Key Insights

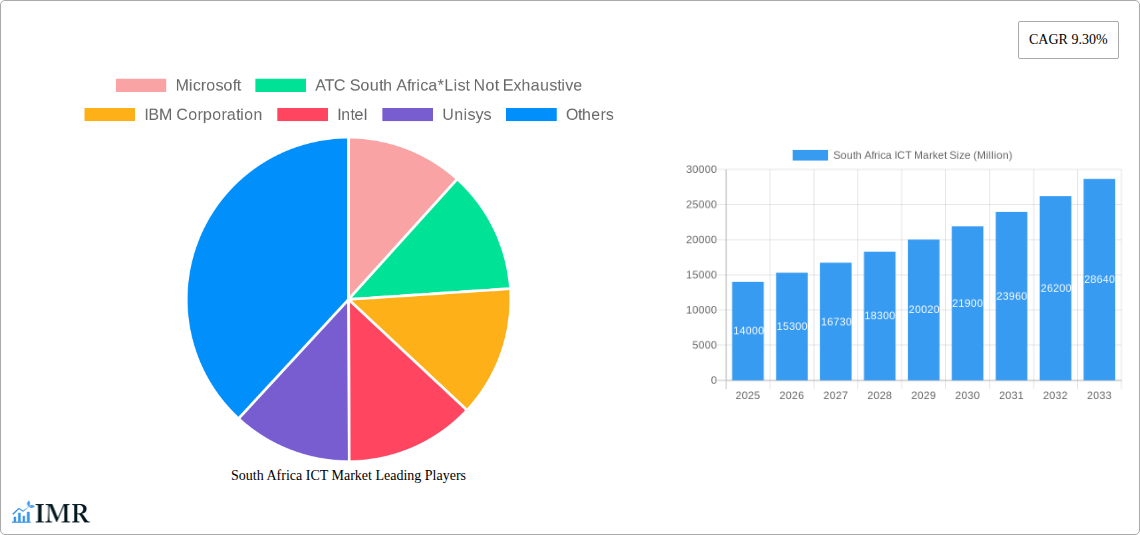

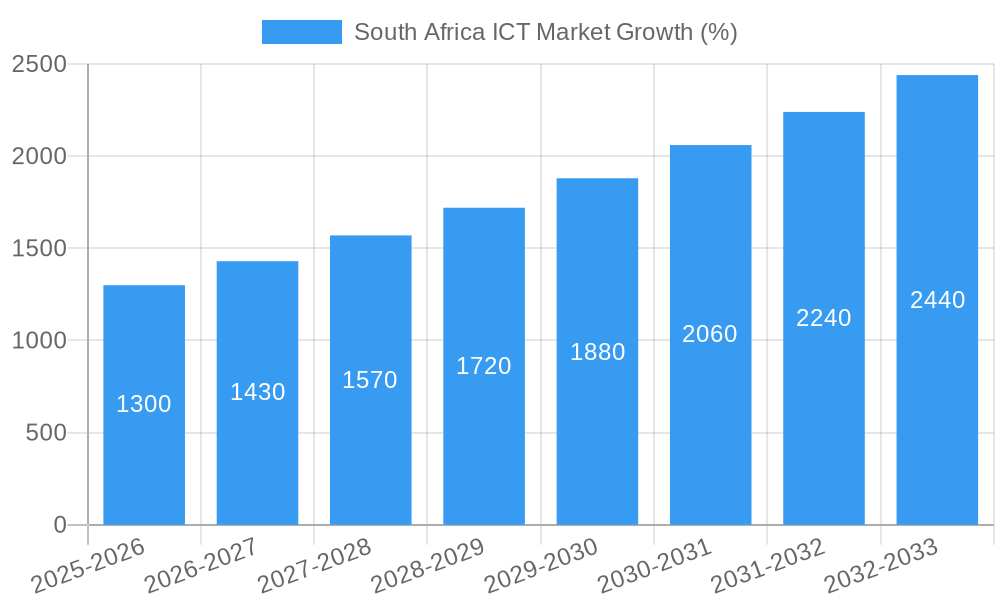

The South African ICT market, valued at an estimated ZAR 250 billion (approximately USD 14 billion) in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 9.3% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing government initiatives promoting digitalization across sectors, particularly in BFSI, IT & Telecom, and government itself, are stimulating demand for advanced ICT solutions. Secondly, the burgeoning e-commerce sector and the growing adoption of mobile technologies across the population are significantly contributing to market growth. Further driving the market is the expanding need for robust cybersecurity measures and cloud-based services. The rise of big data analytics and AI adoption across various industries also contributes to the robust growth forecast. Small and medium enterprises (SMEs) represent a significant portion of the market, although large enterprises are driving higher-value investments in sophisticated technology solutions.

Despite these positive trends, the South African ICT market faces challenges. Infrastructure limitations, particularly in rural areas, hinder widespread connectivity and access to digital services. Additionally, skills shortages in areas like software development and cybersecurity pose a significant constraint on market growth. Furthermore, economic volatility and regulatory uncertainties can impact investment decisions and overall market expansion. Despite these restraints, the long-term outlook remains optimistic, driven by ongoing digital transformation across various sectors and the sustained growth of the mobile and internet user base in South Africa. The key segments driving growth are Software, IT Services, and Hardware, with strong contributions expected from both large and small enterprises across diverse industry verticals.

South Africa ICT Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa ICT market, covering market dynamics, growth trends, key players, and future opportunities. With a detailed study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by industry vertical, type, and enterprise size, offering granular insights into market behavior and potential. Market values are presented in Million units.

South Africa ICT Market Dynamics & Structure

This section analyzes the South Africa ICT market's structure, encompassing market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activity. We delve into the competitive landscape, identifying key players and their market share, examining the impact of regulatory changes, and exploring the role of technological advancements in shaping market dynamics. The analysis considers factors influencing market concentration, including barriers to entry and the presence of dominant players.

- Market Concentration: The South Africa ICT market shows a moderately concentrated structure, with a few large players holding significant market share, particularly in telecommunications. The market share of the top 5 players is estimated at xx%.

- Technological Innovation: Key drivers include the adoption of 5G, cloud computing, and the increasing demand for cybersecurity solutions. However, limited digital literacy and infrastructure gaps in certain regions pose challenges.

- Regulatory Framework: Government initiatives promoting digital inclusion and broadband expansion influence market growth. However, regulatory complexities can create barriers for smaller players.

- Competitive Product Substitutes: The emergence of alternative technologies and service providers constantly shapes the competitive landscape, leading to price adjustments and service innovation.

- End-User Demographics: The market is driven by a growing young, tech-savvy population and expanding businesses adopting digital technologies. However, digital divides based on location and income persist.

- M&A Trends: The report tracks recent mergers and acquisitions, estimating xx M&A deals in the past 5 years, highlighting consolidation trends within the sector.

South Africa ICT Market Growth Trends & Insights

This section presents a detailed analysis of the South Africa ICT market's growth trajectory, utilizing various data points to illustrate market size evolution, adoption rates, technological disruptions, and shifting consumer behavior. The analysis incorporates specific metrics like Compound Annual Growth Rate (CAGR) and market penetration rates to offer deeper insights into market performance.

The South Africa ICT market has witnessed significant growth in recent years, driven by increasing smartphone penetration, expanding internet access, and government initiatives promoting digitalization. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by the rising adoption of cloud computing, big data analytics, and the Internet of Things (IoT) across various sectors. Technological disruptions, such as the introduction of 5G, are expected to accelerate this growth trajectory even further. Consumer behavior shifts towards digital services and online transactions are also contributing to the market's expansion. The transition to digital channels within BFSI, for instance, is a key catalyst.

Dominant Regions, Countries, or Segments in South Africa ICT Market

This section identifies leading segments within the South Africa ICT market, analyzing their dominance and growth potential. We examine factors such as economic policies, infrastructure development, and market size to understand the drivers of growth in each segment. The analysis covers the market segmentation by Industry Vertical (BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, Other Industry Verticals), by Type (Hardware, Software, IT Services, Telecommunication Services), and by Enterprise Size (Small and Medium Enterprises, Large Enterprises).

- By Industry Vertical: The IT and Telecom sector is currently the dominant segment, followed by BFSI and Government. Rapid digital transformation in BFSI and increasing government investment in ICT infrastructure are key drivers. The Retail and E-commerce sector is also experiencing substantial growth due to rising online shopping.

- By Type: The IT Services segment holds the largest market share due to the growing demand for outsourcing and cloud-based solutions. The Telecommunication Services segment also exhibits significant growth driven by the expansion of 4G and 5G networks.

- By Enterprise Size: Large Enterprises are the major consumers of ICT solutions, but SMEs are increasingly adopting digital technologies, boosting overall market growth.

South Africa ICT Market Product Landscape

The South Africa ICT market showcases a diverse product landscape, featuring advancements in hardware, software, and services. Innovations in areas like 5G network technologies, cloud-based solutions, and artificial intelligence are driving product development. Companies are focused on developing products with enhanced security features and user-friendly interfaces. The market also emphasizes solutions tailored to specific industry needs, offering customized software and service packages. The competitive landscape encourages continuous innovation and improvement in product offerings, resulting in increased efficiency and enhanced performance metrics.

Key Drivers, Barriers & Challenges in South Africa ICT Market

Key Drivers: The South Africa ICT market is propelled by factors such as increasing government investment in digital infrastructure, rising smartphone penetration, expanding internet access, and the growing adoption of cloud computing and big data analytics. The demand for enhanced cybersecurity measures and the push for digital transformation across various industries also contribute significantly.

Key Challenges: Challenges include infrastructure limitations, particularly in rural areas, limited digital literacy, high costs of technology adoption, and regulatory complexities. Supply chain disruptions and skills shortages also impact market growth. The competitive landscape also poses challenges, including pricing pressures and the need to innovate continuously.

Emerging Opportunities in South Africa ICT Market

The South Africa ICT market presents several emerging opportunities. Untapped markets in rural areas offer significant growth potential with increased infrastructure investment. The increasing adoption of fintech solutions and the growing demand for cybersecurity services also presents new avenues for expansion. Furthermore, innovative applications of AI and IoT across various sectors offer exciting growth prospects.

Growth Accelerators in the South Africa ICT Market Industry

Long-term growth in the South Africa ICT market is accelerated by several key factors. Significant investments in digital infrastructure, strategic partnerships between public and private sector entities, and government initiatives aimed at digital inclusion are playing pivotal roles. Technological advancements, such as the rollout of 5G networks, and the continuous innovation in software and services further enhance market growth prospects. Expansion into untapped markets and the adoption of innovative business models also contribute to the sector's long-term sustainability.

Key Players Shaping the South Africa ICT Market Market

- Microsoft

- ATC South Africa

- IBM Corporation

- Intel

- Unisys

- Novell

- Cell C Limited

- Wipro

- Dell Inc

- MTN South Africa

- Telkom SA SOC Limited

- Saicom South Africa

- SAP SE

- Vodacom South Africa

Notable Milestones in South Africa ICT Market Sector

- November 2022: Vodacom launched a state-of-the-art patient engagement solution with a computer-aided emergency services dispatch system, a first for South Africa's public healthcare sector.

- October 2022: Telkom partnered with Huawei to roll out 5G services in South Africa, becoming the third major provider after Vodacom and MTN.

In-Depth South Africa ICT Market Market Outlook

The South Africa ICT market exhibits promising future potential, driven by continued technological advancements, expanding digital literacy, and increased government investment in digital infrastructure. Strategic partnerships between ICT companies and government agencies are expected to further accelerate growth. The focus on developing customized solutions for specific industry needs and the expansion into untapped markets will shape the market's trajectory in the coming years. Opportunities abound for players who can adapt to changing market dynamics and offer innovative, cost-effective solutions.

South Africa ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

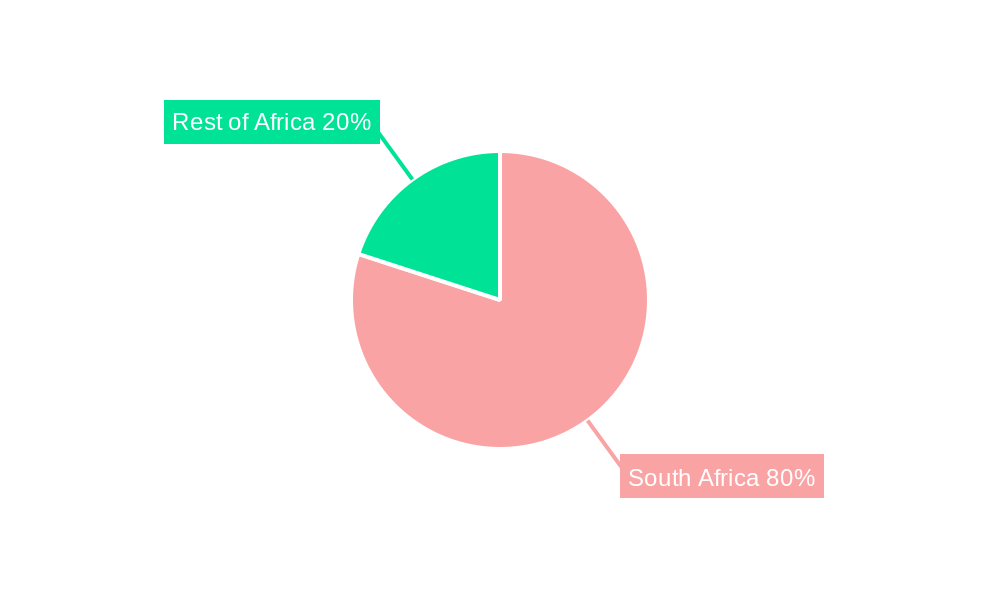

South Africa ICT Market Segmentation By Geography

- 1. South Africa

South Africa ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Digital Transformation in the Financial Service Sector; Robust Roll Out of 5G

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness among Professionals

- 3.4. Market Trends

- 3.4.1. Robust 5G Deployment in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa ICT Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Microsoft

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ATC South Africa*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Intel

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Unisys

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Novell

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cell C Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Wipro

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Dell Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 MTN South Africa

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Telkom SA SOC Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Saicom South Africa

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 SAP SE

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Vodacom South Africa

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Microsoft

List of Figures

- Figure 1: South Africa ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa ICT Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Africa ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: South Africa ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: South Africa ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa South Africa ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: South Africa ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 15: South Africa ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: South Africa ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa ICT Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the South Africa ICT Market?

Key companies in the market include Microsoft, ATC South Africa*List Not Exhaustive, IBM Corporation, Intel, Unisys, Novell, Cell C Limited, Wipro, Dell Inc, MTN South Africa, Telkom SA SOC Limited, Saicom South Africa, SAP SE, Vodacom South Africa.

3. What are the main segments of the South Africa ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Digital Transformation in the Financial Service Sector; Robust Roll Out of 5G.

6. What are the notable trends driving market growth?

Robust 5G Deployment in the Country.

7. Are there any restraints impacting market growth?

Lack of Awareness among Professionals.

8. Can you provide examples of recent developments in the market?

In November 2022, Vodacom introduced a state-of-the-art patient engagement solution incorporating a computer-aided emergency services dispatch system, this first for South Africa's public healthcare sector. The event, which took place at the Provincial Health Offices in the Northern Cape, demonstrates how public-private collaborations can drive innovation and ultimately save lives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa ICT Market?

To stay informed about further developments, trends, and reports in the South Africa ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence