Key Insights

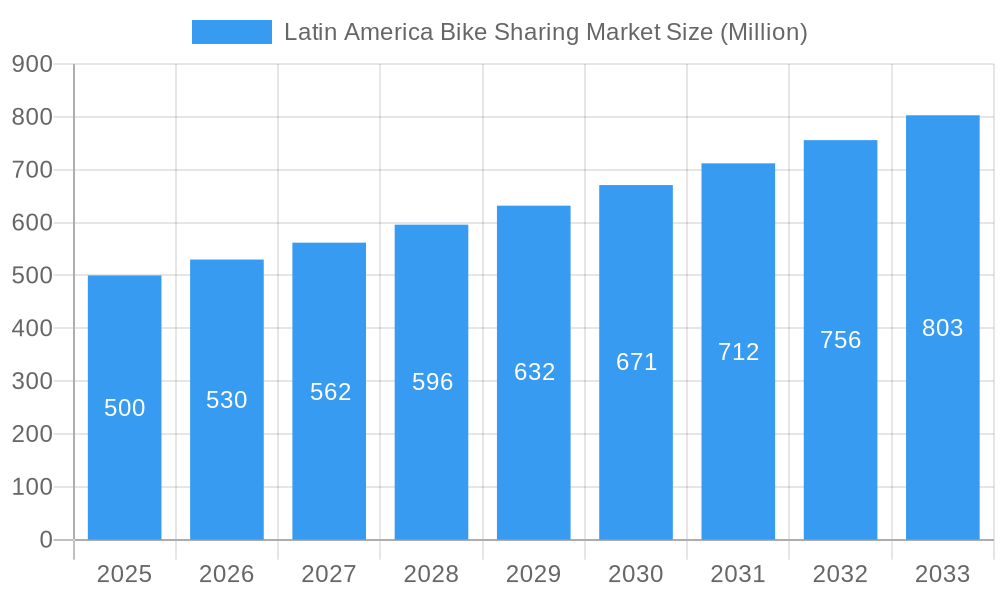

The Latin American bike-sharing market is experiencing robust growth, fueled by increasing urbanization, rising environmental awareness, and the adoption of innovative technologies. The market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided CAGR of >6% and unspecified 2019-2024 market size), is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is driven by several key factors: the increasing popularity of e-bikes, offering a convenient and sustainable transportation alternative; the shift towards dockless systems, enhancing user accessibility and flexibility; and supportive government initiatives promoting sustainable urban mobility in major cities across Brazil, Mexico, Argentina, and Colombia. While the initial adoption was largely concentrated in major metropolitan areas, expansion into secondary cities is anticipated to further fuel market growth. Challenges remain, including the need for improved infrastructure (dedicated bike lanes), addressing safety concerns, and managing operational costs related to maintenance and vandalism.

Latin America Bike Sharing Market Market Size (In Million)

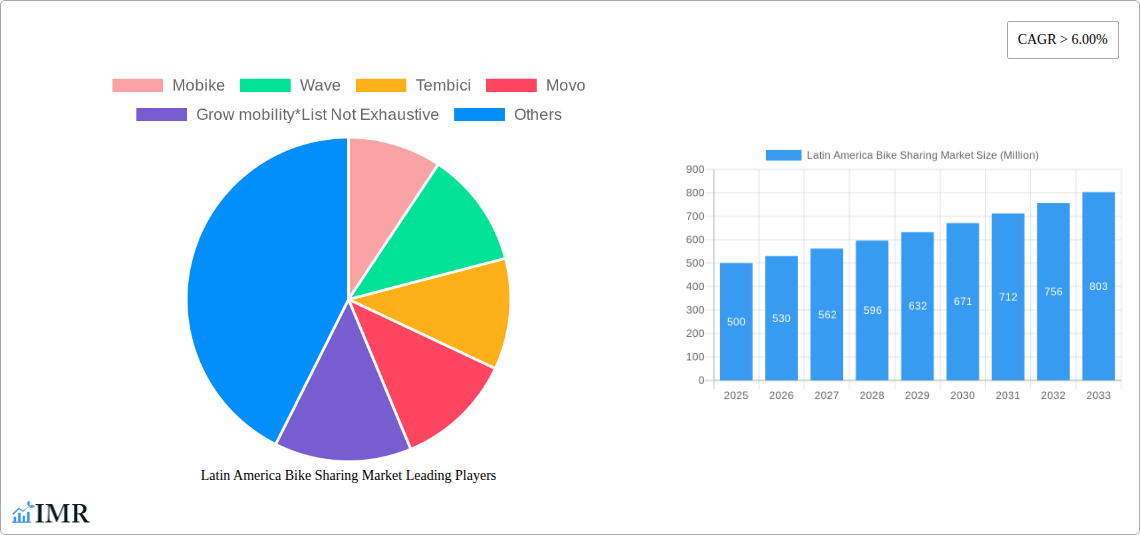

However, the market's segmentation provides opportunities for specialized players. The e-bike segment is poised for significant growth, driven by technological advancements and government subsidies promoting electric vehicle adoption. The dockless system enjoys considerable popularity due to its convenience, but requires careful management to prevent issues with bike abandonment and illegal parking. Geographically, Brazil, Mexico, and Argentina currently represent the largest markets, but substantial growth potential exists in countries like Colombia and Peru, as urban populations expand and environmental concerns intensify. Competition is relatively intense, with established players like Mobike and Tembici vying for market share against a rising number of smaller, regional companies. Successful players will need to differentiate themselves through innovative technology, efficient operations, and strategic partnerships with local governments to overcome regulatory and infrastructural hurdles.

Latin America Bike Sharing Market Company Market Share

Latin America Bike Sharing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America bike-sharing market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report meticulously analyzes the parent market (Micromobility) and child markets (bike sharing) within Latin America, providing crucial insights for industry professionals, investors, and strategic decision-makers.

Latin America Bike Sharing Market Dynamics & Structure

The Latin American bike-sharing market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is relatively low, with several key players vying for market share. Technological innovation, particularly in e-bike technology and smart locking systems, is a significant driver. Regulatory frameworks vary across countries, impacting market entry and operation. Competitive substitutes include ride-hailing services and public transportation. The end-user demographic is primarily young urban professionals and students, but expanding to include broader age groups. M&A activity has been moderate, with some consolidation expected in the coming years. The total market size in 2025 is estimated at XX Million units.

- Market Concentration: Moderately fragmented, with no single dominant player.

- Technological Innovation: E-bikes and improved app functionalities are key innovations.

- Regulatory Frameworks: Vary significantly across countries, creating operational challenges.

- Competitive Substitutes: Ride-hailing services and public transport pose competition.

- End-User Demographics: Primarily young urban professionals and students, but expanding.

- M&A Activity: Moderate, with potential for increased consolidation. XX M&A deals in the last 5 years.

Latin America Bike Sharing Market Growth Trends & Insights

The Latin American bike-sharing market has experienced significant growth since 2019, driven by increasing urbanization, growing environmental awareness, and the adoption of shared mobility services. The market is expected to continue its expansion, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), reaching an estimated XX Million units by 2033. Technological disruptions, such as the introduction of e-bikes and dockless systems, have significantly impacted market adoption rates and consumer behavior. Consumers increasingly prefer convenient, affordable, and environmentally friendly transportation options. Market penetration is still relatively low compared to other regions, indicating significant untapped potential.

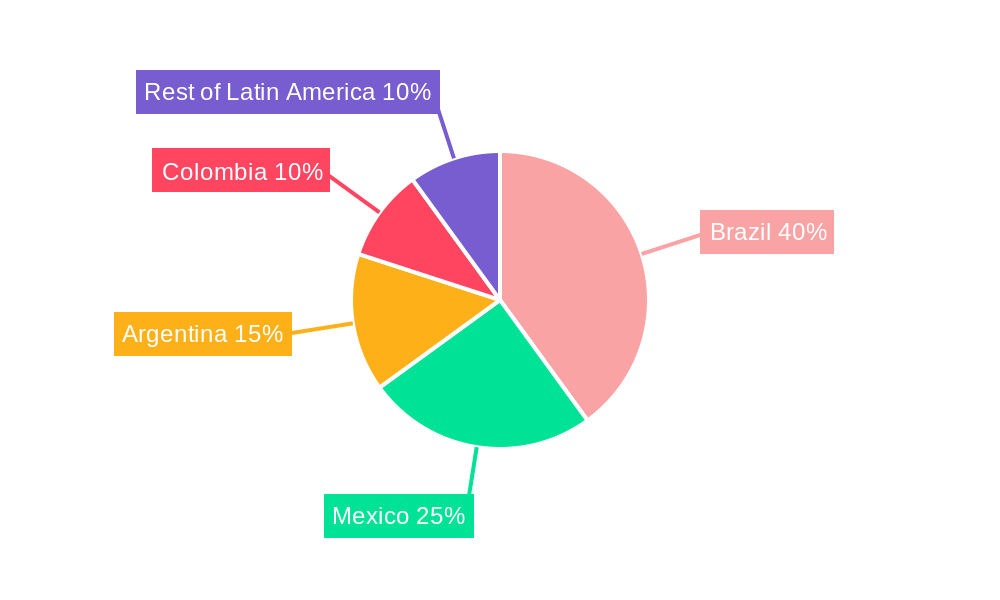

Dominant Regions, Countries, or Segments in Latin America Bike Sharing Market

Brazil, Mexico, and Argentina are the leading countries in the Latin American bike-sharing market, accounting for the largest share of the market. Within these countries, urban centers with robust public transportation infrastructure and a significant young population are driving growth. The e-bike segment is experiencing faster growth compared to traditional bikes, propelled by increased convenience and longer travel distances. Dockless systems are gaining popularity due to their flexibility and accessibility.

- By Country: Brazil (XX Million units), Mexico (XX Million units), Argentina (XX Million units) dominate.

- By Bike Type: E-bikes show faster growth than traditional bikes due to convenience and range.

- By Sharing System Type: Dockless systems are gaining traction due to flexibility and accessibility.

- Key Drivers: Growing urbanization, government initiatives promoting sustainable transport, increasing environmental awareness.

Latin America Bike Sharing Market Product Landscape

The Latin American bike-sharing market features a diverse range of products, including traditional bikes, e-bikes, and various docking and dockless systems. Innovation focuses on enhancing user experience through improved app functionalities, enhanced security features, and durable, weather-resistant bike designs. E-bikes are gaining prominence due to their ability to address longer distances and hilly terrains. Key selling propositions revolve around convenience, affordability, and eco-friendliness.

Key Drivers, Barriers & Challenges in Latin America Bike Sharing Market

Key Drivers: Increasing urbanization, government support for sustainable transport, rising environmental consciousness, and the adoption of shared mobility solutions. For example, several Latin American cities have implemented bike-sharing infrastructure projects, creating opportunities for growth.

Challenges: High initial investment costs, inconsistent regulatory frameworks across countries, theft and vandalism, and competition from other transportation modes. For example, varying regulatory hurdles across countries impact operational efficiency. Estimated annual losses due to theft and vandalism are approximately XX Million units.

Emerging Opportunities in Latin America Bike Sharing Market

Emerging opportunities include expansion into smaller cities and underserved communities, integration with other transportation systems (e.g., public transit), and the development of specialized bike-sharing programs (e.g., cargo bikes for deliveries). The increasing demand for sustainable and eco-friendly transportation opens further avenues for growth.

Growth Accelerators in the Latin America Bike Sharing Market Industry

Technological advancements like improved battery technology for e-bikes and advanced GPS tracking systems will significantly boost market growth. Strategic partnerships between bike-sharing operators and local governments to develop and maintain infrastructure will accelerate expansion. Market expansion strategies, particularly into less-penetrated areas, will continue to drive growth.

Notable Milestones in Latin America Bike Sharing Market Sector

- 2020: Tembici expands operations into major cities in Brazil.

- 2021: Mexico City launches a large-scale bike-sharing program.

- 2022: Several Latin American countries introduce regulations for e-bike usage.

- 2023: Wave introduces a new e-bike model with improved battery technology.

In-Depth Latin America Bike Sharing Market Market Outlook

The Latin American bike-sharing market exhibits significant growth potential. Continued technological advancements, expanding partnerships, and supportive government policies will fuel the market’s expansion into new regions and customer segments. The future holds substantial opportunities for innovative business models and strategic collaborations. The projected market size by 2033 is XX Million units, representing substantial growth and opportunities for stakeholders.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market Regional Market Share

Geographic Coverage of Latin America Bike Sharing Market

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobike

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wave

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tembici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grow mobility*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bird

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Loop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bim Bim Bikes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2020 & 2033

- Table 2: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2020 & 2033

- Table 3: Latin America Bike Sharing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2020 & 2033

- Table 5: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2020 & 2033

- Table 6: Latin America Bike Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence