Key Insights

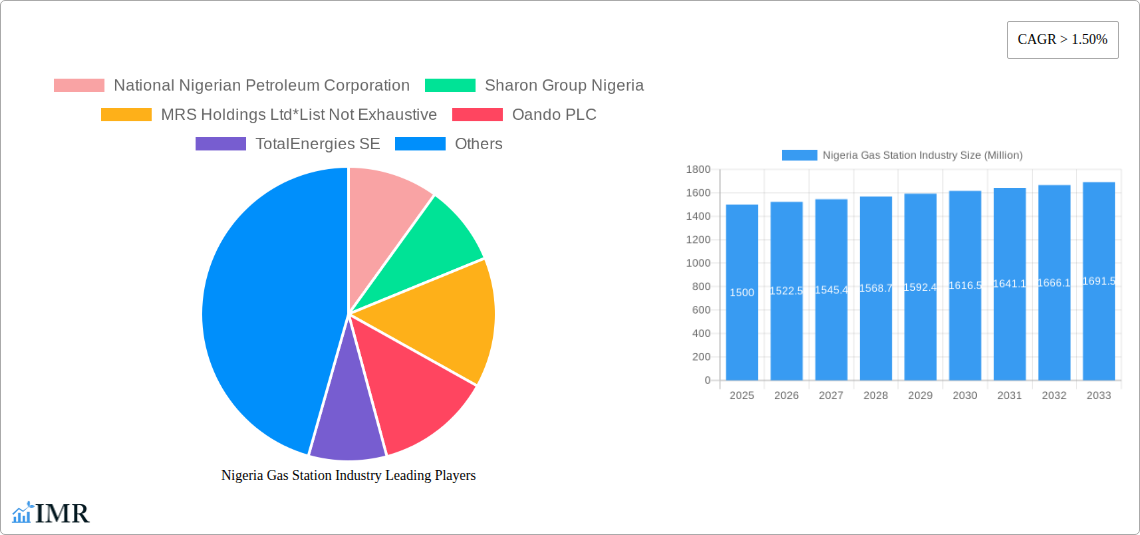

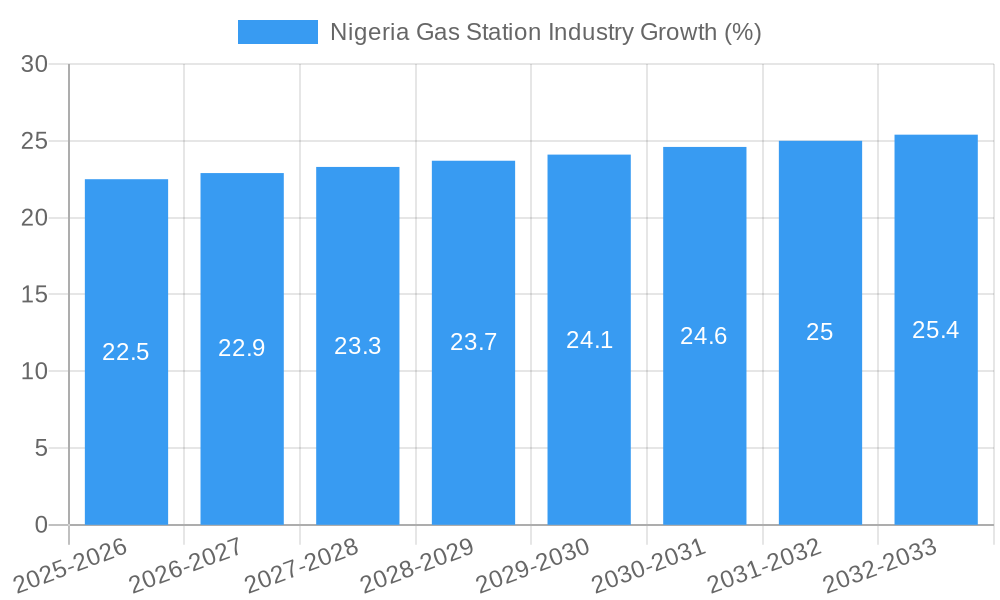

The Nigerian gas station industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 1.5% Compound Annual Growth Rate (CAGR) through 2033. This expansion is fueled by several key drivers. Firstly, Nigeria's burgeoning population and increasing vehicle ownership are creating higher demand for fuel. Secondly, government initiatives aimed at improving infrastructure and streamlining the energy sector contribute positively. Finally, the rising adoption of technological advancements within the industry, such as improved fuel management systems and cashless payment options, enhances operational efficiency and customer experience. However, challenges remain. Price volatility in the global oil market significantly impacts profitability, and infrastructure limitations in certain regions continue to hinder distribution efficiency. Furthermore, stringent environmental regulations and the push towards renewable energy sources present both opportunities and constraints for the industry's long-term growth trajectory. The segmentation of the market, encompassing transportation, storage, and LNG terminals, reflects the diverse nature of the industry's operations and the different revenue streams. Key players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited compete within this dynamic landscape, constantly adapting to shifting market dynamics.

The forecast period (2025-2033) anticipates a continued expansion driven by sustained economic growth in Nigeria, albeit with potential fluctuations due to global oil price fluctuations and the ongoing transition towards cleaner energy solutions. Industry players will need to focus on diversification, strategic partnerships, and technological innovation to maintain competitiveness and capitalize on emerging opportunities. A deeper penetration into underserved regions and investments in sustainable practices will be crucial in ensuring long-term success and mitigating the risks associated with environmental concerns and volatile energy markets.

This comprehensive report provides an in-depth analysis of the Nigerian gas station industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes parent markets (Petroleum & Energy) and child markets (Transportation Fuel Retail, Storage & Logistics, LNG).

Nigeria Gas Station Industry Market Dynamics & Structure

The Nigerian gas station industry is characterized by a moderately concentrated market structure, with major players like National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd, Oando PLC, TotalEnergies SE, and Almoner Petroleum and Gas Limited holding significant market share. However, the presence of numerous smaller independent operators creates a competitive landscape. Technological innovation, driven by the need for improved efficiency and environmental compliance, is slowly increasing. Regulatory frameworks, primarily overseen by the Department of Petroleum Resources (DPR), play a crucial role in shaping industry practices and safety standards. Competitive substitutes are limited, primarily focusing on alternative fuels, with slow adoption. End-user demographics are diverse, ranging from individual consumers to commercial fleets. The industry has witnessed significant M&A activity in recent years, highlighting consolidation trends.

- Market Concentration: xx% controlled by top 5 players (2025 Estimate).

- M&A Activity (2019-2024): xx deals, totaling xx Million USD in value (estimated).

- Technological Innovation: Focus on automation, digital payments, and alternative fuel infrastructure is slowly emerging.

- Regulatory Landscape: DPR regulations primarily drive safety and operational standards.

- Competitive Substitutes: Limited, with a gradual increase in electric vehicle charging infrastructure.

Nigeria Gas Station Industry Growth Trends & Insights

The Nigerian gas station industry experienced a CAGR of xx% during the historical period (2019-2024) with the market size reaching xx Million units in 2024. This growth is driven by increasing vehicle ownership, rising fuel consumption, and expanding infrastructure in various regions. However, fluctuating oil prices, economic instability, and infrastructural limitations presented challenges. The forecast period (2025-2033) projects continued growth, albeit at a potentially moderated pace, reaching an estimated xx Million units in 2033, with a projected CAGR of xx%. This growth is contingent upon macroeconomic stability, government policies supporting infrastructure development, and the penetration of cleaner fuel technologies. Consumer behavior is shifting towards convenience, digital payment options, and loyalty programs. Technological disruptions in the form of automated fuel dispensing, cashless transactions, and loyalty programs are transforming customer experiences.

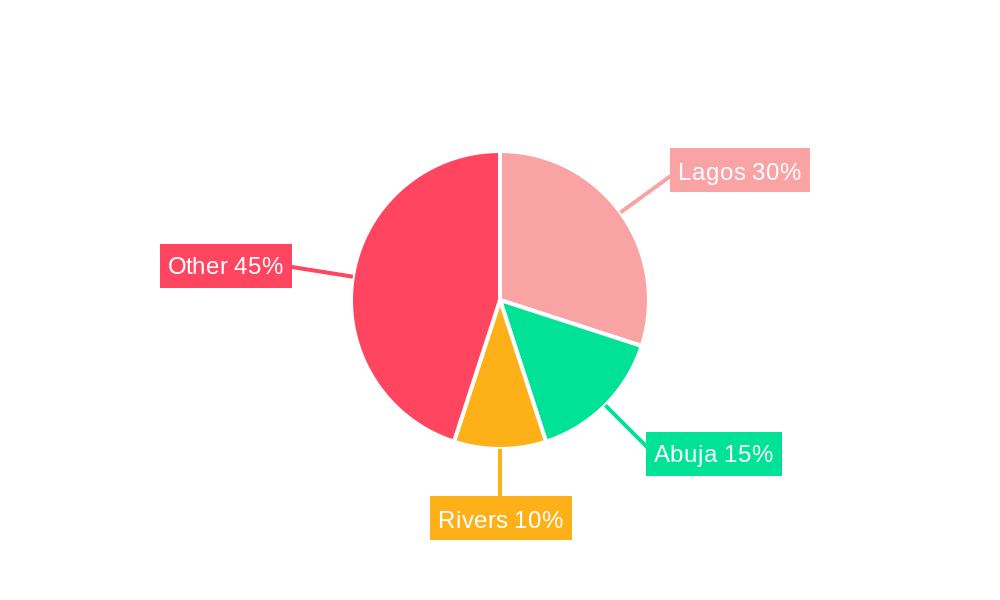

Dominant Regions, Countries, or Segments in Nigeria Gas Station Industry

The transportation segment dominates the Nigerian gas station industry, accounting for over xx% of the market in 2025. This is due to the high demand for gasoline and diesel fuels for personal and commercial vehicles. Lagging behind are the storage and LNG terminals segments, which are limited by infrastructural challenges and capital-intensive requirements.

- Key Drivers in Transportation Segment:

- Growing vehicle ownership.

- Increasing urbanization and population growth.

- Expansion of road networks in certain regions.

- Dominance Factors: High fuel consumption and limited alternatives.

- Growth Potential: Continued growth is projected, albeit potentially lower than the historical rate due to economic factors.

Nigeria Gas Station Industry Product Landscape

The Nigerian gas station industry's product landscape is primarily focused on traditional gasoline and diesel fuels. However, there's a slow but steady introduction of value-added services such as convenience stores, car washes, and digital payment options. The key differentiators among players are often convenience, location, and pricing strategies, while technological advancements are concentrated on enhancing payment systems and operational efficiency.

Key Drivers, Barriers & Challenges in Nigeria Gas Station Industry

Key Drivers:

- Increasing vehicle ownership and rising fuel consumption.

- Urbanization and population growth.

- Government investments in road infrastructure (in specific regions).

Challenges & Restraints:

- Fluctuating oil prices and forex volatility impacting profitability.

- Inadequate infrastructure in some regions.

- Security concerns impacting supply chain operations.

- Regulatory complexities and licensing requirements.

- Intense competition among established players.

Emerging Opportunities in Nigeria Gas Station Industry

- Expansion into underserved rural markets.

- Growing demand for alternative fuels (albeit slow).

- Adoption of digital technologies to enhance customer experience and operational efficiency.

- Strategic partnerships to improve supply chain logistics.

Growth Accelerators in the Nigeria Gas Station Industry

Long-term growth will be fueled by sustained economic growth, targeted infrastructure investments, and favorable government policies. Strategic alliances between gas station operators and technology companies can enhance efficiency and customer experience. Expanding into under-served markets, particularly in rapidly urbanizing areas, presents significant growth opportunities.

Key Players Shaping the Nigeria Gas Station Industry Market

- National Nigerian Petroleum Corporation

- Sharon Group Nigeria

- MRS Holdings Ltd

- Oando PLC

- TotalEnergies SE

- Almoner Petroleum and Gas Limited

Notable Milestones in Nigeria Gas Station Industry Sector

- November 2021: Ardova PLC acquires Enyo Retail and Supply Limited, adding 90 filling stations.

- November 2021: Rainoil Limited acquires a 61% stake in Eterna Oil PLC.

- August 2021: Five filling stations previously shut down by LASBCA are reopened by DPR.

In-Depth Nigeria Gas Station Industry Market Outlook

The Nigerian gas station industry shows promising long-term potential, driven by increasing vehicle ownership, population growth, and continued investment in infrastructure. However, success will hinge on navigating economic volatility, securing reliable fuel supplies, and effectively adapting to evolving consumer preferences and technological advancements. Strategic partnerships, diversification into value-added services, and efficient supply chain management will be crucial for sustained growth.

Nigeria Gas Station Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Gas Station Industry Segmentation By Geography

- 1. Niger

Nigeria Gas Station Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure

- 3.4. Market Trends

- 3.4.1. Smuggling of Crude Oil and Refined Products is expected to Restrain the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Gas Station Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Nigerian Petroleum Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharon Group Nigeria

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MRS Holdings Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oando PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almoner Petroleum and Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 National Nigerian Petroleum Corporation

List of Figures

- Figure 1: Nigeria Gas Station Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Gas Station Industry Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Nigeria Gas Station Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Nigeria Gas Station Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 15: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Nigeria Gas Station Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Nigeria Gas Station Industry Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 19: Nigeria Gas Station Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Nigeria Gas Station Industry Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Nigeria Gas Station Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Nigeria Gas Station Industry Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Nigeria Gas Station Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Nigeria Gas Station Industry Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Nigeria Gas Station Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Nigeria Gas Station Industry Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Nigeria Gas Station Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Nigeria Gas Station Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Gas Station Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Nigeria Gas Station Industry?

Key companies in the market include National Nigerian Petroleum Corporation, Sharon Group Nigeria, MRS Holdings Ltd*List Not Exhaustive, Oando PLC, TotalEnergies SE, Almoner Petroleum and Gas Limited.

3. What are the main segments of the Nigeria Gas Station Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Pipelines for Fuel Transportation 4.; Increasing Production and Consumption of Natural Gas and Refined Petroleum Products.

6. What are the notable trends driving market growth?

Smuggling of Crude Oil and Refined Products is expected to Restrain the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns Regarding New Pipelines and Transportation Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, Energy firm Ardova PLC announced the completion of a complete acquisition of Enyo Retail and Supply Limited. The takeover of Enyo Retail and Supply Limited has automatically transferred the 90 filling stations and about 100,000 customers maintained by Enyo's former owner to the Ardova Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Gas Station Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Gas Station Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Gas Station Industry?

To stay informed about further developments, trends, and reports in the Nigeria Gas Station Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence