Key Insights

The Saudi Arabian e-commerce eyewear market is poised for significant expansion, driven by widespread internet and smartphone adoption, a youthful, fashion-forward demographic, and a rapidly growing e-commerce ecosystem. Key growth catalysts include the unparalleled convenience, extensive product selection, and competitive pricing offered online, surpassing traditional retail limitations. While specific Saudi Arabian market data is limited, projections based on the Middle East & Africa (MEA) region's projected 7.89% CAGR and Saudi Arabia's substantial economic influence suggest a robust market. Rising disposable incomes and a strong consumer preference for online purchasing further fuel this growth. The market is segmented by end-user (men, women, unisex) and product type (spectacles, sunglasses, contact lenses, others). Sunglasses and spectacles are expected to lead, influenced by fashion trends and optical correction demands. The competitive arena features prominent international entities such as EssilorLuxottica alongside agile local businesses. Key challenges include ensuring product authenticity, optimizing delivery logistics, and establishing robust customer service to foster online trust. Future growth is contingent on effectively addressing these hurdles, enhancing digital infrastructure, and building consumer confidence. Strategic collaborations between e-commerce platforms and eyewear brands will be vital for maximizing market reach and future expansion.

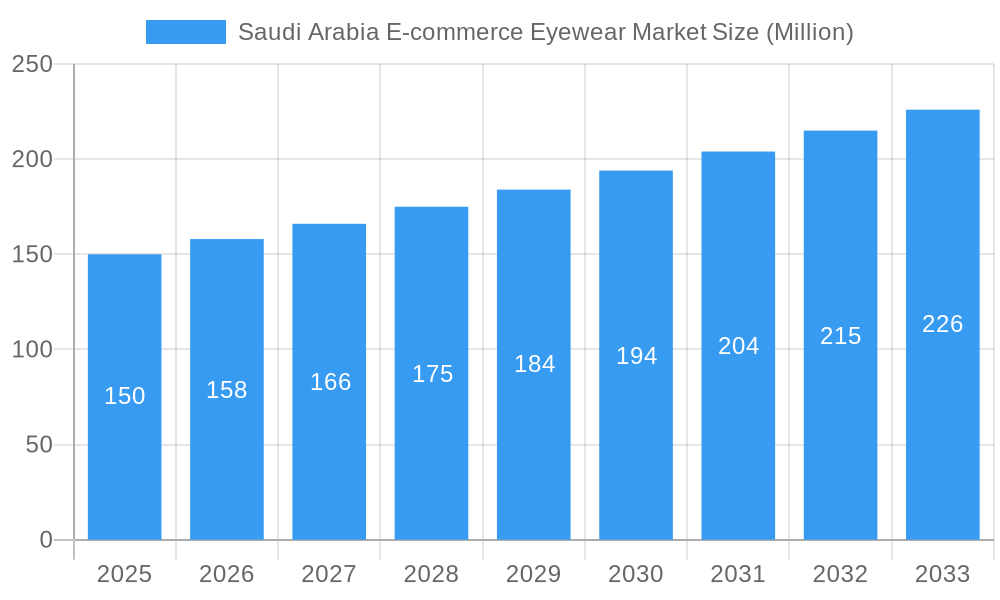

Saudi Arabia E-commerce Eyewear Market Market Size (In Million)

The market trajectory indicates substantial growth potential from the base year 2025 through 2033. Companies seeking to leverage this opportunity should prioritize digital marketing initiatives, implement virtual try-on technologies, and offer secure payment solutions. The proliferation of mobile commerce and advancements in last-mile delivery services will further accelerate market expansion. Technological innovations and a growing demand for bespoke products will increasingly shift focus towards personalized and customized eyewear offerings. Intensified competition will necessitate continuous innovation and adaptation to evolving consumer preferences. This dynamic landscape presents opportunities for both established players and emerging businesses, with e-commerce-centric strategies being paramount for sustained success. The estimated market size for Saudi Arabia's e-commerce eyewear sector is projected to reach 632.6 million by 2033.

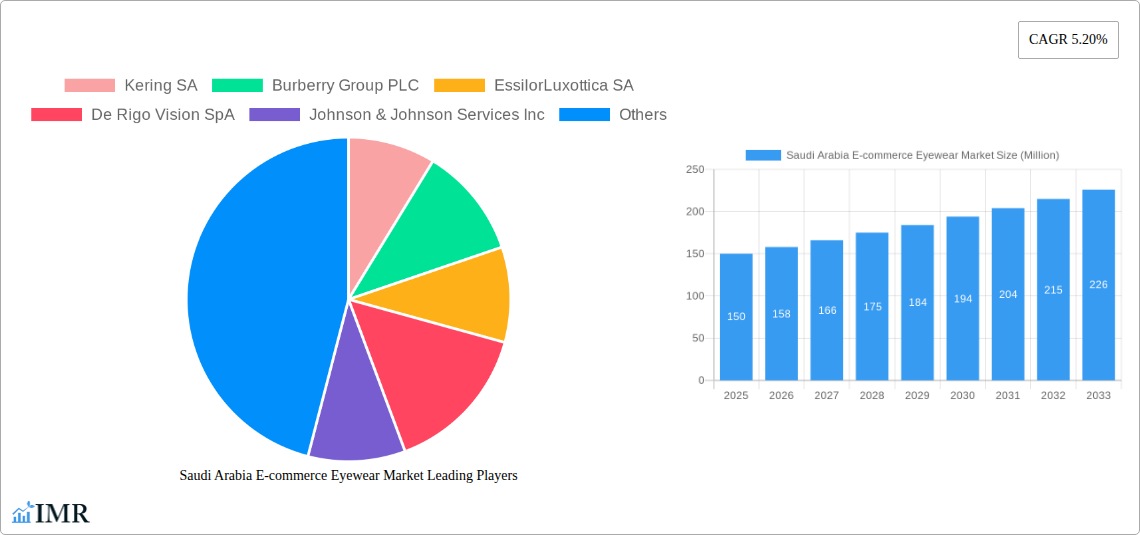

Saudi Arabia E-commerce Eyewear Market Company Market Share

Saudi Arabia E-commerce Eyewear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Saudi Arabia e-commerce eyewear market, covering market dynamics, growth trends, key players, and future opportunities. With a focus on both parent (e-commerce) and child (eyewear) markets, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

Saudi Arabia E-commerce Eyewear Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Saudi Arabian e-commerce eyewear sector. The market is characterized by a mix of established international brands and emerging local players, resulting in a moderately concentrated market structure. We estimate the market share of the top 5 players to be approximately xx%.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller competitors.

- Technological Innovation: Driving factors include augmented reality (AR) fitting tools, personalized lens recommendations, and improved online shopping experiences. Barriers to innovation include the need for significant investments in technology and infrastructure.

- Regulatory Framework: Government regulations concerning online sales, product safety, and consumer protection influence market dynamics.

- Competitive Product Substitutes: Contact lenses and other vision correction methods pose some competitive pressure on the spectacles and sunglasses market segments.

- End-User Demographics: A significant portion of the market is comprised of young adults (18-35), with a growing segment of older consumers embracing online purchasing. The gender distribution is relatively balanced across men and women.

- M&A Trends: The past five years have witnessed xx M&A deals in the Saudi Arabian e-commerce market, indicating a moderate level of consolidation.

Saudi Arabia E-commerce Eyewear Market Growth Trends & Insights

The Saudi Arabia e-commerce eyewear market has witnessed substantial growth between 2019 and 2024, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for online shopping convenience. The market is expected to continue its expansion, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration is currently estimated at xx% and projected to reach xx% by 2033. Technological disruptions, such as the integration of AR and AI, are further accelerating market growth. Changing consumer preferences towards fashionable eyewear and personalized vision solutions are also contributing to the growth trajectory.

Dominant Regions, Countries, or Segments in Saudi Arabia E-commerce Eyewear Market

The major cities in Saudi Arabia, such as Riyadh, Jeddah, and Dammam, dominate the e-commerce eyewear market due to higher internet penetration, greater disposable incomes, and established e-commerce infrastructure. The sunglasses segment currently holds the largest market share due to its strong fashion appeal and the high prevalence of sunny weather.

- End-User: The demand from both Men and Women segments is nearly equally distributed. Unisex styles are experiencing consistent growth.

- Product Category: Sunglasses, driven by fashion trends, dominate the market. The Spectacles segment shows strong growth potential with rising awareness of eye health and vision correction. Contact lenses demonstrate slower growth.

- Key Drivers: Rising disposable incomes, increasing internet and smartphone penetration, and a young, fashion-conscious population.

Saudi Arabia E-commerce Eyewear Market Product Landscape

The Saudi Arabian e-commerce eyewear market offers a diverse range of products, from classic designs to cutting-edge styles. Sunglasses feature innovative materials, polarized lenses, and UV protection enhancements. Spectacles include a variety of frame materials, lens coatings, and personalized prescription options. Contact lenses offer daily disposables, extended wear options, and advanced lens technologies. A unique selling proposition (USP) in this market is the offering of customized products and personalized online fitting experiences.

Key Drivers, Barriers & Challenges in Saudi Arabia E-commerce Eyewear Market

Key Drivers: Growing online retail penetration, rising disposable incomes, increasing fashion consciousness, and technological advancements like AR fitting.

Key Challenges: Maintaining trust and authenticity in an online environment, managing logistics and delivery effectively, and navigating potential regulatory hurdles related to online sales and product standards. Counterfeit products pose a significant challenge, potentially impacting the market size by xx Million units annually.

Emerging Opportunities in Saudi Arabia E-commerce Eyewear Market

Untapped opportunities exist in reaching rural populations through improved logistics and expanding product offerings to cater to specific needs such as sports eyewear and protective eyewear. The integration of telehealth platforms with e-commerce platforms offers significant opportunities for personalized vision care and convenient product delivery.

Growth Accelerators in the Saudi Arabia E-commerce Eyewear Market Industry

Strategic partnerships between eyewear brands and major e-commerce platforms, coupled with increased investments in technology and logistics, will fuel market growth. Furthermore, innovative marketing campaigns targeting specific consumer segments and leveraging social media influencers will accelerate adoption.

Key Players Shaping the Saudi Arabia E-commerce Eyewear Market Market

- Kering SA

- Burberry Group PLC

- EssilorLuxottica SA

- De Rigo Vision SpA

- Johnson & Johnson Services Inc

- Alcon Laboratories Inc

- LVMH Moët Hennessy Louis Vuitton

- Safilo Group S p A

- Charmant Group

- Bausch Health Companies Inc

Notable Milestones in Saudi Arabia E-commerce Eyewear Market Sector

- November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, the Ray-Ban Legacy sunglasses.

- July 2022: Lenskart partnered with noon.com to expand its presence in the region.

- February 2021: Safilo Group unveiled a travel retail-exclusive pair of Jimmy Choo sunglasses.

In-Depth Saudi Arabia E-commerce Eyewear Market Market Outlook

The Saudi Arabia e-commerce eyewear market is poised for continued robust growth. Technological advancements, strategic partnerships, and evolving consumer preferences will drive expansion. The focus on providing personalized experiences and leveraging omnichannel strategies will be crucial for success in this dynamic and rapidly growing market. The market is projected to reach xx Million units by 2033.

Saudi Arabia E-commerce Eyewear Market Segmentation

-

1. Product Category

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

Saudi Arabia E-commerce Eyewear Market Segmentation By Geography

- 1. Saudi Arabia

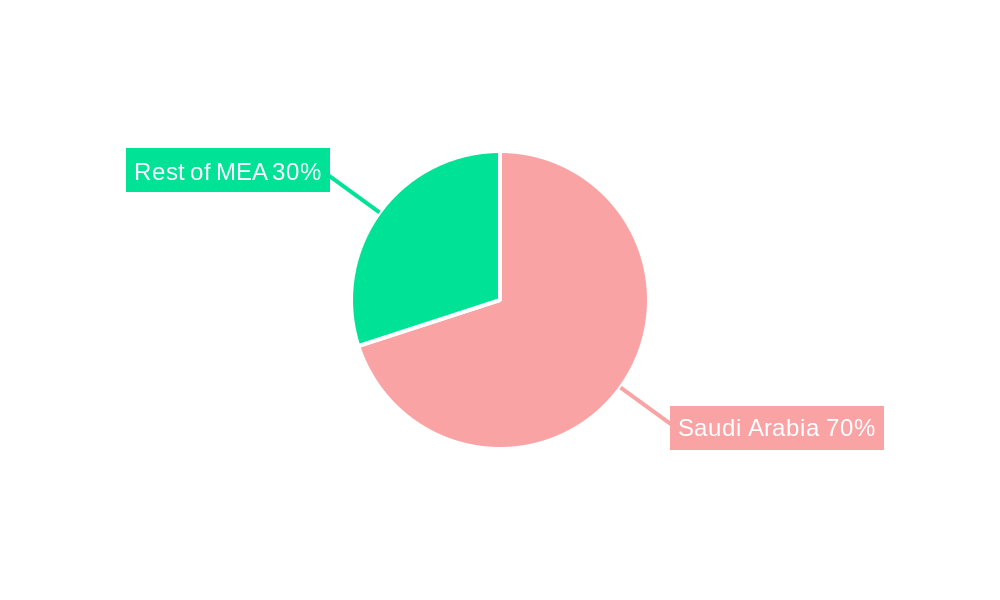

Saudi Arabia E-commerce Eyewear Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Eyewear Market

Saudi Arabia E-commerce Eyewear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Booming Online Retail Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Eyewear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kering SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Burberry Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EssilorLuxottica SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Rigo Vision SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Laboratories Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moët Hennessy Louis Vuitton

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safilo Group S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charmant Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bausch Health Companies Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kering SA

List of Figures

- Figure 1: Saudi Arabia E-commerce Eyewear Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Eyewear Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 2: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Product Category 2020 & 2033

- Table 5: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Saudi Arabia E-commerce Eyewear Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Eyewear Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Eyewear Market?

Key companies in the market include Kering SA, Burberry Group PLC, EssilorLuxottica SA, De Rigo Vision SpA, Johnson & Johnson Services Inc, Alcon Laboratories Inc *List Not Exhaustive, LVMH Moët Hennessy Louis Vuitton, Safilo Group S p A, Charmant Group, Bausch Health Companies Inc.

3. What are the main segments of the Saudi Arabia E-commerce Eyewear Market?

The market segments include Product Category, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 632.6 million as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Booming Online Retail Industry.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Ray-Ban launched its first-ever Middle East-exclusive product, the Ray-Ban Legacy. The sunglasses came in a classic black, featuring gold detailing on the temples and a gold Ray-Ban logo. The sunglasses are a mix of modernity and ancestry, and their pair came in a custom-designed box showcasing the symbolic "shemagh" print, with the intricate packaging highlighting the brand's first Middle East exclusive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Eyewear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Eyewear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Eyewear Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Eyewear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence