Key Insights

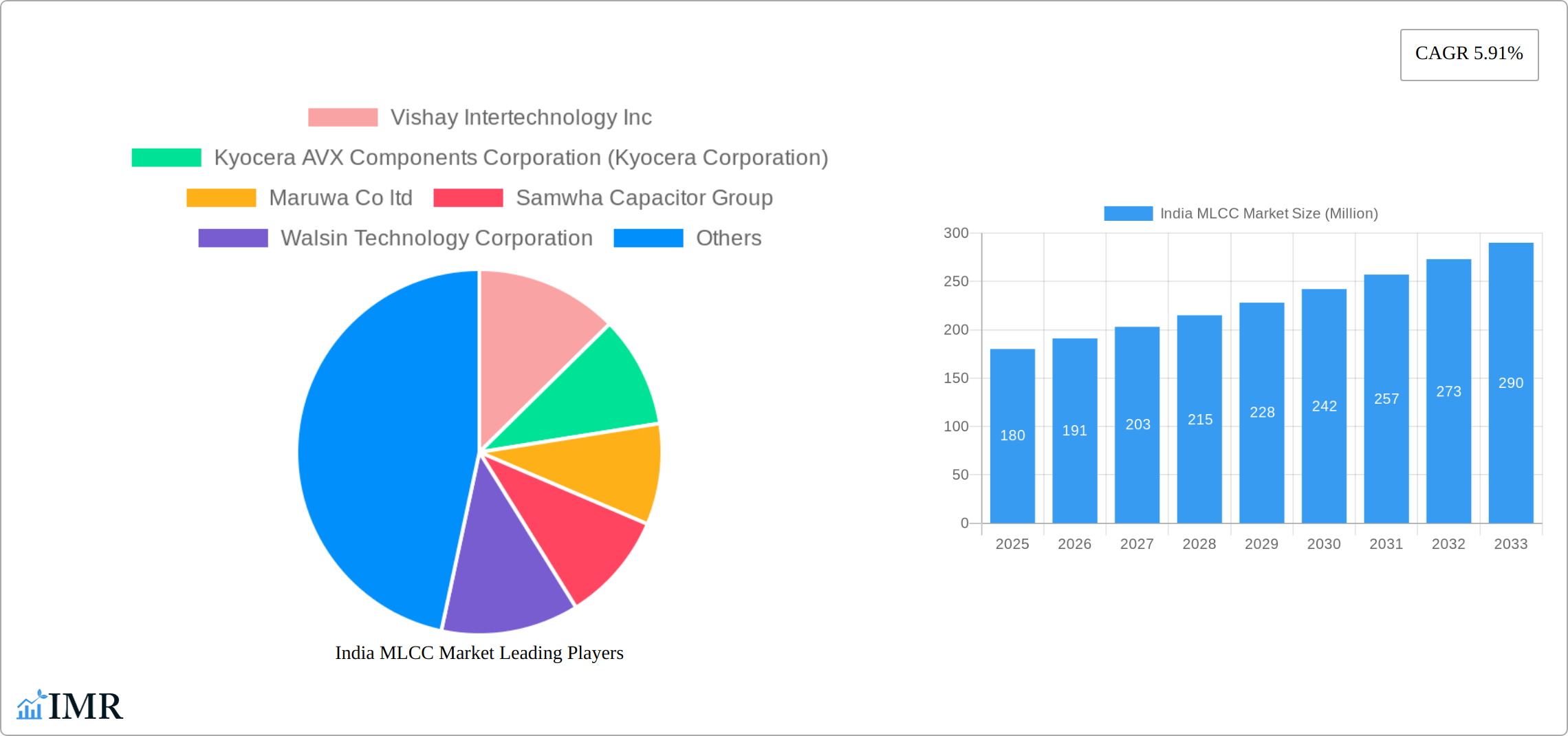

The India Multilayer Ceramic Capacitor (MLCC) market, valued at approximately ₹1500 crore (approximately $180 million USD) in 2025, is projected to experience robust growth, driven by the burgeoning electronics manufacturing sector and increasing demand across diverse end-use industries. The 5.91% CAGR from 2019 to 2025 indicates a steadily expanding market, fueled by factors such as the rising adoption of smartphones, automotive electronics, and industrial automation, all significant consumers of MLCCs. The growth is further supported by government initiatives promoting domestic manufacturing and technological advancements leading to higher capacitance and miniaturization in MLCC technology. Key market segments include the high-capacitance range (100µF to 1000µF) and surface mount types which dominate due to their suitability for compact designs. The automotive and consumer electronics sectors represent the largest demand segments, significantly contributing to the overall market expansion. While challenges like global supply chain disruptions and price volatility of raw materials may pose some constraints, the long-term outlook for the India MLCC market remains optimistic, particularly as domestic production scales up to meet rising local demand.

The regional distribution within India reveals significant variations in market penetration. While precise data for individual regions (North, South, East, and West India) is unavailable, it’s expected that regions with concentrated manufacturing hubs for electronics and automotive components will exhibit higher demand. South India, for example, known for its robust IT and electronics manufacturing, likely holds a significant share. The competitive landscape is characterized by the presence of both global and domestic players, with leading companies like Murata, TDK, Samsung Electro-Mechanics, and others vying for market share. The competitive dynamics are expected to remain intense as companies focus on product innovation, price competitiveness, and building stronger relationships with local manufacturers. Future growth will depend heavily on the continued growth of India's electronics manufacturing ecosystem, along with innovation in MLCC technology to cater to the demands of next-generation applications.

India MLCC Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India MLCC (Multilayer Ceramic Capacitor) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. It segments the market across various parameters, including capacitance, mounting type, end-user, dielectric type, case size, and voltage, providing a granular understanding of market dynamics. Key players like Vishay Intertechnology Inc., Kyocera AVX Components Corporation, Murata Manufacturing Co Ltd, and others are analyzed in detail. The report projects the market size in Million units throughout the forecast period.

India MLCC Market Dynamics & Structure

The India MLCC market is characterized by a moderately concentrated landscape with key players holding significant market share. Technological innovation, particularly in miniaturization and high-voltage applications, is a major driver. Stringent regulatory frameworks related to electronic component reliability and safety influence market dynamics. The market faces competition from alternative capacitor technologies, and the adoption of new materials and manufacturing processes remains a key challenge. Furthermore, mergers and acquisitions (M&A) activity, while not extremely frequent, can significantly impact the market structure.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Focus on high-voltage, miniaturized, and automotive-grade MLCCs is driving growth.

- Regulatory Framework: Compliance with BIS standards and other relevant regulations is crucial.

- Competitive Substitutes: Film capacitors and other types of capacitors present competitive pressure.

- M&A Activity: An average of xx M&A deals per year were observed during 2019-2024.

- End-User Demographics: The automotive and consumer electronics sectors are major drivers of MLCC demand.

India MLCC Market Growth Trends & Insights

The India MLCC market experienced significant growth during the historical period (2019-2024), driven by factors such as the increasing adoption of electronics in various end-user sectors. The market size is estimated to be xx million units in 2025 and is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the development of high-voltage MLCCs for electric vehicles and the increasing demand for miniaturized components, are expected to accelerate market expansion. Consumer behavior shifts towards advanced electronic devices further fuel this growth. The adoption rate of advanced MLCC technologies is expected to increase significantly.

Dominant Regions, Countries, or Segments in India MLCC Market

The dominant segment in the India MLCC market in 2025 is expected to be the surface mount type MLCC, driven by the increasing demand for compact and efficient electronic devices. Among end-users, the automotive and consumer electronics sectors are leading, contributing to a substantial market share. Within capacitance segments, the "Less than 100µF" category dominates due to its widespread use in various applications.

- Leading Segment: Surface Mount MLCCs hold the largest market share.

- Dominant End-User: Automotive and Consumer Electronics sectors are key drivers.

- High-Growth Capacitance Range: Less than 100µF holds the highest market share.

- Regional Variation: Growth is expected to be relatively uniform across major Indian regions.

India MLCC Market Product Landscape

The India MLCC market features a diverse range of products catering to different applications and performance requirements. Innovations focus on enhanced capacitance, smaller form factors, improved temperature stability, and higher voltage ratings. Key product differentiators include superior reliability, advanced material compositions, and efficient manufacturing processes. The market is seeing a significant shift towards high-voltage MLCCs for automotive applications and energy-efficient solutions for consumer electronics.

Key Drivers, Barriers & Challenges in India MLCC Market

Key Drivers:

- Increasing demand from automotive and consumer electronics sectors.

- Growing adoption of advanced electronic devices.

- Technological advancements in miniaturization and high-voltage capabilities.

- Government initiatives promoting domestic manufacturing.

Key Challenges:

- Dependence on imports for certain raw materials.

- Intense competition from established global players.

- Fluctuations in raw material prices.

- Ensuring consistent product quality and reliability.

Emerging Opportunities in India MLCC Market

- Expanding market for electric vehicles and renewable energy technologies.

- Growing adoption of IoT and 5G technologies.

- Increased demand for high-reliability MLCCs in medical and aerospace applications.

- Opportunities for local manufacturers to capture market share through cost optimization and efficient supply chains.

Growth Accelerators in the India MLCC Market Industry

The long-term growth of the India MLCC market will be fueled by continuous technological innovation in materials and manufacturing processes. Strategic partnerships between domestic and international players will further accelerate growth. Expanding into new end-user segments, such as smart homes and wearables, will unlock significant market potential. Government support for the electronics industry will play a crucial role.

Key Players Shaping the India MLCC Market Market

- Vishay Intertechnology Inc.

- Kyocera AVX Components Corporation (Kyocera Corporation)

- Maruwa Co ltd

- Samwha Capacitor Group

- Walsin Technology Corporation

- Samsung Electro-Mechanics

- Würth Elektronik GmbH & Co KG

- Yageo Corporation

- Taiyo Yuden Co Ltd

- TDK Corporation

- Murata Manufacturing Co Ltd

- Nippon Chemi-Con Corporation

Notable Milestones in India MLCC Market Sector

- July 2023: KEMET (Yageo Corporation) launched the X7R automotive-grade MLCC, meeting high-voltage requirements (500V-1kV) for automotive subsystems.

- June 2023: Launch of NTS/NTF Series SMD type MLCCs to cater to the growing demand in industrial equipment.

- May 2023: Murata introduced the EVA series MLCC, suitable for various EV applications (OBC, inverters, BMS, WPT).

In-Depth India MLCC Market Market Outlook

The future of the India MLCC market looks bright, with continued strong growth projected across various segments. The convergence of technological advancements, increasing demand from key end-user sectors, and supportive government policies will drive market expansion. Strategic investments in R&D, capacity expansion, and supply chain optimization will be crucial for success in this dynamic market. Companies focusing on high-voltage, miniaturized, and specialized MLCCs are poised for significant market share gains.

India MLCC Market Segmentation

-

1. Dielectric Type

- 1.1. Class 1

- 1.2. Class 2

-

2. Case Size

- 2.1. 0 201

- 2.2. 0 402

- 2.3. 0 603

- 2.4. 1 005

- 2.5. 1 210

- 2.6. Others

-

3. Voltage

- 3.1. 500V to 1000V

- 3.2. Less than 500V

- 3.3. More than 1000V

-

4. Capacitance

- 4.1. 100µF to 1000µF

- 4.2. Less than 100µF

- 4.3. More than 1000µF

-

5. Mlcc Mounting Type

- 5.1. Metal Cap

- 5.2. Radial Lead

- 5.3. Surface Mount

-

6. End User

- 6.1. Aerospace and Defence

- 6.2. Automotive

- 6.3. Consumer Electronics

- 6.4. Industrial

- 6.5. Medical Devices

- 6.6. Power and Utilities

- 6.7. Telecommunication

- 6.8. Others

India MLCC Market Segmentation By Geography

- 1. India

India MLCC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 5.1.1. Class 1

- 5.1.2. Class 2

- 5.2. Market Analysis, Insights and Forecast - by Case Size

- 5.2.1. 0 201

- 5.2.2. 0 402

- 5.2.3. 0 603

- 5.2.4. 1 005

- 5.2.5. 1 210

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Voltage

- 5.3.1. 500V to 1000V

- 5.3.2. Less than 500V

- 5.3.3. More than 1000V

- 5.4. Market Analysis, Insights and Forecast - by Capacitance

- 5.4.1. 100µF to 1000µF

- 5.4.2. Less than 100µF

- 5.4.3. More than 1000µF

- 5.5. Market Analysis, Insights and Forecast - by Mlcc Mounting Type

- 5.5.1. Metal Cap

- 5.5.2. Radial Lead

- 5.5.3. Surface Mount

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Aerospace and Defence

- 5.6.2. Automotive

- 5.6.3. Consumer Electronics

- 5.6.4. Industrial

- 5.6.5. Medical Devices

- 5.6.6. Power and Utilities

- 5.6.7. Telecommunication

- 5.6.8. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. India

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 6. North India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kyocera AVX Components Corporation (Kyocera Corporation)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maruwa Co ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samwha Capacitor Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Walsin Technology Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electro-Mechanics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Würth Elektronik GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Yageo Corporatio

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Taiyo Yuden Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TDK Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Nippon Chemi-Con Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: India MLCC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India MLCC Market Share (%) by Company 2024

List of Tables

- Table 1: India MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 3: India MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 4: India MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 5: India MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 6: India MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 7: India MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: India MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: India MLCC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: East India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: West India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 15: India MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 16: India MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 17: India MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 18: India MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 19: India MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: India MLCC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India MLCC Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the India MLCC Market?

Key companies in the market include Vishay Intertechnology Inc, Kyocera AVX Components Corporation (Kyocera Corporation), Maruwa Co ltd, Samwha Capacitor Group, Walsin Technology Corporation, Samsung Electro-Mechanics, Würth Elektronik GmbH & Co KG, Yageo Corporatio, Taiyo Yuden Co Ltd, TDK Corporation, Murata Manufacturing Co Ltd, Nippon Chemi-Con Corporation.

3. What are the main segments of the India MLCC Market?

The market segments include Dielectric Type, Case Size, Voltage, Capacitance, Mlcc Mounting Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

July 2023: KEMET, part of the Yageo Corporation developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet the high voltage requirements of automotive subsystems, ranging from 100pF-0.1uF and with a DC voltage range of 500V-1kV. The range of cases available is EIA 0603-1210, and is suitable for both automotive under hoods and in-cabin applications. These MLCCs demonstrate the essential and reliable nature of capacitors, which are essential for the mission and safety of automotive subsystems.June 2023: The growing demand for industrial equipments has driven the company to introduce NTS/NTF NTS/NTF Series of SMD type MLCC. These capacitors are rated with 25 to 500 Vdc with a capacitance ranging from 0.010 to 47µF. These MLCCs are used in on-board power supplies,voltage regulators for computers,smoothing circuit of DC-DC converters,etc.May 2023: Murata has introduced the EVA series of MLCC, which are beneficial to EV manufacturers due to their versatility. These MLCC's can be used in a variety of applications, including OBC (On-Board Charger), inverter and DC/DC Converter, BMS (Battery Management System), and WPT (Wireless Power Transfer) implementations. As a result, they are ideal to the increased isolation that the 800V powertrain migration will require, while also meeting the miniaturization requirements of modern automotive systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India MLCC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India MLCC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India MLCC Market?

To stay informed about further developments, trends, and reports in the India MLCC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence