Key Insights

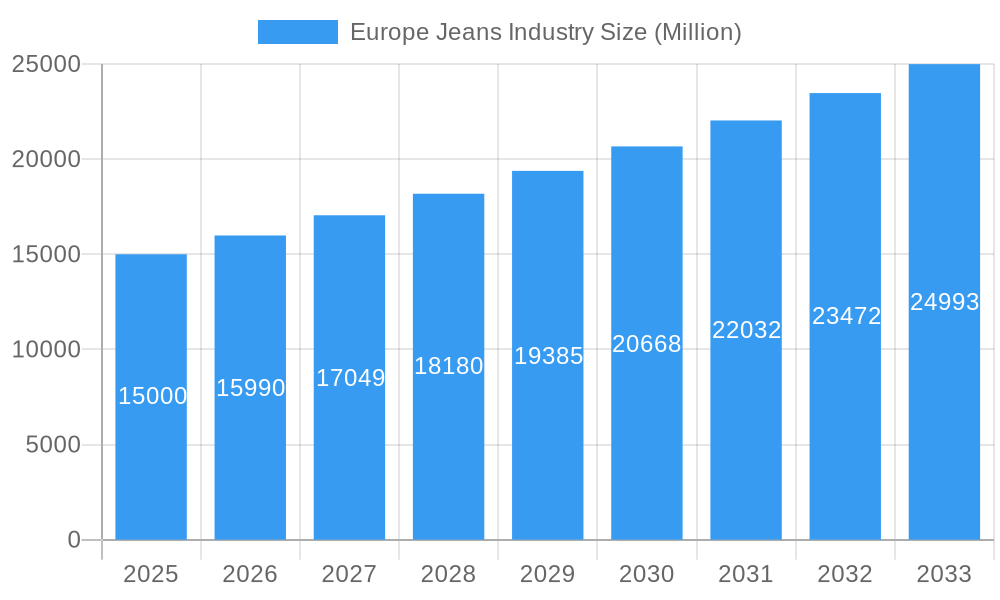

The European jeans market, valued at approximately €22614.4 million in 2024, is poised for significant expansion. This growth is propelled by a growing young adult demographic favoring casual attire and increasing disposable incomes across key European economies. The market is observing a pronounced trend towards premium and sustainable denim, driven by heightened consumer consciousness regarding ethical and environmental impacts. Brands are actively innovating with sustainable materials, eco-friendly production, and influencer collaborations to attract this discerning segment. While e-commerce channels continue to gain traction, traditional retail formats, including specialty stores and supermarkets, retain a substantial market presence, serving diverse consumer needs and price sensitivities. Germany, France, and the UK lead market share, with the Netherlands and Sweden demonstrating considerable growth potential.

Europe Jeans Industry Market Size (In Billion)

Anticipated at a Compound Annual Growth Rate (CAGR) of 5.9% from 2024 to 2033, this sustained expansion is underpinned by the enduring appeal of jeans across demographics and the industry's adaptive capacity to evolving consumer preferences. The strategic diversification of distribution, encompassing both e-commerce growth and established retail networks, ensures broad consumer accessibility. A steadfast commitment to sustainability and ethical sourcing will remain a critical differentiator, shaping future production methodologies and material selections by leading brands. Market segmentation by gender and age, with varied price points and styles, facilitates targeted marketing efforts and further market penetration.

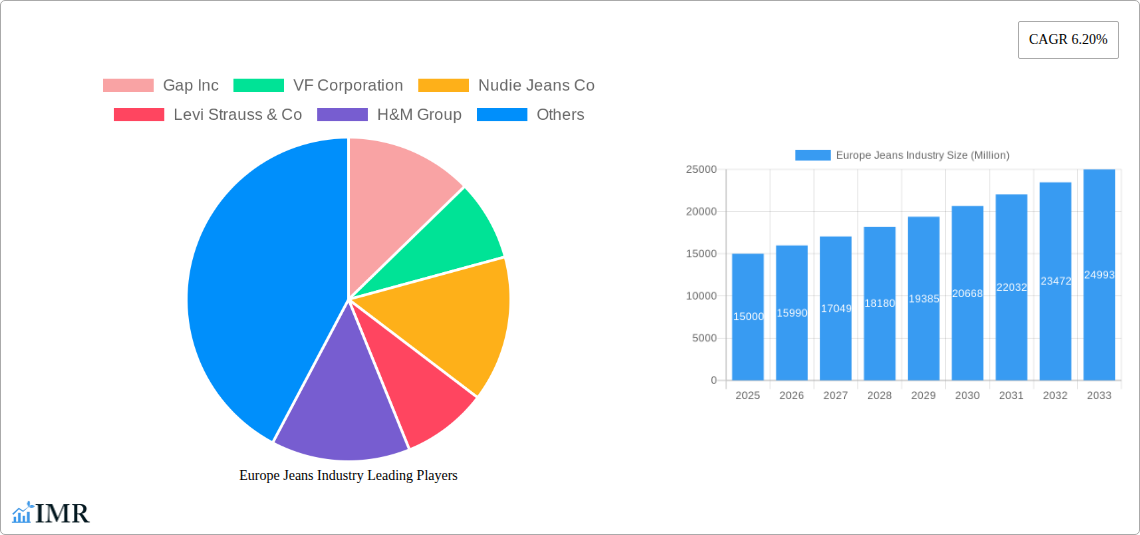

Europe Jeans Industry Company Market Share

Europe Jeans Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European jeans industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year. It segments the market by end-user (men, women, children), category (mass, premium), and distribution channel (supermarket/hypermarket, specialty stores, online retail stores, other). This in-depth analysis is crucial for businesses, investors, and industry professionals seeking to navigate this dynamic market.

Keywords: Europe Jeans Industry, Jeans Market, Denim Market, European Apparel Market, Mass Market Jeans, Premium Jeans, Online Jeans Retail, Jeans Distribution, Denim Trends, Gap Inc, VF Corporation, Levi Strauss & Co, H&M Group, Market Size, Market Share, CAGR, Market Forecast, Industry Analysis, Competitive Landscape, Market Segmentation.

Europe Jeans Industry Market Dynamics & Structure

The European jeans market is a highly competitive landscape characterized by a blend of established giants and emerging brands. Market concentration is moderate, with several key players holding significant market share, but also a considerable presence of smaller, niche brands. Technological innovation, primarily in sustainable manufacturing and improved fabric technology, is a key driver. Stringent regulatory frameworks concerning ethical sourcing, water usage, and waste management are shaping industry practices. Competitive product substitutes, such as leggings and other comfortable pants, exert pressure on market growth. End-user demographics are shifting, with increasing demand from younger consumers focusing on sustainable and ethically produced jeans. M&A activity has been relatively moderate in recent years, though strategic partnerships are becoming increasingly common.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on sustainable materials (organic cotton, recycled denim), improved comfort and fit through advanced fabric technology.

- Regulatory Framework: Stringent environmental regulations impacting manufacturing processes and supply chains.

- Competitive Substitutes: Leggings, joggers, and other comfortable alternatives are impacting jean demand.

- M&A Activity: xx deals recorded between 2019-2024, with a predicted xx deals for 2025-2033.

- End-User Demographics: Growing demand from millennials and Gen Z, focusing on sustainable and ethical products.

Europe Jeans Industry Growth Trends & Insights

The European jeans market experienced a CAGR of xx% during the historical period (2019-2024). Market size in 2024 reached approximately xx million units, projected to reach xx million units in 2025 and xx million units by 2033. Adoption rates of sustainable and ethically produced jeans are increasing significantly, driven by heightened consumer awareness. Technological disruptions, such as improved manufacturing processes and innovative fabric technologies, are enhancing product quality and reducing environmental impact. Consumer behavior is shifting towards online purchasing, impacting distribution channels and requiring brands to adapt their retail strategies. Premium segment growth outpaces the mass market segment, demonstrating a willingness to pay more for higher quality, sustainable, and ethically sourced jeans.

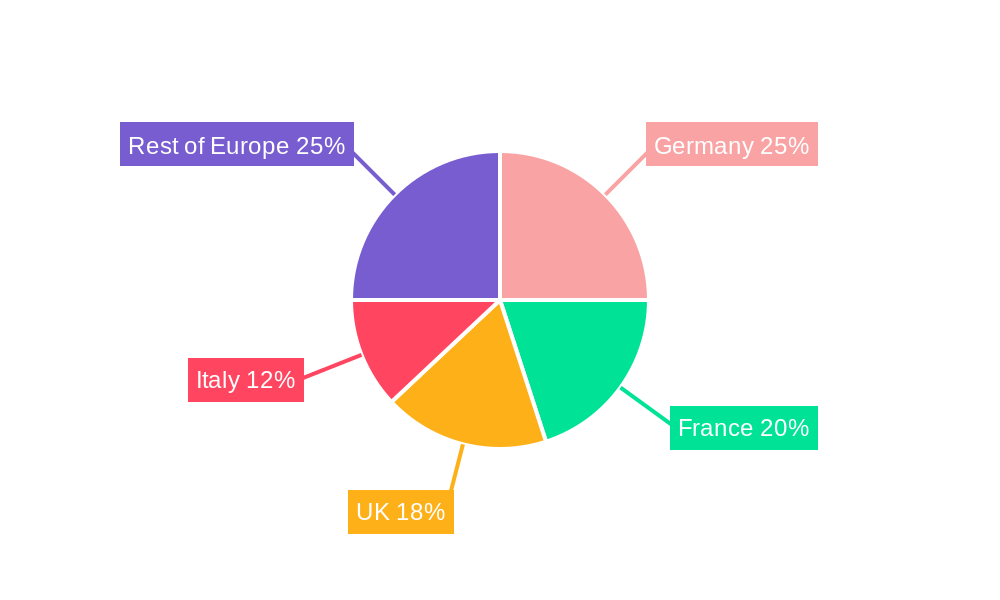

Dominant Regions, Countries, or Segments in Europe Jeans Industry

Western Europe, particularly Germany, France, and the UK, are the dominant regions in the European jeans market. These countries possess established retail infrastructure and high consumer spending power. Within end-user segments, men's jeans hold the largest market share, followed by women's and children's segments. The premium segment demonstrates higher growth potential compared to the mass market, driven by consumer demand for higher-quality and sustainable options. Online retail stores are experiencing significant growth as a distribution channel, surpassing supermarket/hypermarkets in certain segments.

- Key Drivers: Strong consumer spending in Western Europe, growing online retail sector, increasing demand for premium and sustainable options.

- Dominant Regions: Western Europe (Germany, France, UK) account for approximately xx% of market share.

- Dominant Segments: Men's jeans (xx% market share), Premium category (xx% growth rate).

- Dominant Distribution Channels: Online retail stores are experiencing significant growth (xx% CAGR).

Europe Jeans Industry Product Landscape

Product innovation in the European jeans industry focuses on sustainable materials, improved fits and styles, and enhanced durability. New technologies include innovative weaving techniques, advanced finishes offering water resistance or stretch properties, and the use of recycled or organically sourced denim. Unique selling propositions encompass ethical sourcing, transparency in supply chains, and superior comfort and longevity. Technological advancements center on sustainable and efficient manufacturing processes, reducing the environmental footprint of denim production.

Key Drivers, Barriers & Challenges in Europe Jeans Industry

Key Drivers: Growing consumer demand for sustainable fashion, increasing preference for online shopping, technological innovations leading to enhanced comfort and durability, expanding middle class in emerging European markets.

Challenges and Restraints: Fluctuating raw material prices, increased competition from fast-fashion brands, concerns over supply chain disruptions and ethical sourcing, strict environmental regulations impacting manufacturing costs, and maintaining consistent high-quality products. Supply chain disruptions have resulted in an estimated xx% increase in production costs in the last year (2024).

Emerging Opportunities in Europe Jeans Industry

Untapped markets exist in Eastern Europe and Southern Europe, presenting opportunities for market expansion. The growing demand for sustainable and ethically produced jeans creates opportunities for innovative brands focusing on transparency and responsible sourcing. The integration of smart technologies, such as RFID tags, offers potential for enhanced inventory management and improved customer experience.

Growth Accelerators in the Europe Jeans Industry Industry

Technological advancements in fabric technology and manufacturing processes will drive long-term growth. Strategic partnerships between brands and sustainable material suppliers will improve product sustainability. Expansion into new markets and the continued growth of e-commerce will fuel market expansion and reach new customer segments.

Key Players Shaping the Europe Jeans Industry Market

- Gap Inc.

- VF Corporation

- Nudie Jeans Co

- Levi Strauss & Co

- H&M Group

- EDWIN Europe GmbH

- Living Craft GmbH & Co Kg

- Hiut Denim Co

- Kontoor Brands Inc

- Carhartt Inc

Notable Milestones in Europe Jeans Industry Sector

- March 2022: Gap Inc. opened its first shop-in-shop on Oxford Street, UK, through a joint venture with NEXT Plc.

- March 2022: M&S launched its first capsule collection as part of The Jeans Redesign project, focusing on responsible sourcing.

- February 2021: H&M Group's Weekday brand launched a jeans collection made with reborn textile waste.

In-Depth Europe Jeans Industry Market Outlook

The European jeans industry is poised for continued growth, driven by technological advancements, increasing demand for sustainable products, and the expansion of e-commerce. Strategic partnerships, focusing on sustainable sourcing and innovative manufacturing, will be crucial for success. Brands that successfully adapt to evolving consumer preferences and leverage technological advancements to enhance product quality and reduce environmental impact will capture significant market share. The premium segment shows the highest potential for growth, with increased consumer willingness to pay a premium for sustainable and ethically produced jeans.

Europe Jeans Industry Segmentation

-

1. End User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Specialty Stores

- 3.3. Online Retail stores

- 3.4. Other Distribution Channels

Europe Jeans Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Jeans Industry Regional Market Share

Geographic Coverage of Europe Jeans Industry

Europe Jeans Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation is Boosting the Market Growth; Increasing Innovation and Upgradation in Merchandizing Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Sports Merchandise Products

- 3.4. Market Trends

- 3.4.1. The Shifting Consumer Preference for Innovative Jeans Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. Spain

- 5.4.4. France

- 5.4.5. Italy

- 5.4.6. Russia

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. United Kingdom Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/Hypermarket

- 6.3.2. Specialty Stores

- 6.3.3. Online Retail stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Germany Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/Hypermarket

- 7.3.2. Specialty Stores

- 7.3.3. Online Retail stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Spain Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/Hypermarket

- 8.3.2. Specialty Stores

- 8.3.3. Online Retail stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. France Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarket/Hypermarket

- 9.3.2. Specialty Stores

- 9.3.3. Online Retail stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Italy Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass

- 10.2.2. Premium

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarket/Hypermarket

- 10.3.2. Specialty Stores

- 10.3.3. Online Retail stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Russia Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Men

- 11.1.2. Women

- 11.1.3. Children

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Mass

- 11.2.2. Premium

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarket/Hypermarket

- 11.3.2. Specialty Stores

- 11.3.3. Online Retail stores

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Rest of Europe Europe Jeans Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by End User

- 12.1.1. Men

- 12.1.2. Women

- 12.1.3. Children

- 12.2. Market Analysis, Insights and Forecast - by Category

- 12.2.1. Mass

- 12.2.2. Premium

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Supermarket/Hypermarket

- 12.3.2. Specialty Stores

- 12.3.3. Online Retail stores

- 12.3.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by End User

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Gap Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 VF Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nudie Jeans Co

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Levi Strauss & Co

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 H&M Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EDWIN Europe GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Living Craft GmbH & Co Kg

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hiut Denim Co*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kontoor Brands Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Carhartt Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Gap Inc

List of Figures

- Figure 1: Europe Jeans Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Jeans Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 2: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 3: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 4: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 5: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Jeans Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: Europe Jeans Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 11: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 12: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 13: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 19: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 20: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 21: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 26: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 27: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 28: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 29: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 34: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 35: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 36: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 37: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 42: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 43: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 44: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 45: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 48: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 50: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 51: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 52: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 53: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 56: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Europe Jeans Industry Revenue million Forecast, by End User 2020 & 2033

- Table 58: Europe Jeans Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 59: Europe Jeans Industry Revenue million Forecast, by Category 2020 & 2033

- Table 60: Europe Jeans Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 61: Europe Jeans Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Jeans Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Jeans Industry Revenue million Forecast, by Country 2020 & 2033

- Table 64: Europe Jeans Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Jeans Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Europe Jeans Industry?

Key companies in the market include Gap Inc, VF Corporation, Nudie Jeans Co, Levi Strauss & Co, H&M Group, EDWIN Europe GmbH, Living Craft GmbH & Co Kg, Hiut Denim Co*List Not Exhaustive, Kontoor Brands Inc, Carhartt Inc.

3. What are the main segments of the Europe Jeans Industry?

The market segments include End User, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 22614.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation is Boosting the Market Growth; Increasing Innovation and Upgradation in Merchandizing Products.

6. What are the notable trends driving market growth?

The Shifting Consumer Preference for Innovative Jeans Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Sports Merchandise Products.

8. Can you provide examples of recent developments in the market?

In March 2022, Gap Inc. opened First Shop-In-Shop on oxford street, United Kingdom through joint venture agreement with NEXT Plc.The Gap store, which has over 4,000 square feet of retail space and is the largest brand shop inside the store, represents the brand's reimagined approach to retail in the UK with an open, modern, and basic design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Jeans Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Jeans Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Jeans Industry?

To stay informed about further developments, trends, and reports in the Europe Jeans Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence