Key Insights

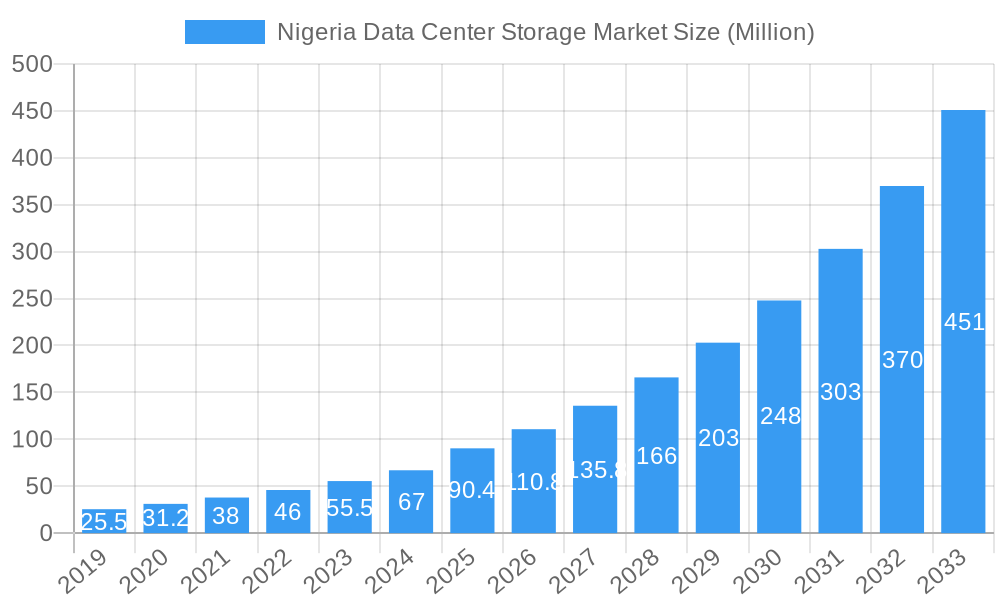

The Nigerian data center storage market is poised for explosive growth, projected to reach a substantial 90.40 million value unit (likely USD millions, given typical market reporting) by 2025. This surge is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 23.50% during the forecast period of 2025-2033. This aggressive expansion signifies Nigeria's burgeoning digital infrastructure and increasing demand for robust data storage solutions. Key drivers behind this growth include the rapid digitalization across various sectors, the proliferation of cloud computing services, and the ever-increasing volume of data generated by businesses and consumers. The IT & Telecommunication and BFSI (Banking, Financial Services, and Insurance) sectors are expected to be the primary consumers, demanding high-performance and scalable storage to manage critical financial transactions and vast network data. Furthermore, the government's push for digital transformation and smart city initiatives will also contribute significantly to market expansion. Emerging trends such as the adoption of All-Flash Storage for enhanced speed and performance, alongside the continued relevance of Hybrid Storage for cost-efficiency and flexibility, will shape market dynamics.

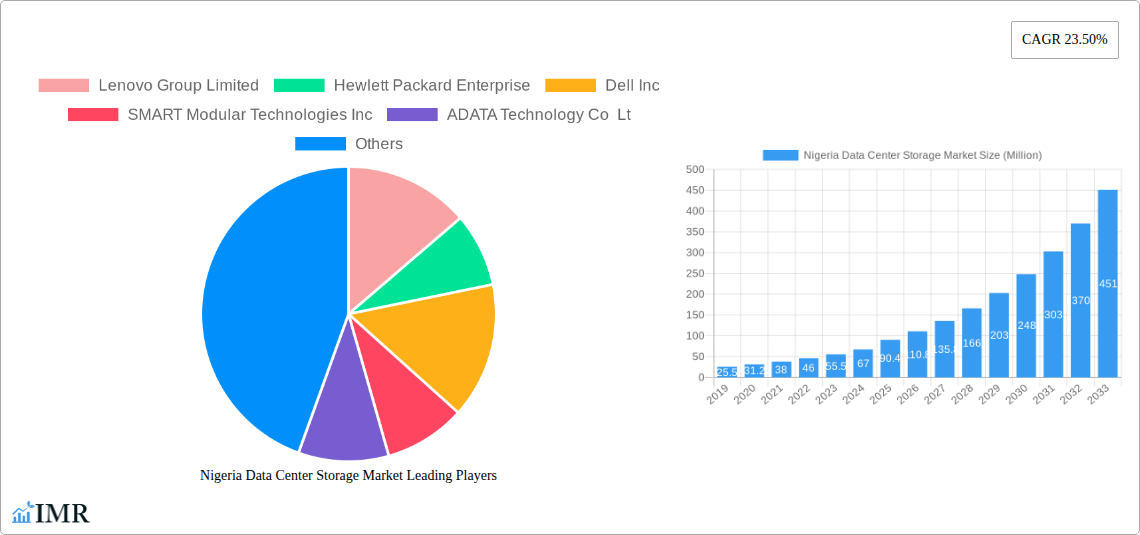

Nigeria Data Center Storage Market Market Size (In Million)

Despite the robust growth, the market faces certain restraints. These may include challenges related to power infrastructure reliability, the need for skilled IT professionals to manage advanced storage systems, and potential upfront investment costs for enterprises. However, the sheer volume of data and the critical need for secure and accessible storage are expected to outweigh these challenges. The market is segmented by storage technology, with Network Attached Storage (NAS) and Storage Area Network (SAN) likely dominating due to their scalability and centralized management capabilities. Direct Attached Storage (DAS) may see continued use in specific applications where simplicity and direct access are paramount. The increasing adoption of cloud services further underscores the demand for efficient and resilient data center storage solutions, positioning Nigeria as a key emerging market in the African data center landscape.

Nigeria Data Center Storage Market Company Market Share

This in-depth report provides a granular analysis of the Nigeria Data Center Storage Market, offering critical insights for industry stakeholders. Covering a comprehensive Study Period of 2019–2033, with a Base Year of 2025, this report delves into market dynamics, growth trends, key players, and future opportunities. We meticulously examine parent and child markets, providing a holistic view of the evolving storage landscape. High-traffic keywords such as "Nigeria data center storage," "enterprise storage solutions," "cloud storage Nigeria," "data management Africa," "IT infrastructure Nigeria," "storage area network (SAN) market," "network attached storage (NAS) solutions," "all-flash storage adoption," and "BFSI data storage" are integrated to ensure maximum SEO visibility and attract relevant professionals. All monetary values are presented in Million units.

Nigeria Data Center Storage Market Market Dynamics & Structure

The Nigeria Data Center Storage Market exhibits a moderate level of concentration, with key players like Lenovo Group Limited, Hewlett Packard Enterprise, and Dell Inc. vying for significant market share. Technological innovation serves as a primary driver, fueled by the escalating demand for higher data processing speeds, enhanced data security, and scalable storage solutions. The regulatory framework, though still developing, is gradually evolving to support digital transformation initiatives, impacting data sovereignty and cloud adoption. Competitive product substitutes, ranging from on-premise solutions to various cloud storage offerings, present a dynamic competitive landscape. End-user demographics are shifting, with an increasing reliance on data-intensive applications across sectors like IT & Telecommunication and BFSI. Mergers & Acquisitions (M&A) trends are expected to gain traction as larger players seek to consolidate their market position and expand their service portfolios.

- Market Concentration: Moderate, with a few key players holding substantial market share.

- Technological Innovation Drivers: Demand for speed, security, scalability, and advanced analytics.

- Regulatory Framework: Developing, with a focus on data protection and digital infrastructure growth.

- Competitive Product Substitutes: On-premise storage, cloud storage (IaaS, SaaS), hybrid cloud solutions.

- End-User Demographics: Growing adoption in IT & Telecommunication, BFSI, Government, and Media & Entertainment.

- M&A Trends: Anticipated increase in consolidation and strategic partnerships.

- Innovation Barriers: High initial investment costs for advanced technologies and skilled workforce shortages.

- Market Share of Top 3 Players (Estimated 2025): XX%

Nigeria Data Center Storage Market Growth Trends & Insights

The Nigeria Data Center Storage Market is poised for significant expansion, driven by the rapid digital transformation initiatives across the nation. The market size is projected to grow from an estimated XX Million in 2025 to XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for advanced storage technologies like all-flash storage and hybrid storage are accelerating, as organizations recognize their benefits in terms of performance, efficiency, and cost optimization. Technological disruptions, including the advent of edge computing and the increasing prevalence of AI-powered data analytics, are creating new demands for specialized storage solutions. Consumer behavior shifts are characterized by a growing preference for data accessibility, real-time insights, and robust disaster recovery capabilities, pushing businesses to invest more in resilient and agile storage infrastructure. The expanding internet penetration and mobile device usage are also contributing to the exponential growth of data generation, further fueling the demand for sophisticated data center storage.

- Market Size Evolution: Projected to grow from XX Million in 2025 to XX Million by 2033.

- CAGR (2025-2033): XX%.

- Adoption Rates: Increasing for all-flash and hybrid storage.

- Technological Disruptions: Edge computing, AI-driven analytics, and IoT data management.

- Consumer Behavior Shifts: Demand for data accessibility, real-time insights, and disaster recovery.

- Market Penetration of All-Flash Storage (Estimated 2025): XX%.

- Impact of Cloud Computing: Driving demand for scalable and flexible storage solutions.

Dominant Regions, Countries, or Segments in Nigeria Data Center Storage Market

Within the Nigeria Data Center Storage Market, the IT & Telecommunication sector is emerging as the dominant end-user segment, driven by the continuous expansion of digital infrastructure, 5G network rollouts, and the proliferation of mobile services. This segment's insatiable need for high-capacity, high-performance storage solutions to manage vast amounts of user data, network traffic, and application logs positions it at the forefront of market growth. Lagos State is anticipated to be the dominant geographical region due to its status as Nigeria's economic hub, hosting a significant concentration of major corporations, data centers, and cloud service providers. The robust digital ecosystem and government initiatives promoting technology adoption in Lagos further solidify its dominance.

In terms of Storage Technology, Network Attached Storage (NAS) is expected to witness considerable growth, catering to the increasing demand for centralized file sharing, collaboration, and data backup solutions in small and medium-sized enterprises (SMEs). However, Storage Area Network (SAN) solutions are crucial for mission-critical applications in larger enterprises, especially in the BFSI sector, demanding high availability and performance.

Regarding Storage Type, hybrid storage solutions are gaining significant traction. They offer a balanced approach by combining the speed of flash storage with the cost-effectiveness of traditional hard disk drives, making them ideal for a wide range of workloads. The IT & Telecommunication sector's need for both high-performance and cost-efficient storage fuels this trend.

- Dominant End User Segment: IT & Telecommunication.

- Key Drivers: 5G network expansion, mobile service growth, massive data generation from users.

- Market Share (Estimated 2025): XX%.

- Dominant Geographical Region: Lagos State.

- Key Drivers: Economic hub, concentration of businesses and data centers, government support.

- Growth Potential: High, driven by ongoing infrastructure development.

- Dominant Storage Technology: Network Attached Storage (NAS) for growing SMEs; Storage Area Network (SAN) for enterprise-critical applications.

- Dominant Storage Type: Hybrid Storage, offering a balance of performance and cost.

- Key Drivers: Versatility for diverse workloads, cost optimization.

- BFSI Sector: Significant contributor, demanding high security and compliance for financial data.

Nigeria Data Center Storage Market Product Landscape

The Nigeria Data Center Storage Market product landscape is characterized by continuous innovation, with vendors focusing on developing high-performance, scalable, and secure storage solutions. Key product innovations include advancements in all-flash arrays offering unparalleled IOPS for demanding applications, software-defined storage (SDS) solutions providing greater flexibility and agility, and intelligent data deduplication and compression technologies to optimize storage utilization. Applications span across big data analytics, artificial intelligence (AI) workloads, virtual desktop infrastructure (VDI), and critical business applications demanding low latency. Performance metrics such as IOPS, latency, throughput, and data availability are crucial differentiators. The unique selling propositions revolve around enhanced data protection, simplified management, and cost-effectiveness in the long run.

Key Drivers, Barriers & Challenges in Nigeria Data Center Storage Market

Key Drivers:

- Digital Transformation Initiatives: Government and private sector push for digitalization fuels demand for robust IT infrastructure, including data center storage.

- Exponential Data Growth: Proliferation of mobile devices, IoT, and cloud services leads to massive data generation requiring scalable storage.

- Increasing Cloud Adoption: Businesses are migrating to cloud environments, driving demand for hybrid and cloud-integrated storage solutions.

- Focus on Data Analytics and AI: The need for real-time data processing and advanced analytics necessitates high-performance storage.

Barriers & Challenges:

- High Initial Investment Costs: Advanced storage hardware and infrastructure require significant capital expenditure.

- Skills Gap: Shortage of skilled IT professionals to manage and maintain complex storage systems.

- Power and Cooling Infrastructure: Inconsistent power supply and inadequate cooling can impact data center operations and storage reliability.

- Cybersecurity Concerns: Increasing threats necessitate robust data protection and security measures, adding to complexity and cost.

- Limited Access to Financing: Challenges in securing adequate funding for large-scale IT infrastructure projects.

Emerging Opportunities in Nigeria Data Center Storage Market

Emerging opportunities in the Nigeria Data Center Storage Market lie in the growing demand for edge data storage solutions to support the proliferation of IoT devices and the increasing need for localized data processing. The expansion of hyper-converged infrastructure (HCI) offers an integrated approach to compute, storage, and networking, appealing to businesses seeking simplified management. Furthermore, the burgeoning FinTech sector presents a significant opportunity for specialized data storage solutions that meet stringent regulatory compliance and security requirements. The ongoing development of cloud-native storage solutions also provides avenues for growth, catering to containerized applications and microservices.

Growth Accelerators in the Nigeria Data Center Storage Market Industry

Long-term growth in the Nigeria Data Center Storage Market will be significantly accelerated by advancements in artificial intelligence and machine learning (AI/ML) capabilities integrated into storage systems for intelligent data management, predictive maintenance, and automated tiering. Strategic partnerships between local telecommunication companies and global technology providers will foster the development of robust data center ecosystems. Furthermore, government incentives and policies aimed at promoting local manufacturing and technology adoption will create a more favorable environment for market expansion. The increasing adoption of disaster recovery and business continuity solutions is also a key accelerator, as organizations prioritize resilience in their data strategies.

Key Players Shaping the Nigeria Data Center Storage Market Market

- Lenovo Group Limited

- Hewlett Packard Enterprise

- Dell Inc.

- SMART Modular Technologies Inc

- ADATA Technology Co Lt

- Huawei Technologies Co Ltd

- Oracle Corporation

- QSAN Technology Inc

Notable Milestones in Nigeria Data Center Storage Market Sector

- June 2023: Huawei launched its innovative F2F2X (flash-to-flash-to-anything) data center architecture at the Huawei Intelligent Finance Summit 2023 (HiFS 2023). This architecture provides a reliable data foundation for financial institutions facing challenges from new data, applications, and resilience needs.

- April 2023: Hewlett Packard Enterprise announced new file, block, disaster, and backup recovery data services designed to help customers eliminate data silos, reduce cost and complexity, and improve performance. The new file storage data services deliver scale-out, enterprise-grade performance for data-intensive workloads, and the expanded block services provide mission-critical storage with mid-range economics.

In-Depth Nigeria Data Center Storage Market Market Outlook

The Nigeria Data Center Storage Market is projected to witness sustained growth, driven by a confluence of factors including robust digital transformation efforts, the exponential rise in data generation, and increasing adoption of cloud-based solutions. Key growth accelerators such as advancements in AI-powered data management, strategic collaborations between technology giants and local enterprises, and supportive government policies will further propel the market forward. Opportunities in edge computing, hyper-converged infrastructure, and specialized FinTech storage solutions will define the future trajectory. The market is expected to evolve towards more intelligent, automated, and resilient storage architectures, catering to the diverse and evolving needs of Nigerian businesses.

Nigeria Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Nigeria Data Center Storage Market Segmentation By Geography

- 1. Niger

Nigeria Data Center Storage Market Regional Market Share

Geographic Coverage of Nigeria Data Center Storage Market

Nigeria Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitalization and Emergence of Data-centric Applications; Evolution of Hybrid Flash Arrays

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lenovo Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dell Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SMART Modular Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADATA Technology Co Lt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 QSAN Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Nigeria Data Center Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Data Center Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 2: Nigeria Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 3: Nigeria Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Nigeria Data Center Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Nigeria Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 6: Nigeria Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 7: Nigeria Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Nigeria Data Center Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Data Center Storage Market?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the Nigeria Data Center Storage Market?

Key companies in the market include Lenovo Group Limited, Hewlett Packard Enterprise, Dell Inc, SMART Modular Technologies Inc, ADATA Technology Co Lt, Huawei Technologies Co Ltd, Oracle Corporation, QSAN Technology Inc.

3. What are the main segments of the Nigeria Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitalization and Emergence of Data-centric Applications; Evolution of Hybrid Flash Arrays.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

June 2023: Huawei launched its innovative F2F2X (flash-to-flash-to-anything) data center architecture at the Huawei Intelligent Finance Summit 2023 (HiFS 2023). This architecture provides a reliable data foundation for financial institutions facing challenges from new data, applications, and resilience needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Nigeria Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence