Key Insights

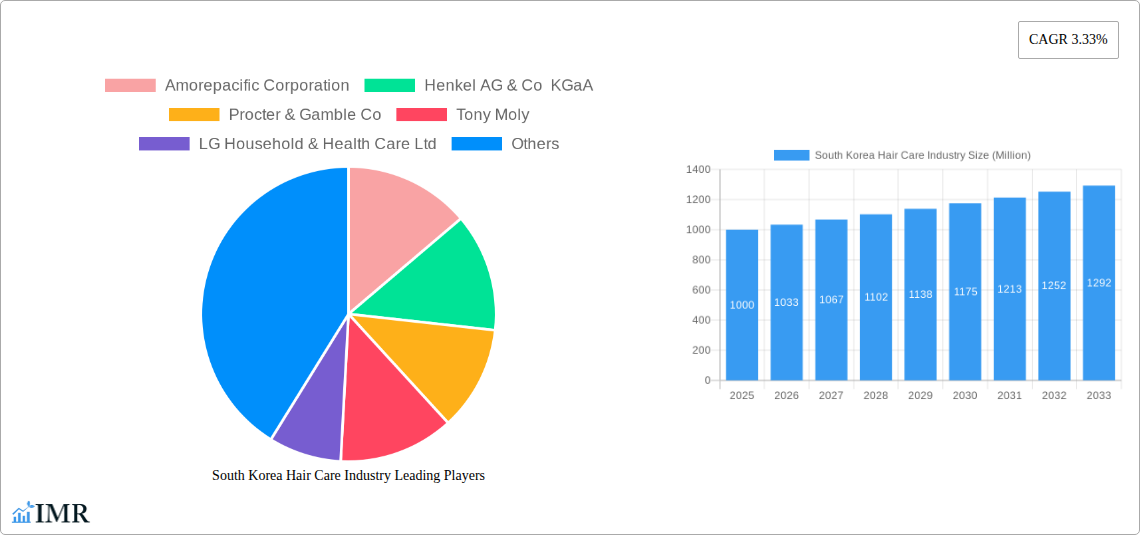

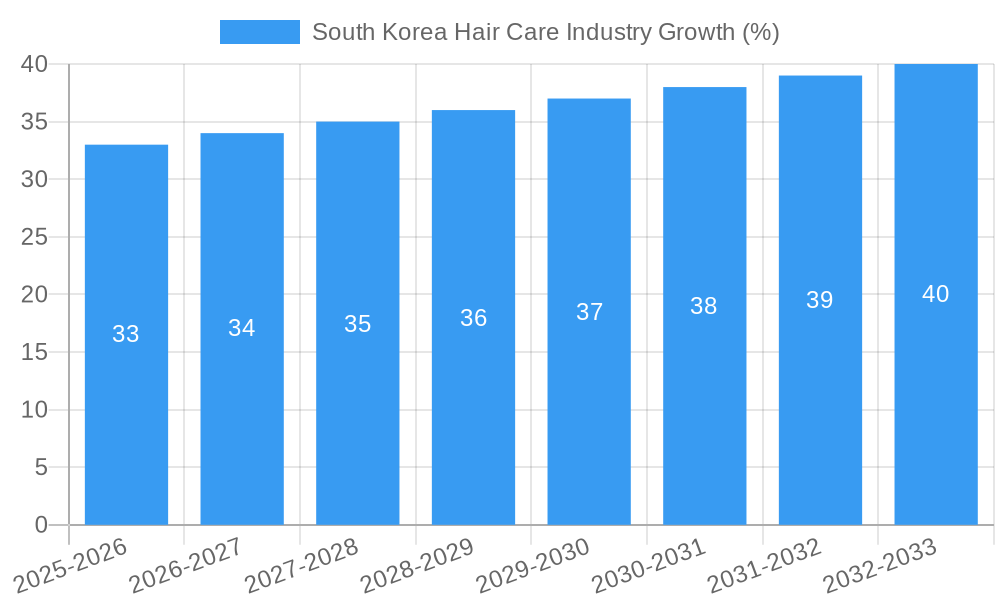

The South Korean hair care market, valued at approximately $XX million in 2025, exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 3.33% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes among South Koreans, coupled with a strong emphasis on personal appearance and beauty trends, drive demand for premium and specialized hair care products. The increasing popularity of K-beauty globally also contributes significantly, boosting exports and domestic consumption. Furthermore, the expansion of online retail channels offers convenient access to a wide range of products, further fueling market growth. The market is segmented by product type (shampoo, conditioner, hair gel, hair colorant, others) and distribution channel (supermarkets/hypermarkets, convenience stores, specialty stores, online retail, others). Major players like Amorepacific, LG Household & Health Care, and Shiseido compete fiercely, innovating with advanced formulations and targeted marketing strategies to capture market share.

However, certain challenges exist. Fluctuations in raw material prices and intense competition among established brands and emerging players could impact profit margins. Furthermore, evolving consumer preferences and the rise of natural and organic hair care products present opportunities as well as challenges for existing players. Companies are adapting by incorporating natural ingredients, promoting sustainable practices, and focusing on personalized hair care solutions to cater to the evolving needs of the discerning South Korean consumer. The projected market value in 2033 will depend on maintaining this CAGR and adapting to evolving consumer trends and competitive pressures. Further analysis is needed to accurately predict specific market values beyond 2025, but the 3.33% CAGR suggests a continued, albeit moderate, expansion.

South Korea Hair Care Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the South Korea hair care industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking in-depth insights into this dynamic market.

Keywords: South Korea hair care, hair care market, K-beauty, hair products, shampoo, conditioner, hair color, hair gel, beauty industry, cosmetic market, Amorepacific, LG Household & Health Care, market analysis, market forecast, industry trends, consumer behavior, market size, growth opportunities, competitive landscape.

South Korea Hair Care Industry Market Dynamics & Structure

The South Korean hair care market, valued at xx million units in 2024, exhibits a moderately concentrated structure with key players like Amorepacific Corporation, LG Household & Health Care Ltd, and Henkel AG & Co KGaA holding significant market share. Technological innovation, driven by advancements in natural ingredients, personalized formulations, and sustainable packaging, is a crucial driver. Stringent regulatory frameworks concerning ingredient safety and labeling influence product development and marketing strategies. Competitive substitutes include homemade remedies and imported brands, impacting market share dynamics. The end-user demographic is primarily comprised of young adults and working professionals with a high disposable income and interest in advanced beauty products. Recent M&A activities reflect consolidation trends, with xx deals recorded between 2019 and 2024, primarily focused on enhancing distribution networks and expanding product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on natural ingredients, personalized formulations (e.g., CJ OnStyle's bespoke shampoo), and sustainable packaging.

- Regulatory Framework: Strict regulations on ingredient safety and labeling impact product development.

- Competitive Substitutes: Homemade remedies and imported brands pose competitive pressure.

- End-User Demographics: Young adults and working professionals are primary consumers.

- M&A Trends: xx M&A deals between 2019-2024, focused on distribution and portfolio expansion.

South Korea Hair Care Industry Growth Trends & Insights

The South Korean hair care market has witnessed robust growth during the historical period (2019-2024), exhibiting a CAGR of xx%. This growth is attributed to increasing disposable incomes, rising consumer awareness of hair care, and the burgeoning popularity of K-beauty globally. The adoption rate of premium and specialized hair care products has significantly increased, driven by a preference for natural and technologically advanced formulations. Technological disruptions, such as the introduction of grey hair concealing shampoos by Amorepacific and LG H&H, have reshaped consumer preferences and created new market segments. Changing consumer behaviors, such as increased online shopping and demand for personalized products, are key factors shaping the industry's trajectory. The market is projected to maintain a steady growth trajectory, reaching xx million units by 2033, with a forecasted CAGR of xx% during the forecast period (2025-2033). Market penetration of premium segments is expected to increase by xx% by 2033.

Dominant Regions, Countries, or Segments in South Korea Hair Care Industry

The South Korean hair care market is largely dominated by urban centers, reflecting higher disposable incomes and greater access to retail channels. By product type, shampoos constitute the largest segment, accounting for xx% of the market in 2024, followed by conditioners at xx%. The online retail channel is experiencing rapid growth, fueled by the increasing digital adoption of consumers.

- Key Drivers:

- High disposable income in urban areas.

- Strong preference for premium and specialized products.

- Extensive distribution networks across urban areas.

- Rise in popularity of online retail channels.

- Dominant Segments:

- By Product Type: Shampoo (xx% market share), Conditioner (xx% market share)

- By Distribution Channel: Online Retail Channels (growing at xx% CAGR)

South Korea Hair Care Industry Product Landscape

The South Korean hair care industry showcases a diverse product landscape, encompassing a wide range of shampoos, conditioners, hair gels, hair colorants, and other specialized products. Product innovations emphasize natural ingredients, advanced formulations for specific hair types (e.g., damaged, oily, fine), and sophisticated packaging designs. Key performance metrics include consumer satisfaction ratings, repeat purchase rates, and market share within specific product categories. Unique selling propositions (USPs) often revolve around natural ingredients, efficacy claims, and brand heritage. Technological advancements have focused on delivering personalized hair care solutions, such as bespoke shampoos tailored to individual needs.

Key Drivers, Barriers & Challenges in South Korea Hair Care Industry

Key Drivers:

Rising consumer awareness of hair care, increasing disposable incomes, and the growing popularity of K-beauty are driving the market. Technological advancements, particularly in personalized formulations and sustainable packaging, further fuel market growth. Favorable government policies supporting the cosmetics industry also play a role.

Key Challenges & Restraints:

Intense competition from both domestic and international brands poses a significant challenge. Supply chain disruptions due to global events can impact product availability and pricing. Stringent regulatory requirements can increase product development costs. Fluctuations in raw material prices also impact profitability.

Emerging Opportunities in South Korea Hair Care Industry

Untapped opportunities exist in niche segments, such as products catering to specific hair concerns (e.g., hair loss, scalp health). The growing demand for personalized and sustainable hair care solutions presents significant opportunities for innovative product development. Expansion into emerging markets through strategic partnerships can further drive growth. Finally, leveraging the popularity of K-beauty globally can attract international consumers.

Growth Accelerators in the South Korea Hair Care Industry

Technological advancements, particularly in personalized formulations and ingredient discovery, will accelerate market growth. Strategic partnerships between domestic brands and international distributors can expand market reach. Aggressive marketing campaigns highlighting the benefits of K-beauty hair care products will drive adoption. Focusing on sustainability and eco-friendly packaging will attract environmentally conscious consumers.

Key Players Shaping the South Korea Hair Care Industry Market

- Amorepacific Corporation

- Henkel AG & Co KGaA

- Procter & Gamble Co

- Tony Moly

- LG Household & Health Care Ltd

- Mandom Corporation

- AEKYUNG Industry Co Ltd

- Shiseido Company Limited

- Kao Corporation

- Nature Republic Inc

Notable Milestones in South Korea Hair Care Industry Sector

- September 2022: Duopharma Biotech Bhd signs distribution agreement with SCM Lifescience Inc for anti-hair loss products in Malaysia.

- June 2022: Amorepacific and LG H&H launch successful grey hair concealing shampoos, signaling high demand for anti-aging products.

- May 2022: CJ OnStyle launches personalized beauty brand with bespoke shampoo developed with Cosmax.

In-Depth South Korea Hair Care Industry Market Outlook

The South Korean hair care market is poised for sustained growth, driven by technological innovations, evolving consumer preferences, and strategic partnerships. The rising popularity of K-beauty globally presents significant opportunities for expansion into international markets. Focus on sustainability, personalization, and addressing specific hair concerns will be crucial for maintaining a competitive edge. The market is expected to continue its upward trajectory, with significant potential for both domestic and international players to capture market share.

South Korea Hair Care Industry Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Gel

- 1.4. Hair Colorant

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Retail Stores

- 2.4. Online Retail Channels

- 2.5. Other Distribution Channels

South Korea Hair Care Industry Segmentation By Geography

- 1. South Korea

South Korea Hair Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Rising Incidence Of Hair-Related Problems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Hair Care Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Gel

- 5.1.4. Hair Colorant

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Retail Stores

- 5.2.4. Online Retail Channels

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amorepacific Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henkel AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Procter & Gamble Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tony Moly

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LG Household & Health Care Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mandom Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AEKYUNG Industry Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiseido Company Limited*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kao Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nature Republic Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amorepacific Corporation

List of Figures

- Figure 1: South Korea Hair Care Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Hair Care Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Hair Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Hair Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Korea Hair Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Korea Hair Care Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Hair Care Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Hair Care Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: South Korea Hair Care Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: South Korea Hair Care Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Hair Care Industry?

The projected CAGR is approximately 3.33%.

2. Which companies are prominent players in the South Korea Hair Care Industry?

Key companies in the market include Amorepacific Corporation, Henkel AG & Co KGaA, Procter & Gamble Co, Tony Moly, LG Household & Health Care Ltd, Mandom Corporation, AEKYUNG Industry Co Ltd, Shiseido Company Limited*List Not Exhaustive, Kao Corporation, Nature Republic Inc.

3. What are the main segments of the South Korea Hair Care Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Rising Incidence Of Hair-Related Problems.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

In September 2022, Duopharma Biotech Bhd, via wholly-owned Duopharma Consumer Healthcare Sdn Bhd, signed a product distribution agreement with South Korea-based stem cell technology company SCM Lifescience Inc to distribute a range of anti-hair loss products in Malaysia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Hair Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Hair Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Hair Care Industry?

To stay informed about further developments, trends, and reports in the South Korea Hair Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence