Key Insights

The North American online gambling market is experiencing robust growth, projected to reach a substantial size within the next decade. Driven by increasing smartphone penetration, readily available high-speed internet access, and a shift in consumer preferences towards digital entertainment, the market's Compound Annual Growth Rate (CAGR) of 11.78% from 2019 to 2024 indicates significant momentum. The market segmentation reveals strong performance across various segments. Sports betting, fueled by the increasing legalization and acceptance of online sports wagering across several states, is a key driver. Casino games, including slots and table games offered through online platforms, also contribute significantly to the market's expansion. The mobile segment is particularly dynamic, demonstrating rapid growth due to the convenience and accessibility of mobile gambling applications. While regulatory hurdles and concerns about responsible gambling remain potential restraints, the overall market outlook remains positive, supported by continuous technological advancements, strategic partnerships between gaming operators and technology providers, and targeted marketing campaigns focusing on enhanced user experience.

North America Online Gambling Market Market Size (In Billion)

The competitive landscape features a mix of established players like Caesars Entertainment and MGM Resorts, alongside newer entrants like DraftKings, all vying for market share. The strategic acquisitions and mergers prevalent in the industry demonstrate the intense competition and the high stakes involved. While precise market size figures for 2025 are not provided, based on the given CAGR of 11.78% from 2019-2024 and considering the sustained growth trajectory, a reasonable estimation for the 2025 market size for North America would be in the billions of dollars. Continued regulatory clarity and the development of effective responsible gambling initiatives are critical to ensuring sustainable growth and maintaining consumer trust. The regional focus on North America (specifically the United States, Canada, and Mexico) underscores the significant market potential within this region, driven by factors such as favorable legislation and high disposable incomes.

North America Online Gambling Market Company Market Share

This in-depth report provides a comprehensive analysis of the North America online gambling market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional variations, key players, and future projections, offering valuable insights for industry professionals, investors, and stakeholders. The report segments the market by device (desktop, mobile) and game type (sports betting, casino, other casino games), providing granular data for informed decision-making. Projected market value for 2025 is estimated at xx Million.

North America Online Gambling Market Dynamics & Structure

The North American online gambling market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intense competition. Market concentration is moderate, with a few major players holding significant market share, but a vibrant landscape of smaller operators also contributing. Technological advancements, such as improved mobile gaming experiences and the integration of virtual and augmented reality, are key drivers of growth. Conversely, stringent regulatory frameworks and evolving consumer preferences present both opportunities and challenges. The landscape is further shaped by mergers and acquisitions (M&A), with significant deals reshaping the competitive structure.

- Market Concentration: Moderate, with top players holding xx% market share in 2024 (estimated).

- Technological Innovation: Mobile optimization, VR/AR integration, AI-powered personalization are key drivers.

- Regulatory Frameworks: Vary significantly across states/provinces, impacting market access and growth.

- Competitive Substitutes: Traditional land-based casinos, social gaming platforms.

- End-User Demographics: Millennials and Gen Z are key demographic segments, with increasing participation from older age groups.

- M&A Trends: Significant consolidation activity, with xx major deals concluded between 2019 and 2024 (estimated).

North America Online Gambling Market Growth Trends & Insights

The North American online gambling market experienced substantial growth during the historical period (2019-2024), fueled by increased internet penetration, mobile device adoption, and the legalization of online gambling in several jurisdictions. The market is projected to continue this trajectory during the forecast period (2025-2033), driven by factors such as the expansion of regulated markets, technological advancements, and shifting consumer preferences toward digital entertainment. The CAGR for the forecast period is estimated at xx%. Market penetration is expected to reach xx% by 2033. Technological disruptions, such as the rise of esports betting and the integration of blockchain technology, will shape future growth. Consumer behavior is shifting towards mobile-first engagement, personalized gaming experiences, and responsible gaming initiatives.

Dominant Regions, Countries, or Segments in North America Online Gambling Market

The market exhibits significant regional variations. Currently, states with established regulatory frameworks and a high concentration of tech-savvy consumers, such as New Jersey, Pennsylvania, and Nevada, lead the market. However, expanding legalization across more states is projected to create new regional growth hubs. In terms of segments, the mobile segment is expected to maintain its dominance, driven by increased smartphone penetration and convenience. Sports betting and casino games constitute the largest revenue segments.

- Leading Region: New Jersey & Pennsylvania (xx% combined market share in 2024 - estimated).

- By Device: Mobile dominates (xx% in 2024 - estimated), growing faster than desktop.

- By Game Type: Sports Betting and Casino games are major contributors, with projected growth in 'Other Casino Games' segment.

- Key Drivers: Legalization efforts, growing internet and mobile penetration, favorable regulatory environments.

North America Online Gambling Market Product Landscape

The online gambling market offers a diverse range of products, from traditional casino games like slots and poker to innovative offerings such as esports betting and virtual sports. Product innovation focuses on enhancing user experience through advanced graphics, personalized recommendations, and immersive gameplay. Key performance metrics include average revenue per user (ARPU), customer acquisition cost (CAC), and player retention rates. Technological advancements such as AI-driven game design and the integration of blockchain for secure transactions are shaping the product landscape.

Key Drivers, Barriers & Challenges in North America Online Gambling Market

Key Drivers:

- Increasing legalization and regulation in more states.

- Growing smartphone penetration and mobile gaming adoption.

- Technological advancements creating immersive and personalized experiences.

Key Barriers and Challenges:

- Varying and evolving regulatory frameworks across states create complexity and uncertainty.

- Intense competition among established and emerging players.

- Concerns around responsible gaming and preventing underage gambling. xx million dollars (estimated) were lost to fraudulent activities in 2024.

Emerging Opportunities in North America Online Gambling Market

- Expansion into new states as legalization progresses.

- Integration of innovative technologies such as VR/AR and blockchain.

- Growing popularity of esports betting and virtual sports.

- Focus on personalized gaming experiences and responsible gambling initiatives.

Growth Accelerators in the North America Online Gambling Market Industry

The long-term growth of the North American online gambling market is driven by several factors, including the ongoing legalization and regulation of online gambling in more states, the continuous development and refinement of gaming technology, strategic partnerships between gaming operators and technology providers, and the expanding adoption of mobile gaming among a broader demographic base. This confluence of factors is expected to fuel significant expansion of the market during the forecast period.

Key Players Shaping the North America Online Gambling Market Market

- Slots Empire Casino

- El Royale Casino

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- The Stars Group Inc

- BoVegas

- 888 Holding PLC

- Cherry Gold Casino

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Wild Casino

- DraftKings (Golden Nugget)

Notable Milestones in North America Online Gambling Market Sector

- July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment.

- May 2022: DraftKings acquired Golden Nugget Online Gaming (GNOG).

- July 2021: Flutter Entertainment's FanDuel Group expanded its FanDuel Casino offerings in New Jersey and Michigan.

In-Depth North America Online Gambling Market Market Outlook

The North American online gambling market is poised for continued significant growth over the next decade. Strategic opportunities lie in leveraging technological advancements, expanding into newly regulated markets, focusing on responsible gaming initiatives, and forging strategic partnerships to enhance market share and reach. The long-term potential is substantial, particularly as more states legalize online gambling and consumer adoption continues to rise. The market is expected to reach xx Million by 2033.

North America Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. Device

- 2.1. Desktop

- 2.2. Mobile

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

North America Online Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

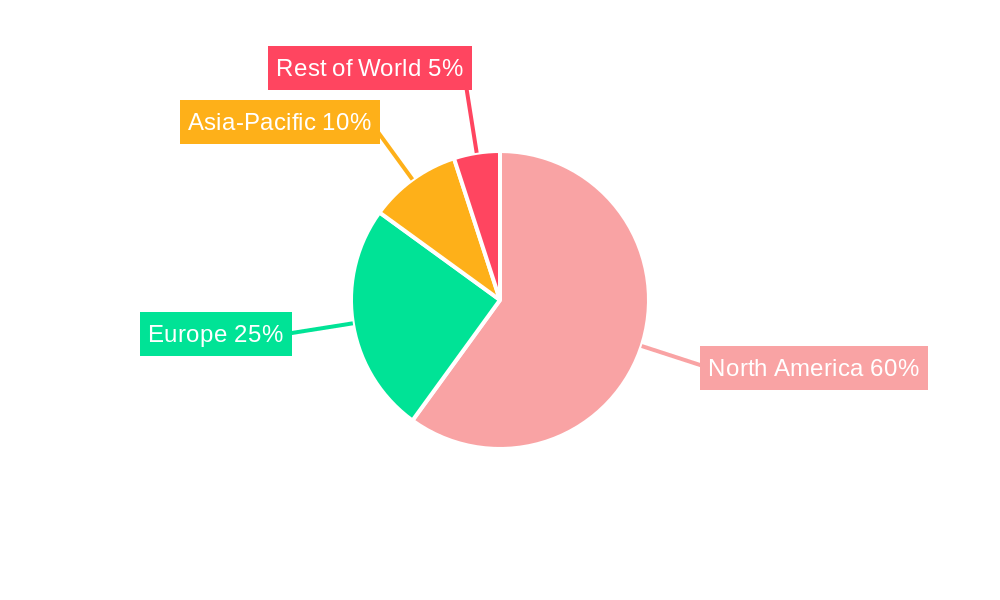

North America Online Gambling Market Regional Market Share

Geographic Coverage of North America Online Gambling Market

North America Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. United States North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Slots

- 6.1.2.3. Baccarat

- 6.1.2.4. Blackjack

- 6.1.2.5. Poker

- 6.1.2.6. Other Casino Games

- 6.1.3. Other Game Types

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Canada North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Slots

- 7.1.2.3. Baccarat

- 7.1.2.4. Blackjack

- 7.1.2.5. Poker

- 7.1.2.6. Other Casino Games

- 7.1.3. Other Game Types

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Mexico North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Slots

- 8.1.2.3. Baccarat

- 8.1.2.4. Blackjack

- 8.1.2.5. Poker

- 8.1.2.6. Other Casino Games

- 8.1.3. Other Game Types

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the North America North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Slots

- 9.1.2.3. Baccarat

- 9.1.2.4. Blackjack

- 9.1.2.5. Poker

- 9.1.2.6. Other Casino Games

- 9.1.3. Other Game Types

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Slots Empire Casino

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 El Royale Casino

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Caesars Entertainment Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutter Entertainment PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Stars Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BoVegas

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 888 Holding PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cherry Gold Casino*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MGM Resorts International (Borgata Hotel Casino & Spa)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wild Casino

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DraftKings (Golden Nugget

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 3: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 6: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 7: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 10: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 11: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 15: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 18: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 19: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Gambling Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the North America Online Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Caesars Entertainment Corporation, Flutter Entertainment PLC, The Stars Group Inc, BoVegas, 888 Holding PLC, Cherry Gold Casino*List Not Exhaustive, MGM Resorts International (Borgata Hotel Casino & Spa), Wild Casino, DraftKings (Golden Nugget.

3. What are the main segments of the North America Online Gambling Market?

The market segments include Game Type, Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth..

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. William Hill is a popular online gambling platform brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Gambling Market?

To stay informed about further developments, trends, and reports in the North America Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence