehicle Rental Market?

Key companies in the market include Driverso Ltd, Rentloox, Auto Europe, Booking Holdings Inc (Rentalcars com), Enterprise Holdings Inc, Avis Budget Group, Hertz Global Holdings Inc, Drivy (Part of Getaround)*List Not Exhaustive, Europe Car Mobility Group, Fraikin SA.

3. What are the main segments of the Europe Tourism Vehicle Rental Market?

The market segments include Application type, Booking Type, Rental Duration type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Activities is Likely to Drive Demand in the Market.

6. What are the notable trends driving market growth?

Rising Tourism Activities is Likely to Drive Leisure/Tourism Application Segment of the Market.

7. Are there any restraints impacting market growth?

Low Cost of Public Transport May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

October 2022: Hertz and Palantir Technologies Inc. announced a multi-year partnership to use real-time, data-driven insights to drive operational excellence at Hertz and improve the customer experience. This investment is part of Hertz's ongoing commitment to modernize its technology platforms in order to lead in electrification, shared mobility, and customer experience. Hertz is using the Palantir Foundry operating system to build a platform that will help the company manage and operate its nearly 500,000-vehicle fleet, which includes tens of thousands of EVs, more efficiently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Tourism Vehicle Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Tourism Vehicle Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Tourism Vehicle Rental Market?

To stay informed about further developments, trends, and reports in the Europe Tourism Vehicle Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence