Key Insights

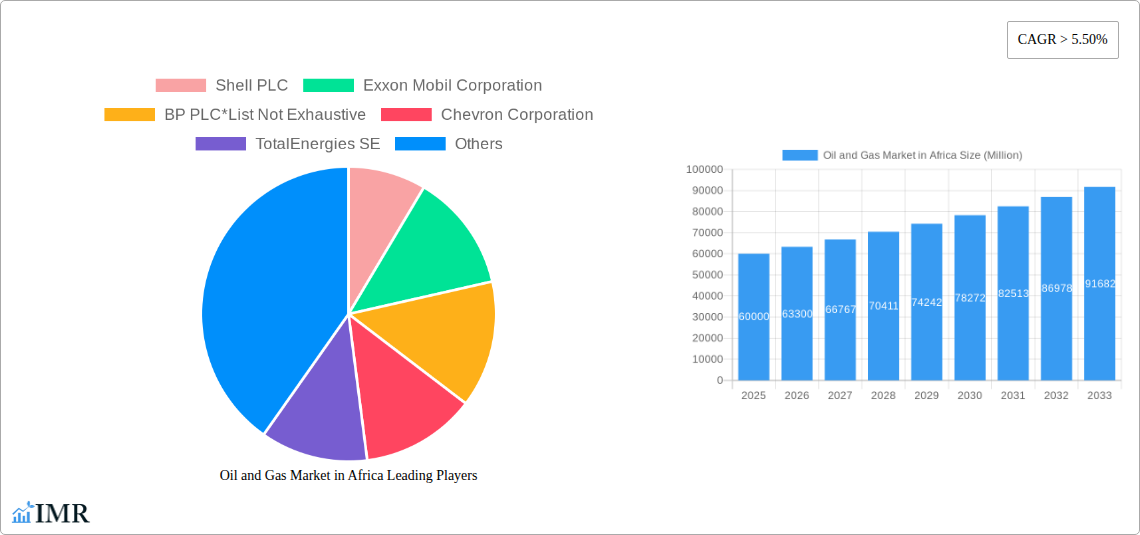

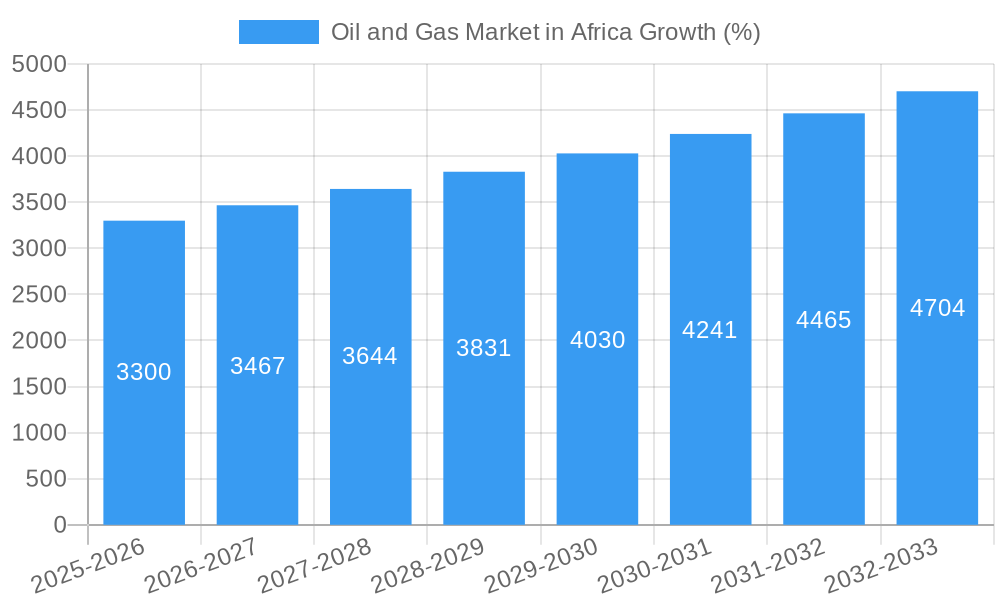

The African oil and gas market presents a compelling investment landscape, projected to experience robust growth over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) exceeding 5.5% indicates significant expansion, driven by rising energy demand fueled by population growth and industrialization across the continent. Key drivers include substantial untapped reserves, particularly in East and West Africa, coupled with ongoing exploration and production activities by major international oil companies (IOCs) like Shell, ExxonMobil, and BP, alongside national oil companies such as GNPC and NNPC. While significant challenges exist, including infrastructure limitations and geopolitical instability in certain regions, the long-term outlook remains positive. The market is segmented into upstream (exploration and production), midstream (transportation and storage), and downstream (refining and distribution) sectors, each contributing to the overall market value. Growth will be particularly pronounced in the upstream sector due to continued exploration and development of new oil and gas fields. The downstream sector will also see growth, driven by increasing demand for refined petroleum products. However, regulatory hurdles, environmental concerns, and price volatility remain significant restraints that need to be addressed for sustained growth. The market's future is intricately linked to the continent's economic development and effective energy policies. Strategic investments in infrastructure development and technological advancements are crucial for unlocking the full potential of this burgeoning sector.

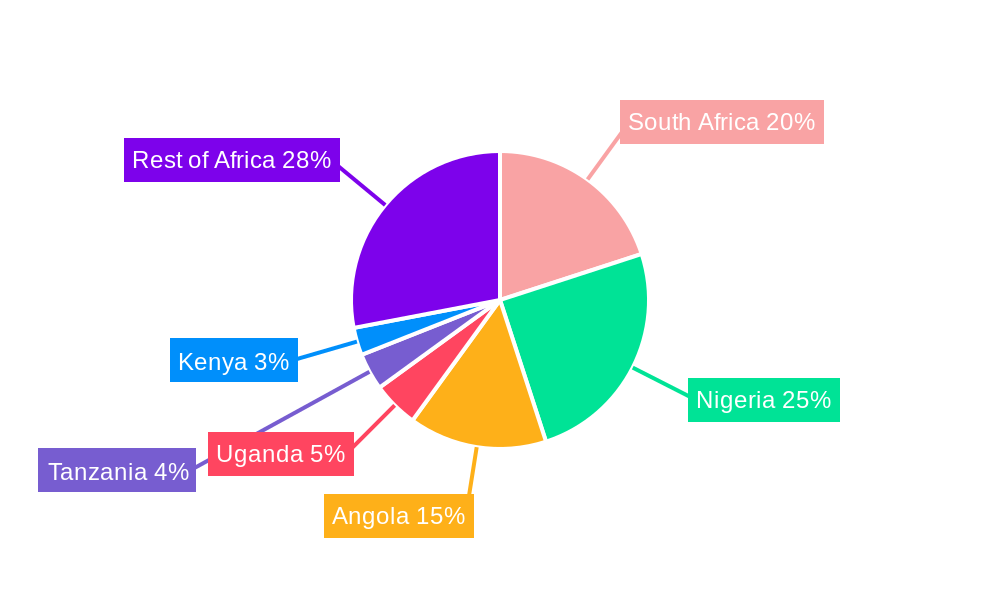

The market's regional dynamics are crucial to understanding its growth trajectory. Countries like South Africa, Nigeria, and Angola, with established oil and gas industries, will continue to play a dominant role. However, substantial growth is anticipated in East African nations such as Uganda and Tanzania, where significant oil and gas discoveries have spurred increased investment and development activity. The Rest of Africa region also holds significant potential, albeit with varying levels of exploration and production activity. The competitive landscape is shaped by the presence of both major international players and national oil companies. This dynamic mix contributes to the market's complexity and potential for both cooperation and competition as the industry continues to evolve. Further research into specific sub-sectors and individual countries within the region is needed to gain a more granular understanding of market dynamics. Considering the available data and industry trends, a reasonable estimate for the 2025 market size would be in the range of $50-70 Billion USD. Further estimations for following years can be based on the 5.5% CAGR.

Oil and Gas Market in Africa: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Oil and Gas Market in Africa, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant regions, key players, and future outlook, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the forecast period (2025-2033). The market is segmented by Upstream, Midstream, and Downstream activities. Key players include Shell PLC, Exxon Mobil Corporation, BP PLC, Chevron Corporation, TotalEnergies SE, Ghana National Petroleum Corporation (GNPC), Eni SpA, Nigerian National Petroleum Corporation, and Cairn Energy PLC (list not exhaustive).

Oil and Gas Market in Africa: Market Dynamics & Structure

This section analyzes the market structure, concentration, technological innovation, regulatory landscape, competitive forces, and M&A activity within the African oil and gas sector. Market concentration is assessed through market share analysis of key players, revealing dominance patterns and competitive intensity. The report identifies technological drivers such as enhanced oil recovery (EOR) techniques and explores the impact of regulatory frameworks on investment and operational efficiency.

- Market Concentration: xx% market share held by top 5 players in 2024. This is expected to xx% by 2033.

- Technological Innovation: Focus on EOR techniques, digitalization, and sustainable practices is driving innovation but faces challenges in accessing advanced technology.

- Regulatory Frameworks: Variable regulatory environments across African nations impact investment decisions and project timelines. Harmonization efforts are crucial.

- Competitive Product Substitutes: Renewable energy sources are emerging as significant substitutes, impacting long-term demand for oil and gas.

- End-User Demographics: Industrial and power generation sectors are major end-users, with variations across regions.

- M&A Trends: The report analyzes the volume and value of M&A deals over the study period, identifying key strategic drivers and implications for market consolidation. xx billion USD in M&A activity projected between 2025-2033.

Oil and Gas Market in Africa: Growth Trends & Insights

This section provides a detailed analysis of the market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior within the African oil and gas industry. The report leverages extensive data analysis to present a comprehensive view of market growth trajectory, utilizing metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates. Factors influencing growth include discoveries, production levels, pricing dynamics, and infrastructural development. Expected CAGR of xx% for the forecast period is driven by increased demand for energy, particularly in the industrial and power generation sectors.

Dominant Regions, Countries, or Segments in Oil and Gas Market in Africa

This section identifies the leading regions, countries, and segments (Upstream, Midstream, Downstream) within the African oil and gas market driving market growth. It explores the factors contributing to regional dominance, including economic policies, infrastructure, and resource availability.

- Upstream Dominance: Nigeria and Angola are major players in the upstream sector, accounting for xx% of total production. Growth in this segment will continue to be influenced by investment in exploration and production.

- Midstream Dominance: South Africa and Nigeria are key players in the midstream sector, with xx% market share, mainly due to existing pipeline infrastructure.

- Downstream Dominance: South Africa, Egypt, and Nigeria account for xx% of the downstream market, with refining capacity and distribution networks significantly shaping the region's market.

- Key Drivers: Government policies promoting domestic energy production, growing industrialization, and population growth are major drivers of growth in these regions.

Oil and Gas Market in Africa: Product Landscape

This section explores the innovation, applications, and performance metrics of oil and gas products in the African market. The report highlights unique selling propositions (USPs) and technological advancements driving product development. This includes improvements in extraction technology, refining processes, and the development of cleaner energy sources. Significant attention is devoted to advancements in pipeline infrastructure and the exploration of new technologies that improve efficiency and safety across the supply chain.

Key Drivers, Barriers & Challenges in Oil and Gas Market in Africa

This section outlines the key drivers and challenges impacting the African oil and gas market.

Key Drivers:

- Increasing energy demand fueled by population growth and industrialization.

- Significant oil and gas reserves across the continent.

- Government initiatives to boost domestic energy production.

Key Challenges:

- Infrastructure limitations (pipeline networks, storage facilities).

- Political instability and regulatory uncertainties in some regions.

- Competition from renewable energy sources. xx% decline in oil prices by 2033 anticipated due to renewable energy penetration.

Emerging Opportunities in Oil and Gas Market in Africa

This section highlights emerging opportunities for growth within the African oil and gas market, including untapped markets in underserved regions, the adoption of innovative technologies, and a focus on developing cleaner energy solutions. The exploration of offshore resources, particularly in East Africa, presents significant potential. The growth of liquefied natural gas (LNG) and the increased focus on gas monetization also represent substantial opportunities. A shift towards sustainable practices and investment in carbon capture and storage technologies can foster long-term growth.

Growth Accelerators in the Oil and Gas Market in Africa Industry

Technological advancements, strategic partnerships, and market expansion strategies are identified as key growth accelerators. Improved drilling techniques, the adoption of digital technologies, and partnerships with international energy companies are expected to significantly increase production efficiency. Expanding into new markets and developing infrastructure in less-explored regions can unlock substantial long-term growth potential. Government support and incentives targeting investment in the oil and gas sector also play a crucial role.

Key Players Shaping the Oil and Gas Market in Africa Market

- Shell PLC

- Exxon Mobil Corporation

- BP PLC

- Chevron Corporation

- TotalEnergies SE

- Ghana National Petroleum Corporation (GNPC)

- Eni SpA

- Nigerian National Petroleum Corporation

- Cairn Energy PLC

Notable Milestones in Oil and Gas Market in Africa Sector

- January 2022: Nigerian National Petroleum Company Ltd secured a USD 5 billion commitment from the African Export-Import Bank to fund its major investment in the Nigerian upstream sector. This will boost production significantly and reduce reliance on foreign financing.

- February 2022: The Nigerian Upstream Petroleum Regulatory Commission announced the "Industry-Wide Oil Revenue Recovery Initiative" aiming to recover lost revenue from pipeline theft. This initiative, if successful, could significantly increase Nigeria's oil revenue.

In-Depth Oil and Gas Market in Africa Market Outlook

The African oil and gas market is poised for substantial growth in the coming years. Continued investment in exploration and production, coupled with the development of necessary infrastructure and the adoption of new technologies, will drive this expansion. The strategic partnerships between international and national oil companies, and the increasing focus on gas monetization, will further accelerate market growth. Despite challenges, the market outlook remains promising, particularly for countries with significant reserves and conducive investment climates.

Oil and Gas Market in Africa Segmentation

-

1. Type

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Algeria

- 2.2. Nigeria

- 2.3. Egypt

- 2.4. Rest of Africa

Oil and Gas Market in Africa Segmentation By Geography

- 1. Algeria

- 2. Nigeria

- 3. Egypt

- 4. Rest of Africa

Oil and Gas Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Upstream Segment to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Algeria

- 5.2.2. Nigeria

- 5.2.3. Egypt

- 5.2.4. Rest of Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Algeria

- 5.3.2. Nigeria

- 5.3.3. Egypt

- 5.3.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Algeria Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Algeria

- 6.2.2. Nigeria

- 6.2.3. Egypt

- 6.2.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Nigeria Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Algeria

- 7.2.2. Nigeria

- 7.2.3. Egypt

- 7.2.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Egypt Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Algeria

- 8.2.2. Nigeria

- 8.2.3. Egypt

- 8.2.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Africa Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Algeria

- 9.2.2. Nigeria

- 9.2.3. Egypt

- 9.2.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Oil and Gas Market in Africa Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shell PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Exxon Mobil Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 BP PLC*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Chevron Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 TotalEnergies SE

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ghana National Petroleum Corporation (GNPC)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Eni SpA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Nigerian National Petroleum Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cairn Energy PLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Shell PLC

List of Figures

- Figure 1: Oil and Gas Market in Africa Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oil and Gas Market in Africa Share (%) by Company 2024

List of Tables

- Table 1: Oil and Gas Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oil and Gas Market in Africa Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Oil and Gas Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Oil and Gas Market in Africa Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Oil and Gas Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Oil and Gas Market in Africa Volume K Tons Forecast, by Geography 2019 & 2032

- Table 7: Oil and Gas Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Oil and Gas Market in Africa Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Oil and Gas Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Oil and Gas Market in Africa Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: South Africa Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Sudan Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Uganda Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Kenya Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Oil and Gas Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Oil and Gas Market in Africa Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Oil and Gas Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Oil and Gas Market in Africa Volume K Tons Forecast, by Type 2019 & 2032

- Table 25: Oil and Gas Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Oil and Gas Market in Africa Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: Oil and Gas Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Oil and Gas Market in Africa Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: Oil and Gas Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Oil and Gas Market in Africa Volume K Tons Forecast, by Type 2019 & 2032

- Table 31: Oil and Gas Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Oil and Gas Market in Africa Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: Oil and Gas Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Oil and Gas Market in Africa Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Oil and Gas Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Oil and Gas Market in Africa Volume K Tons Forecast, by Type 2019 & 2032

- Table 37: Oil and Gas Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Oil and Gas Market in Africa Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: Oil and Gas Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Oil and Gas Market in Africa Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Oil and Gas Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Oil and Gas Market in Africa Volume K Tons Forecast, by Type 2019 & 2032

- Table 43: Oil and Gas Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Oil and Gas Market in Africa Volume K Tons Forecast, by Geography 2019 & 2032

- Table 45: Oil and Gas Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Oil and Gas Market in Africa Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Market in Africa?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Oil and Gas Market in Africa?

Key companies in the market include Shell PLC, Exxon Mobil Corporation, BP PLC*List Not Exhaustive, Chevron Corporation, TotalEnergies SE, Ghana National Petroleum Corporation (GNPC), Eni SpA, Nigerian National Petroleum Corporation, Cairn Energy PLC.

3. What are the main segments of the Oil and Gas Market in Africa?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Upstream Segment to dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

In January 2022, Nigerian National Petroleum Company Ltd secured a USD 5 billion commitment from the African Export-Import Bank to fund its major investment in the Nigerian upstream sector. The repayment of this funding is expected to be done through a forward sale arrangement, whereby the funds will constitute the payment purchase of 90-120 kpd of crude to be delivered to the lender within a four to eight-year period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Market in Africa?

To stay informed about further developments, trends, and reports in the Oil and Gas Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence