Key Insights

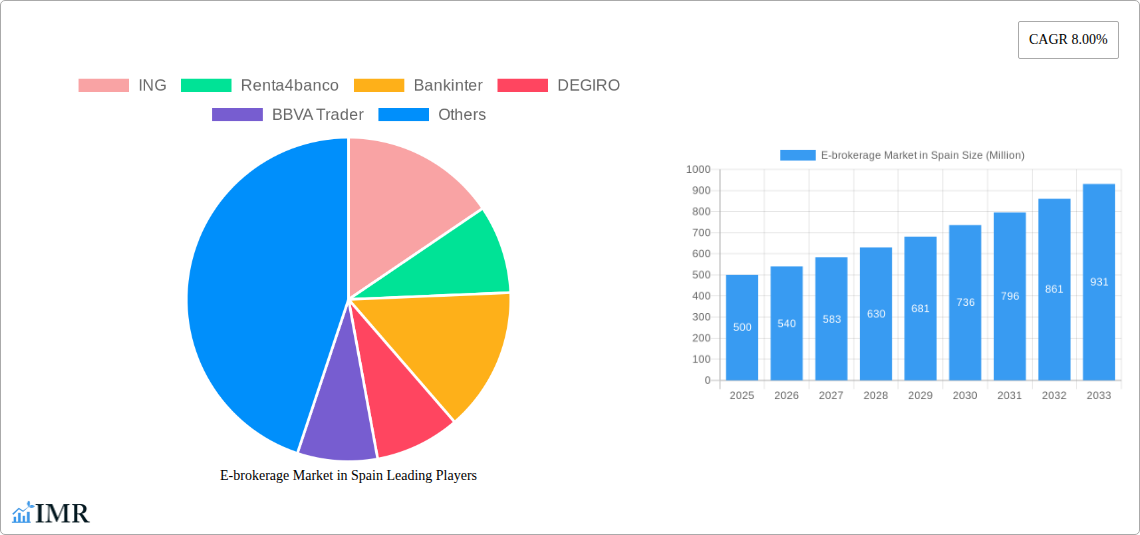

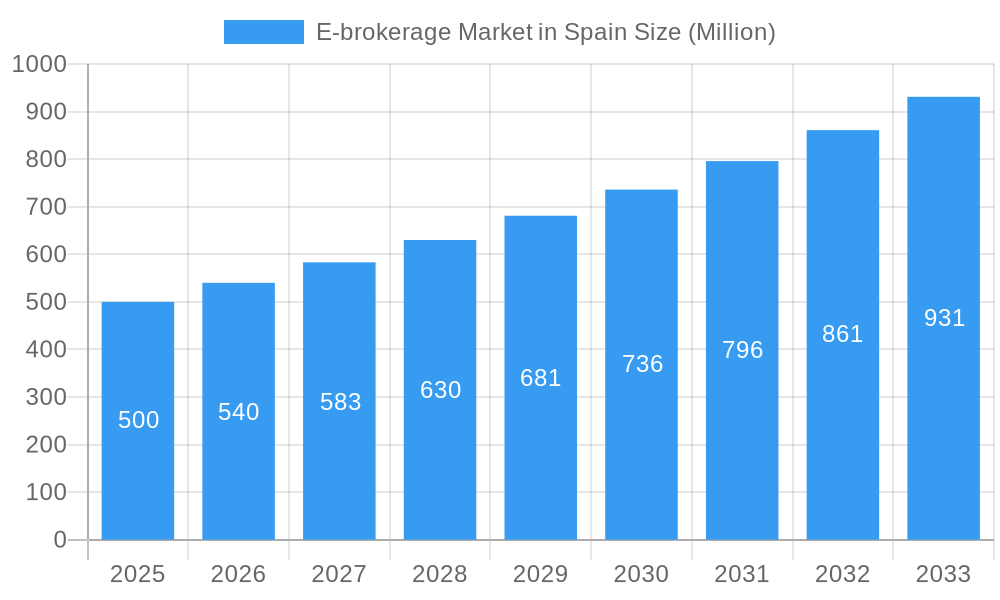

Spain's e-brokerage market is projected to experience significant expansion, driven by increasing digital adoption and financial literacy. With an estimated market size of 15.37 billion by 2025, and a Compound Annual Growth Rate (CAGR) of 11.5%, the sector offers substantial opportunities. Key growth catalysts include widespread internet and smartphone penetration, a growing digitally astute demographic, and the proliferation of user-friendly mobile trading applications. The introduction of innovative trading tools further enhances user experience and attracts new investors. The market is anticipated to cater to a diverse investor base, including both retail and institutional participants, with specialized platforms addressing varied needs. While regulatory frameworks and security considerations present potential challenges, the overarching market trajectory indicates sustained growth. Intense competition exists among domestic leaders such as ING, Renta4banco, Bankinter, and BBVA Trader, as well as global entities including DEGIRO, IC Markets, AVA Trade, FP Markets, tastyworks, and Pepperstone. The forecast period (2025-2033) is expected to witness continued advancement, supported by ongoing technological innovations and heightened financial awareness within the Spanish populace. This dynamic competitive environment underscores the imperative for continuous innovation and strategic adaptation.

E-brokerage Market in Spain Market Size (In Billion)

The success of individual e-brokerage providers in Spain hinges on several critical factors: competitive pricing and fee structures, the sophistication and mobile accessibility of their trading platforms, the quality of customer support, and adept navigation of regulatory mandates. Expanding the range of investment products and integrating personalized financial advisory services will be crucial for attracting and retaining clients in an increasingly discerning market. The projected sustained growth presents a compelling investment landscape, though careful evaluation of market dynamics and competitive pressures is essential for achieving success.

E-brokerage Market in Spain Company Market Share

E-brokerage Market in Spain: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the E-brokerage market in Spain, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends through 2033. This analysis is crucial for investors, industry professionals, and businesses seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market by various factors and provides detailed insights into the parent market (Online Brokerage) and the child market (E-brokerage in Spain), offering a granular view of the competitive landscape.

E-brokerage Market in Spain Market Dynamics & Structure

The Spanish e-brokerage market is characterized by a blend of established players and emerging fintech firms, resulting in a moderately concentrated market structure. While a few dominant players hold significant market share, the increasing adoption of digital platforms and the rise of innovative business models have fostered competition. Technological innovation, particularly in areas like AI-driven investment advice and mobile trading platforms, is a key driver of growth. The regulatory framework, largely aligned with European Union directives, plays a significant role in shaping market conduct and investor protection. Competitive substitutes include traditional brokerage services and other investment vehicles, though the convenience and cost-effectiveness of e-brokerage are driving market expansion. The end-user demographic is evolving, with younger, tech-savvy investors increasingly adopting online platforms. Finally, M&A activity, as exemplified by the flatexDEGIRO merger, significantly impacts market consolidation and competitive dynamics.

- Market Concentration: Moderately concentrated, with a few dominant players holding approximately xx% of the market share in 2025.

- Technological Innovation: AI-driven trading tools, mobile-first platforms, and fractional share trading are key innovations.

- Regulatory Framework: Compliance with ESMA regulations and MiFID II is crucial for market participants.

- Competitive Substitutes: Traditional brokerage services, Robo-advisors, and other investment platforms.

- End-User Demographics: Growing adoption amongst younger investors and a gradual shift towards digital-first strategies from older demographics.

- M&A Trends: Significant consolidation through mergers and acquisitions, impacting market structure and competition. The FlatexDEGIRO merger demonstrates an increase in deal volume with an estimated xx Million EUR worth of deals in the last 5 years.

E-brokerage Market in Spain Growth Trends & Insights

The Spanish e-brokerage market experienced robust growth during the historical period (2019-2024), driven by increased internet and smartphone penetration, coupled with a growing preference for self-directed investments. The market size (in Million units) is estimated at xx Million in 2025, reflecting a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024. This growth is further fueled by technological disruptions, such as the introduction of commission-free trading and sophisticated mobile applications. Changing consumer behavior, particularly among younger generations, favors the convenience and accessibility of e-brokerage platforms over traditional methods. Market penetration continues to increase, with an estimated xx% of the adult population utilizing online brokerage services in 2025. This trend is projected to continue, leading to significant market expansion during the forecast period (2025-2033), with a projected CAGR of xx%.

Dominant Regions, Countries, or Segments in E-brokerage Market in Spain

The Spanish e-brokerage market demonstrates relatively uniform growth across regions, with major cities like Madrid and Barcelona exhibiting higher adoption rates due to higher internet penetration and financial literacy. However, the market’s growth is primarily driven by increasing investor participation from across the country, driven by a combination of factors.

- Key Drivers:

- Increased internet and smartphone penetration across the country.

- Rising financial literacy and awareness amongst the general population.

- Favorable economic conditions and increasing disposable income.

- Government initiatives promoting financial inclusion and digital adoption.

- Dominance Factors:

- Ease of access and convenience offered by online platforms.

- Competitive pricing and transparent fee structures.

- Availability of advanced trading tools and educational resources.

The dominance of specific regions is less pronounced than the overall national growth. The continued expansion of the digital economy and improving infrastructure are expected to further enhance market penetration across all regions, leading to balanced growth in the future.

E-brokerage Market in Spain Product Landscape

The e-brokerage product landscape is evolving rapidly, with a focus on user-friendly interfaces, advanced charting tools, educational resources, and mobile optimization. Key features include real-time market data, automated trading tools, fractional share trading capabilities, and diverse investment options such as stocks, ETFs, and options. Platforms are incorporating AI-powered functionalities to enhance investment decision-making. The unique selling propositions often revolve around competitive pricing, exceptional customer support, and user-friendly interfaces aimed at both beginner and expert investors.

Key Drivers, Barriers & Challenges in E-brokerage Market in Spain

Key Drivers:

- Technological Advancements: User-friendly interfaces, mobile trading apps, and AI-powered tools.

- Rising Smartphone and Internet Penetration: Increased access to online platforms.

- Favorable Regulatory Environment: Supportive policies encouraging digital finance.

Key Challenges & Restraints:

- Cybersecurity Concerns: Data breaches and fraud are major concerns impacting investor trust.

- Regulatory Scrutiny: Compliance requirements and changing regulations can impact operating costs.

- Competition: Intense competition from established and emerging players. xx% market share loss in 2024 attributed to increased competition.

Emerging Opportunities in E-brokerage Market in Spain

- Expansion into underserved markets: Reaching out to less digitally connected segments.

- Development of innovative products: Introducing new investment tools and features catered to evolving investor needs.

- Strategic partnerships: Collaborating with fintech companies and financial institutions to expand reach and offering.

Growth Accelerators in the E-brokerage Market in Spain Industry

Sustained growth in the Spanish e-brokerage market will be driven by ongoing technological innovation, strategic partnerships between established financial institutions and fintech companies, and expansion into new geographical areas and demographic segments. Government initiatives promoting digital finance and financial literacy will also play a crucial role in fueling market expansion.

Key Players Shaping the E-brokerage Market in Spain Market

- ING

- Renta4banco

- Bankinter

- DEGIRO

- BBVA Trader

- IC Market

- AVA Trade

- FP Market

- tastyworks

- Pepperstone

Notable Milestones in E-brokerage Market in Spain Sector

- April 2020: German Flatex completes its 100% acquisition of DeGiro for 250 Million EUR.

- Early 2021: DeGiro BV merges with flatexDEGIRO Bank AG, creating Europe's largest online brokerage with its own banking license.

- July 2021: Interactive Brokers launches a simplified flat fee structure for stock trading in Western Europe, including Spain.

In-Depth E-brokerage Market in Spain Market Outlook

The Spanish e-brokerage market is poised for continued strong growth over the forecast period (2025-2033), driven by technological advancements, regulatory support, and increasing investor participation. Strategic partnerships and expansion into niche markets will further accelerate growth. The focus on enhanced cybersecurity measures and user-friendly platforms will be crucial for maintaining investor trust and driving market expansion. The market is expected to reach xx Million units by 2033.

E-brokerage Market in Spain Segmentation

-

1. Investor

- 1.1. Retail

- 1.2. Institutional

-

2. Operation

- 2.1. Domestic

- 2.2. Foreign

E-brokerage Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-brokerage Market in Spain Regional Market Share

Geographic Coverage of E-brokerage Market in Spain

E-brokerage Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Financial Products contribute to highest percentage of Family assets of Spanish

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Domestic

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 6. North America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Operation

- 6.2.1. Domestic

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 7. South America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Operation

- 7.2.1. Domestic

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 8. Europe E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Operation

- 8.2.1. Domestic

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 9. Middle East & Africa E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Operation

- 9.2.1. Domestic

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 10. Asia Pacific E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Operation

- 10.2.1. Domestic

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ING

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renta4banco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankinter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DEGIRO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BBVA Trader

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IC Market

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AVA Trade

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FP Market

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 tastyworks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pepperstone**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ING

List of Figures

- Figure 1: Global E-brokerage Market in Spain Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 3: North America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 4: North America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 5: North America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 6: North America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 9: South America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 10: South America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 11: South America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 12: South America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 15: Europe E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 16: Europe E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 17: Europe E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 18: Europe E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 21: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 22: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 23: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 24: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 27: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 28: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 29: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 30: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 2: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Global E-brokerage Market in Spain Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 5: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 6: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 11: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 12: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 17: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 18: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 29: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 30: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 38: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 39: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-brokerage Market in Spain?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the E-brokerage Market in Spain?

Key companies in the market include ING, Renta4banco, Bankinter, DEGIRO, BBVA Trader, IC Market, AVA Trade, FP Market, tastyworks, Pepperstone**List Not Exhaustive.

3. What are the main segments of the E-brokerage Market in Spain?

The market segments include Investor, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.37 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Financial Products contribute to highest percentage of Family assets of Spanish.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In early 2021, DeGiro BV merged with flatexDEGIRO Bank AG, creating the largest online foreclosure broker in Europe with its own banking license. Also in April 2020, German Flatex completes its 100% acquisition of DeGiro. The Deal value of the acquisition was 250 EURO million. With this Flatex Degiro become the leading online broker in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-brokerage Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-brokerage Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-brokerage Market in Spain?

To stay informed about further developments, trends, and reports in the E-brokerage Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence