Key Insights

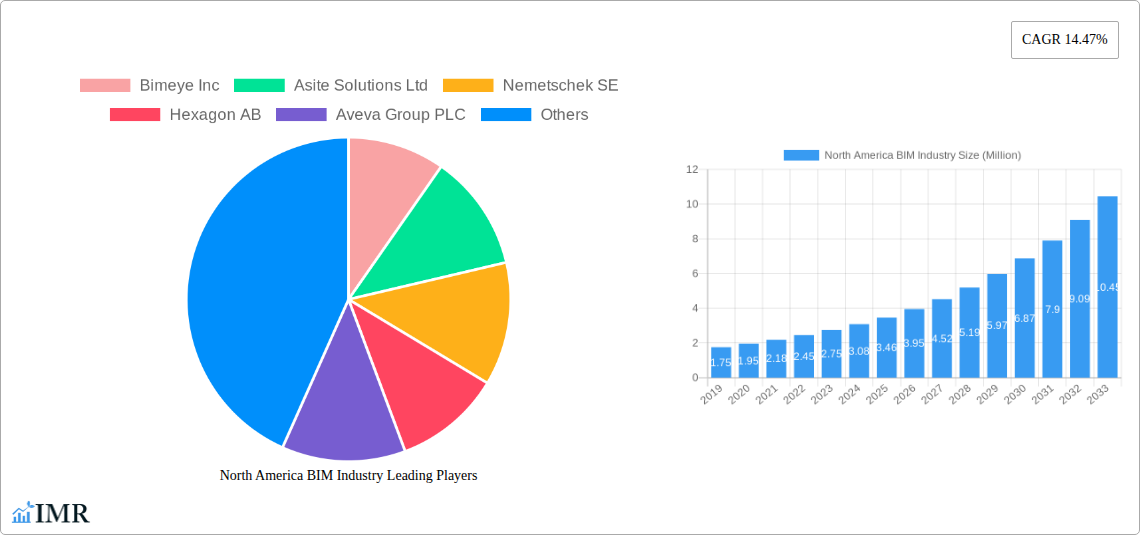

The North American Building Information Modeling (BIM) market is poised for significant expansion, projected to reach an estimated USD 3.46 million in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 14.47% throughout the study period extending to 2033. Key drivers propelling this surge include the increasing adoption of digital construction technologies, the demand for enhanced project efficiency and cost reduction, and stringent government mandates for BIM implementation in public and private sector projects. The software segment is expected to lead the market, driven by advancements in intelligent modeling, cloud-based collaboration tools, and integration with other digital platforms. The services segment, encompassing BIM consulting, training, and implementation, will also witness substantial growth as organizations increasingly seek expertise to leverage BIM effectively. Deployment options are leaning towards cloud-based solutions, offering greater scalability, accessibility, and cost-effectiveness compared to traditional on-premise systems, especially for commercial and industrial applications.

North America BIM Industry Market Size (In Million)

Residential applications, while historically slower to adopt BIM, are now experiencing a noticeable upswing due to increasing awareness of its benefits in streamlining home design, construction, and lifecycle management. The integration of BIM with other emerging technologies like Artificial Intelligence (AI), Virtual Reality (VR), and the Internet of Things (IoT) is further augmenting its capabilities, promising more intelligent and sustainable built environments. Despite the promising outlook, potential restraints such as the initial investment costs for BIM software and training, as well as a shortage of skilled BIM professionals, could temper the growth trajectory. However, the persistent drive for improved productivity, reduced errors, and enhanced stakeholder collaboration across commercial, residential, and industrial sectors in the United States, Canada, and Mexico will continue to push the North American BIM market forward.

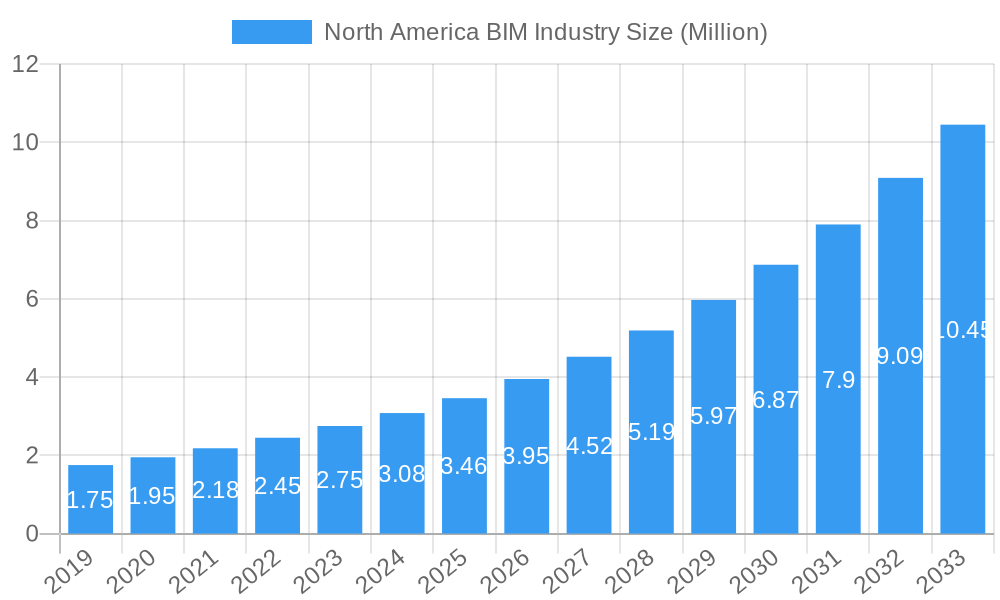

North America BIM Industry Company Market Share

Here is the comprehensive, SEO-optimized report description for the North America BIM Industry, designed for maximum visibility and engagement.

North America BIM Industry Market Dynamics & Structure

The North America BIM (Building Information Modeling) industry is characterized by a dynamic and evolving market structure, driven by technological advancements and increasing demand for efficient construction processes. Market concentration is moderate, with a few dominant players like Autodesk Inc. and Nemetschek SE holding significant shares, alongside a growing number of specialized service providers. Technological innovation is a primary driver, fueled by advancements in cloud computing, AI, and augmented/virtual reality, enabling more sophisticated design, collaboration, and management tools. Regulatory frameworks, particularly in North America, are increasingly mandating BIM adoption for public projects, creating a fertile ground for market expansion. Competitive product substitutes are emerging, ranging from advanced CAD software to integrated digital twin solutions, forcing established BIM providers to continuously innovate. End-user demographics are diversifying, with increased adoption across commercial, residential, and industrial sectors, each with unique BIM needs and integration challenges. Mergers and Acquisitions (M&A) trends indicate a consolidation strategy by larger entities to broaden their product portfolios and geographic reach. The value of M&A deals in the last two years is estimated to be over $500 Million, reflecting aggressive investment in the sector. Barriers to innovation include the high cost of implementing advanced BIM technologies and the need for extensive training and skilled professionals.

North America BIM Industry Growth Trends & Insights

The North America BIM industry is poised for substantial growth, projected to reach an estimated market size of $15,500 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14.2% from the base year of 2025. This impressive trajectory is underpinned by a rising adoption rate of BIM technologies across all construction segments, driven by the inherent benefits of enhanced project visualization, improved collaboration, reduced errors, and significant cost savings. The market penetration of BIM in new construction projects is expected to exceed 70% by 2030, a testament to its becoming an industry standard rather than a niche offering. Technological disruptions are a constant, with the integration of Artificial Intelligence (AI) for predictive analysis, machine learning for design optimization, and the Internet of Things (IoT) for real-time site monitoring further revolutionizing BIM workflows. Consumer behavior is shifting towards a demand for greater transparency, sustainability, and efficiency throughout the building lifecycle, all of which are facilitated by comprehensive BIM implementation. The increasing complexity of construction projects and the drive for digital transformation within the AEC (Architecture, Engineering, and Construction) industry are key factors propelling this market forward. Furthermore, the growing emphasis on smart cities and sustainable infrastructure development necessitates advanced digital tools like BIM for effective planning, execution, and management. The historical period of 2019-2024 saw a steady growth of approximately 10% CAGR, laying the foundation for the accelerated expansion anticipated in the forecast period.

Dominant Regions, Countries, or Segments in North America BIM Industry

The United States stands as the dominant force within the North America BIM industry, commanding an estimated 65% of the total market share. This dominance is attributed to several key factors, including robust government initiatives mandating BIM for public infrastructure projects, a highly developed construction sector with a strong propensity for adopting new technologies, and the presence of major BIM software and service providers. The commercial sector, with its large-scale projects and stringent budget and timeline requirements, is the largest application segment, accounting for approximately 45% of the BIM market value. Following closely is the industrial sector, driven by the need for precise design and construction of complex facilities, contributing around 30% to market revenue. The residential sector, while growing, currently holds a smaller but expanding share, estimated at 25%.

In terms of deployment type, the cloud segment is rapidly overtaking on-premise solutions, driven by the advantages of accessibility, scalability, and collaborative capabilities. Cloud-based BIM is projected to capture over 60% of the market by 2030. Within the Type segment, BIM software holds the largest market share at an estimated 55%, due to its foundational role in creating and managing BIM models. However, the BIM services segment is experiencing a higher growth rate, estimated at 16% CAGR, as companies increasingly outsource their BIM needs to specialized providers for expertise and efficiency. Key drivers for this dominance include favorable economic policies, substantial government investment in infrastructure development such as transportation networks and public buildings, and a proactive approach by architectural and engineering firms to leverage BIM for competitive advantage. The sheer volume of construction activity and the willingness to invest in advanced technologies solidify the US's leading position, with Canada also demonstrating significant growth and adoption, particularly in its major urban centers.

North America BIM Industry Product Landscape

The North America BIM industry is characterized by a landscape rich in product innovation, focusing on enhancing collaboration, data management, and lifecycle insights. Key innovations include the integration of AI for automated design checks and clash detection, real-time data synchronization across cloud platforms, and the development of interoperable solutions that bridge the gap between design, construction, and operations. Autodesk Inc.'s offerings, such as Revit and Navisworks, continue to be central, while Bentley Systems Inc. and Nemetschek SE provide comprehensive platforms catering to diverse project needs. Companies like Bimeye Inc. are focusing on data-centric BIM solutions, offering advanced analytics and visualization tools. The performance metrics for these products are increasingly measured by their ability to improve project efficiency, reduce rework, enhance safety, and provide better asset management post-construction. Unique selling propositions often revolve around intuitive user interfaces, seamless integration with other industry software, and robust support for open BIM standards, ensuring data exchange and model integrity across different platforms.

Key Drivers, Barriers & Challenges in North America BIM Industry

Key Drivers:

- Regulatory Mandates & Government Initiatives: Increasing adoption of BIM for public sector projects, particularly in the US, is a significant growth catalyst.

- Demand for Efficiency & Cost Reduction: BIM's ability to streamline workflows, minimize errors, and optimize resource allocation is a primary driver for adoption across all project types.

- Technological Advancements: Integration of AI, cloud computing, and AR/VR technologies enhances BIM's capabilities, driving innovation and adoption.

- Improved Collaboration & Communication: BIM platforms facilitate seamless information sharing among stakeholders, leading to better project outcomes.

- Focus on Sustainability & Lifecycle Management: BIM supports sustainable design practices and provides valuable data for facility management and operational efficiency.

Barriers & Challenges:

- High Implementation Costs: Initial investment in software, hardware, and training can be a deterrent for smaller firms.

- Skilled Workforce Shortage: A lack of adequately trained BIM professionals can hinder widespread adoption and effective utilization.

- Interoperability Issues: Challenges in seamless data exchange between different software platforms can create inefficiencies.

- Resistance to Change: Overcoming traditional workflows and mindsets within the industry presents an ongoing challenge.

- Data Security & Privacy Concerns: With increasing cloud adoption, ensuring the security of sensitive project data is crucial. The potential financial impact of data breaches is estimated to be in the tens of millions of dollars annually for the construction industry.

Emerging Opportunities in North America BIM Industry

Emerging opportunities in the North America BIM industry are centered around the expansion of BIM into new applications and the integration of advanced technologies. The growing demand for smart city infrastructure presents a significant avenue, where BIM can be utilized for the planning, construction, and ongoing management of urban environments, creating a potential market of over $2,000 Million. Furthermore, the increasing focus on retrofitting existing buildings for energy efficiency and sustainability will drive the adoption of BIM for renovation projects, offering substantial growth potential. The development of digital twin technology, powered by BIM data, for real-time asset monitoring and predictive maintenance is another key opportunity, promising enhanced operational efficiency for building owners and operators. Untapped markets include smaller construction firms and specialized trades that are gradually realizing the benefits of BIM adoption, creating a niche for accessible and tailored BIM solutions and services.

Growth Accelerators in the North America BIM Industry Industry

Several catalysts are accelerating long-term growth in the North America BIM industry. The continued push for digitalization across the AEC sector, amplified by government mandates and industry best practices, is a primary accelerator. Strategic partnerships between software developers, construction firms, and technology providers are fostering innovation and expanding market reach. For instance, collaborations between BIM software companies and AI developers are leading to more intelligent and automated workflows. Market expansion strategies, including the development of specialized BIM solutions for niche sectors like healthcare and education, are further broadening the industry's appeal. The increasing emphasis on data analytics and performance-based design, enabled by BIM, is also driving demand for more sophisticated BIM tools and services. The recent investment trends, with venture capital funding flowing into construction tech, including BIM, are fueling rapid development and market penetration.

Key Players Shaping the North America BIM Industry Market

- Autodesk Inc.

- Nemetschek SE

- Trimble Inc.

- Bentley Systems Inc.

- Hexagon AB

- Dassault Systems SA

- Aveva Group PLC

- Topcon Positioning Systems Inc

- Asite Solutions Ltd

- Bimeye Inc

- Rib Software AG

- Clearedge3D Inc.

Notable Milestones in North America BIM Industry Sector

- September 2023: US-based Diasphere, a BIM VDC services provider, introduced an enhanced service offering for MEP systems, aiming to minimize errors and financial risks by leveraging extensive virtual design and construction experience for a 24-hour turnaround on constructable BIM content.

- October 2023: Nouveau Monde Graphite Inc. (Canada) announced readiness for Phase-2 construction of its Matawinie Mine and Bécancour Battery Material Plant. Pomerleau, a Canadian construction company, is managing pre-construction and integrating BIM into planning and engineering for improved project efficiency and cost control.

In-Depth North America BIM Industry Market Outlook

The North America BIM industry outlook remains exceptionally strong, driven by ongoing digitalization and the inherent value proposition of BIM in improving project outcomes. Growth accelerators such as advancements in AI-driven analytics, the expansion of cloud-based BIM platforms for enhanced collaboration, and the increasing adoption of digital twins for lifecycle management are set to propel the market further. Strategic alliances between key industry players and the development of more accessible and user-friendly BIM solutions will democratize access, particularly for small and medium-sized enterprises. The future potential lies in the seamless integration of BIM data with operational technologies, leading to smarter, more sustainable, and cost-effective built environments, creating a sustained upward trajectory for the market.

North America BIM Industry Segmentation

-

1. Type

- 1.1. Software

- 1.2. Services

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

-

3. Application

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

North America BIM Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America BIM Industry Regional Market Share

Geographic Coverage of North America BIM Industry

North America BIM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Mandates Promoting the Usage of BIM in Key International Markets; Increased Project Performance and Productivity

- 3.3. Market Restrains

- 3.3.1. Cost and Implementation Issues

- 3.4. Market Trends

- 3.4.1. Commercial Application Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America BIM Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bimeye Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Asite Solutions Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nemetschek SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hexagon AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aveva Group PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Autodesk Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topcon Positioning Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clearedge3D Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dassault Systems SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bentley Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Trimble Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rib Software AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bimeye Inc

List of Figures

- Figure 1: North America BIM Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America BIM Industry Share (%) by Company 2025

List of Tables

- Table 1: North America BIM Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America BIM Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America BIM Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 4: North America BIM Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 5: North America BIM Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America BIM Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: North America BIM Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America BIM Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America BIM Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America BIM Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: North America BIM Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 12: North America BIM Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 13: North America BIM Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America BIM Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: North America BIM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America BIM Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America BIM Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America BIM Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America BIM Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America BIM Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America BIM Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America BIM Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America BIM Industry?

The projected CAGR is approximately 14.47%.

2. Which companies are prominent players in the North America BIM Industry?

Key companies in the market include Bimeye Inc, Asite Solutions Ltd, Nemetschek SE, Hexagon AB, Aveva Group PLC, Autodesk Inc, Topcon Positioning Systems Inc, Clearedge3D Inc, Dassault Systems SA, Bentley Systems Inc, Trimble Inc, Rib Software AG.

3. What are the main segments of the North America BIM Industry?

The market segments include Type, Deployment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Mandates Promoting the Usage of BIM in Key International Markets; Increased Project Performance and Productivity.

6. What are the notable trends driving market growth?

Commercial Application Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Cost and Implementation Issues.

8. Can you provide examples of recent developments in the market?

September 2023: US based Diasphere, a BIM VDC services provider for MEP systems, introduced to offer an extensive working experience that enables the avoidance of any mistakes and unnecessary financial risks. The company's extensive experience in virtual design and construction allows them to make a quick turnaround time of just 24 hours, providing only constructable BIM content without any delays.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America BIM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America BIM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America BIM Industry?

To stay informed about further developments, trends, and reports in the North America BIM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence