Key Insights

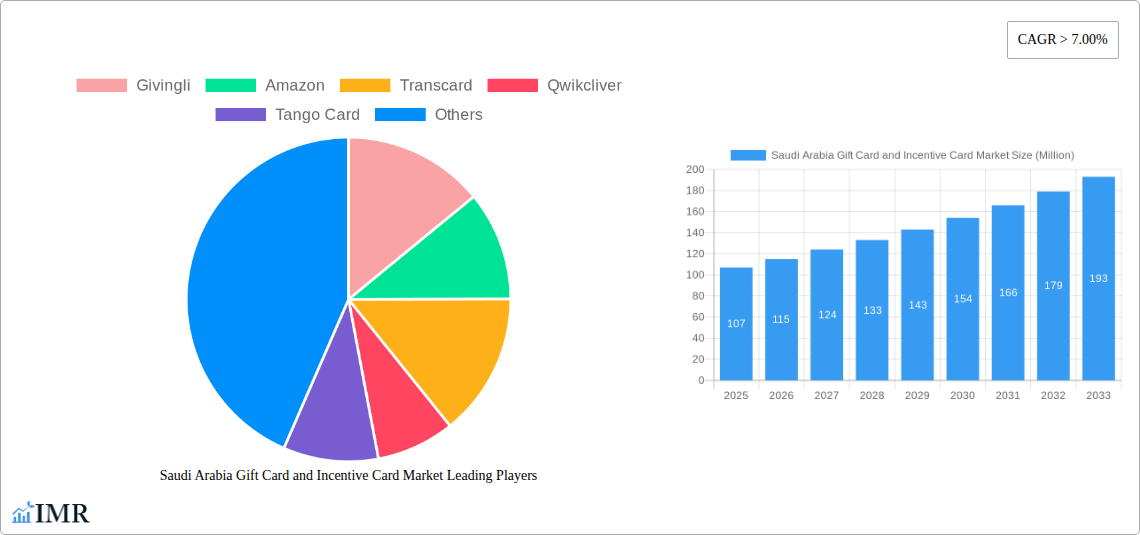

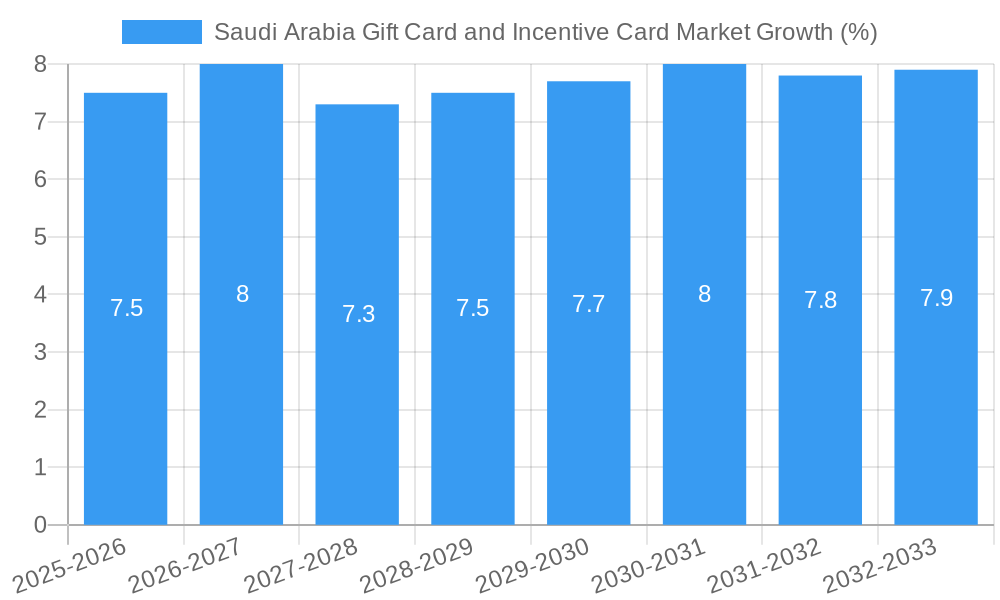

The Saudi Arabian gift card and incentive card market is experiencing robust growth, driven by increasing disposable incomes, a burgeoning e-commerce sector, and a shift towards digital gifting solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 7% from 2019 to 2024 suggests a significant upward trajectory. This growth is fueled by both individual consumers embracing gift cards for personal gifting occasions and corporations utilizing them for employee incentives and rewards programs. The preference for digital gift cards is accelerating, surpassing physical cards in popularity due to convenience and ease of distribution. Online channels are consequently playing a dominant role in market expansion. While the precise market size for 2025 is unavailable, extrapolating from the given CAGR and assuming a 2024 market size of approximately $100 million (a reasonable estimate based on regional market comparisons), we can project a 2025 market size of approximately $107 million. This estimate assumes the CAGR remains consistent, a reasonable assumption given the market's ongoing drivers. The market segmentation reveals significant potential in both corporate and individual segments, with opportunities for further penetration within the SME sector. The market also witnesses considerable competition with both established players like Amazon and regional players like Givingli catering to unique market demands. Restraints could include regulatory changes impacting digital transactions and the increasing preference for alternative forms of rewards. The dominance of the online channel suggests that companies need to invest in seamless digital platforms to reach consumers effectively.

Further growth in the Saudi Arabian gift card and incentive card market is anticipated throughout the forecast period (2025-2033). The ongoing digital transformation and increasing adoption of cashless payment methods will propel the market forward. To capitalize on the opportunities, companies should focus on personalized offerings and seamless integration with existing e-commerce platforms. Strategic partnerships with key players in the retail sector will be crucial to expand distribution channels and reach a wider consumer base. Companies should also prioritize building secure and trustworthy platforms to address consumer concerns regarding online security. Regional differences in consumer preferences also need to be carefully considered to maximize market penetration. Continued government initiatives promoting digital adoption and e-commerce will further stimulate market growth.

Saudi Arabia Gift Card and Incentive Card Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia gift card and incentive card market, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by consumer (individual, corporate), distribution channel (online, offline), and product type (e-gift card, physical card). This report is crucial for businesses, investors, and market analysts seeking a thorough understanding of this rapidly evolving market.

Saudi Arabia Gift Card and Incentive Card Market Market Dynamics & Structure

The Saudi Arabia gift card and incentive card market is experiencing significant growth fueled by increasing digital adoption, a burgeoning e-commerce sector, and a rise in corporate gifting and employee reward programs. Market concentration is currently moderate, with both established international players and local firms vying for market share. Technological innovation, particularly in digital gifting platforms and mobile payment integration, is a key driver. The regulatory framework, while generally supportive of e-commerce, requires ongoing monitoring for evolving policies related to financial transactions and data privacy.

- Market Concentration: Moderate, with a mix of large multinational corporations and smaller regional players. Market share for top 5 players is estimated at xx%.

- Technological Innovation: Focus on mobile-first solutions, integrated loyalty programs, and personalized gifting experiences.

- Regulatory Framework: Generally supportive, but evolving regulations around digital payments and data protection present both opportunities and challenges.

- Competitive Substitutes: Cash, other forms of digital payments.

- End-User Demographics: Significant growth in both individual and corporate segments, with a skew towards younger demographics in online purchasing.

- M&A Trends: A moderate level of M&A activity is expected, with larger players potentially acquiring smaller, specialized firms to expand their product offerings and market reach. xx M&A deals were recorded in the historical period.

Saudi Arabia Gift Card and Incentive Card Market Growth Trends & Insights

The Saudi Arabian gift card and incentive card market exhibited robust growth during the historical period (2019-2024), driven by factors such as increasing disposable incomes, a thriving e-commerce landscape, and the growing popularity of digital gift cards. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a value of xx Million units by 2033. This growth is fueled by rising smartphone penetration, government initiatives to promote digital payments, and the increasing adoption of gift cards as a preferred method of gifting and employee incentives. Market penetration is estimated at xx% in 2025 and is expected to rise significantly by 2033. Technological disruptions, such as the introduction of blockchain technology and enhanced security measures, are contributing to market expansion.

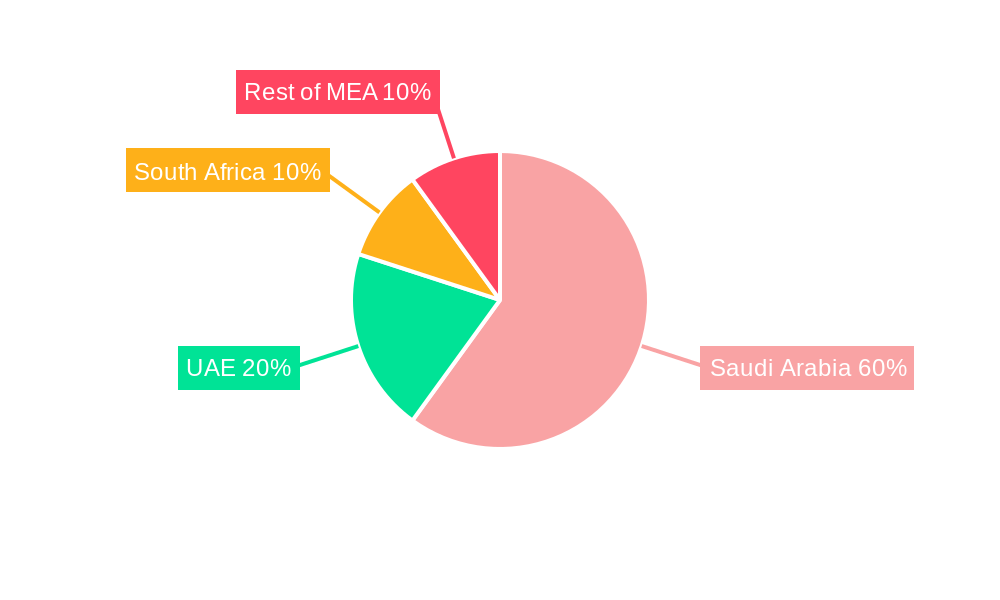

Dominant Regions, Countries, or Segments in Saudi Arabia Gift Card and Incentive Card Market

The Saudi Arabia gift card and incentive card market is experiencing robust growth across all segments, but the largest segment is expected to be the corporate segment. This is largely fueled by a growing number of businesses adopting gift cards as a tool for employee engagement and rewards. Urban areas are currently leading market growth due to higher internet penetration and spending power. Online distribution channels are rapidly gaining traction, reflecting the digital-first habits of the Saudi population.

- By Consumer: Corporate segment is the fastest growing driven by increasing adoption of gift cards as employee incentives.

- By Distribution Channel: Online channels are experiencing the highest growth due to convenience and accessibility.

- By Product: E-gift cards are witnessing rapid adoption fueled by the convenience of online purchasing and instant delivery.

- Key Drivers: Increasing disposable incomes, rising e-commerce activity, government initiatives to promote digital payments, and growing adoption of gift cards as corporate incentives.

Saudi Arabia Gift Card and Incentive Card Market Product Landscape

The Saudi Arabian gift card market offers a diverse range of products, including physical gift cards with customizable designs and e-gift cards delivered via email or mobile apps. Technological advancements focus on enhancing security features, offering greater personalization options, and integrating with various loyalty and rewards programs. Unique selling propositions include personalized messaging, branded designs, and multi-retailer options, catering to varied preferences and gifting occasions.

Key Drivers, Barriers & Challenges in Saudi Arabia Gift Card and Incentive Card Market

Key Drivers:

- The rise of e-commerce and digital payments.

- Growing popularity of gift cards as employee incentives and corporate gifts.

- Increased smartphone penetration and internet access.

- Government initiatives to promote digital financial services.

Challenges and Restraints:

- Concerns about security and fraud.

- Competition from alternative payment methods.

- Regulatory hurdles and compliance requirements.

- Supply chain disruptions impacting the availability of physical gift cards. These disruptions caused a xx% decrease in physical gift card sales in 2022.

Emerging Opportunities in Saudi Arabia Gift Card and Incentive Card Market

- Expansion into untapped market segments, such as smaller businesses and rural areas.

- Development of innovative gift card experiences, such as personalized virtual gift experiences.

- Integration with loyalty programs and other reward systems.

- Leveraging social media and influencer marketing to promote gift cards.

Growth Accelerators in the Saudi Arabia Gift Card and Incentive Card Market Industry

The Saudi Arabia gift card and incentive card market is poised for significant long-term growth, driven by sustained economic development, rising digital adoption, and government support for e-commerce. Strategic partnerships between fintech companies and retailers will further accelerate market expansion, creating a more integrated and seamless gifting experience for consumers. Technological breakthroughs, particularly in the field of blockchain technology for enhanced security and transparency, will play a significant role in driving growth.

Key Players Shaping the Saudi Arabia Gift Card and Incentive Card Market Market

- Givingli

- Amazon

- Transcard

- Qwikcliver

- Tango Card

- Alyce

- Ininal

- Riskified

- Swile

- One4all

- List Not Exhaustive

Notable Milestones in Saudi Arabia Gift Card and Incentive Card Market Sector

- September 2021: Amazon One expands beyond retail with its first third-party customer, AXS, enabling palm-based entry at venues across the globe, including Saudi Arabia. This signals a shift towards biometric payment and access solutions.

- August 2021: Hub Engage and Tango Card launch a strategic partnership to deliver gift card incentives for employee engagement programs across the Gulf, including Saudi Arabia. This signifies a growing demand for integrated employee reward solutions.

In-Depth Saudi Arabia Gift Card and Incentive Card Market Market Outlook

The future of the Saudi Arabia gift card and incentive card market is extremely positive. Sustained economic growth, increased digital literacy, and the government's focus on digital transformation will all contribute to market expansion. Strategic opportunities abound for companies that can leverage technology to offer innovative, personalized, and secure gift card solutions. The market’s continuous growth trajectory presents significant potential for both established players and new entrants to capitalize on the expanding opportunities in this dynamic sector.

Saudi Arabia Gift Card and Incentive Card Market Segmentation

-

1. Consumer

- 1.1. Individual

- 1.2. Corporate

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-Gift Card

- 3.2. Physical Card

Saudi Arabia Gift Card and Incentive Card Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Gift Card and Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Increase in the E-Commerce market in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-Gift Card

- 5.3.2. Physical Card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. UAE Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Givingli

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amazon

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Transcard

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Qwikcliver

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tango Card

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alyce

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ininal

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Riskified

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Swile

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 One4all**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Givingli

List of Figures

- Figure 1: Saudi Arabia Gift Card and Incentive Card Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Gift Card and Incentive Card Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Consumer 2019 & 2032

- Table 3: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Product 2019 & 2032

- Table 5: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Saudi Arabia Gift Card and Incentive Card Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Saudi Arabia Gift Card and Incentive Card Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Saudi Arabia Gift Card and Incentive Card Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Saudi Arabia Gift Card and Incentive Card Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Consumer 2019 & 2032

- Table 12: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Saudi Arabia Gift Card and Incentive Card Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Gift Card and Incentive Card Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Saudi Arabia Gift Card and Incentive Card Market?

Key companies in the market include Givingli, Amazon, Transcard, Qwikcliver, Tango Card, Alyce, Ininal, Riskified, Swile, One4all**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Gift Card and Incentive Card Market?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Increase in the E-Commerce market in Saudi Arabia.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

On September 2021, Amazon One has expanded beyond retail with first third-party customer, ticketing company AXS. Amazon One from then was available on AXS's mobile ticketing pedestals, giving Red Rocks Amphitheatre event goers the option to enter using just their palm across the globe including Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Gift Card and Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Gift Card and Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Gift Card and Incentive Card Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Gift Card and Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence