Key Insights

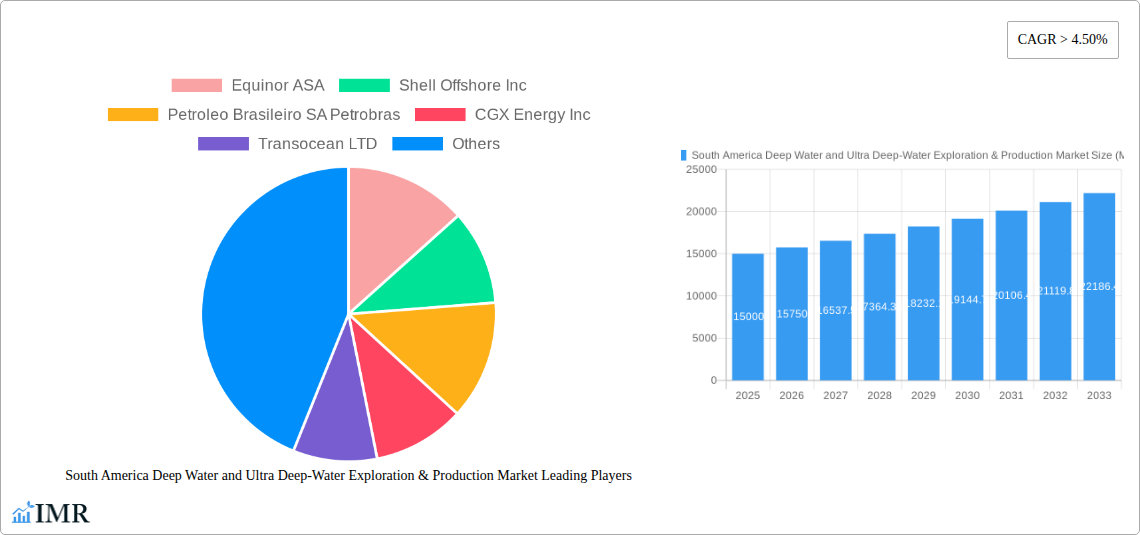

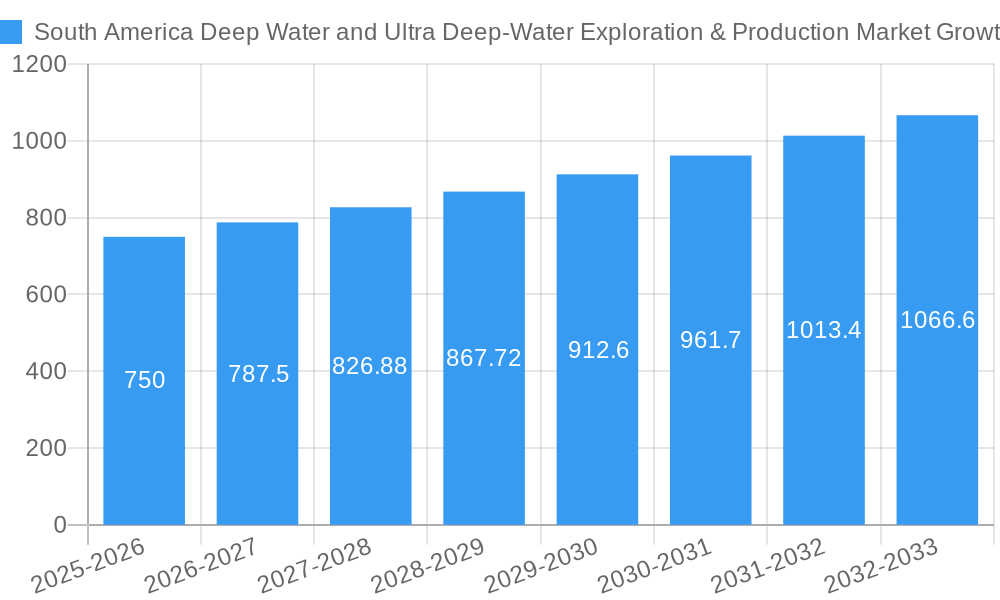

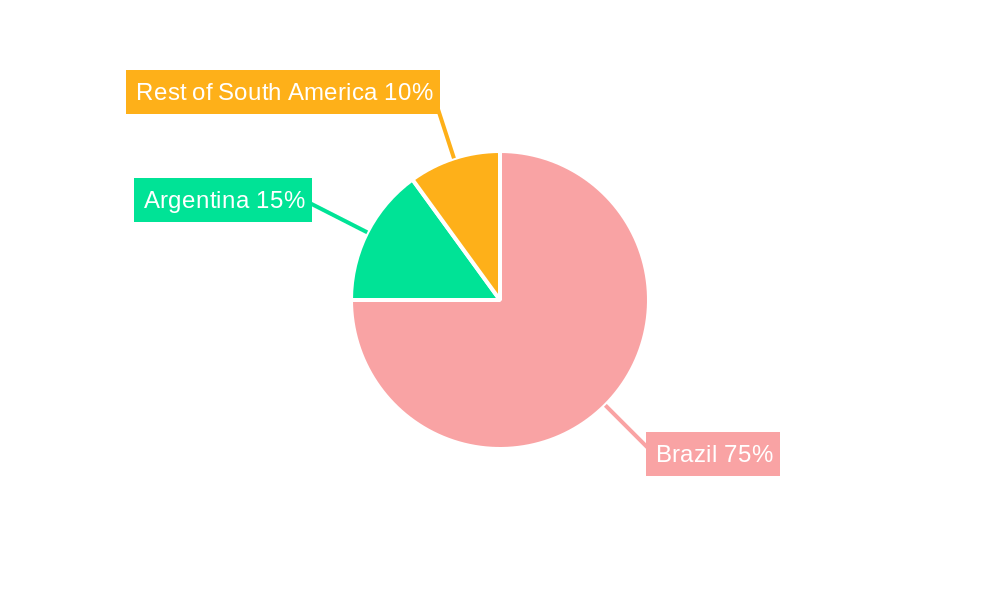

The South American deepwater and ultra-deepwater exploration and production (E&P) market is experiencing robust growth, driven by significant offshore oil and gas reserves, particularly in Brazil. With a Compound Annual Growth Rate (CAGR) exceeding 4.50%, the market, valued at an estimated $XX million in 2025, is projected to reach substantial heights by 2033. This expansion is fueled by increasing investments in advanced drilling technologies, enabling exploration in previously inaccessible ultra-deepwater environments. Furthermore, favorable government policies aimed at stimulating offshore energy production in the region are playing a crucial role. Key players like Petrobras, Equinor, and Shell are heavily involved, driving technological advancements and contributing significantly to production output. The seismic submarket, in particular, is experiencing substantial growth due to the need for accurate subsurface imaging before drilling operations commence. However, market growth is not without its challenges. Environmental concerns related to offshore drilling, stringent regulatory frameworks, and the inherent risks associated with deepwater operations pose significant restraints. The market is segmented by water depth (deepwater and ultra-deepwater) and submarkets (seismic, drilling, floating production systems, and others), offering diverse investment opportunities. Brazil's dominance in the region's E&P sector is evident, largely due to its vast offshore reserves and established infrastructure. Argentina and other South American nations, while showing potential, currently contribute a smaller share. The long-term outlook remains positive, given continuous exploration efforts and technological improvements, though navigating environmental and regulatory hurdles will be critical for sustained growth.

The forecast period (2025-2033) anticipates significant increases in exploration activity. Brazil's pre-salt reserves, known for their substantial hydrocarbon potential, are a major driver. The drilling submarket, alongside floating production systems, will benefit directly from this expansion. Competition among major international oil companies (IOCs) and national oil companies (NOCs) is intense, leading to continuous innovation and cost optimization strategies. The "other submarkets" segment, encompassing activities such as subsea equipment and services, is also likely to experience considerable growth, reflecting the overall expansion of the E&P ecosystem. The potential for new discoveries and advancements in technologies such as digitalization and artificial intelligence are set to further shape the market's trajectory. Managing the environmental impact of deepwater operations and ensuring regulatory compliance will be crucial in sustaining the industry's long-term viability and positive public perception.

South America Deep Water and Ultra Deep-Water Exploration & Production Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America deepwater and ultra-deepwater exploration and production market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market dynamics, growth trends, dominant segments, and key players shaping this dynamic sector. The report analyzes the parent market of Oil and Gas Exploration and Production in South America and its child market focusing on Deepwater and Ultra-deepwater Operations. The total market size in 2025 is estimated at xx Million.

South America Deep Water and Ultra Deep-Water Exploration & Production Market Market Dynamics & Structure

The South American deepwater and ultra-deepwater exploration and production market is characterized by a moderate level of concentration, with key players like Equinor ASA, Shell Offshore Inc, and Petroleo Brasileiro SA Petrobras holding significant market share. Technological innovation, particularly in subsea technologies and enhanced oil recovery (EOR) techniques, is a major driver. However, regulatory frameworks and environmental concerns present considerable challenges. The market witnesses continuous M&A activity, with xx deals recorded in the historical period (2019-2024), primarily focused on consolidating assets and expertise. Substitute energy sources and fluctuating oil prices exert pressure.

- Market Concentration: Moderately concentrated, with top 3 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on subsea technologies, EOR, and digitalization to enhance efficiency and reduce costs. Barriers include high initial investment costs and technological complexity.

- Regulatory Framework: Stringent environmental regulations and licensing processes influence exploration and production activities.

- Competitive Substitutes: Renewable energy sources and other fossil fuels pose a competitive threat.

- End-User Demographics: Primarily driven by national oil companies and international energy majors.

- M&A Trends: xx M&A deals recorded between 2019-2024, indicating a trend towards consolidation.

South America Deep Water and Ultra Deep-Water Exploration & Production Market Growth Trends & Insights

The South American deepwater and ultra-deepwater exploration and production market experienced fluctuating growth during the historical period (2019-2024), influenced by global oil price volatility and pandemic-related disruptions. However, the market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements, particularly in deepwater drilling and production technologies, are expected to drive adoption rates. Increasing demand for oil and gas, coupled with the exploration of new reserves in deepwater regions, fuels market expansion. Consumer behavior shifts towards sustainable energy sources could pose long-term challenges. Market penetration for deepwater technologies is currently at xx% and is expected to rise to xx% by 2033.

Dominant Regions, Countries, or Segments in South America Deep Water and Ultra Deep-Water Exploration & Production Market

Brazil stands as the dominant country in the South American deepwater and ultra-deepwater exploration and production market, owing to its substantial offshore reserves and robust regulatory framework encouraging investment. The deepwater segment holds the largest market share, driven by its significant reserve potential and technological advancements enabling efficient extraction from these depths. Within submarkets, the Drilling Submarket currently holds the largest share, followed by Floating Production Systems.

- Brazil: Dominant due to significant offshore reserves and supportive government policies.

- Guyana: Emerging as a significant player with recent discoveries.

- Deepwater Segment: Largest market share due to significant reserve potential.

- Drilling Submarket: Holds the largest share among submarkets.

- Floating Production Systems Submarket: Significant growth potential due to the complex nature of deepwater operations.

South America Deep Water and Ultra Deep-Water Exploration & Production Market Product Landscape

The market is witnessing continuous innovation in deepwater drilling equipment, subsea production systems, and floating production units. These innovations focus on enhancing efficiency, safety, and environmental sustainability. Companies are adopting advanced materials, automation, and data analytics to optimize operations and reduce costs. Unique selling propositions include enhanced drilling capabilities, improved safety features, and reduced environmental impact.

Key Drivers, Barriers & Challenges in South America Deep Water and Ultra Deep-Water Exploration & Production Market

Key Drivers: The primary drivers are rising global demand for oil and gas, significant untapped deepwater reserves in South America, technological advancements enabling cost-effective deepwater exploration and production, and favorable government policies in some regions.

Key Challenges: High capital expenditure requirements, stringent environmental regulations, complex logistics, geopolitical risks, and the fluctuating price of oil represent major hurdles. Supply chain disruptions also impact project timelines and costs.

Emerging Opportunities in South America Deep Water and Ultra Deep-Water Exploration & Production Market

Emerging opportunities include the exploration of frontier deepwater basins, the adoption of advanced digital technologies for improved operational efficiency, and the development of sustainable solutions to minimize environmental impact. Further, collaborations between international oil companies and national oil companies could open up further exploration opportunities.

Growth Accelerators in the South America Deep Water and Ultra Deep-Water Exploration & Production Market Industry

Technological breakthroughs in subsea production systems, increased investment in deepwater exploration, and strategic partnerships between energy companies and technology providers are key growth accelerators. Government initiatives promoting investment in the sector and expansion into new deepwater basins further propel growth.

Key Players Shaping the South America Deep Water and Ultra Deep-Water Exploration & Production Market Market

- Equinor ASA

- Shell Offshore Inc

- Petroleo Brasileiro SA Petrobras

- CGX Energy Inc

- Transocean LTD

- Chevron U S A Inc

- Halliburton Company

Notable Milestones in South America Deep Water and Ultra Deep-Water Exploration & Production Market Sector

- 2021: Significant oil discovery offshore Guyana sparks increased investment.

- 2022: Introduction of a new generation of deepwater drilling rigs in Brazil.

- 2023: Launch of a major subsea production system project in Brazil.

In-Depth South America Deep Water and Ultra Deep-Water Exploration & Production Market Market Outlook

The South American deepwater and ultra-deepwater exploration and production market exhibits substantial long-term growth potential, driven by technological advancements, significant untapped reserves, and supportive government policies. Strategic partnerships and investments in innovative technologies will play a crucial role in unlocking the full potential of this dynamic sector. The market is poised for significant expansion, offering lucrative opportunities for established players and new entrants alike.

South America Deep Water and Ultra Deep-Water Exploration & Production Market Segmentation

-

1. Water Depth

- 1.1. Deepwater

- 1.2. Ultra-deepwater

-

2. Submarket

- 2.1. Seismic Submarket

- 2.2. Drilling Submarket

- 2.3. Floating Production Systems Submarket

- 2.4. Other Submarkets

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Venezuela

- 3.4. Ecuador

- 3.5. Rest of South America

South America Deep Water and Ultra Deep-Water Exploration & Production Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Venezuela

- 4. Ecuador

- 5. Rest of South America

South America Deep Water and Ultra Deep-Water Exploration & Production Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Industrialization across the Globe; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Deepwater Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 5.1.1. Deepwater

- 5.1.2. Ultra-deepwater

- 5.2. Market Analysis, Insights and Forecast - by Submarket

- 5.2.1. Seismic Submarket

- 5.2.2. Drilling Submarket

- 5.2.3. Floating Production Systems Submarket

- 5.2.4. Other Submarkets

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Venezuela

- 5.3.4. Ecuador

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Venezuela

- 5.4.4. Ecuador

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 6. Brazil South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Water Depth

- 6.1.1. Deepwater

- 6.1.2. Ultra-deepwater

- 6.2. Market Analysis, Insights and Forecast - by Submarket

- 6.2.1. Seismic Submarket

- 6.2.2. Drilling Submarket

- 6.2.3. Floating Production Systems Submarket

- 6.2.4. Other Submarkets

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Venezuela

- 6.3.4. Ecuador

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Water Depth

- 7. Argentina South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Water Depth

- 7.1.1. Deepwater

- 7.1.2. Ultra-deepwater

- 7.2. Market Analysis, Insights and Forecast - by Submarket

- 7.2.1. Seismic Submarket

- 7.2.2. Drilling Submarket

- 7.2.3. Floating Production Systems Submarket

- 7.2.4. Other Submarkets

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Venezuela

- 7.3.4. Ecuador

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Water Depth

- 8. Venezuela South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Water Depth

- 8.1.1. Deepwater

- 8.1.2. Ultra-deepwater

- 8.2. Market Analysis, Insights and Forecast - by Submarket

- 8.2.1. Seismic Submarket

- 8.2.2. Drilling Submarket

- 8.2.3. Floating Production Systems Submarket

- 8.2.4. Other Submarkets

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Venezuela

- 8.3.4. Ecuador

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Water Depth

- 9. Ecuador South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Water Depth

- 9.1.1. Deepwater

- 9.1.2. Ultra-deepwater

- 9.2. Market Analysis, Insights and Forecast - by Submarket

- 9.2.1. Seismic Submarket

- 9.2.2. Drilling Submarket

- 9.2.3. Floating Production Systems Submarket

- 9.2.4. Other Submarkets

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Venezuela

- 9.3.4. Ecuador

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Water Depth

- 10. Rest of South America South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Water Depth

- 10.1.1. Deepwater

- 10.1.2. Ultra-deepwater

- 10.2. Market Analysis, Insights and Forecast - by Submarket

- 10.2.1. Seismic Submarket

- 10.2.2. Drilling Submarket

- 10.2.3. Floating Production Systems Submarket

- 10.2.4. Other Submarkets

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Venezuela

- 10.3.4. Ecuador

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Water Depth

- 11. Brazil South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 12. Argentina South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of South America South America Deep Water and Ultra Deep-Water Exploration & Production Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Equinor ASA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Shell Offshore Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Petroleo Brasileiro SA Petrobras

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 CGX Energy Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Transocean LTD

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Chevron U S A Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Halliburton Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Equinor ASA

List of Figures

- Figure 1: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Deep Water and Ultra Deep-Water Exploration & Production Market Share (%) by Company 2024

List of Tables

- Table 1: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 3: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 4: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 11: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 12: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 15: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 16: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 19: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 20: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 23: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 24: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Water Depth 2019 & 2032

- Table 27: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Submarket 2019 & 2032

- Table 28: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: South America Deep Water and Ultra Deep-Water Exploration & Production Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

Key companies in the market include Equinor ASA, Shell Offshore Inc, Petroleo Brasileiro SA Petrobras, CGX Energy Inc, Transocean LTD, Chevron U S A Inc, Halliburton Company.

3. What are the main segments of the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

The market segments include Water Depth, Submarket, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Industrialization across the Globe; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Deepwater Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Deep Water and Ultra Deep-Water Exploration & Production Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Deep Water and Ultra Deep-Water Exploration & Production Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

To stay informed about further developments, trends, and reports in the South America Deep Water and Ultra Deep-Water Exploration & Production Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence