Key Insights

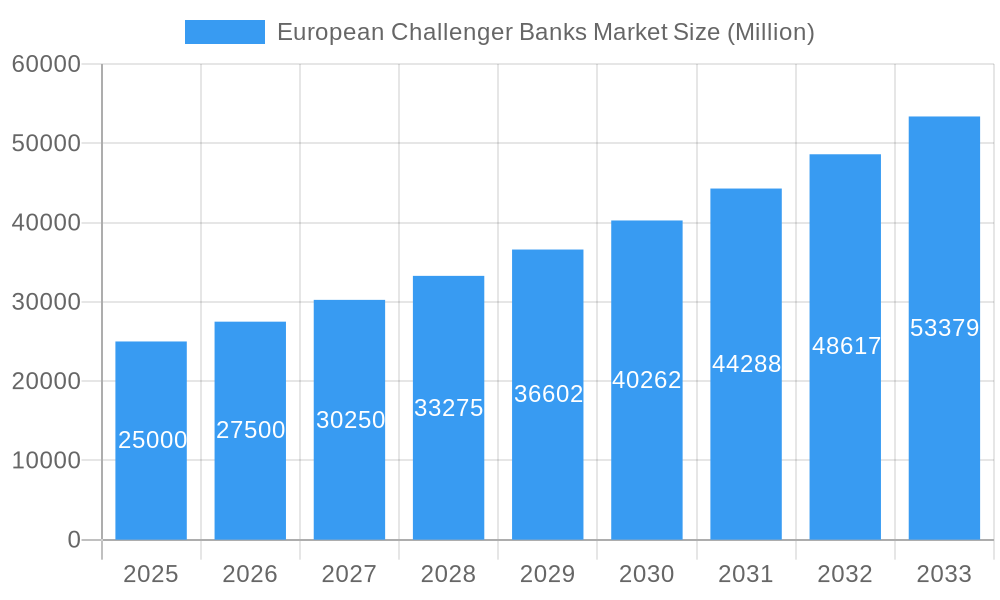

The European challenger bank market is poised for substantial growth, driven by escalating customer demand for digital-first banking and a preference for personalized, efficient financial services. With a projected Compound Annual Growth Rate (CAGR) of 46.7%, the market size is expected to reach 35875.26 million by 2024, expanding significantly through the forecast period (2025-2033). This expansion is propelled by the widespread adoption of mobile banking, advancements in fintech such as open banking and AI-driven personalization, and growing dissatisfaction with traditional banking models' perceived inflexibility and high fees. Leading players like Revolut, Monzo, and Starling Bank are capturing market share through innovative products, seamless user experiences, and competitive pricing. Market segmentation encompasses personal, business, and SME banking, with geographical variations across European nations reflecting diverse digital adoption and regulatory environments. Despite challenges including regulatory compliance, cybersecurity threats, and competition from incumbent banks, the market's trajectory indicates robust future growth.

European Challenger Banks Market Market Size (In Billion)

Continued expansion in the European challenger bank market is contingent upon sustained investment in technology and innovation to maintain a competitive advantage. Broadening product portfolios to address diverse customer needs, particularly in niche segments like sustainable finance or specific demographics, will be critical. Successfully navigating evolving regulatory landscapes and implementing robust cybersecurity measures are paramount for building and sustaining customer trust. The market's success will also depend on challenger banks effectively managing operational costs and scaling infrastructure to accommodate a growing customer base while preserving their agile, customer-centric brand identities. Geographic expansion across Europe, considering varying penetration rates, will also significantly influence future market growth.

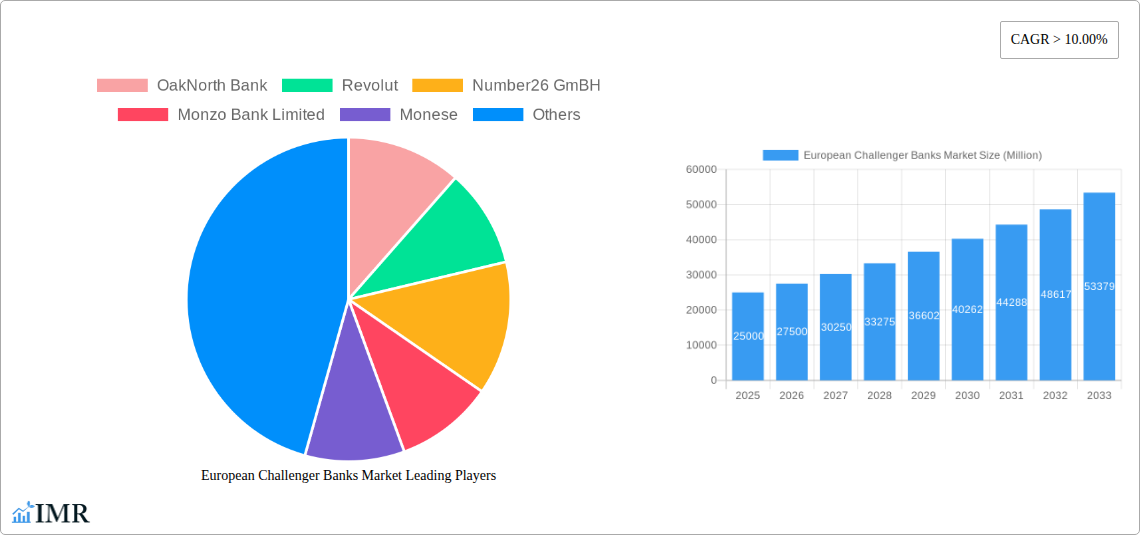

European Challenger Banks Market Company Market Share

European Challenger Banks Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European Challenger Banks market, offering invaluable insights for industry professionals, investors, and strategists. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The report delves into market dynamics, growth trends, regional analysis, product landscapes, and key players shaping this dynamic sector. Discover the opportunities and challenges within the parent market of Financial Services and the child market of Digital Banking.

European Challenger Banks Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends impacting the European Challenger Bank market. We examine market concentration, highlighting the share held by key players and exploring the impact of mergers and acquisitions (M&A) activity. The report further investigates the role of technological innovation, regulatory frameworks (e.g., PSD2), the emergence of competitive substitutes, and evolving end-user demographics.

- Market Concentration: The European Challenger Bank market exhibits a moderately concentrated structure, with a few dominant players and a significant number of smaller, niche players. Market share data for 2024 indicates that the top 5 players collectively hold approximately xx% of the market.

- Technological Innovation: Open banking APIs and advancements in AI and machine learning are key drivers of innovation, enhancing personalization and efficiency. However, challenges remain in integrating legacy systems and ensuring data security.

- Regulatory Landscape: Regulations such as PSD2 have created both opportunities and challenges for Challenger Banks, promoting open banking while increasing compliance costs.

- M&A Activity: The market has witnessed significant M&A activity in recent years, with xx major deals recorded between 2019 and 2024, indicating consolidation and strategic expansion within the sector. Deal value totaled approximately €xx million during this period.

- Competitive Substitutes: Traditional banks and fintech companies offering similar services pose competitive pressure to Challenger Banks.

European Challenger Banks Market Growth Trends & Insights

This section provides a comprehensive analysis of the market's growth trajectory, examining market size evolution (in Million units), adoption rates, technological disruptions, and evolving consumer preferences. We utilize both quantitative and qualitative data to illustrate market dynamics and forecast future growth. The European Challenger Bank market is projected to experience significant growth during the forecast period, driven by factors such as increasing smartphone penetration, rising demand for digital banking services, and the growing adoption of fintech solutions.

- Market Size: The market size in 2024 was estimated at €xx million and is projected to reach €xx million by 2033, exhibiting a CAGR of xx% during the forecast period.

- Adoption Rates: The adoption rate of digital banking services in Europe is steadily increasing, with a notable shift towards mobile-first banking solutions.

- Technological Disruptions: Innovations such as embedded finance and the rise of super apps are reshaping the competitive landscape.

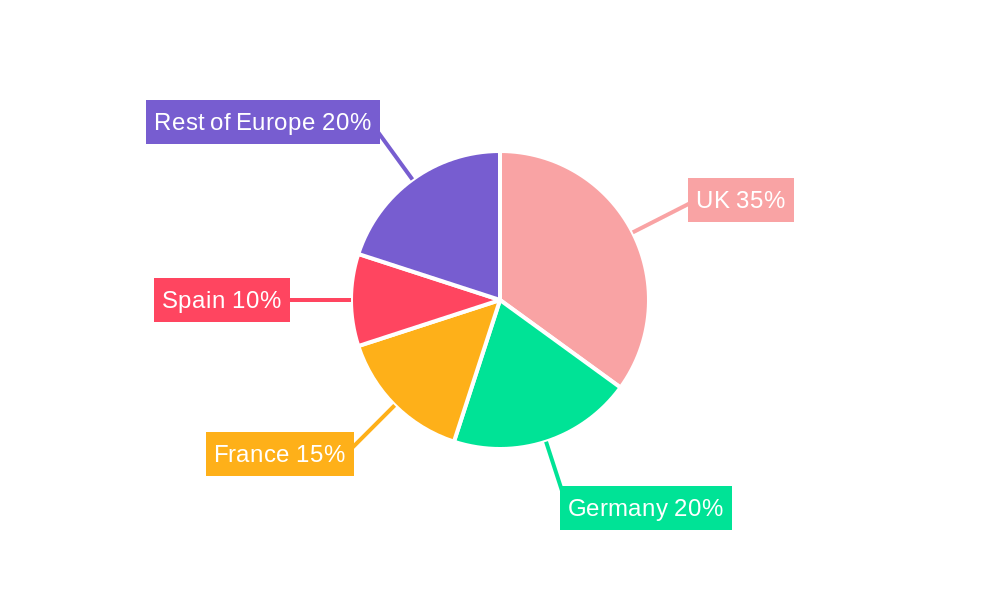

Dominant Regions, Countries, or Segments in European Challenger Banks Market

This section pinpoints the leading regions and countries driving market growth in Europe. We analyze the factors contributing to their dominance, including economic conditions, regulatory frameworks, and technological infrastructure.

- United Kingdom: The UK remains a dominant market due to its strong fintech ecosystem, supportive regulatory environment, and high adoption of digital banking services. It holds approximately xx% of the market share in 2024.

- Germany: Germany's large and digitally savvy population contributes to its significant market size. However, stricter regulatory hurdles compared to the UK impact growth.

- Other Key Markets: France, Spain, and the Nordic countries are also exhibiting strong growth, fueled by rising digital adoption and government initiatives.

European Challenger Banks Market Product Landscape

Challenger banks offer a diverse range of products, including current accounts, savings accounts, loans, and investment services. Innovation focuses on personalized user experiences, seamless integration with other financial apps, and advanced security features. Many differentiate themselves through mobile-first approaches, competitive fees, and enhanced customer service.

Key Drivers, Barriers & Challenges in European Challenger Banks Market

Key Drivers: Increased smartphone penetration, rising demand for digital banking services, supportive regulatory frameworks (like PSD2 in Europe), and advancements in fintech technologies are key growth drivers. Government initiatives promoting digital finance also play a crucial role.

Key Barriers & Challenges: Stringent regulatory compliance requirements, cybersecurity threats, intense competition from established banks and other fintech players, and challenges in acquiring and retaining customers are significant challenges. Furthermore, achieving profitability while managing operational costs remains a key hurdle for many Challenger Banks. The estimated cost of regulatory compliance for Challenger banks in 2024 was approximately €xx million.

Emerging Opportunities in European Challenger Banks Market

Untapped markets in Southern and Eastern Europe present significant growth potential. The integration of AI and machine learning into banking services offers opportunities for personalized financial management tools. The expansion into adjacent financial services, like insurance and investment, is another significant area of opportunity.

Growth Accelerators in the European Challenger Banks Market Industry

Technological advancements, strategic partnerships with established financial institutions, and expansion into new geographical markets are vital growth accelerators. Open banking initiatives and the increasing adoption of cloud-based solutions are also driving growth.

Key Players Shaping the European Challenger Banks Market Market

- OakNorth Bank

- Revolut

- Number26 GmBH

- Monzo Bank Limited

- Monese

- Tandem Bank

- Pockit

- One Savings Bank

- Shawbrook Bank

- Aldermore

- Atom Bank PLc

- TSB

- Clydesdale

- Virgin Bank

- Metro Bank

- Starling Bank

- Fidor Solutions AG

- List Not Exhaustive

Notable Milestones in European Challenger Banks Market Sector

- October 2022: OakNorth Bank acquired a 50% stake in property lender ASK Partners.

- July 2021: Revolut secured USD 800 million in funding at a USD 33 billion valuation.

In-Depth European Challenger Banks Market Market Outlook

The European Challenger Bank market is poised for continued growth, driven by technological innovation, regulatory changes, and evolving consumer preferences. Strategic partnerships, expansion into new markets, and diversification of product offerings will be critical for success in this competitive landscape. The market's future potential is significant, with opportunities for both established players and new entrants to capture market share. Further consolidation through M&A activity is also anticipated.

European Challenger Banks Market Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Account

- 1.4. Consumer Credit

- 1.5. Loans

- 1.6. Others

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

European Challenger Banks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Challenger Banks Market Regional Market Share

Geographic Coverage of European Challenger Banks Market

European Challenger Banks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 46.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Challenger Banks are Gaining Traction in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Challenger Banks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Account

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OakNorth Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Revolut

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Number26 GmBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Monzo Bank Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monese

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tandem Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pockit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 One Savings Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shawbrook Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aldermore

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Atom Bank PLc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TSB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Clydesdale

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Virgin Bank

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Metro Bank

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Starling Bank

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Fidor Solutions AG**List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 OakNorth Bank

List of Figures

- Figure 1: European Challenger Banks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: European Challenger Banks Market Share (%) by Company 2025

List of Tables

- Table 1: European Challenger Banks Market Revenue million Forecast, by Service Type 2020 & 2033

- Table 2: European Challenger Banks Market Revenue million Forecast, by End-User Type 2020 & 2033

- Table 3: European Challenger Banks Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: European Challenger Banks Market Revenue million Forecast, by Service Type 2020 & 2033

- Table 5: European Challenger Banks Market Revenue million Forecast, by End-User Type 2020 & 2033

- Table 6: European Challenger Banks Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Challenger Banks Market?

The projected CAGR is approximately 46.7%.

2. Which companies are prominent players in the European Challenger Banks Market?

Key companies in the market include OakNorth Bank, Revolut, Number26 GmBH, Monzo Bank Limited, Monese, Tandem Bank, Pockit, One Savings Bank, Shawbrook Bank, Aldermore, Atom Bank PLc, TSB, Clydesdale, Virgin Bank, Metro Bank, Starling Bank, Fidor Solutions AG**List Not Exhaustive.

3. What are the main segments of the European Challenger Banks Market?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 35875.26 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Challenger Banks are Gaining Traction in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, OakNorth Bank acquired a 50% stake in property lender ASK Partners. The company has lent in excess of £1bn across over 90 transactions through its online platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Challenger Banks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Challenger Banks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Challenger Banks Market?

To stay informed about further developments, trends, and reports in the European Challenger Banks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence