Key Insights

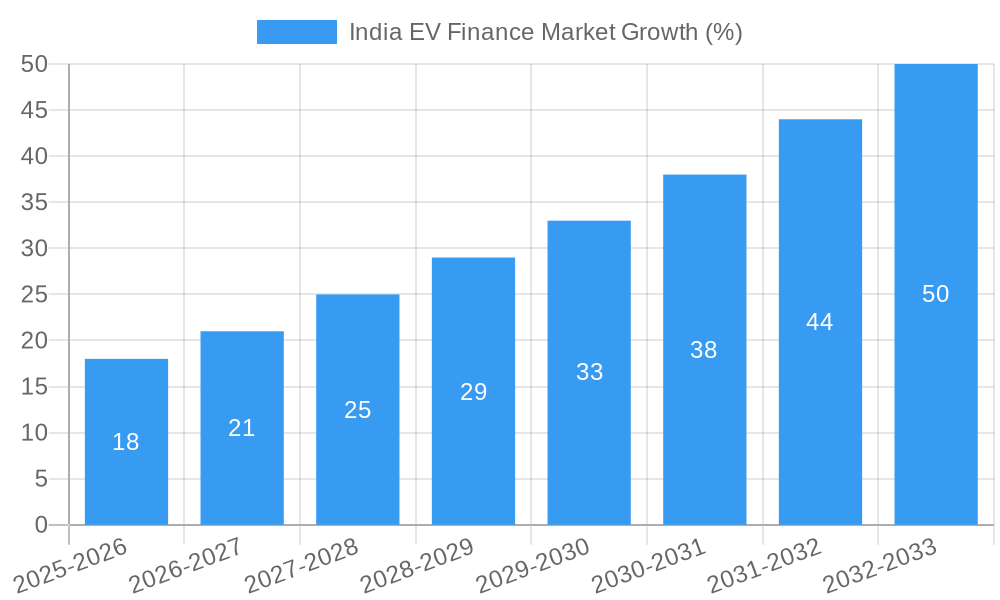

The India EV Finance Market is experiencing robust growth, fueled by the government's push for electric vehicle adoption and increasing environmental awareness among consumers. With a current market size exceeding ₹100 million (a reasonable estimate based on a high-growth CAGR of >15% and considering the scale of the Indian automotive market), the market is projected to expand significantly over the forecast period (2025-2033). Key drivers include supportive government policies like subsidies and tax benefits, improving EV infrastructure (charging stations), and a growing preference for eco-friendly transportation. The market is segmented by vehicle type (passenger cars, commercial vehicles, two- and three-wheelers), financing source (OEMs, banks, credit unions, financial institutions), and vehicle condition (new and used). The dominance of banks and financial institutions in financing is expected to continue, although OEM financing is likely to increase as manufacturers strive to boost EV sales. Challenges include the relatively high upfront cost of EVs compared to internal combustion engine vehicles, limited consumer awareness in certain regions, and the need for further development of the charging infrastructure in less developed areas. Nevertheless, the long-term outlook remains positive, with the market poised for substantial expansion driven by technological advancements, decreasing battery prices, and increasing consumer acceptance.

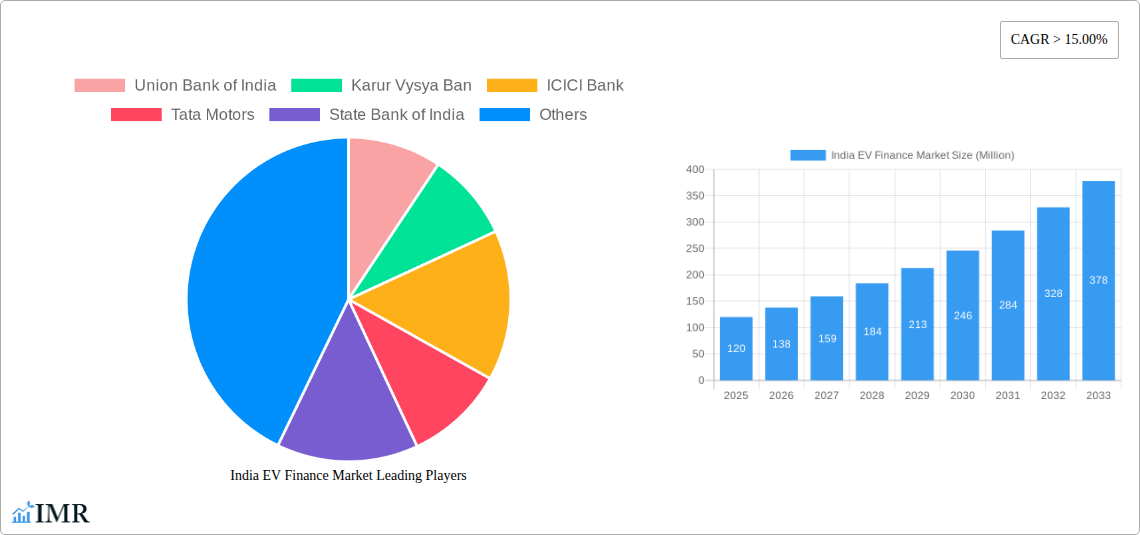

The competitive landscape is characterized by a mix of traditional banks (State Bank of India, ICICI Bank, Axis Bank, Union Bank of India, Karur Vysya Bank, IDFC FIRST Bank) and specialized financing companies (Poonawalla Fincorp Limited, Shriram Transport Finance Company). These players are adapting their strategies to cater to the specific financing needs of the EV market, including offering tailored loan products, competitive interest rates, and innovative financing solutions. Regional variations exist, with higher adoption rates anticipated in urban centers and more developed states, though government initiatives are aiming to bridge this gap. The market segmentation provides opportunities for targeted marketing and product development, allowing companies to tailor their offerings to the unique needs of different customer segments. A focus on developing robust risk management frameworks and efficient credit scoring systems will be crucial for sustainable growth in this evolving market.

India EV Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning India EV Finance Market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of Electric Vehicle (EV) sales in India and delves into the child market of financing solutions for these vehicles, offering valuable insights for investors, industry professionals, and policymakers. The study period spans from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market size is presented in million units.

India EV Finance Market Dynamics & Structure

The Indian EV finance market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is currently moderate, with a few large banks and financial institutions dominating alongside specialized financing companies. However, increasing participation from OEMs and new fintech players is expected to intensify competition. Technological innovation, particularly in battery technology and charging infrastructure, is a key driver, while regulatory frameworks (including government incentives and emission standards) play a crucial role in shaping market behavior. Competitive product substitutes (e.g., internal combustion engine vehicles) still present a challenge, as does the need to expand access to financing in underserved demographics.

- Market Concentration: Moderate, shifting towards increased competition.

- Technological Innovation: Battery advancements, charging infrastructure development are key drivers.

- Regulatory Framework: Government incentives and emission norms significantly influence market growth. xx% of market growth attributed to government policies.

- Competitive Substitutes: ICE vehicles remain a significant competitor.

- End-User Demographics: Growing middle class and urban population are key target segments.

- M&A Activity: xx M&A deals in the last 5 years, indicating consolidation and expansion.

India EV Finance Market Growth Trends & Insights

The India EV finance market is experiencing exponential growth, driven by increasing EV adoption rates and supportive government policies. Market size is projected to increase from xx million units in 2024 to xx million units by 2033, exhibiting a CAGR of xx%. This growth is fueled by several factors, including the decreasing cost of EVs, improved battery technology, expanding charging infrastructure, and growing consumer awareness of environmental concerns. Technological disruptions, such as the introduction of new battery chemistries and charging technologies, are further accelerating market expansion. Consumer behavior is shifting towards preference for EVs, especially in urban areas, where charging infrastructure is more accessible.

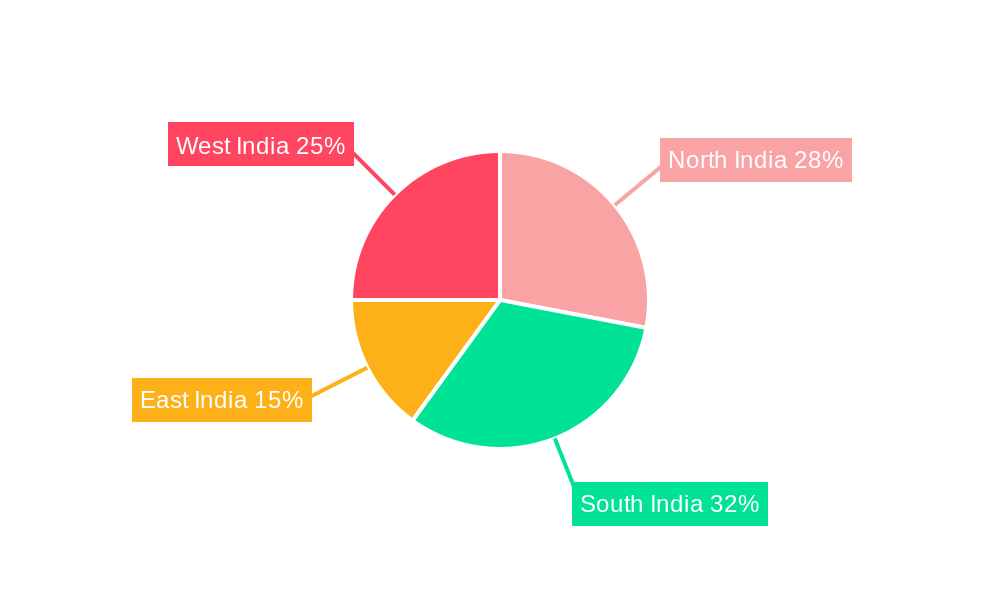

Dominant Regions, Countries, or Segments in India EV Finance Market

While the entire nation is seeing growth, certain regions, segments, and vehicle types are driving the Indian EV finance market's expansion more significantly. Urban centers in states like Maharashtra, Gujarat, and Karnataka demonstrate higher adoption rates due to better infrastructure and consumer awareness. The New Vehicle segment dominates, representing xx% of the market in 2025, while the Two-Wheeler segment holds the largest market share by vehicle type (xx%), driven by the affordability and suitability for urban commuting. Banks and Financial Institutions are the primary source of funding for EV purchases, holding a combined xx% of market share.

- Leading Region: Urban areas of Maharashtra, Gujarat, and Karnataka.

- Dominant Segment (By Type): New Vehicles (xx%)

- Largest Segment (By Vehicle Type): Two-Wheelers (xx%)

- Primary Source Type: Banks and Financial Institutions (xx%)

- Key Drivers: Government incentives, improving charging infrastructure, growing consumer preference.

India EV Finance Market Product Landscape

The EV finance product landscape is evolving rapidly, with offerings tailored to diverse customer needs and vehicle types. Products include conventional loans, lease financing, and innovative solutions like battery leasing and subscription models. A key differentiator is the integration of technology, such as digital platforms for loan applications and processing, and real-time tracking of vehicle usage. Competition is driving the development of attractive interest rates, flexible repayment options, and streamlined approval processes, enhancing the customer experience.

Key Drivers, Barriers & Challenges in India EV Finance Market

Key Drivers: Government initiatives promoting EV adoption, increasing affordability of EVs, expanding charging infrastructure, growing consumer awareness of environmental benefits, technological advancements in battery technology.

Key Challenges: High upfront cost of EVs remains a barrier, limited availability of charging infrastructure in certain regions, lack of consumer awareness in rural areas, concerns about range anxiety, and potential supply chain disruptions. xx% of potential buyers cite cost as a primary barrier.

Emerging Opportunities in India EV Finance Market

The market presents exciting opportunities in untapped segments, including financing for commercial EVs (e.g., three-wheelers and buses for last-mile delivery), and the development of customized financial products for rural markets. Leveraging technology to create innovative financing solutions (like pay-per-use models or battery-as-a-service) also holds significant potential. The growing demand for used EVs is another emerging segment, representing xx million units by 2033.

Growth Accelerators in the India EV Finance Market Industry

The long-term growth of the Indian EV finance market is poised to be significantly impacted by factors like continued governmental support through subsidies and tax benefits, accelerating technological advancements in battery technology leading to extended ranges and decreased charging times, and strategic alliances between OEMs, banks, and fintech companies. Increased investment in charging infrastructure and wider consumer adoption, particularly in rural areas, will further amplify growth.

Key Players Shaping the India EV Finance Market Market

- Union Bank of India

- Karur Vysya Bank

- ICICI Bank

- Tata Motors

- State Bank of India

- Axis Bank

- Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- IDFC FIRST Bank

- Shriram Transport Finance Company (STFC)

Notable Milestones in India EV Finance Market Sector

- June 2022: Ather Energy and State Bank of India collaborate on EV financing.

- August 2022: Tata Motors and State Bank of India launch an Electronic Dealer Finance solution (e-DFS).

- October 2022: BYD India and ICICI Bank partner for EV financing solutions.

- November 2022: Shriram Transport Finance Co. (STFC) partners with Euler Motors to finance electric 3-wheeler cargo vehicles.

In-Depth India EV Finance Market Market Outlook

The future of the India EV finance market is bright, driven by a confluence of factors. Continued government support, coupled with technological advancements, will fuel further adoption. Strategic partnerships and the emergence of innovative financing models will unlock significant market potential. The expansion of charging infrastructure and increased consumer awareness will drive demand, leading to substantial growth over the forecast period. The market is expected to reach xx million units by 2033, presenting lucrative opportunities for both established and emerging players.

India EV Finance Market Segmentation

-

1. Type

- 1.1. New Vehicles

- 1.2. Used Vehicles

-

2. Source Type

- 2.1. OEMs

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

- 3.3. Two-Wheelers

- 3.4. Three-Wheelers

India EV Finance Market Segmentation By Geography

- 1. India

India EV Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Penetration of Electric Vehicles in India to Spur Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicles

- 5.1.2. Used Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEMs

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.3.3. Two-Wheelers

- 5.3.4. Three-Wheelers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India EV Finance Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India EV Finance Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India EV Finance Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India EV Finance Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Union Bank of India

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Karur Vysya Ban

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ICICI Bank

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tata Motors

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 State Bank of India

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Axis Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IDFC FIRST Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Shriram Transport Finance Company (STFC)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Union Bank of India

List of Figures

- Figure 1: India EV Finance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India EV Finance Market Share (%) by Company 2024

List of Tables

- Table 1: India EV Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India EV Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India EV Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 4: India EV Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: India EV Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India EV Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India EV Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India EV Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India EV Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India EV Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India EV Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India EV Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 13: India EV Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: India EV Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Finance Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the India EV Finance Market?

Key companies in the market include Union Bank of India, Karur Vysya Ban, ICICI Bank, Tata Motors, State Bank of India, Axis Bank, Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited), IDFC FIRST Bank, Shriram Transport Finance Company (STFC).

3. What are the main segments of the India EV Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Penetration of Electric Vehicles in India to Spur Market Growth.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Shriram Transport Finance Co. (STFC) tied up with Euler Motors (Euler) to finance electric 3-wheeler cargo vehicles for last-mile logistics solutions. The partnership is in line with the objective of a green and sustainable future that Shriram embarked upon in 2022. STFC has witnessed the rising demand for e-commerce and logistics-related vehicles and the rising need for their financing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Finance Market?

To stay informed about further developments, trends, and reports in the India EV Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence