Key Insights

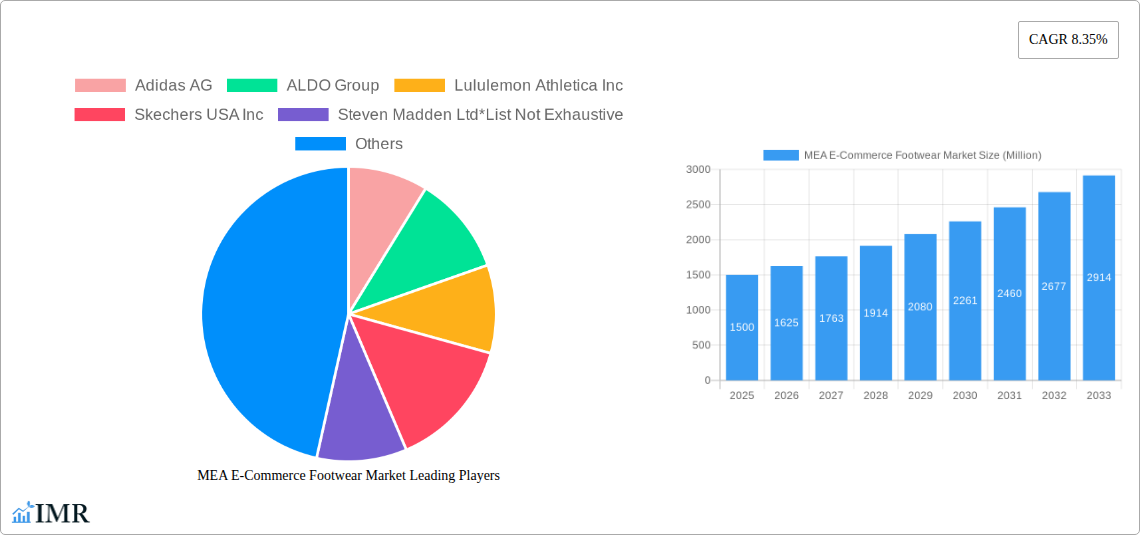

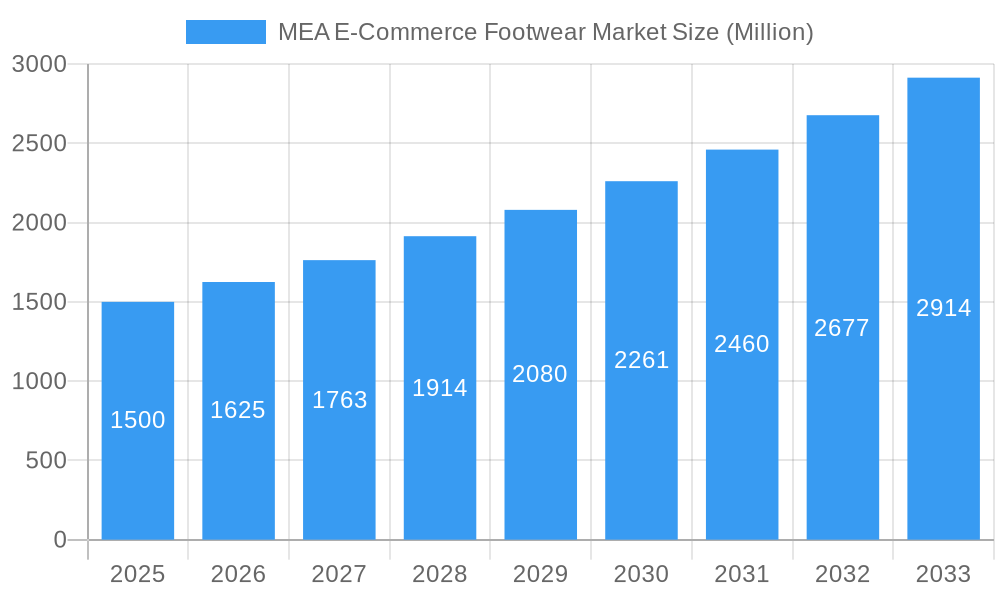

The MEA e-commerce footwear market is experiencing robust growth, driven by rising internet and smartphone penetration, increasing disposable incomes, and a preference for convenient online shopping. The market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 8.35% and a starting point extrapolated from available industry reports), is projected to expand significantly over the forecast period (2025-2033). Key growth drivers include the expanding young and digitally savvy population in the MEA region, coupled with aggressive marketing strategies employed by major footwear brands and burgeoning e-commerce platforms. Furthermore, the increasing popularity of athleisure and the growing trend of purchasing footwear online for enhanced price comparison and variety significantly contribute to the market's upward trajectory. The segmentation reveals that athletic footwear holds a substantial market share, likely driven by the increasing popularity of fitness activities and sports within the region. Men and women constitute the largest end-user segments, while third-party retailers currently dominate the platform landscape. However, brands are increasingly investing in their own e-commerce channels to enhance customer loyalty and brand control. Competitive intensity remains high with established international players like Adidas, Nike, and Puma alongside local and regional brands vying for market share. Challenges include inconsistent internet connectivity in some areas and concerns around online payment security, which could slightly dampen growth in certain segments.

MEA E-Commerce Footwear Market Market Size (In Billion)

Despite these challenges, the long-term outlook for the MEA e-commerce footwear market remains positive. The continued expansion of e-commerce infrastructure, coupled with targeted marketing campaigns focused on building consumer trust and addressing logistical concerns, will further fuel market expansion. Strategic partnerships between international brands and regional distributors will also play a crucial role in optimizing market penetration and driving sales. The consistent adoption of mobile-first approaches by companies is another key factor underpinning the market's strong growth trajectory. The rise of social commerce and influencer marketing within the region also presents significant opportunities for growth, leveraging the strong social media presence among consumers in the MEA region. Specific regional variations in demand and consumer preference need to be addressed through tailored product offerings and marketing initiatives to maximize market capture.

MEA E-Commerce Footwear Market Company Market Share

MEA E-Commerce Footwear Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) e-commerce footwear market, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities within this rapidly expanding sector. The report segments the market by product type (athletic and non-athletic footwear), end-user (men, women, and kids/children), and platform type (third-party retailers and company websites), offering granular insights for strategic decision-making. With a focus on key players like Adidas AG, Nike Inc., and Puma SE, this report is an essential resource for industry professionals, investors, and market researchers seeking to navigate the complexities of the MEA e-commerce footwear landscape. Market values are presented in million units.

MEA E-Commerce Footwear Market Dynamics & Structure

The MEA e-commerce footwear market is characterized by a moderately concentrated landscape, with a few dominant players and numerous smaller niche brands. Technological innovation, particularly in areas like personalized recommendations and augmented reality (AR) fitting, is a key driver. Regulatory frameworks concerning online sales and consumer protection are evolving, impacting market operations. Competitive product substitutes, such as sandals and traditional footwear, still hold significant market share, posing a challenge to e-commerce growth. End-user demographics show a rising young population increasingly inclined towards online shopping. M&A activity in the sector is moderate, with strategic acquisitions focused on expanding market reach and product portfolios.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AR/VR for virtual try-ons, personalized recommendations, and improved logistics are key drivers.

- Regulatory Framework: Varying regulations across countries impact market access and operations; ongoing developments are expected to create more unified standards.

- Competitive Substitutes: Traditional brick-and-mortar stores and other footwear types pose moderate competition.

- End-User Demographics: A young and growing population fuels online shopping adoption, particularly in urban areas.

- M&A Trends: Strategic acquisitions aimed at geographical expansion and product diversification. xx M&A deals were recorded in the period 2019-2024.

MEA E-Commerce Footwear Market Growth Trends & Insights

The MEA e-commerce footwear market exhibits a robust growth trajectory, driven by increasing internet and smartphone penetration, rising disposable incomes, and a shift in consumer preferences towards online shopping convenience. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This growth is further fueled by technological disruptions like mobile commerce and the adoption of advanced e-commerce platforms. Consumer behavior is evolving towards personalized shopping experiences, influencing demand for customized products and services. The market penetration rate for e-commerce footwear is projected to reach xx% by 2033.

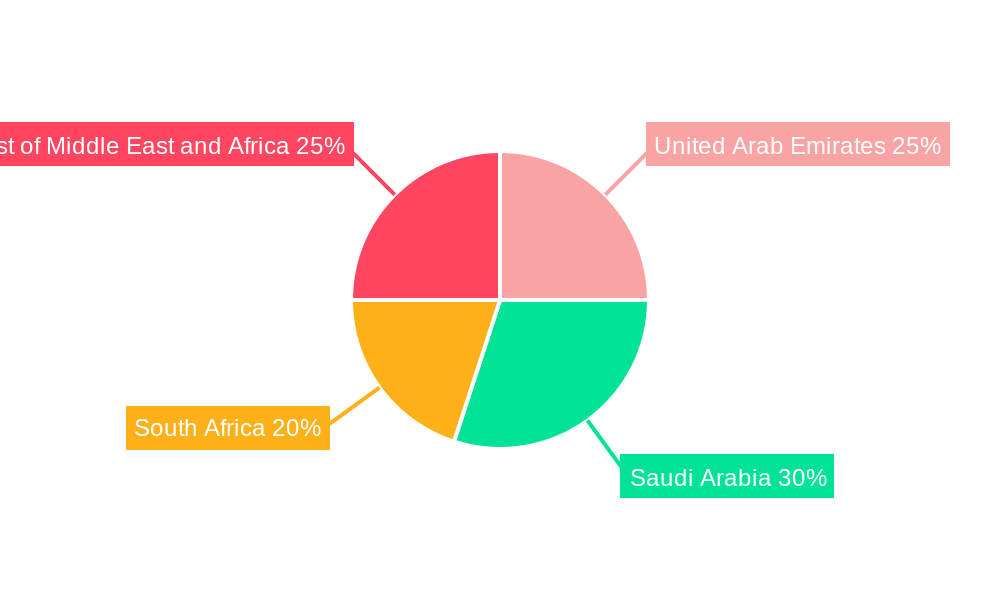

Dominant Regions, Countries, or Segments in MEA E-Commerce Footwear Market

The United Arab Emirates (UAE) and South Africa emerge as dominant regions, driven by strong e-commerce infrastructure, high internet penetration, and a significant young population. Within product types, athletic footwear commands a larger market share compared to non-athletic footwear due to increasing fitness awareness and the popularity of sports. The men’s segment leads in terms of sales volume, followed by women's and kids'/children's segments. Third-party retailers dominate the platform landscape, benefiting from extensive reach and established customer bases.

- Key Drivers: Strong e-commerce infrastructure, high internet penetration, rising disposable incomes, and increasing adoption of online shopping.

- UAE & South Africa Dominance: Advanced e-commerce ecosystems, large populations, and favorable economic conditions.

- Athletic Footwear Segment: High demand driven by increased fitness consciousness and popularity of sports.

- Men's Segment: Holds the largest market share among end-users.

- Third-Party Retailers: Significant market share due to established customer base and extensive reach.

MEA E-Commerce Footwear Market Product Landscape

The MEA e-commerce footwear market showcases a diverse range of products catering to various preferences and needs. Innovation focuses on enhanced comfort, durability, and style. Athletic footwear incorporates advanced technologies like responsive cushioning and breathable materials, while non-athletic footwear emphasizes design and versatility. Unique selling propositions (USPs) include collaborations with prominent designers and athletes, offering limited-edition releases that generate significant buzz. Technological advancements like 3D-printed footwear are emerging, albeit slowly, presenting future opportunities for customization and personalization.

Key Drivers, Barriers & Challenges in MEA E-Commerce Footwear Market

Key Drivers:

- Increasing internet and smartphone penetration.

- Rising disposable incomes, especially among the younger generation.

- Growing preference for online shopping convenience and wider selection.

- Investments in logistics and delivery infrastructure.

Key Challenges:

- Logistics and delivery challenges in certain regions.

- Counterfeit products remain a considerable concern impacting trust.

- Varying consumer preferences across different regions of MEA.

- The need for enhanced payment gateway options.

Emerging Opportunities in MEA E-Commerce Footwear Market

Untapped markets in smaller cities and rural areas present significant growth opportunities. The increasing popularity of athleisure and personalized footwear creates demand for customized products and services. The integration of virtual reality (VR) and augmented reality (AR) technologies for virtual try-ons offers enhanced customer experience and reduces return rates.

Growth Accelerators in the MEA E-Commerce Footwear Market Industry

Technological advancements like AI-powered recommendation engines and improved delivery networks are expected to drive long-term growth. Strategic partnerships between footwear brands and e-commerce platforms broaden market reach and customer acquisition. Expansion into underserved markets and the introduction of innovative product offerings will play a crucial role in accelerating market growth.

Key Players Shaping the MEA E-Commerce Footwear Market Market

Notable Milestones in MEA E-Commerce Footwear Market Sector

- April 2021: Adidas Originals and Arwa Al Banawi collaborated on a new sneaker, exclusively available through AlUla in Saudi Arabia.

- October 2022: Nike's Jordan Brand partnered with South African retailer Shelflife for a limited-edition release.

- November 2022: Steve Madden launched its first African collaboration with Bonang Matheba, featuring footwear and handbags.

In-Depth MEA E-Commerce Footwear Market Market Outlook

The MEA e-commerce footwear market is poised for substantial growth over the forecast period (2025-2033), driven by technological advancements, rising consumer spending, and expanding e-commerce infrastructure. Strategic partnerships, innovative product launches, and expansion into new markets will further propel growth. Brands that effectively leverage digital marketing, offer personalized experiences, and navigate the complexities of the evolving regulatory landscape will capture significant market share and drive profitability.

MEA E-Commerce Footwear Market Segmentation

-

1. Product Type

- 1.1. Athletic Footwear

- 1.2. Non-Athletic Footwear

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. South Africa

- 4.2. United Arab Emirates

- 4.3. Rest of Middle East and Africa

MEA E-Commerce Footwear Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Rest of Middle East and Africa

MEA E-Commerce Footwear Market Regional Market Share

Geographic Coverage of MEA E-Commerce Footwear Market

MEA E-Commerce Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfiet Products

- 3.4. Market Trends

- 3.4.1. Social Media Influence and Aggressive Marketing Fueling Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Athletic Footwear

- 5.1.2. Non-Athletic Footwear

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. United Arab Emirates

- 5.5.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Athletic Footwear

- 6.1.2. Non-Athletic Footwear

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. United Arab Emirates

- 6.4.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Athletic Footwear

- 7.1.2. Non-Athletic Footwear

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. United Arab Emirates

- 7.4.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Athletic Footwear

- 8.1.2. Non-Athletic Footwear

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. United Arab Emirates

- 8.4.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ALDO Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Lululemon Athletica Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Skechers USA Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Steven Madden Ltd*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 LVMH Moët Hennessy Louis Vuitton

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Under Armour Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 New Balance Athletics Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 ASICS Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: MEA E-Commerce Footwear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA E-Commerce Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 4: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: MEA E-Commerce Footwear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 9: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 14: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 19: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA E-Commerce Footwear Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the MEA E-Commerce Footwear Market?

Key companies in the market include Adidas AG, ALDO Group, Lululemon Athletica Inc, Skechers USA Inc, Steven Madden Ltd*List Not Exhaustive, Puma SE, LVMH Moët Hennessy Louis Vuitton, Under Armour Inc, Nike Inc, New Balance Athletics Inc, ASICS Corporation.

3. What are the main segments of the MEA E-Commerce Footwear Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players.

6. What are the notable trends driving market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand.

7. Are there any restraints impacting market growth?

Availability of Counterfiet Products.

8. Can you provide examples of recent developments in the market?

November 2022: Steve Madden announced its first-ever African collaboration with South African media personality Bonang Matheba. The apparel, footwear, and accessory brand stated that this collaboration is part of their 10-year celebration in Africa. The company launched six pieces of footwear and two handbags as a part of this collaboration in Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA E-Commerce Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA E-Commerce Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA E-Commerce Footwear Market?

To stay informed about further developments, trends, and reports in the MEA E-Commerce Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence