Key Insights

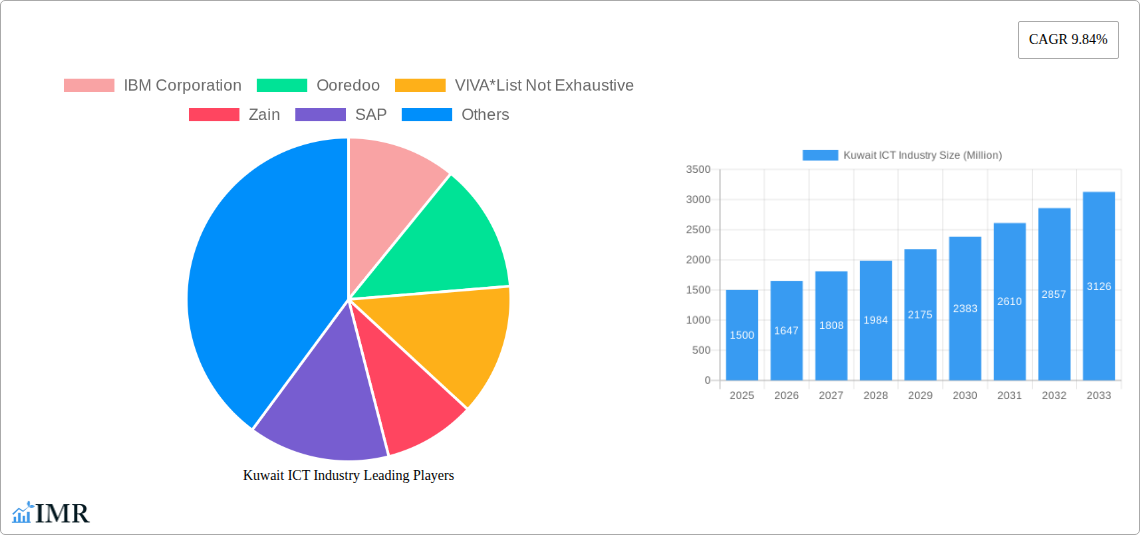

The Kuwaiti ICT market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 9.84% and a 2019-2024 historical period), is projected to experience robust growth, reaching $Y million by 2033. This expansion is fueled by several key drivers. The government's ongoing investments in digital infrastructure, including 5G network deployment and the development of smart city initiatives, are creating significant opportunities for ICT companies. Furthermore, the increasing adoption of cloud computing, big data analytics, and business process outsourcing across various sectors—particularly oil, gas, and utilities; transportation and logistics; and financial services—is driving demand for advanced ICT solutions. The rise of mobile technologies and the growing need for enhanced cybersecurity are also contributing factors. However, the market faces some challenges. These include the need for skilled workforce development to meet the demands of a rapidly evolving technological landscape and potential regulatory hurdles in implementing certain innovative technologies. Competition amongst established players like IBM, SAP, and Cisco, alongside regional operators like Ooredoo and Zain, remains intense, fostering innovation and competitive pricing.

The segmentation analysis reveals a diverse market landscape. Hardware, software and services, and communication and connectivity are significant components, while end-user industries show varying levels of ICT adoption. The oil and gas sector is a major contributor due to its reliance on advanced technologies for efficient operations and safety. The growth within the financial services sector is driven by the need for robust digital platforms and cybersecurity measures. Within technologies, Big Data Analytics and Cloud Computing are leading the charge, reflecting global trends towards data-driven decision-making and scalable IT infrastructure. The forecast period of 2025-2033 promises continued expansion, driven by factors like ongoing digital transformation initiatives and increasing government support for the ICT sector. The Kuwaiti ICT market is poised for significant growth, representing an attractive investment opportunity for both domestic and international players. (Note: X and Y represent estimated values based on the provided CAGR and should be calculated for a complete analysis.)

Kuwait ICT Industry: Market Report 2019-2033

This comprehensive report delivers an in-depth analysis of the Kuwait ICT industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report provides invaluable insights for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market by component (Hardware, Devices, Software & Services, Communication & Connectivity), end-user industry (Oil, Gas & Utilities, Transportation & Logistics, Healthcare, Financial Services, Manufacturing & Construction, Other End-User Industries), and technology (Big Data Analytics, Mobility, Cloud Computing, Storage, Business Process Outsourcing, Other Technologies).

Kuwait ICT Industry Market Dynamics & Structure

The Kuwaiti ICT market exhibits moderate concentration, with key players like Zain, VIVA, and Ooredoo holding significant market share. However, the landscape is increasingly competitive due to the entry of international players such as IBM, SAP, and Cisco. Technological innovation, driven by the adoption of 5G, cloud computing, and big data analytics, is a key growth driver. The regulatory framework, while supportive of digital transformation, faces challenges in keeping pace with rapid technological advancements. The market also witnesses significant M&A activity, as evidenced by recent acquisitions like Kalaam Telecom's purchase of Zajil and Kamco Invest's acquisition of E-Portal Holding. Substitute products, such as open-source software and alternative communication platforms, present a level of competitive pressure. The end-user demographics are shifting towards a younger, digitally savvy population, driving demand for advanced technologies and services.

- Market Concentration: Moderately concentrated, with a few major players dominating certain segments. Market share data for 2024: Zain (xx%), VIVA (xx%), Ooredoo (xx%), Others (xx%).

- Technological Innovation: Strong adoption of 5G, cloud computing, and big data analytics. Innovation barriers include a shortage of skilled professionals and limited venture capital funding.

- Regulatory Framework: Supportive but requires updates to adapt to rapid technological change.

- M&A Activity: Significant increase in M&A deals in recent years, totaling xx Million in 2024.

Kuwait ICT Industry Growth Trends & Insights

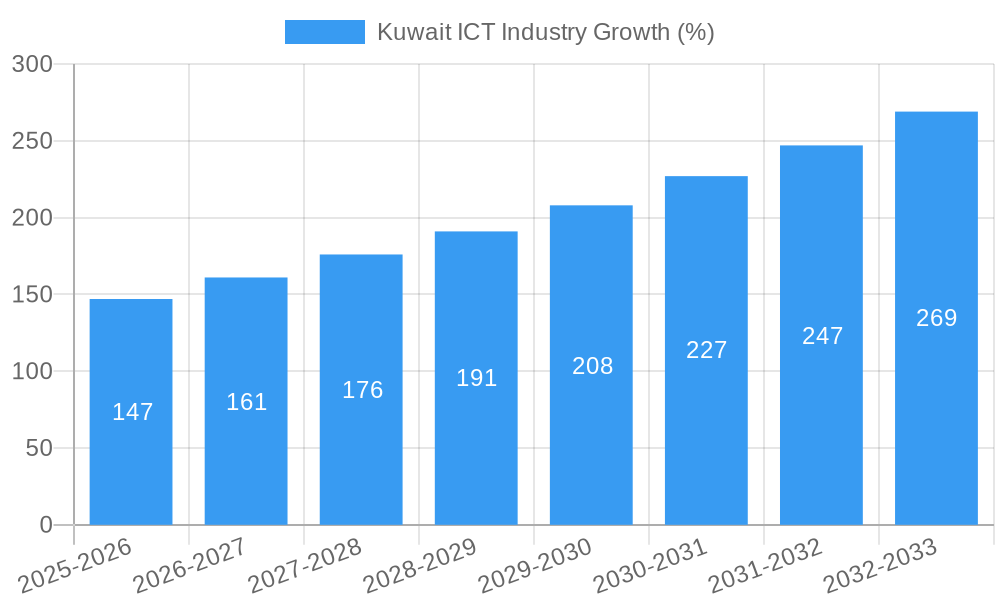

The Kuwait ICT market has experienced substantial growth over the historical period (2019-2024), driven by increasing government investments in digital infrastructure, rising smartphone penetration, and the adoption of digital technologies across various sectors. The market size in 2024 was estimated at xx Million, and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the expanding adoption of cloud computing, the deployment of 5G networks, and the increasing demand for cybersecurity solutions. The adoption rate of cloud computing services is expected to increase significantly over the forecast period, with market penetration reaching xx% by 2033. The shift in consumer behavior towards digital platforms and services further accelerates market growth. Technological disruptions, such as the emergence of AI and IoT, are creating new opportunities while simultaneously challenging existing business models.

Dominant Regions, Countries, or Segments in Kuwait ICT Industry

The Kuwaiti ICT market is largely concentrated within urban areas, with Kuwait City and other major urban centers driving the majority of growth. Among the segments, the Software and Services segment is experiencing the fastest growth, driven by the increasing demand for digital transformation solutions across various industries. The Oil, Gas and Utilities sector represents a substantial end-user industry due to the country's reliance on hydrocarbons. Within the technology segments, cloud computing is experiencing rapid adoption.

- By Component: Software and Services displays the highest growth potential with projected revenue of xx Million by 2033.

- By End-User Industry: Oil, Gas and Utilities represent the largest end-user segment due to digital transformation initiatives, with estimated revenue of xx Million in 2025.

- By Technology: Cloud computing is experiencing the highest adoption rate with a projected market value of xx Million in 2033.

- Key Drivers: Government initiatives promoting digitalization, increasing investments in infrastructure, and a growing demand for advanced technological solutions.

Kuwait ICT Industry Product Landscape

The Kuwaiti ICT market showcases a diverse range of products and services, encompassing cutting-edge technologies like 5G networks, cloud-based solutions, and advanced cybersecurity systems. These solutions cater to a wide range of applications, from enterprise resource planning to consumer-focused digital services. The focus is on delivering high-performance solutions with robust security features and seamless integration capabilities. Unique selling propositions include tailored solutions for the local market and strong partnerships with international technology providers.

Key Drivers, Barriers & Challenges in Kuwait ICT Industry

Key Drivers:

- Government initiatives promoting digital transformation.

- Growing adoption of cloud computing and 5G technologies.

- Increasing demand for cybersecurity solutions.

Key Challenges:

- Limited skilled workforce.

- Dependence on foreign expertise.

- Cybersecurity threats. Estimated annual losses from cybercrime are xx Million in 2024.

Emerging Opportunities in Kuwait ICT Industry

- Growing demand for fintech solutions.

- Expansion of e-commerce and digital payments.

- Potential for growth in the IoT and AI sectors.

Growth Accelerators in the Kuwait ICT Industry

Sustained government investments in digital infrastructure, coupled with the burgeoning adoption of advanced technologies across various sectors, are poised to propel significant growth in the Kuwait ICT industry. Strategic partnerships between local and international players will further amplify market expansion.

Key Players Shaping the Kuwait ICT Industry Market

- IBM Corporation

- Ooredoo

- VIVA

- Zain

- SAP

- Amadeus IT Group

- Cisco Systems

- Huawei Technologies

- Oracle

- HP Middle East

Notable Milestones in Kuwait ICT Industry Sector

- December 2022: Huawei launches the Huawei Cloud Startup Program in Kuwait.

- March 2022: ZainTech partners with Huawei to accelerate 5G transition.

- April 2022: Kalaam Telecom acquires Zajil International Telecom Co.

- April 2022: Kamco Invest acquires E-Portal Holding K.S.C.C.

In-Depth Kuwait ICT Industry Market Outlook

The Kuwait ICT market exhibits immense future potential, fueled by government-led digital transformation initiatives and the expanding adoption of advanced technologies across various sectors. Strategic partnerships between local and international players, coupled with continuous investment in infrastructure development, will further accelerate growth. The market is projected to witness significant expansion, creating lucrative opportunities for businesses to capitalize on the growing demand for innovative ICT solutions and services.

Kuwait ICT Industry Segmentation

-

1. Technology

- 1.1. Big Data Analytics

- 1.2. Mobility

- 1.3. Cloud Computing

- 1.4. Storage

- 1.5. Business Process Outsourcing

- 1.6. Other Technologies

-

2. Component

- 2.1. Hardware

- 2.2. Devices

- 2.3. Software and Services

- 2.4. Communication and Connectivity

-

3. End-User Industry

- 3.1. Oil, Gas and Utilities

- 3.2. Transportation and Logistics

- 3.3. Healthcare

- 3.4. Financial Services

- 3.5. Manufacturing and Construction

- 3.6. Other En

Kuwait ICT Industry Segmentation By Geography

- 1. Kuwait

Kuwait ICT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Early Adoption of 5G Network Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait ICT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Big Data Analytics

- 5.1.2. Mobility

- 5.1.3. Cloud Computing

- 5.1.4. Storage

- 5.1.5. Business Process Outsourcing

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Devices

- 5.2.3. Software and Services

- 5.2.4. Communication and Connectivity

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil, Gas and Utilities

- 5.3.2. Transportation and Logistics

- 5.3.3. Healthcare

- 5.3.4. Financial Services

- 5.3.5. Manufacturing and Construction

- 5.3.6. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ooredoo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VIVA*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amadeus IT Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HP Middle East

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Kuwait ICT Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait ICT Industry Share (%) by Company 2024

List of Tables

- Table 1: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Kuwait ICT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kuwait ICT Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: Kuwait ICT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Kuwait ICT Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 10: Kuwait ICT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait ICT Industry?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Kuwait ICT Industry?

Key companies in the market include IBM Corporation, Ooredoo, VIVA*List Not Exhaustive, Zain, SAP, Amadeus IT Group, Cisco Systems, Huawei Technologies, Oracle, HP Middle East.

3. What are the main segments of the Kuwait ICT Industry?

The market segments include Technology, Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government policies and PPP initiatives such as National Development Plan called New Kuwait; Early adoption of 5G network; Increasing penetration of technology giants.

6. What are the notable trends driving market growth?

Early Adoption of 5G Network Drives the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

December 2022: Huawei is launching the Huawei Cloud Startup Program in Kuwait in collaboration with local partners. The initiative helps Kuwaiti startups grow their businesses by utilizing Huawei technology. The initiative was developed with local partners such as the Central Agency for Information Technology, Rasameel Investment Company, Kuwait Youth Assembly, and eWTP Arabia Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait ICT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait ICT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait ICT Industry?

To stay informed about further developments, trends, and reports in the Kuwait ICT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence