Key Insights

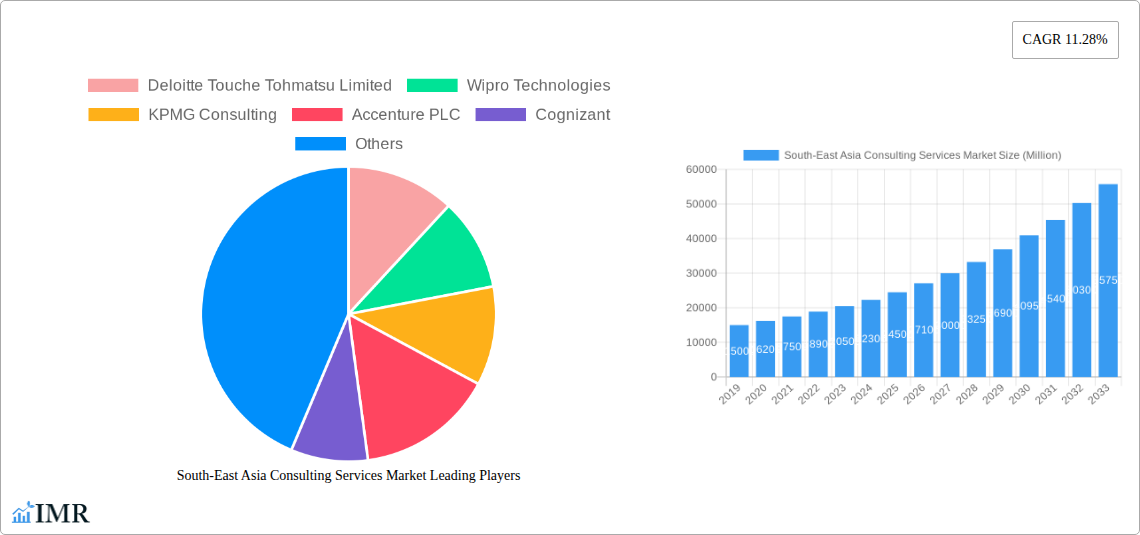

The South-East Asia Consulting Services Market is poised for significant expansion, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) of 11.28% over the forecast period of 2025-2033. This robust growth is underpinned by several key drivers, including the increasing demand for digital transformation initiatives across various industries, the escalating need for strategic guidance to navigate complex regulatory landscapes, and the growing adoption of specialized HR and financial consulting services. The region's burgeoning economies, coupled with a strong push towards technological advancement and operational efficiency, are creating fertile ground for consulting firms. Key sectors such as Financial Services, Life Sciences and Healthcare, and IT and Telecommunication are at the forefront, actively seeking expert advice to optimize their operations, enhance customer experiences, and maintain competitive advantages. The "Other End-user Industries" segment, encompassing rapidly developing sectors like e-commerce and advanced manufacturing, is also expected to contribute significantly to market expansion.

South-East Asia Consulting Services Market Market Size (In Billion)

Further analysis reveals that the market's trajectory is influenced by a dynamic interplay of trends and restraints. Emerging trends such as the focus on sustainability consulting, the rise of data analytics and AI-driven insights, and the growing demand for agile and cloud-based solutions are shaping service offerings. Consulting firms are increasingly integrating these advanced capabilities to deliver more impactful and tailored solutions to their clients. However, the market also faces challenges, including a shortage of highly skilled talent in specialized consulting areas and the potential for economic volatility in certain regional economies. Despite these restraints, the overarching optimism for economic growth and digitalization in South-East Asia, coupled with the strategic importance of consulting services for businesses aiming for sustained success, will continue to fuel market expansion. Major global players like Accenture, Deloitte, KPMG, and McKinsey, alongside prominent regional entities such as Tata Consultancy Services, are actively investing in and expanding their presence in South-East Asia to capitalize on these opportunities.

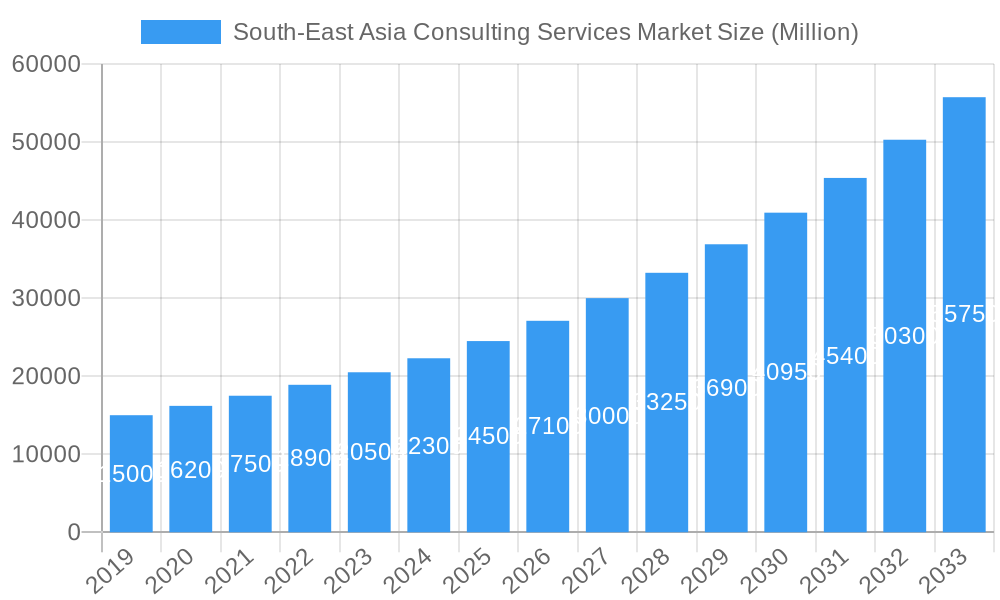

South-East Asia Consulting Services Market Company Market Share

Here's a compelling, SEO-optimized report description for the South-East Asia Consulting Services Market, designed for maximum visibility and engagement:

Uncover the Dynamic South-East Asia Consulting Services Market: Trends, Opportunities, and Future Outlook (2019-2033)

Dive deep into the rapidly evolving South-East Asia consulting services market with this comprehensive report. Analyzing the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers unparalleled insights into market dynamics, growth trajectories, and key player strategies. We cover critical segments including HR Consulting, Financial Consulting, IT and Digital Consulting, and Strategy and Operations, catering to a diverse range of end-user industries like Financial Services, Life Sciences and Healthcare, IT and Telecommunication, Government, and Energy and Utilities. This in-depth analysis will equip industry professionals, investors, and stakeholders with the crucial data needed to navigate this lucrative market.

South-East Asia Consulting Services Market Market Dynamics & Structure

The South-East Asia consulting services market is characterized by a moderate to high degree of concentration, with leading global firms vying for market share alongside a growing number of agile local players. Technological innovation serves as a primary driver, fueled by the region's rapid digital transformation initiatives and the increasing adoption of advanced technologies like AI, cloud computing, and data analytics. Regulatory frameworks, while varying across countries, are generally becoming more conducive to business growth, though localized compliance remains a key consideration. Competitive product substitutes are minimal in the core consulting service offerings, but the landscape is shaped by the evolving capabilities of in-house teams and the emergence of niche digital solution providers. End-user demographics are shifting towards younger, tech-savvy professionals demanding sophisticated, data-driven solutions. Mergers and acquisitions (M&A) are a significant trend, indicating consolidation and strategic expansion by major players to enhance service portfolios and regional reach.

- Market Concentration: Dominated by a mix of global consultancies and emerging local firms.

- Technological Innovation Drivers: Digital transformation, AI, cloud computing, data analytics.

- Regulatory Frameworks: Generally favorable, with country-specific compliance nuances.

- Competitive Landscape: Primarily shaped by service provider capabilities, with emerging digital solution providers.

- End-User Demographics: Growing demand for advanced, data-driven, and digitally enabled consulting services.

- M&A Trends: Active consolidation and strategic acquisitions to expand capabilities and market presence.

South-East Asia Consulting Services Market Growth Trends & Insights

The South-East Asia consulting services market is poised for robust expansion, driven by persistent economic growth, increasing digitalization across all sectors, and a growing awareness of the value of strategic advisory services. The market size is projected to witness a significant upward trajectory, with a Compound Annual Growth Rate (CAGR) estimated at xx% during the forecast period of 2025–2033. Adoption rates for specialized consulting services, particularly in IT and digital transformation, are accelerating as businesses strive to remain competitive in a rapidly changing global landscape. Technological disruptions, such as the widespread implementation of AI-powered tools and the continued shift to cloud-based solutions, are not only creating new service demands but also reshaping how consulting services are delivered. Consumer behavior shifts are evident in the demand for more agile, outcome-oriented, and integrated consulting approaches that address complex business challenges holistically. This evolution signifies a maturing market that is increasingly sophisticated in its engagement with consulting partners. The market penetration of high-value, specialized consulting services is expected to deepen, reflecting the growing maturity and strategic imperatives of businesses in the region.

Dominant Regions, Countries, or Segments in South-East Asia Consulting Services Market

Within the South-East Asia consulting services market, IT and Digital Consulting is emerging as the dominant service type, spearheading market growth. This segment's ascendancy is largely attributed to the region's aggressive push towards digital transformation across all industries, fueled by government initiatives and private sector investment in innovation. The IT and Telecommunication end-user industry is a primary beneficiary and driver of this trend, showcasing substantial demand for services related to cloud migration, cybersecurity, data analytics, and enterprise resource planning (ERP) implementations.

- Dominant Service Type: IT and Digital Consulting, driven by the widespread need for digital transformation.

- Key End-User Industry: IT and Telecommunication, consistently investing in technology upgrades and digital solutions.

- Growth Drivers in IT and Telecommunication:

- Rapid Digitalization: Businesses in this sector are at the forefront of adopting new technologies.

- Infrastructure Development: Ongoing investment in telecommunications networks and data centers creates demand for specialized consulting.

- Emergence of Tech Hubs: Countries like Singapore and Vietnam are fostering innovation ecosystems that require advanced IT consulting.

- Market Share and Growth Potential: The IT and Digital Consulting segment is expected to capture a significant market share, estimated at xx% by 2033, with a projected CAGR of xx% during the forecast period. This growth is further propelled by the increasing adoption of cloud-based solutions and the growing importance of cybersecurity.

- Country-Specific Dominance: Singapore, with its advanced digital infrastructure and strong government support for innovation, leads the market. Other countries like Indonesia and Vietnam are exhibiting rapid growth potential due to their burgeoning digital economies and large young populations.

South-East Asia Consulting Services Market Product Landscape

The product landscape of the South-East Asia consulting services market is characterized by an increasing emphasis on data-driven insights, digital solutions, and integrated advisory packages. Firms are continually innovating by developing proprietary methodologies and digital platforms to enhance service delivery in areas such as AI-powered business process optimization, cloud strategy implementation, and cybersecurity assessment. Performance metrics are shifting towards demonstrable ROI, client satisfaction, and the successful integration of digital tools into client operations. Unique selling propositions often lie in the ability to tailor global best practices to local market nuances, offering customized digital transformation roadmaps and specialized expertise in emerging technologies like blockchain and IoT for specific industry applications.

Key Drivers, Barriers & Challenges in South-East Asia Consulting Services Market

Key Drivers:

- Digital Transformation Imperative: Businesses are compelled to adopt digital technologies to remain competitive.

- Economic Growth and Investment: Robust economic expansion fuels demand for strategic advice and operational improvements.

- Government Initiatives: Supportive policies for digitalization and foreign investment stimulate consulting needs.

- Rise of Startups and SMEs: The growing entrepreneurial ecosystem requires guidance for scaling and efficiency.

- Technological Advancements: The rapid pace of innovation creates opportunities for specialized IT and digital consulting.

Barriers & Challenges:

- Talent Shortages: A lack of skilled consultants can hinder service delivery and expansion.

- Regulatory Variations: Navigating diverse compliance requirements across different countries can be complex.

- Price Sensitivity: Some markets exhibit price sensitivity, demanding value-driven solutions.

- Data Privacy and Security Concerns: Ensuring client data protection is paramount and can be challenging.

- Intense Competition: The market faces competition from both global giants and agile local firms.

Emerging Opportunities in South-East Asia Consulting Services Market

Emerging opportunities in the South-East Asia consulting services market are abundant, particularly in the sustainability and ESG (Environmental, Social, and Governance) consulting space as businesses increasingly prioritize responsible practices. The supply chain resilience and optimization domain presents significant potential, especially in light of recent global disruptions. Furthermore, the growth of the e-commerce and digital payments sector is creating substantial demand for specialized consulting in customer experience enhancement, fraud prevention, and platform integration. The burgeoning fintech sector also offers fertile ground for advisory services related to regulatory compliance, product development, and market entry strategies. The increasing adoption of remote and hybrid work models is also driving demand for consulting in organizational redesign and employee engagement solutions.

Growth Accelerators in the South-East Asia Consulting Services Market Industry

Growth in the South-East Asia consulting services market is significantly accelerated by ongoing digitalization initiatives and the widespread adoption of advanced technologies like artificial intelligence and cloud computing across industries. Strategic partnerships between global consulting firms and local technology providers are also playing a crucial role in expanding service offerings and market reach. Furthermore, government investments in smart city projects and digital infrastructure are creating sustained demand for expert advisory services. The increasing focus on sustainability and circular economy principles is emerging as a powerful growth catalyst, driving demand for specialized consulting in ESG reporting and green business strategy.

Key Players Shaping the South-East Asia Consulting Services Market Market

- Deloitte Touche Tohmatsu Limited

- Wipro Technologies

- KPMG Consulting

- Accenture PLC

- Cognizant

- Boston Consulting Group

- Ernst & Young Global Limited

- Mercer Consulting

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- Tata Consultancy Services

- McKinsey & Company

Notable Milestones in South-East Asia Consulting Services Market Sector

- March 2023: IBM Consulting launched a new Innovation Hub in the Philippines, reinforcing its commitment to South East Asia. This hub aims to address the growing demand from IBM Consulting's clients, particularly in Japan, for expertise in business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

- June 2022: Accenture announced the acquisition of Entropia, its first acquisition in Southeast Asia. This strategic move is designed to bolster Accenture Interactive's capabilities in experience-led transformation services by integrating Entropia, a rapidly growing global agency, into its operations.

In-Depth South-East Asia Consulting Services Market Market Outlook

The future outlook for the South-East Asia consulting services market is exceptionally positive, fueled by sustained economic momentum and the region's embrace of digital transformation. Key growth accelerators include the ongoing integration of AI and advanced analytics into business operations, creating a demand for specialized consulting expertise. Strategic partnerships between global and local entities will continue to unlock new market segments and service innovations. Government-backed digital infrastructure projects and the increasing emphasis on sustainable business practices are poised to drive long-term demand for advisory services. The market is expected to witness further evolution towards outcome-based consulting models, emphasizing tangible results and long-term value creation for clients, positioning South-East Asia as a critical hub for consulting innovation and growth.

South-East Asia Consulting Services Market Segmentation

-

1. Service Type

- 1.1. HR Consulting

- 1.2. Financial Consulting

- 1.3. IT and Digital Consulting

- 1.4. Strategy and Operations

-

2. End-user Industry

- 2.1. Financial Services

- 2.2. Life Sciences and Healthcare

- 2.3. IT and Telecommunication

- 2.4. Government

- 2.5. Energy and Utilities

- 2.6. Other End-user Industries

South-East Asia Consulting Services Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asia Consulting Services Market Regional Market Share

Geographic Coverage of South-East Asia Consulting Services Market

South-East Asia Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Financial Advisory to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. HR Consulting

- 5.1.2. Financial Consulting

- 5.1.3. IT and Digital Consulting

- 5.1.4. Strategy and Operations

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Financial Services

- 5.2.2. Life Sciences and Healthcare

- 5.2.3. IT and Telecommunication

- 5.2.4. Government

- 5.2.5. Energy and Utilities

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deloitte Touche Tohmatsu Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipro Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPMG Consulting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Accenture PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cognizant

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mercer Consulting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A T Kearney Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PricewaterhouseCoopers LLP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tata Consultancy Services

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 McKinsey & Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: South-East Asia Consulting Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South-East Asia Consulting Services Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: South-East Asia Consulting Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South-East Asia Consulting Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South-East Asia Consulting Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: South-East Asia Consulting Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Indonesia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Malaysia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Singapore South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Thailand South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Vietnam South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Philippines South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Myanmar South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Cambodia South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Laos South-East Asia Consulting Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia Consulting Services Market?

The projected CAGR is approximately 11.28%.

2. Which companies are prominent players in the South-East Asia Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Wipro Technologies, KPMG Consulting, Accenture PLC, Cognizant, Boston Consulting Group, Ernst & Young Global Limited, Mercer Consulting, A T Kearney Inc, PricewaterhouseCoopers LLP, Tata Consultancy Services, McKinsey & Company.

3. What are the main segments of the South-East Asia Consulting Services Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain.

6. What are the notable trends driving market growth?

Financial Advisory to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

March 2023: IBM Consulting doubled down on its dedication to South East Asia with the introduction of a new Innovation Hub in the Philippines. The primary aim of the Innovation Hub in Cebu City was to cater to the growing demand for IBM Consulting's clients in Japan on topics involving business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia Consulting Services Market?

To stay informed about further developments, trends, and reports in the South-East Asia Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence