Key Insights

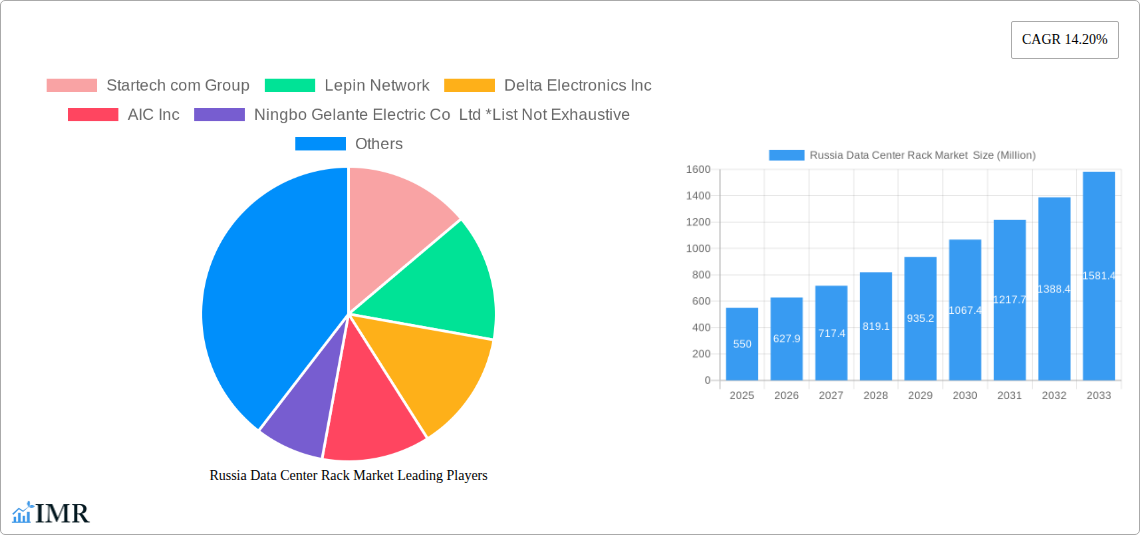

The Russian data center rack market is poised for significant expansion, driven by a projected market size of USD 550 million and a robust Compound Annual Growth Rate (CAGR) of 14.20% from 2025 to 2033. This accelerated growth is fueled by the escalating demand for digital infrastructure, particularly within the IT & Telecommunication and BFSI sectors, which are heavily investing in cloud computing, data analytics, and secure data storage solutions. The government's increasing focus on digitalization initiatives and the burgeoning media & entertainment industry further bolster this demand, creating a dynamic environment for data center rack manufacturers and suppliers. The prevalence of solutions like half racks and full racks within these sectors indicates a need for scalable and high-density storage, aligning with the market's expansion trajectory.

Russia Data Center Rack Market Market Size (In Million)

Several key trends are shaping the Russian data center rack market. The increasing adoption of hyperscale data centers, driven by cloud service providers and large enterprises, is a primary growth catalyst. Furthermore, the rising implementation of edge computing is creating localized demand for smaller form-factor racks, such as quarter racks, in remote or distributed locations. This diversification in demand across different rack sizes caters to a broader spectrum of end-user needs. However, the market faces certain restraints, including the upfront capital investment required for data center construction and upgrades, as well as potential geopolitical uncertainties that could impact supply chains and foreign investment. Despite these challenges, the inherent growth in data generation and the continuous need for robust IT infrastructure are expected to drive sustained market development. Key players are actively innovating to offer advanced cooling solutions, improved power distribution, and enhanced security features within their rack offerings to capture market share.

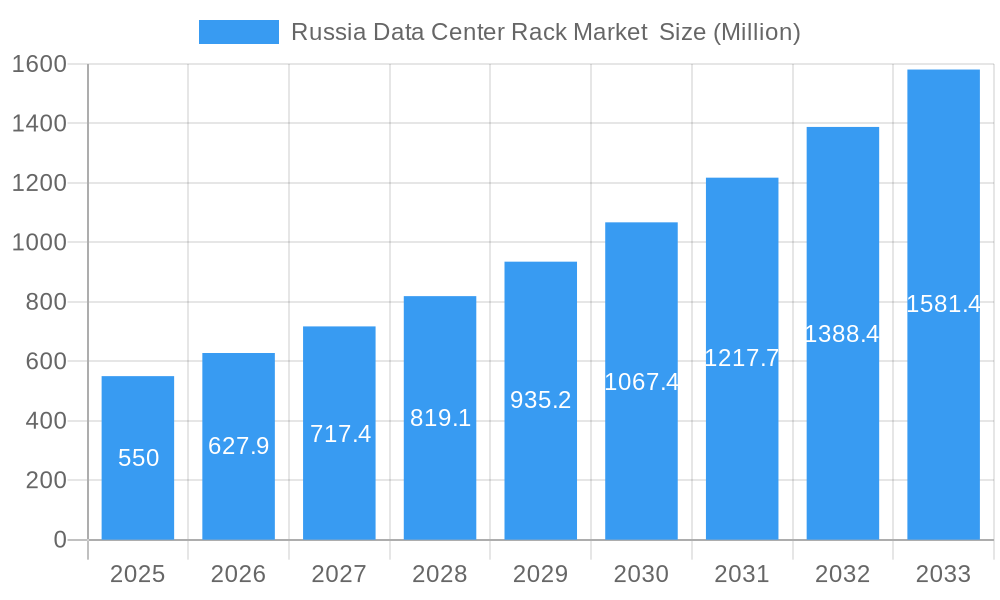

Russia Data Center Rack Market Company Market Share

This in-depth report provides a strategic overview of the Russia Data Center Rack Market, offering critical insights into its structure, growth trajectory, and future potential. Analyzing market dynamics from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for data center infrastructure providers, equipment manufacturers, IT decision-makers, and investors seeking to understand and capitalize on the evolving Russian data center landscape. We meticulously examine various market segments, including Rack Size (Quarter Rack, Half Rack, Full Rack) and End-Users (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users), to deliver a granular understanding of market penetration and adoption rates. Values are presented in Million units for clarity and actionable decision-making.

Russia Data Center Rack Market Market Dynamics & Structure

The Russia Data Center Rack Market exhibits a moderate concentration, with key players vying for dominance through technological innovation and strategic expansion. Several factors influence this dynamic landscape. Regulatory frameworks, while evolving, are increasingly aligning with global data localization mandates, driving demand for on-premises and co-location facilities. Technological innovation, particularly in areas like modular data centers and advanced cooling solutions, is a significant driver, enabling more efficient and scalable infrastructure deployments. Competitive product substitutes, such as pre-fabricated solutions and cloud-based infrastructure, also play a role, pushing rack manufacturers to enhance product features and cost-effectiveness. End-user demographics are shifting, with a growing demand from the IT & Telecommunication and BFSI sectors for robust and secure data storage and processing capabilities. Mergers and acquisitions (M&A) trends, while not yet defining the market, are anticipated to accelerate as larger entities seek to consolidate their presence and expand their service offerings.

- Market Concentration: Moderate, with a few key players holding significant market share.

- Technological Innovation: Driven by advancements in cooling, power efficiency, and modular designs.

- Regulatory Frameworks: Influenced by data localization laws and data privacy regulations.

- Competitive Substitutes: Cloud services and pre-fabricated data center modules.

- End-User Demographics: Growing demand from IT & Telecommunication and BFSI sectors.

- M&A Trends: Emerging as a strategy for market consolidation and expansion.

Russia Data Center Rack Market Growth Trends & Insights

The Russia Data Center Rack Market is poised for substantial growth, propelled by the accelerating digital transformation across various industries. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) during the forecast period, reflecting increasing investments in data center infrastructure. Adoption rates for advanced rack solutions are on an upward trajectory, driven by the need for higher density, improved thermal management, and enhanced security features. Technological disruptions, such as the increasing adoption of AI and Big Data analytics, are creating a demand for more powerful and efficient computing environments, directly impacting rack specifications and functionality. Consumer behavior shifts are also evident, with businesses prioritizing reliability, scalability, and cost-effectiveness in their data center rack procurements. The market penetration of specialized rack solutions designed for specific applications, like high-performance computing, is expected to rise significantly.

The increasing reliance on digital services and the burgeoning volume of data generated necessitate the expansion and modernization of data center facilities. This fundamental shift underpins the robust growth observed in the Russia Data Center Rack Market. The ongoing digitalization of critical sectors, including finance and telecommunications, requires significant investments in secure and high-capacity data storage and processing. Consequently, the demand for data center racks, the fundamental building blocks of these facilities, is experiencing a corresponding surge.

Furthermore, the evolving nature of technology, with advancements in areas like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), is creating new demands for computing power and data handling capabilities. This, in turn, is driving the adoption of higher-density rack solutions that can accommodate more powerful servers and networking equipment within a smaller footprint. The need for improved thermal management is also a key trend, as increased computing power generates more heat, requiring sophisticated cooling solutions integrated within or around the data center racks.

The competitive landscape is characterized by a dynamic interplay of established global players and emerging local manufacturers, each striving to offer innovative and cost-effective solutions. The market is witnessing a growing emphasis on sustainability and energy efficiency, with rack designs increasingly incorporating features that minimize power consumption and environmental impact. This aligns with global trends and governmental initiatives aimed at promoting greener IT infrastructure.

In terms of market penetration, the IT & Telecommunication sector continues to be a primary driver, followed closely by the BFSI segment, which demands high levels of security and uptime. The government sector, with its increasing focus on e-governance and data localization, is also a significant contributor to market growth. The Media & Entertainment industry's reliance on data-intensive operations, such as content creation and streaming, further fuels the demand for robust data center infrastructure.

The forecast period anticipates continued expansion, driven by both the build-out of new data centers and the modernization of existing facilities. Investments in edge computing and specialized data processing hubs are also expected to contribute to market growth. The Russia Data Center Rack Market is therefore not just a market for physical hardware but a critical enabler of the broader digital economy, poised for sustained and significant expansion.

Dominant Regions, Countries, or Segments in Russia Data Center Rack Market

Within the Russia Data Center Rack Market, the IT & Telecommunication segment stands out as the dominant force driving growth. This dominance is fueled by several interconnected factors, including the rapid expansion of digital services, increasing internet penetration, and the ongoing rollout of 5G networks. The telecommunications industry's perpetual need for infrastructure upgrades and capacity expansion directly translates into a consistent and substantial demand for data center racks.

The Full Rack size segment also exhibits significant dominance, reflecting the industry's need for scalable and high-density solutions. As data volumes escalate and computing power requirements grow, organizations are opting for full racks to maximize space utilization and accommodate a larger number of servers, storage devices, and networking equipment. This allows for greater consolidation and simplifies infrastructure management.

Dominant Segment (End-User): IT & Telecommunication

- Key Drivers:

- Rapid expansion of digital services and cloud adoption.

- Ongoing 5G network deployment and infrastructure upgrades.

- Increasing demand for data processing and storage capacity.

- Growth of online gaming and content streaming platforms.

- Market Share Contribution: Projected to account for a significant portion of the overall market demand due to continuous infrastructure investments.

- Key Drivers:

Dominant Segment (Rack Size): Full Rack

- Key Drivers:

- Need for high-density server deployments to optimize space utilization.

- Scalability to accommodate growing data volumes and computing needs.

- Cost-effectiveness for large-scale deployments compared to smaller rack sizes.

- Simplified management and maintenance of consolidated infrastructure.

- Growth Potential: Expected to maintain its leading position as organizations focus on efficient data center build-outs.

- Key Drivers:

While other segments like BFSI and Government are crucial and experiencing steady growth, the sheer scale of infrastructure required by the IT & Telecommunication sector, coupled with the efficiency benefits offered by full racks, solidifies their dominant positions. The economic policies encouraging digital transformation and infrastructure development in Russia further bolster the growth of these dominant segments, creating a fertile ground for data center rack manufacturers and suppliers. The continued investment in technological advancements within these sectors will ensure sustained demand for advanced and robust data center rack solutions.

Russia Data Center Rack Market Product Landscape

The Russia Data Center Rack Market's product landscape is characterized by increasing innovation focused on high-density configurations, advanced cooling integration, and enhanced modularity. Manufacturers are developing racks that can accommodate more powerful servers and networking equipment, often featuring specialized airflow management systems, such as hot-aisle/cold-aisle containment solutions, to optimize thermal performance. The emphasis is on delivering products that not only provide robust physical support but also contribute to the overall efficiency and sustainability of the data center. Unique selling propositions include features like integrated power distribution units (PDUs), robust cable management systems, and customizable configurations to meet diverse client requirements. Technological advancements are geared towards simplifying installation, improving accessibility for maintenance, and ensuring the highest levels of physical security for critical IT assets.

Key Drivers, Barriers & Challenges in Russia Data Center Rack Market

Key Drivers:

The Russia Data Center Rack Market is primarily propelled by the accelerating digital transformation across industries, leading to increased demand for data storage and processing capabilities. The growing adoption of cloud computing, Big Data analytics, and AI technologies necessitates the expansion and modernization of data center infrastructure. Government initiatives supporting digitalization and data localization policies further act as significant catalysts. Technological advancements in rack design, such as improved thermal management and higher density solutions, are also crucial drivers, enabling more efficient and scalable data center operations. The continuous need for reliable and secure IT infrastructure in sectors like IT & Telecommunication and BFSI underpins sustained market growth.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces several barriers and challenges. Fluctuations in raw material prices, particularly steel, can impact manufacturing costs and pricing strategies. Geopolitical factors and international sanctions can introduce supply chain disruptions and affect the availability of specialized components. The high capital investment required for establishing and expanding data centers can be a deterrent for some organizations. Intense competition among both domestic and international players can lead to price wars, squeezing profit margins. Furthermore, a shortage of skilled IT professionals for managing and maintaining advanced data center infrastructure can also pose a challenge. Regulatory complexities and evolving compliance standards can also present hurdles for market entrants and existing players.

Emerging Opportunities in Russia Data Center Rack Market

Emerging opportunities in the Russia Data Center Rack Market lie in the growth of edge computing deployments and the increasing demand for specialized, high-performance computing (HPC) racks. As organizations seek to reduce latency and process data closer to the source, edge data centers will proliferate, creating a need for compact and ruggedized rack solutions. The burgeoning AI and machine learning sectors are also driving demand for HPC racks designed to house powerful GPUs and specialized processing units. Furthermore, there's an untapped market for sustainable and energy-efficient rack solutions, aligning with global environmental concerns. Opportunities also exist in offering comprehensive rack integration services, including power, cooling, and cabling, to provide end-to-end solutions for data center builders.

Growth Accelerators in the Russia Data Center Rack Market Industry

Several key catalysts are accelerating long-term growth in the Russia Data Center Rack Market. The continuous technological breakthroughs in server efficiency and density are creating a perpetual demand for advanced rack solutions that can house these evolving hardware configurations. Strategic partnerships between rack manufacturers and cloud service providers, as well as colocation data center operators, are crucial for expanding market reach and understanding evolving customer needs. Furthermore, market expansion strategies, including the development of localized manufacturing capabilities and the penetration of emerging regions within Russia, are significant growth accelerators. Investments in research and development to create innovative, customizable, and environmentally friendly rack solutions will also be pivotal in capturing future market share.

Key Players Shaping the Russia Data Center Rack Market Market

- Startech com Group

- Lepin Network

- Delta Electronics Inc

- AIC Inc

- Ningbo Gelante Electric Co Ltd

- Topwell Technology Group Limited

- Yuyao Sunpln Communication Equipment Co Ltd

- Rittal GMBH & Co KG

- Takachi Electronics Enclosure Co Ltd

- Verotec Limited

Notable Milestones in Russia Data Center Rack Market Sector

- 2021: Increased government investment in digital infrastructure initiatives, boosting data center expansion projects.

- 2022: Launch of new high-density rack solutions by key manufacturers to support growing server demands.

- 2023: Growing adoption of modular data center designs, influencing rack form factors and integration.

- 2024: Enhanced focus on energy-efficient rack designs and cooling integration due to rising operational costs.

- 2025 (Estimated): Expected surge in demand from BFSI sector for enhanced security and compliance-ready racks.

- 2026-2028: Anticipated strategic partnerships and potential M&A activities to consolidate market presence.

- 2029-2033: Continued innovation in smart racks with integrated monitoring and automation capabilities.

In-Depth Russia Data Center Rack Market Market Outlook

The future outlook for the Russia Data Center Rack Market remains highly promising, fueled by an unwavering commitment to digital transformation and technological advancement. Growth accelerators, including relentless innovation in hardware density and power efficiency, alongside strategic collaborations between manufacturers and key data center stakeholders, will continue to shape the market. The expansion into emerging regions and the development of sustainable, intelligent rack solutions represent significant strategic opportunities. This forward-looking approach positions the market for sustained growth and increased value creation throughout the forecast period.

Russia Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Russia Data Center Rack Market Segmentation By Geography

- 1. Russia

Russia Data Center Rack Market Regional Market Share

Geographic Coverage of Russia Data Center Rack Market

Russia Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Migration to Cloud-based Business Operations; Internet Adoption and Information Technology Services to Boost Market Progress

- 3.3. Market Restrains

- 3.3.1. Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. BFSI Sector Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Data Center Rack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Startech com Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lepin Network

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delta Electronics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIC Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ningbo Gelante Electric Co Ltd *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Topwell Technology Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yuyao Sunpln Communication Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rittal GMBH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Takachi Electronics Enclosure Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Verotec Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Startech com Group

List of Figures

- Figure 1: Russia Data Center Rack Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Data Center Rack Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Data Center Rack Market Revenue Million Forecast, by Rack Size 2020 & 2033

- Table 2: Russia Data Center Rack Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Russia Data Center Rack Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Russia Data Center Rack Market Revenue Million Forecast, by Rack Size 2020 & 2033

- Table 5: Russia Data Center Rack Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Russia Data Center Rack Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Data Center Rack Market ?

The projected CAGR is approximately 14.20%.

2. Which companies are prominent players in the Russia Data Center Rack Market ?

Key companies in the market include Startech com Group, Lepin Network, Delta Electronics Inc, AIC Inc, Ningbo Gelante Electric Co Ltd *List Not Exhaustive, Topwell Technology Group Limited, Yuyao Sunpln Communication Equipment Co Ltd, Rittal GMBH & Co KG, Takachi Electronics Enclosure Co Ltd, Verotec Limited.

3. What are the main segments of the Russia Data Center Rack Market ?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Migration to Cloud-based Business Operations; Internet Adoption and Information Technology Services to Boost Market Progress.

6. What are the notable trends driving market growth?

BFSI Sector Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Data Center Rack Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Data Center Rack Market ?

To stay informed about further developments, trends, and reports in the Russia Data Center Rack Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence