Key Insights

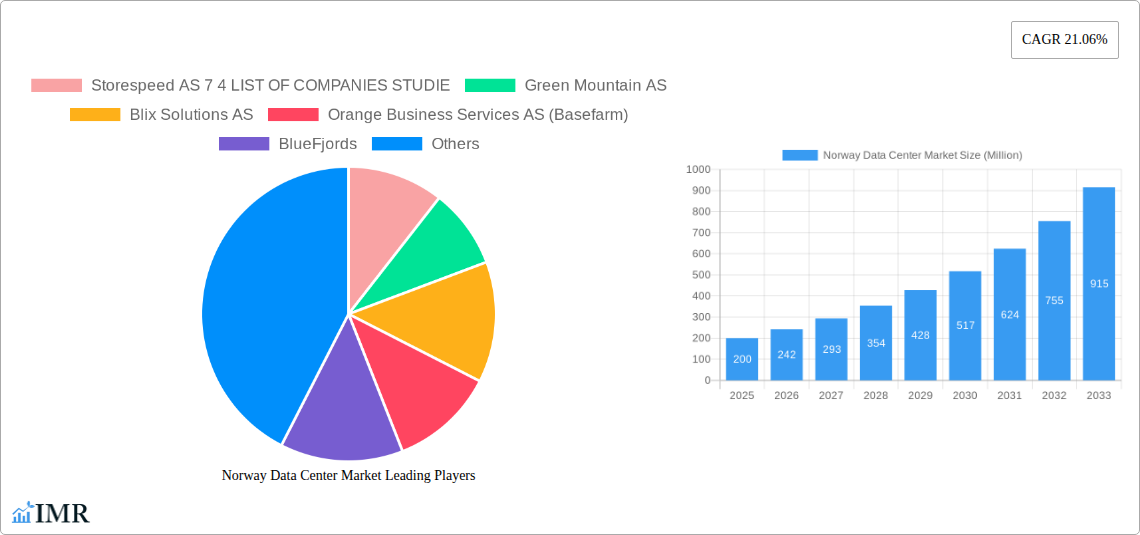

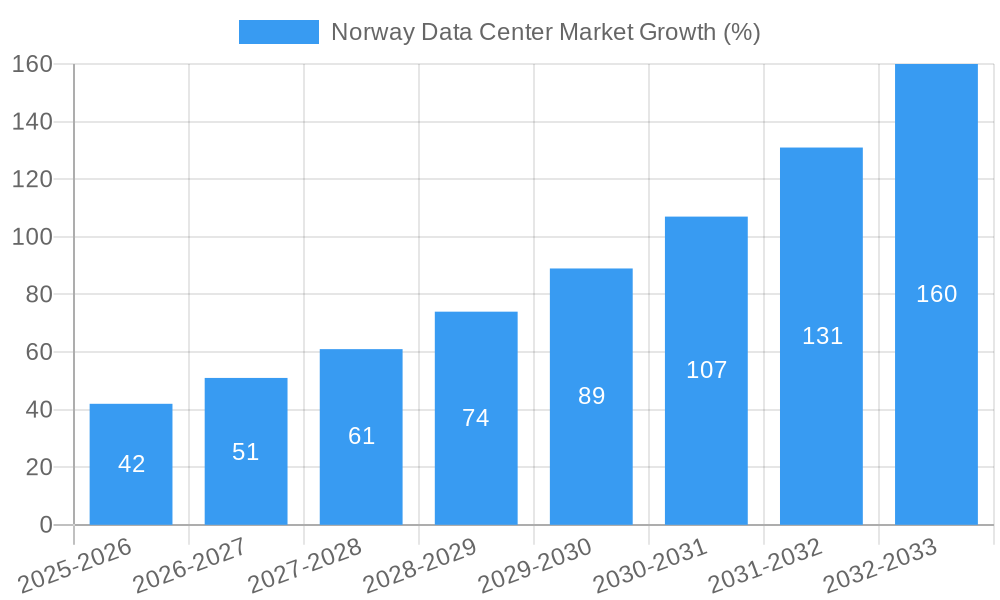

The Norway data center market is experiencing robust growth, driven by increasing digitalization, the rise of cloud computing, and the expansion of digital services across various sectors. A Compound Annual Growth Rate (CAGR) of 21.06% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by substantial investments from both domestic and international players, particularly in key regions like Oslo and Vestland, which boast robust digital infrastructure and skilled workforces. The market is segmented by data center size (small, medium, mega, massive, large), tier type (Tier 1-4), utilization (utilized, non-utilized), colocation type (hyperscale, retail, wholesale), and end-user (BFSI, cloud, e-commerce, government, manufacturing, media & entertainment, telecom, others). The presence of established players like Green Mountain AS and Lefdal Mine Data Center AS, alongside emerging companies like Storespeed AS and Nordic Hub Data Centers AS, indicates a dynamic and competitive landscape. The increasing demand for low-latency connectivity and sustainable data center operations is further shaping market trends, driving the adoption of energy-efficient technologies and renewable energy sources.

Looking ahead, the forecast period (2025-2033) is poised for continued expansion, with the market likely exceeding 1 billion NOK by 2033 (assuming a current market size of roughly 200 million NOK in 2025, a figure extrapolated based on the provided CAGR and the understanding of market dynamics in similar regions). Key restraints to growth could include high energy costs and limited availability of skilled labor. However, government initiatives promoting digitalization and investments in renewable energy infrastructure are mitigating these challenges. The market's segmentation offers opportunities for specialized providers catering to specific end-user needs and infrastructure requirements. The strategic location of Norway, providing good connectivity to Europe and beyond, contributes to its attractiveness as a data center hub, attracting both local and international investment.

Norway Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Norway data center market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, key players, and future opportunities within this rapidly evolving sector. The report segments the market by data center size (Large, Massive, Medium, Mega, Small), tier type (Tier 1 & 2, Tier 3, Tier 4), absorption (Utilized, Non-Utilized), colocation type (Hyperscale, Retail, Wholesale), and end-user (BFSI, Cloud, E-commerce, Government, Manufacturing, Media & Entertainment, Telecom, Other), providing a granular understanding of the market landscape. Key geographic hotspots analyzed include Oslo, Vestland, and the Rest of Norway.

The report also includes detailed profiles of key market players, including Storespeed AS, Green Mountain AS, Blix Solutions AS, Orange Business Services AS (Basefarm), BlueFjords, Nordic Hub Data Centers AS, New Mining (Dataroom AS), Lefdal Mine Data Center AS, AQ Compute Data Center (Aquila Capital Management GmbH), Bulk Infrastructure Group AS, Stack Infrastructure Inc, and GlobalConnect AB.

Norway Data Center Market Dynamics & Structure

The Norwegian data center market is experiencing significant growth, driven by increasing digitalization, stringent data privacy regulations, and a robust digital infrastructure. Market concentration is relatively moderate, with a few dominant players alongside several smaller, specialized providers. Technological innovation is a key driver, with advancements in cloud computing, edge computing, and AI fueling demand for advanced data center facilities. Regulatory frameworks, while generally supportive of digital growth, are constantly evolving, influencing investment decisions. The market faces competition from alternative solutions like cloud services, but the need for on-premises data storage for sensitive data and latency-sensitive applications sustains considerable demand. Mergers and acquisitions are relatively frequent, reflecting industry consolidation and the pursuit of scale.

- Market Concentration: Moderate, with a few major players holding significant market share (xx%).

- Technological Innovation: Cloud computing, edge computing, and AI are major drivers.

- Regulatory Framework: Supportive, but evolving, impacting investment strategies.

- M&A Activity: xx deals in the past 5 years, indicating consolidation trends.

- Innovation Barriers: High capital expenditure requirements, specialized skills shortage.

Norway Data Center Market Growth Trends & Insights

The Norwegian data center market exhibits a strong growth trajectory, fueled by the increasing adoption of digital technologies across various sectors. The market size experienced significant growth during the historical period (2019-2024), with a projected CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors including the rising demand for cloud services, the increasing need for data storage and processing capabilities among businesses, and government initiatives promoting digital transformation. The adoption rate of advanced data center technologies, such as hyperscale facilities and Tier IV data centers, is also increasing steadily, indicating a move towards greater efficiency and resilience. Consumer behavior shifts towards digital services and remote work are further contributing to this growth. Technological disruptions, such as the increasing use of AI and machine learning, are shaping the demand for more sophisticated data center infrastructure.

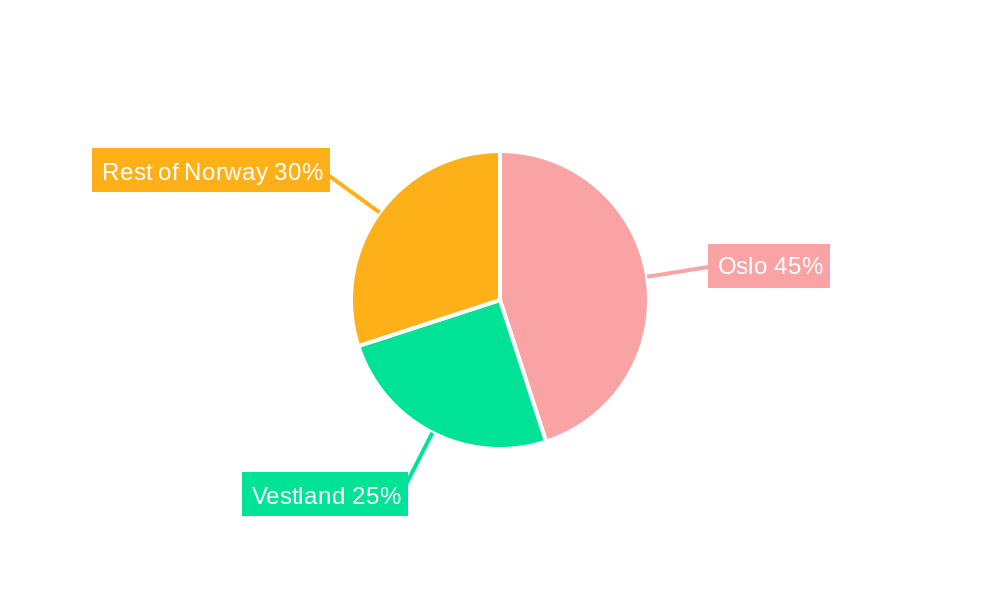

Dominant Regions, Countries, or Segments in Norway Data Center Market

Oslo dominates the Norwegian data center market, owing to its established digital infrastructure, skilled workforce, and proximity to key businesses. Vestland also shows considerable growth potential, driven by its burgeoning tech sector and government initiatives. The large data center segment commands the largest market share due to its ability to accommodate the increasing demand for capacity from hyperscale cloud providers and large enterprises. Tier III data centers are the most prevalent, offering a balance between cost and resilience. Utilized capacity is significantly higher than non-utilized capacity, highlighting strong market demand. The hyperscale colocation type shows robust growth, driven by the expansion of cloud services. The cloud end-user segment is a major driver, while BFSI and government sectors also contribute significantly.

- Dominant Region: Oslo (xx% market share)

- Fastest Growing Region: Vestland (xx% CAGR)

- Dominant Segment (Data Center Size): Large (xx% market share)

- Dominant Segment (Tier Type): Tier III (xx% market share)

- Dominant Segment (Colocation Type): Hyperscale (xx% market share)

- Dominant Segment (End-User): Cloud (xx% market share)

- Key Drivers: Robust digital infrastructure, government support for digital transformation, growing demand from cloud providers.

Norway Data Center Market Product Landscape

The Norwegian data center market showcases a diverse range of products, including advanced cooling systems, high-density computing solutions, and robust security measures. Innovation focuses on improving energy efficiency, enhancing scalability, and bolstering security protocols. Data center operators continuously integrate new technologies to enhance performance and meet evolving customer requirements. Unique selling propositions center around energy sustainability, advanced security features, and tailored solutions for specific industry needs.

Key Drivers, Barriers & Challenges in Norway Data Center Market

Key Drivers: Increasing digitalization across sectors, government initiatives promoting digital transformation, rising demand for cloud services, and the need for robust data storage and processing capabilities. The expansion of 5G networks and the rising adoption of IoT devices are also pushing demand.

Key Challenges: High capital expenditure requirements for building and maintaining data centers, land scarcity in prime locations, and competition from established international players. Furthermore, energy costs and sustainable energy sourcing remain significant concerns. Regulatory complexities, particularly concerning data privacy and security, also pose challenges.

Emerging Opportunities in Norway Data Center Market

Emerging opportunities include the expansion of edge data centers to support the growing IoT market, the increasing demand for specialized data centers tailored to specific industry needs (e.g., healthcare, finance), and the growing focus on sustainable and energy-efficient data center solutions. The development of hybrid cloud strategies also presents significant growth potential. Furthermore, tapping into underserved regions and promoting digital inclusion presents notable opportunities.

Growth Accelerators in the Norway Data Center Market Industry

The long-term growth of the Norwegian data center market will be propelled by continued technological advancements, strategic partnerships between data center providers and technology companies, and government support for digital infrastructure development. Expanding into new markets, such as the renewable energy sector, and attracting foreign investment will further fuel growth. The increasing adoption of AI and machine learning will also drive demand for advanced data center capabilities.

Key Players Shaping the Norway Data Center Market Market

- Storespeed AS

- Green Mountain AS

- Blix Solutions AS

- Orange Business Services AS (Basefarm)

- BlueFjords

- Nordic Hub Data Centers AS

- New Mining (Dataroom AS)

- Lefdal Mine Data Center AS

- AQ Compute Data Center (Aquila Capital Management GmbH)

- Bulk Infrastructure Group AS

- Stack Infrastructure Inc

- GlobalConnect AB

Notable Milestones in Norway Data Center Market Sector

- 2021: Green Mountain AS announces expansion of its data center facilities.

- 2022: Government initiates a program to support the development of sustainable data centers.

- 2023: Several M&A activities occur among smaller data center providers.

- 2024: New regulations on data privacy and security come into effect.

In-Depth Norway Data Center Market Market Outlook

The Norwegian data center market is poised for continued robust growth, driven by technological advancements, supportive government policies, and increasing demand from various sectors. Strategic partnerships and investments in sustainable technologies will shape future market dynamics. The expansion of edge computing, the rising adoption of hybrid cloud strategies, and the increasing focus on data security and resilience will present significant opportunities for growth and innovation. The market is expected to see further consolidation and an increased focus on sustainability in the coming years.

Norway Data Center Market Segmentation

-

1. Hotspot

- 1.1. Oslo

- 1.2. Vestland

- 1.3. Rest of Norway

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Norway Data Center Market Segmentation By Geography

- 1. Norway

Norway Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Oslo

- 5.1.2. Vestland

- 5.1.3. Rest of Norway

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Storespeed AS 7 4 LIST OF COMPANIES STUDIE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Green Mountain AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blix Solutions AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orange Business Services AS (Basefarm)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BlueFjords

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nordic Hub Data Centers AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 New Mining (Dataroom AS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lefdal Mine Data Center AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AQ Compute Data Center (Aquila Capital Management GmbH)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bulk Infrastructure Group AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stack Infrastructure Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GlobalConnect AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Storespeed AS 7 4 LIST OF COMPANIES STUDIE

List of Figures

- Figure 1: Norway Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Norway Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Norway Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Norway Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Norway Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Norway Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Norway Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Norway Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Norway Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: Norway Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: Norway Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Norway Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: Norway Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: Norway Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Norway Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Data Center Market?

The projected CAGR is approximately 21.06%.

2. Which companies are prominent players in the Norway Data Center Market?

Key companies in the market include Storespeed AS 7 4 LIST OF COMPANIES STUDIE, Green Mountain AS, Blix Solutions AS, Orange Business Services AS (Basefarm), BlueFjords, Nordic Hub Data Centers AS, New Mining (Dataroom AS), Lefdal Mine Data Center AS, AQ Compute Data Center (Aquila Capital Management GmbH), Bulk Infrastructure Group AS, Stack Infrastructure Inc, GlobalConnect AB.

3. What are the main segments of the Norway Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Data Center Market?

To stay informed about further developments, trends, and reports in the Norway Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence