Key Insights

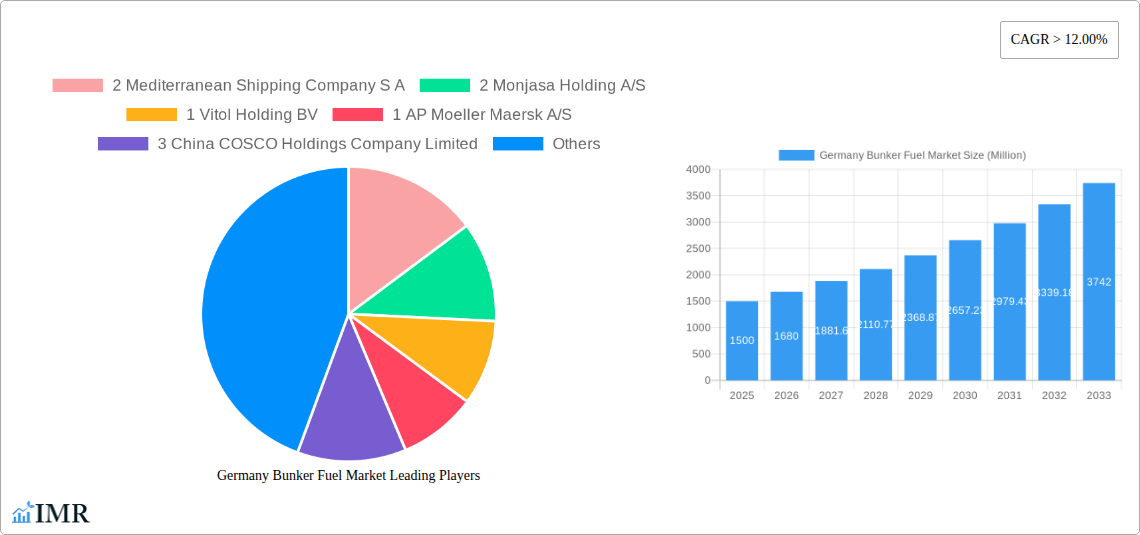

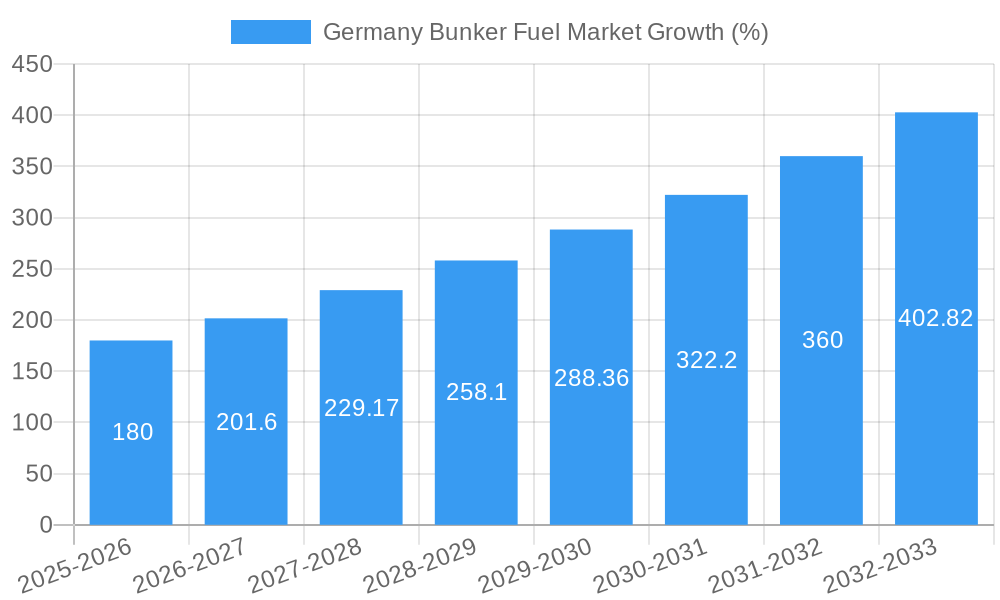

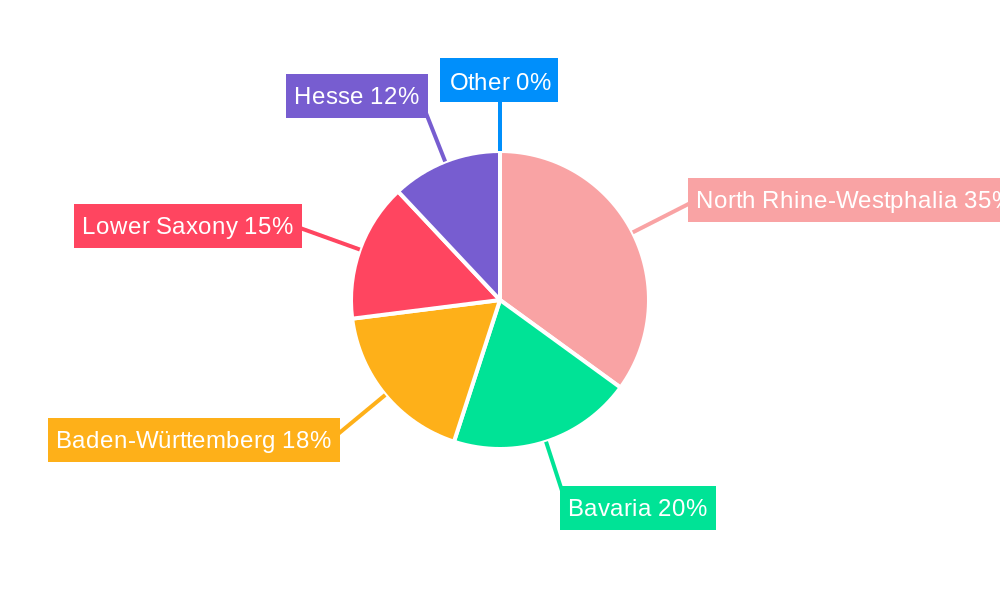

The German bunker fuel market, a vital component of the nation's maritime sector, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 12% from 2025 to 2033. This expansion is fueled by increasing maritime trade volume through German ports, particularly in regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, which house major shipping hubs. The shift towards cleaner fuels, driven by stringent environmental regulations aimed at reducing sulfur emissions, is a key trend. Very Low Sulfur Fuel Oil (VLSFO) is gaining significant traction, replacing High Sulfur Fuel Oil (HSFO), while the adoption of Liquefied Natural Gas (LNG) and alternative fuels like methanol and biodiesel is gradually increasing, albeit from a smaller base. However, market growth faces constraints such as fluctuating fuel prices, geopolitical uncertainties impacting global shipping, and potential infrastructure limitations to fully accommodate the transition to cleaner fuel options. The market is segmented by fuel type (HSFO, VLSFO, MGO, LNG, others) and vessel type (containers, tankers, general cargo, bulk carriers, others), with container vessels representing a substantial portion of fuel demand. Key players include major shipping lines like Mediterranean Shipping Company, Maersk, and COSCO, alongside prominent fuel suppliers such as Vitol, Shell, and Bunker Holding. The increasing focus on sustainability and the need to meet emission standards will significantly shape the market's trajectory in the coming years.

The competitive landscape is characterized by both large multinational corporations and regional players. Major shipping companies are increasingly focusing on fuel efficiency and sustainable practices, influencing the demand for various fuel types. The ongoing investments in port infrastructure and the expansion of LNG bunkering facilities are expected to accelerate the adoption of cleaner fuels. However, the price volatility of alternative fuels and the significant upfront investment required for switching to LNG-powered vessels pose challenges to rapid adoption. Therefore, the German bunker fuel market presents a complex interplay of growth drivers, technological advancements, and regulatory pressures, making it a dynamic and evolving sector. Strategic alliances between fuel suppliers and shipping companies are likely to become more prevalent as the industry strives for cleaner and more sustainable operations.

Germany Bunker Fuel Market: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Bunker Fuel market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market. The report utilizes data up to 2024 and projects data from 2025-2033 based on current market trends.

Germany Bunker Fuel Market Market Dynamics & Structure

This section analyzes the Germany Bunker Fuel market's competitive landscape, technological advancements, regulatory environment, and market trends. The market is characterized by a moderate level of concentration, with key players such as Royal Dutch Shell Plc and CMA CGM Group holding significant market share. However, the market is also witnessing increased participation from smaller, specialized fuel suppliers.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Driven by stricter environmental regulations and the need for cleaner fuels, leading to increased adoption of LNG and alternative fuel types. Barriers to innovation include high upfront investment costs for new technologies and infrastructure.

- Regulatory Framework: Stringent emission regulations from IMO and the EU are major drivers, pushing the adoption of low-sulfur fuels.

- Competitive Product Substitutes: The emergence of alternative fuels like LNG, methanol, and biodiesel presents both opportunities and challenges to traditional HSFO and VLSFO.

- End-User Demographics: Primarily driven by shipping companies, with container ships, tankers, and bulk carriers forming the largest segments.

- M&A Trends: Consolidation is expected to continue, with larger players acquiring smaller firms to expand their market share and geographic reach. Approximately xx M&A deals were recorded in the historical period (2019-2024).

Germany Bunker Fuel Market Growth Trends & Insights

The Germany Bunker Fuel market experienced significant growth during the historical period (2019-2024), driven by increasing shipping activities and the transition to cleaner fuels. The market size is expected to reach xx million units in 2025 and continue its growth trajectory throughout the forecast period (2025-2033). This growth is attributed to factors such as rising global trade, increasing demand for efficient and environmentally friendly fuels, and ongoing investments in port infrastructure. The CAGR is projected to be xx% during the forecast period. Technological disruptions, such as the increasing adoption of LNG and alternative fuels, are reshaping the market landscape. Consumer behavior is shifting towards environmentally conscious choices, driving demand for sustainable bunker fuels.

Dominant Regions, Countries, or Segments in Germany Bunker Fuel Market

The major port cities in Germany are the dominant regions for bunker fuel consumption. Within fuel types, VLSFO is currently the leading segment due to stricter environmental regulations, while LNG is anticipated to show substantial growth in the coming years. Regarding vessel types, container ships and tankers constitute the largest segments of the market due to the high volume of goods transported.

- Leading Fuel Type: VLSFO, driven by regulatory pressures and environmental concerns.

- Leading Vessel Type: Container ships and Tankers, reflecting the dominance of containerized and bulk cargo shipping.

- Key Growth Drivers: Stringent emission regulations, increasing trade volumes, and investments in LNG infrastructure.

Germany Bunker Fuel Market Product Landscape

The German bunker fuel market offers a range of products, including HSFO, VLSFO, MGO, LNG, and alternative fuels like methanol, LPG, and biodiesel. Innovation focuses on improving fuel efficiency, reducing emissions, and developing sustainable alternatives. LNG is gaining traction due to its significantly lower emissions, while the development of biofuels represents a significant step towards environmental sustainability. Key selling propositions include reduced emissions, improved fuel efficiency, and enhanced environmental compliance.

Key Drivers, Barriers & Challenges in Germany Bunker Fuel Market

Key Drivers:

- Increasing global trade and shipping activities.

- Stricter environmental regulations and emission control areas (ECAs).

- Investments in LNG bunkering infrastructure.

- Growing demand for cleaner and more efficient fuels.

Key Barriers & Challenges:

- High initial investment costs for alternative fuel infrastructure.

- Limited availability of alternative fuels in certain regions.

- Supply chain disruptions and price volatility.

- Intense competition among fuel suppliers.

Emerging Opportunities in Germany Bunker Fuel Market

- Growing demand for biofuels and other sustainable alternatives.

- Expansion of LNG bunkering infrastructure.

- Development of new technologies for fuel efficiency and emission reduction.

- Increased focus on digitalization and data analytics in the supply chain.

Growth Accelerators in the Germany Bunker Fuel Market Industry

Long-term growth will be driven by technological advancements in fuel efficiency and emission reduction, strategic partnerships between fuel suppliers and shipping companies to develop and implement alternative fuel solutions, and market expansion into new regions and vessel types. Continued regulatory support for cleaner fuels will also play a crucial role.

Key Players Shaping the Germany Bunker Fuel Market Market

- Mediterranean Shipping Company S A (2)

- Monjasa Holding A/S (2)

- Vitol Holding BV (1)

- AP Moeller Maersk A/S (1)

- China COSCO Holdings Company Limited (3)

- Royal Dutch Shell Plc (5)

- Ship Owners

- Fuel Suppliers

- Ocean Network Express (6)

- CMA CGM Group (4)

- Total SA (4)

- Bunker Holding A/S (3)

- Hapag-Lloyd AG (5)

- List Not Exhaustive

Notable Milestones in Germany Bunker Fuel Market Sector

- June 2022: TGE Marine Gas Engineering GmbH awarded contract to design and provide LNG bunkering barge tanks, signaling growth in LNG bunkering infrastructure.

- October 2022: Biofabrik develops viable bunker fuels from waste oil, highlighting the emergence of sustainable alternatives.

In-Depth Germany Bunker Fuel Market Market Outlook

The future of the German bunker fuel market is bright, driven by ongoing efforts to reduce emissions, expand LNG infrastructure, and develop sustainable alternative fuels. Strategic partnerships and technological innovations will be crucial for long-term success. The market offers significant opportunities for companies willing to invest in environmentally friendly solutions and adapt to the evolving regulatory landscape. The continued growth of global trade will further fuel demand for bunker fuels, creating a sustained market for innovative and efficient solutions.

Germany Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other fuel Types (Methanol, LPG, Biodiesel)

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Container

- 2.5. Other Vessel Types

Germany Bunker Fuel Market Segmentation By Geography

- 1. Germany

Germany Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased LNG Trade Worldwide4.; Increasing Dependecies over Natural Gas for Power Generation

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns and the Strict Regulations Related to Emissions from Maritime Industry

- 3.4. Market Trends

- 3.4.1. Very Low Sulfur Fuel Oil (VLSFO) to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other fuel Types (Methanol, LPG, Biodiesel)

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Container

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. North Rhine-Westphalia Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 2 Mediterranean Shipping Company S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 2 Monjasa Holding A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 1 Vitol Holding BV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 1 AP Moeller Maersk A/S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 China COSCO Holdings Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 5 Royal Dutch Shell Plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ship Owners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fuel Suppliers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 6 Ocean Network Express*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 4 CMA CGM Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 4 Total SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 3 Bunker Holding A/S

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 5 Hapag-Lloyd AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 2 Mediterranean Shipping Company S A

List of Figures

- Figure 1: Germany Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: Germany Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: Germany Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: Germany Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: Germany Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 21: Germany Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 22: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 23: Germany Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 24: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 25: Germany Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Bunker Fuel Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the Germany Bunker Fuel Market?

Key companies in the market include 2 Mediterranean Shipping Company S A, 2 Monjasa Holding A/S, 1 Vitol Holding BV, 1 AP Moeller Maersk A/S, 3 China COSCO Holdings Company Limited, 5 Royal Dutch Shell Plc, Ship Owners, Fuel Suppliers, 6 Ocean Network Express*List Not Exhaustive, 4 CMA CGM Group, 4 Total SA, 3 Bunker Holding A/S, 5 Hapag-Lloyd AG.

3. What are the main segments of the Germany Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased LNG Trade Worldwide4.; Increasing Dependecies over Natural Gas for Power Generation.

6. What are the notable trends driving market growth?

Very Low Sulfur Fuel Oil (VLSFO) to Witness Significant Demand.

7. Are there any restraints impacting market growth?

Environmental Concerns and the Strict Regulations Related to Emissions from Maritime Industry.

8. Can you provide examples of recent developments in the market?

October 2022: Biofabrik, a German oil and plastic recycling firm, developed viable bunker fuels from waste oil products. The company has produced a range of bunker fuels from waste oil fuel products such as sludge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Germany Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence