Key Insights

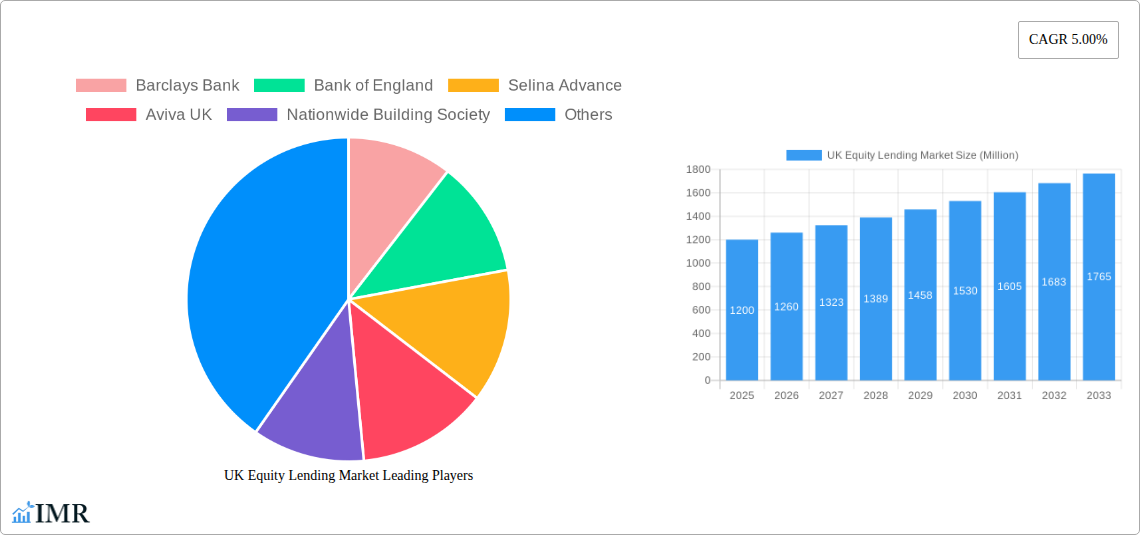

The UK equity lending market is poised for significant expansion, projected at a Compound Annual Growth Rate (CAGR) of 7.9% from a base of £10.2 billion in 2024. This growth is underpinned by several key drivers: increasing participation from institutional investors seeking portfolio diversification and hedging solutions; a supportive regulatory environment promoting transparency and standardization; and technological advancements in trading platforms and data analytics that enhance efficiency and reduce costs. Key market participants include major financial institutions such as Barclays, Bank of England, Royal Bank of Scotland, alongside specialized firms like Aviva UK and Legal & General, and building societies including Nationwide and Coventry, fostering a dynamic and competitive ecosystem.

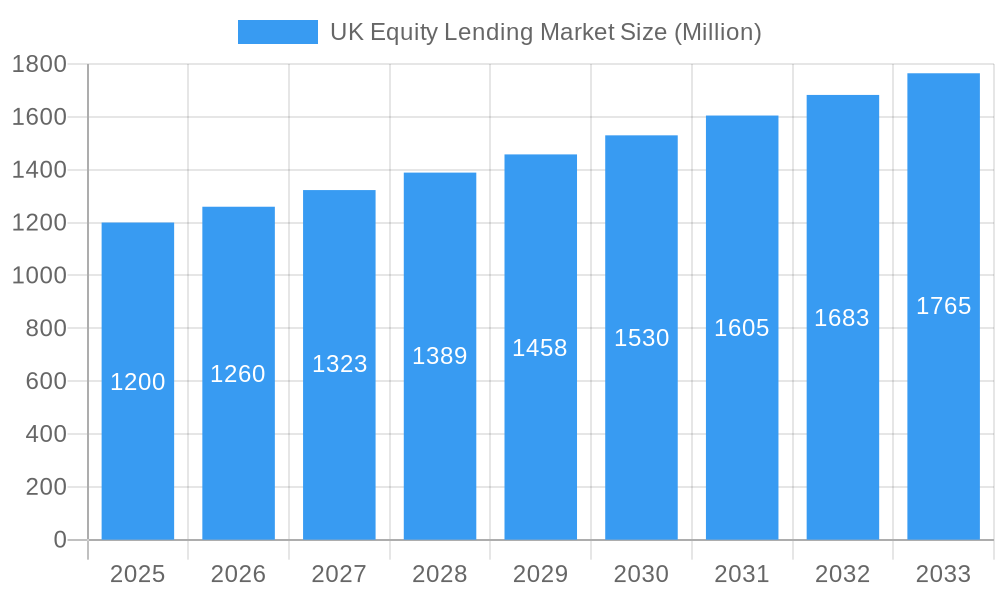

UK Equity Lending Market Market Size (In Billion)

Despite facing challenges such as economic uncertainty, market volatility, and stringent regulatory compliance, the long-term outlook for the UK equity lending market remains robust. The market size is anticipated to surpass £10.2 billion by 2024, offering substantial opportunities for both established and emerging players. Future strategic emphasis will likely be on technological innovation, advanced risk management, and the delivery of tailored solutions to meet the evolving demands of institutional investors.

UK Equity Lending Market Company Market Share

UK Equity Lending Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK Equity Lending Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and stakeholders. The parent market is the broader UK financial services sector, while the child market focuses specifically on equity lending products and services. Projected market size values are in Million units.

UK Equity Lending Market Market Dynamics & Structure

This section analyzes the UK equity lending market's structure, encompassing market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activity. We examine the interplay of these factors to understand the current market landscape and predict future trends.

- Market Concentration: The UK equity lending market exhibits a moderately concentrated structure, with a few major players holding significant market share (estimated at xx%). Smaller fintech companies are emerging, challenging the dominance of established banks.

- Technological Innovation: Technological advancements like AI-powered credit scoring and streamlined online applications are driving efficiency and accessibility in the market. However, high initial investment costs present a barrier to entry for smaller firms.

- Regulatory Framework: Stringent regulatory oversight by the Bank of England and the Financial Conduct Authority (FCA) impacts lending practices and product offerings. Compliance costs can be substantial, particularly for smaller firms.

- Competitive Product Substitutes: Other forms of borrowing, such as personal loans and credit cards, compete with equity lending products. The choice depends on individual financial circumstances and risk appetite.

- End-User Demographics: The primary end-users are homeowners seeking access to capital using their home equity. The demographic profile of borrowers varies depending on the type of equity lending product.

- M&A Trends: The number of M&A deals in the UK equity lending market has been relatively moderate (xx deals in the past five years). Consolidation is anticipated, particularly as larger institutions seek to expand their market share.

UK Equity Lending Market Growth Trends & Insights

This section details the evolution of the UK equity lending market size, adoption rates, technological disruptions, and shifts in consumer behavior. Leveraging comprehensive data analysis, the report presents a detailed picture of market expansion and identifies growth drivers.

The UK equity lending market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. Market penetration is estimated at xx% in 2025, with significant growth potential remaining. Technological disruptions, such as the rise of fintech lenders offering innovative solutions, are accelerating market expansion. Changes in consumer behavior, including increased financial literacy and demand for digital solutions, further propel growth. We project a CAGR of xx% for the forecast period (2025-2033), indicating a substantial market expansion.

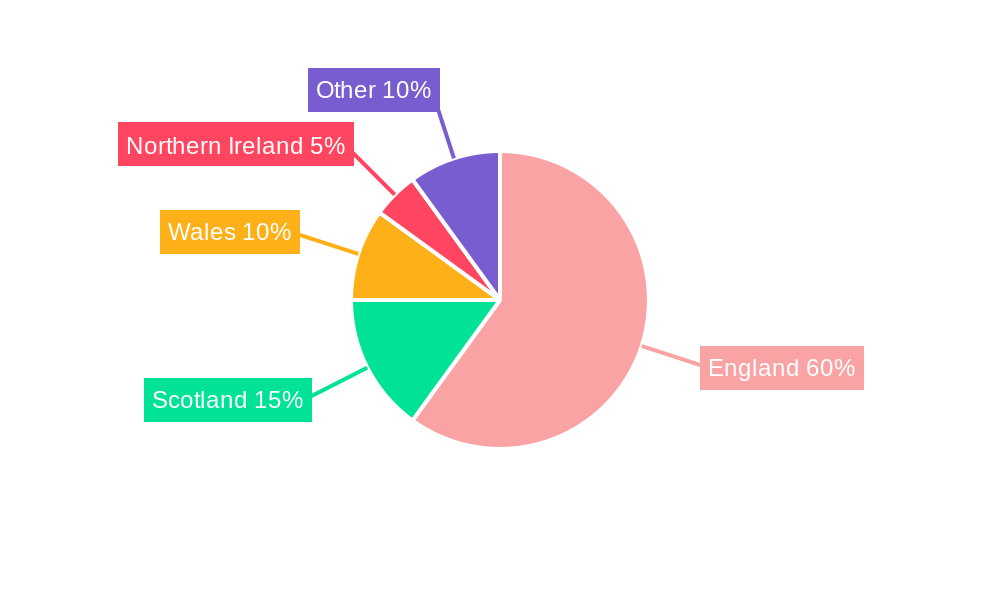

Dominant Regions, Countries, or Segments in UK Equity Lending Market

This section identifies the leading regions, countries, or segments driving market growth. Regional variations in economic conditions, infrastructure development, and regulatory frameworks impact market dynamics. The analysis highlights key factors that contribute to market dominance and assesses future growth potential.

- London: London dominates the UK equity lending market due to its higher property values, concentration of financial institutions, and affluent population.

- South East England: This region follows London, exhibiting strong growth driven by a thriving property market and high homeowner equity.

- Other Regions: Growth in other regions is slower due to factors like lower property values and reduced homeowner equity.

Market dominance is primarily determined by the concentration of high-value properties and financial services infrastructure. Future growth potential is linked to economic performance, technological advancements, and expansion of affordable equity lending solutions into other regions.

UK Equity Lending Market Product Landscape

The UK equity lending market offers various products, including home equity loans, lines of credit, and reverse mortgages. Recent product innovations focus on improved accessibility and user experience through digital platforms and flexible repayment options. Technological advancements enable faster processing times, reduced costs, and personalized lending solutions. This has led to greater competition and product differentiation.

Key Drivers, Barriers & Challenges in UK Equity Lending Market

Key Drivers:

- Increased homeownership rates.

- Rising property values.

- Growing demand for home improvements and renovations.

- Technological advancements that streamline the lending process.

Challenges and Restraints:

- Stringent regulatory environment impacting lending practices.

- Economic uncertainty that may affect borrower creditworthiness and repayment capacity.

- Competition from alternative financing options.

- Potential for increased defaults during economic downturns. This may lead to reduced lending activity and increased risk aversion by lenders.

Emerging Opportunities in UK Equity Lending Market

- Growth in the green financing segment, with increasing demand for home energy efficiency improvements.

- Expansion into underserved markets.

- Development of innovative products tailored to specific customer needs.

- Increased use of data analytics for improved risk assessment and personalized offers.

Growth Accelerators in the UK Equity Lending Market Industry

Long-term growth will be driven by technological innovation (AI, blockchain), strategic partnerships between banks and fintech companies, and targeted expansion strategies focused on underserved segments. The development of new products catering to specific customer needs will further stimulate market growth.

Key Players Shaping the UK Equity Lending Market Market

- Barclays Bank

- Bank of England

- Selina Advance

- Aviva UK

- Nationwide Building Society

- Coventry Building Society

- Royal Bank of Scotland

- Legal and General

- LV Friendly Society

- Onefamily

- List Not Exhaustive

Notable Milestones in UK Equity Lending Market Sector

- February 2022: Selina Advance secured USD 150 million in investment to expand its home equity lending solutions across the UK.

- February 2022: Santander ceased originating residential mortgages and HELOCs.

In-Depth UK Equity Lending Market Market Outlook

The UK equity lending market is poised for significant growth over the forecast period. The combination of a robust housing market, increased consumer demand for home improvements and renovations, and the emergence of innovative financial technology will fuel expansion. Strategic partnerships and product diversification will further enhance the market's potential. Increased regulatory scrutiny will need to be carefully navigated by market players.

UK Equity Lending Market Segmentation

-

1. Product Type

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Banks

- 2.2. Building Societies

- 2.3. Online

- 2.4. Credit Unions

- 2.5. Others

-

3. Mode

- 3.1. Online

- 3.2. Offline

UK Equity Lending Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Equity Lending Market Regional Market Share

Geographic Coverage of UK Equity Lending Market

UK Equity Lending Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Raising Homeownership Rate is Driving the Home Equity Lending Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Banks

- 5.2.2. Building Societies

- 5.2.3. Online

- 5.2.4. Credit Unions

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fixed Rate Loans

- 6.1.2. Home Equity Line of Credit

- 6.2. Market Analysis, Insights and Forecast - by Service Provider

- 6.2.1. Banks

- 6.2.2. Building Societies

- 6.2.3. Online

- 6.2.4. Credit Unions

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Mode

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fixed Rate Loans

- 7.1.2. Home Equity Line of Credit

- 7.2. Market Analysis, Insights and Forecast - by Service Provider

- 7.2.1. Banks

- 7.2.2. Building Societies

- 7.2.3. Online

- 7.2.4. Credit Unions

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Mode

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fixed Rate Loans

- 8.1.2. Home Equity Line of Credit

- 8.2. Market Analysis, Insights and Forecast - by Service Provider

- 8.2.1. Banks

- 8.2.2. Building Societies

- 8.2.3. Online

- 8.2.4. Credit Unions

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Mode

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fixed Rate Loans

- 9.1.2. Home Equity Line of Credit

- 9.2. Market Analysis, Insights and Forecast - by Service Provider

- 9.2.1. Banks

- 9.2.2. Building Societies

- 9.2.3. Online

- 9.2.4. Credit Unions

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Mode

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Equity Lending Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fixed Rate Loans

- 10.1.2. Home Equity Line of Credit

- 10.2. Market Analysis, Insights and Forecast - by Service Provider

- 10.2.1. Banks

- 10.2.2. Building Societies

- 10.2.3. Online

- 10.2.4. Credit Unions

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Mode

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Barclays Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bank of England

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Selina Advance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva UK

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nationwide Building Society

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coventry Building Society

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Royal Bank of Scotland

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Legal and General

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LV Friendly Society

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Onefamily**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Barclays Bank

List of Figures

- Figure 1: Global UK Equity Lending Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Equity Lending Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America UK Equity Lending Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UK Equity Lending Market Revenue (billion), by Service Provider 2025 & 2033

- Figure 5: North America UK Equity Lending Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 6: North America UK Equity Lending Market Revenue (billion), by Mode 2025 & 2033

- Figure 7: North America UK Equity Lending Market Revenue Share (%), by Mode 2025 & 2033

- Figure 8: North America UK Equity Lending Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Equity Lending Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Equity Lending Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America UK Equity Lending Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America UK Equity Lending Market Revenue (billion), by Service Provider 2025 & 2033

- Figure 13: South America UK Equity Lending Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 14: South America UK Equity Lending Market Revenue (billion), by Mode 2025 & 2033

- Figure 15: South America UK Equity Lending Market Revenue Share (%), by Mode 2025 & 2033

- Figure 16: South America UK Equity Lending Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Equity Lending Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Equity Lending Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe UK Equity Lending Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe UK Equity Lending Market Revenue (billion), by Service Provider 2025 & 2033

- Figure 21: Europe UK Equity Lending Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 22: Europe UK Equity Lending Market Revenue (billion), by Mode 2025 & 2033

- Figure 23: Europe UK Equity Lending Market Revenue Share (%), by Mode 2025 & 2033

- Figure 24: Europe UK Equity Lending Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Equity Lending Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Equity Lending Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa UK Equity Lending Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa UK Equity Lending Market Revenue (billion), by Service Provider 2025 & 2033

- Figure 29: Middle East & Africa UK Equity Lending Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 30: Middle East & Africa UK Equity Lending Market Revenue (billion), by Mode 2025 & 2033

- Figure 31: Middle East & Africa UK Equity Lending Market Revenue Share (%), by Mode 2025 & 2033

- Figure 32: Middle East & Africa UK Equity Lending Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Equity Lending Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Equity Lending Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific UK Equity Lending Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific UK Equity Lending Market Revenue (billion), by Service Provider 2025 & 2033

- Figure 37: Asia Pacific UK Equity Lending Market Revenue Share (%), by Service Provider 2025 & 2033

- Figure 38: Asia Pacific UK Equity Lending Market Revenue (billion), by Mode 2025 & 2033

- Figure 39: Asia Pacific UK Equity Lending Market Revenue Share (%), by Mode 2025 & 2033

- Figure 40: Asia Pacific UK Equity Lending Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Equity Lending Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 3: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 4: Global UK Equity Lending Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 7: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 8: Global UK Equity Lending Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 14: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 15: Global UK Equity Lending Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 21: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 22: Global UK Equity Lending Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 34: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 35: Global UK Equity Lending Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Equity Lending Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global UK Equity Lending Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 44: Global UK Equity Lending Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 45: Global UK Equity Lending Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Equity Lending Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Equity Lending Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the UK Equity Lending Market?

Key companies in the market include Barclays Bank, Bank of England, Selina Advance, Aviva UK, Nationwide Building Society, Coventry Building Society, Royal Bank of Scotland, Legal and General, LV Friendly Society, Onefamily**List Not Exhaustive.

3. What are the main segments of the UK Equity Lending Market?

The market segments include Product Type, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.2 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Raising Homeownership Rate is Driving the Home Equity Lending Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2022, Selina Advance, a London-based fintech business, has raised USD150 million in investment to expand its home equity lending solutions to customers across the UK. The round of fundraising, coordinated by global private equity platform Lightrock, included USD 35 million in equity and USD 115 million in loans from Goldman Sachs and GGC to help the company expand across the UK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Equity Lending Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Equity Lending Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Equity Lending Market?

To stay informed about further developments, trends, and reports in the UK Equity Lending Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence