Key Insights

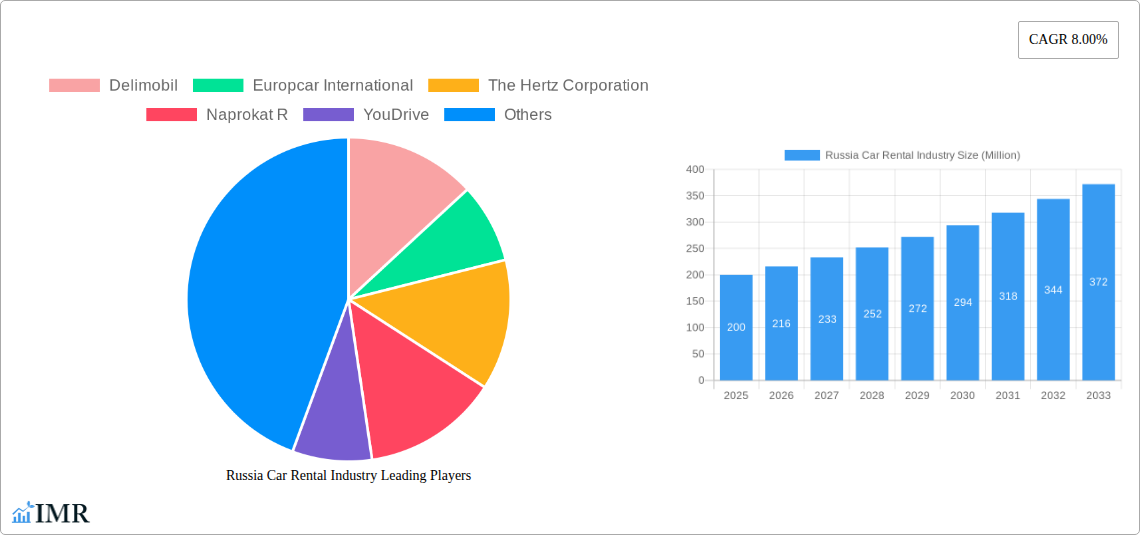

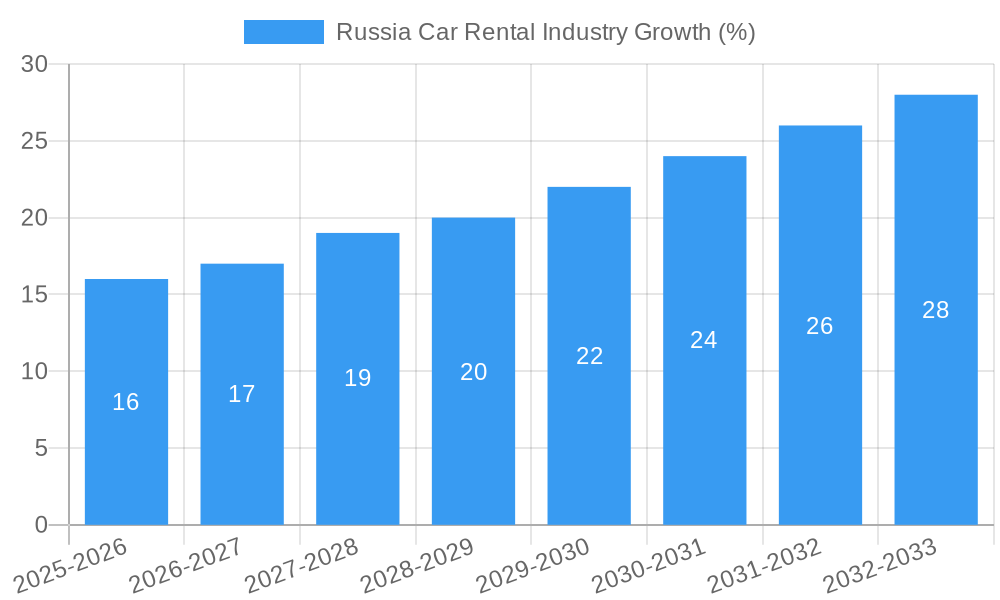

The Russia car rental market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.00% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes and a burgeoning middle class are fueling increased leisure travel and business trips, leading to higher demand for car rental services. The increasing popularity of online booking platforms offers convenience and competitive pricing, further stimulating market growth. Furthermore, the diversification of the car rental fleet, including options like hatchbacks, sedans, and SUVs, caters to a broader range of customer needs and preferences, contributing to market expansion. However, economic fluctuations and potential infrastructural limitations could pose challenges to sustained growth. The market is segmented by booking type (online vs. offline), car type (hatchback, sedan, SUV), rental length (short-term vs. long-term), and application (leisure/tourism vs. business). Key players like Delimobil, Europcar International, Hertz, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget, Avis, and Enterprise are actively competing in this dynamic market, shaping service offerings and pricing strategies.

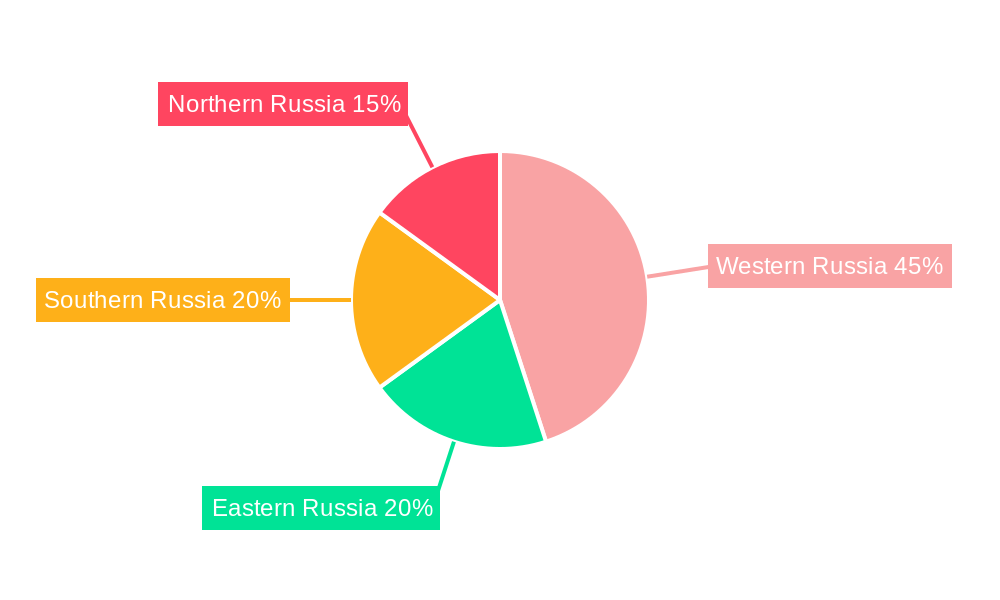

Regional variations within Russia are also significant, with Western Russia likely commanding the largest market share due to higher population density and economic activity. Eastern, Southern, and Northern Russia represent considerable, albeit potentially less mature, segments presenting opportunities for expansion. The historical period (2019-2024) likely showcased fluctuating growth depending on macroeconomic conditions and the impact of external factors. The forecast period (2025-2033) anticipates consistent growth, although precise figures require more detailed analysis specific to each regional segment. The competitive landscape is intense, with both international and domestic players vying for market share through strategic investments in technology, fleet expansion, and service enhancements.

Russia Car Rental Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Russia car rental market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It examines market dynamics, growth trends, key players, and emerging opportunities within the Russian car rental landscape, serving as an invaluable resource for industry professionals, investors, and strategic planners. The report segments the market by booking type (online, offline), car type (hatchback, sedan, SUV), rental length (short-term, long-term), and application (leisure/tourism, business).

Russia Car Rental Industry Market Dynamics & Structure

The Russian car rental market, valued at xx million in 2024, is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is relatively fragmented, with several key players vying for market share. Technological innovation, particularly in mobile applications and digital booking platforms, is a significant driver. However, regulatory frameworks and infrastructure limitations pose challenges. The emergence of subscription services and minute-based rentals signals a shift in consumer preferences and intensifies competition. The market also experiences influence from macroeconomic conditions and geopolitical factors.

- Market Concentration: Moderately fragmented, with no single dominant player holding more than xx% market share in 2024.

- Technological Innovation: Rapid adoption of mobile apps, digital booking systems, and innovative rental models like minute-based rentals.

- Regulatory Framework: Existing regulations impact vehicle licensing, insurance, and operational procedures.

- Competitive Substitutes: Ride-hailing services and personal vehicle ownership exert competitive pressure.

- End-User Demographics: Growing middle class and increasing tourism contribute to market expansion.

- M&A Trends: Limited significant M&A activity observed in the recent past, with xx major deals recorded between 2019-2024, indicating a potential for consolidation.

Russia Car Rental Industry Growth Trends & Insights

The Russia car rental market exhibited a CAGR of xx% during the historical period (2019-2024), driven by rising disposable incomes, increased domestic and international tourism, and the growing adoption of online booking platforms. Technological disruptions, including the introduction of car-sharing services and subscription models, have significantly altered consumer behavior, favoring convenience and flexibility. The market is projected to maintain a robust growth trajectory, reaching xx million by 2033, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions, Countries, or Segments in Russia Car Rental Industry

Moscow and St. Petersburg remain the dominant regions, accounting for xx% of the total market revenue in 2024 due to higher population density, tourism, and business activity. Within the segments, online bookings are gaining traction, exceeding offline bookings in market share, with a projected xx% share by 2033. Short-term rentals constitute a larger proportion of the market compared to long-term rentals. The SUV segment is witnessing significant growth, driven by a preference for larger and more comfortable vehicles, particularly among tourists and families. The leisure/tourism application segment dominates the market, although the business segment shows a steady growth potential.

- Key Drivers:

- Growth of middle class and disposable income

- Increased domestic and international tourism

- Improved road infrastructure in key cities

- Government initiatives supporting tourism sector

- Dominance Factors:

- Higher population density in major cities

- Strong tourism industry

- Concentration of business activity

Russia Car Rental Industry Product Landscape

The Russian car rental market offers a diverse range of vehicles, from compact hatchbacks to premium SUVs, catering to varying customer needs and budgets. Innovations include the introduction of minute-based rental services, subscription models, and advanced mobile applications that streamline the booking and rental process. Unique selling propositions frequently involve bundled services like insurance, GPS navigation, and roadside assistance. Technological advancements focus on enhancing user experience through seamless digital interfaces and real-time vehicle tracking.

Key Drivers, Barriers & Challenges in Russia Car Rental Industry

Key Drivers: Rising disposable incomes, growth in tourism, technological advancements (mobile apps, online booking platforms), and increasing business travel.

Key Challenges: Economic volatility, fluctuating fuel prices, infrastructural limitations outside major cities, intense competition, and regulatory uncertainties. Supply chain disruptions, particularly those related to vehicle imports, have also been a significant challenge, impacting vehicle availability and rental costs. This has resulted in xx% increase in rental prices in the past year.

Emerging Opportunities in Russia Car Rental Industry

Untapped markets exist in smaller cities and regions with developing tourism infrastructure. The rising popularity of eco-friendly vehicles presents an opportunity for introducing electric vehicle rental options. Integration of car-sharing services with public transportation networks could further enhance convenience for users. Expanding into niche markets, such as specialized vehicles for specific industries (e.g., construction, logistics), offers potential for growth.

Growth Accelerators in the Russia Car Rental Industry

Strategic partnerships between car rental companies and hotels, airlines, or tourism agencies can significantly enhance reach and customer acquisition. Expanding into underserved markets and adopting innovative marketing strategies will prove beneficial. Technological breakthroughs, such as autonomous driving technologies and improved vehicle management systems, will transform the industry. Government initiatives that support the tourism sector and improve road infrastructure will catalyze market expansion.

Key Players Shaping the Russia Car Rental Industry Market

- Delimobil

- Europcar International (Europcar International)

- The Hertz Corporation (The Hertz Corporation)

- Naprokat R

- YouDrive

- Yandex Drive

- Belka Car

- Budget Rent a Car System Inc (Budget Rent a Car System Inc)

- Avis (Avis)

- Enterprise Holding Inc (Enterprise Holding Inc)

Notable Milestones in Russia Car Rental Industry Sector

- June 2021: Yandex Drive launches a fleet management platform.

- March 2021: Audi Russia launches the Audi Drive subscription service.

- October 2021: MINI Russia launches the EASY2DRIVE digital rental service.

- May 2022: Mercedes-Benz and BMW AG introduce a minute-based car rental service.

In-Depth Russia Car Rental Industry Market Outlook

The Russia car rental market is poised for sustained growth, driven by technological advancements, expanding tourism, and evolving consumer preferences. Strategic partnerships, market expansion into underserved regions, and the adoption of innovative business models will shape the industry's future. The integration of sustainable practices and the introduction of eco-friendly vehicles will become crucial for long-term success. The market presents significant opportunities for both established players and new entrants to capitalize on the growing demand for convenient and efficient transportation solutions.

Russia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Car Type

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. SUV

-

3. Rental Length

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Leisure/Tourism

- 4.2. Business

Russia Car Rental Industry Segmentation By Geography

- 1. Russia

Russia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Online Booking Segment Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Car Type

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. SUV

- 5.3. Market Analysis, Insights and Forecast - by Rental Length

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Leisure/Tourism

- 5.4.2. Business

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Western Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delimobil

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Europcar International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Hertz Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Naprokat R

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 YouDrive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Yandex Drive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Belka Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Budget Rent a Car System Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avis

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Enterprise Holding Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delimobil

List of Figures

- Figure 1: Russia Car Rental Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Car Rental Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 4: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 5: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Western Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Northern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 13: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 14: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 15: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Car Rental Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Russia Car Rental Industry?

Key companies in the market include Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, Enterprise Holding Inc.

3. What are the main segments of the Russia Car Rental Industry?

The market segments include Booking Type, Car Type, Rental Length, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Online Booking Segment Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In May 2022, Mercedes Benz and BMW AG jointly introduced a car rental service in Russia. The service allows the user to rent a car by the minute. The vehicles were booked over a smartphone application and can be returned anywhere in the business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Russia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence