Key Insights

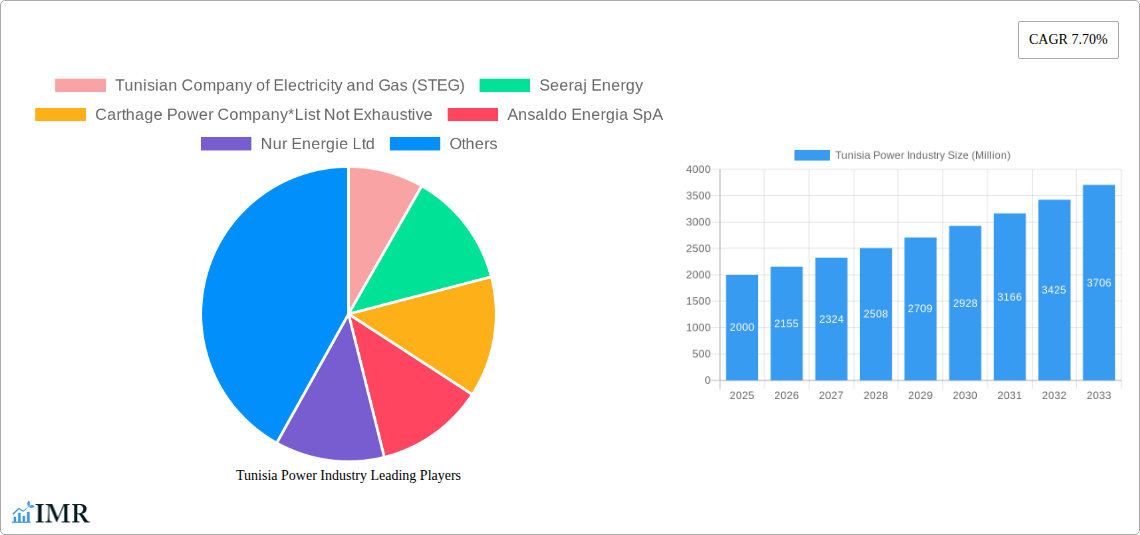

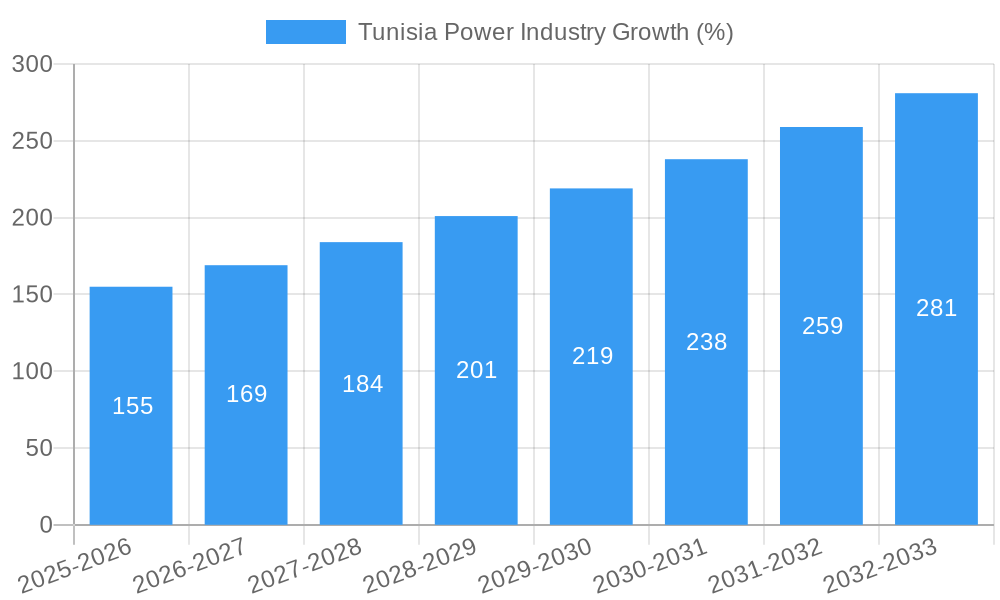

The Tunisian power industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.70% from 2025 to 2033. This expansion is driven by several key factors. Increasing energy demand fueled by population growth and economic development necessitates significant investments in power generation and distribution infrastructure. Furthermore, a shift towards renewable energy sources, particularly solar PV, is gaining momentum, aligning with global sustainability goals and reducing reliance on fossil fuels like diesel and natural gas. Government initiatives promoting energy diversification and efficiency improvements are also contributing to market growth. However, challenges remain. Limited financial resources and infrastructural limitations could hinder the pace of expansion. Furthermore, the intermittent nature of renewable energy sources necessitates robust grid management and energy storage solutions to ensure reliable power supply. The industry is segmented by technology, encompassing Solar PV, Diesel Gensets, Natural Gas Gensets, Microgrids, and other technologies. Key players include STEG, Seeraj Energy, Carthage Power Company, Ansaldo Energia SpA, Nur Energie Ltd, and General Electric Company, though the market is not limited to these entities. Competition is expected to intensify as new entrants and technological advancements continue to reshape the landscape. The forecast period anticipates significant investment in upgrading existing infrastructure and integrating new renewable energy capacities, presenting lucrative opportunities for both domestic and international players. The market’s growth trajectory will depend on the successful implementation of government policies, private sector investment, and technological innovation in overcoming existing infrastructural and financial constraints.

The Tunisian power sector's growth trajectory is intrinsically linked to the country's economic development and its commitment to energy security. While the transition to renewables presents significant opportunities, challenges related to grid modernization, energy storage, and financing remain crucial considerations. The successful navigation of these challenges will be critical in realizing the full potential of the projected market growth and ensuring a stable and sustainable energy future for Tunisia. The increasing adoption of microgrids, offering localized and resilient power solutions, is another significant trend shaping the market, particularly in remote areas. This diversification in technology adoption reflects a concerted effort to enhance the resilience and sustainability of Tunisia’s power infrastructure.

Tunisia Power Industry: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides a detailed analysis of the Tunisia power industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to offer actionable insights for industry professionals, investors, and strategic decision-makers.

Tunisia Power Industry Market Dynamics & Structure

This section analyzes the Tunisian power market's structure, identifying key market drivers, constraints, and future potential. The Tunisian power market, while dominated by STEG (Tunisian Company of Electricity and Gas), is experiencing increasing diversification with the entry of Independent Power Producers (IPPs). This report analyzes market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends.

- Market Concentration: STEG holds a significant market share (estimated at xx%), with IPPs like Seeraj Energy and Carthage Power Company contributing a combined xx%. The remaining market share is divided among smaller players and international companies like Ansaldo Energia SpA and General Electric Company.

- Technological Innovation: The industry is witnessing a shift towards renewable energy sources, driven by government initiatives and decreasing technology costs. However, challenges remain in grid integration and financing.

- Regulatory Framework: Tunisia's regulatory environment is evolving, with a focus on attracting foreign investment in renewable energy projects. However, bureaucratic hurdles and permitting processes remain areas for improvement.

- Competitive Landscape: The competitive landscape is characterized by both domestic and international players vying for market share. Competition is primarily driven by price and technological capabilities. Substitutes include primarily imported energy sources, but this is becoming less prevalent due to increasing local renewable generation.

- M&A Activity: The number of M&A deals in the sector has been moderate (xx deals in the historical period), primarily focused on renewable energy projects. Future M&A activity is expected to increase with growing private sector participation and government incentives.

- End-User Demographics: The end-user base consists primarily of residential, commercial, and industrial consumers, with varying electricity consumption patterns. The growth of industrial consumers (e.g. the phosphate industry) significantly drives electricity demand.

Tunisia Power Industry Growth Trends & Insights

This section delves into the evolution of the Tunisian power market size, adoption rates of different technologies, and shifts in consumer behavior. The report utilizes data from various sources and predictive modelling to provide a comprehensive view of the market's trajectory. Analyzing historical data (2019-2024), we project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), leading to a market size of xx Million in 2033. This growth is fueled by increasing energy demand, government support for renewable energy, and investment from IPPs. Technological disruption, mainly driven by the adoption of solar PV and other renewables, is significantly impacting market dynamics.

Dominant Regions, Countries, or Segments in Tunisia Power Industry

This segment identifies the leading regions and technology segments within Tunisia's power sector, focusing on growth drivers and market share.

- Solar PV: The solar PV segment is experiencing rapid growth, driven by favorable solar irradiance, government incentives, and decreasing technology costs. Growth is particularly strong in the Southern regions, due to better solar resource potential. Market share in 2025 is estimated at xx%.

- Diesel Gensets: While still significant, the diesel genset segment is experiencing a decline due to environmental concerns and higher operating costs compared to natural gas and renewable alternatives. It remains dominant in remote areas with limited grid access. Market share in 2025 is estimated at xx%.

- Natural Gas Gensets: This segment is expected to experience steady growth, driven by the relatively low cost of natural gas and improved grid infrastructure. Market share in 2025 is estimated at xx%.

- Microgrids: The microgrid segment shows considerable growth potential, particularly in rural and remote areas. Market share in 2025 is estimated at xx%.

- Other Technologies: This includes wind energy, which is expected to play a growing role in the country’s energy mix. Market share in 2025 is estimated at xx%.

Tunisia Power Industry Product Landscape

The Tunisian power industry product landscape is evolving, with a growing emphasis on renewable energy technologies. Solar PV systems are becoming increasingly sophisticated, featuring higher efficiency cells and improved energy storage solutions. Diesel and natural gas gensets are also seeing technological advancements in terms of efficiency and emissions reduction. The market is witnessing the integration of smart grid technologies and advanced metering infrastructure (AMI) to improve grid management and energy efficiency.

Key Drivers, Barriers & Challenges in Tunisia Power Industry

Key Drivers:

- Increasing energy demand from growing industrial and residential sectors.

- Government support for renewable energy through various incentives and policies.

- Decreasing costs of renewable energy technologies.

- Growing interest from foreign investors in the Tunisian energy market.

Key Challenges:

- Limited access to financing for renewable energy projects.

- Grid infrastructure limitations in some regions.

- Bureaucratic hurdles and regulatory complexities in project development.

- Potential energy security challenges due to reliance on imported fossil fuels. A disruption to the supply could impact the price by xx%.

Emerging Opportunities in Tunisia Power Industry

Emerging opportunities exist in decentralized energy solutions, such as microgrids, particularly in rural areas with limited grid access. Furthermore, the increasing adoption of energy storage technologies offers significant potential for improving grid stability and integrating renewable energy sources. Opportunities also exist in developing smart grid technologies and energy management systems.

Growth Accelerators in the Tunisia Power Industry

Long-term growth in the Tunisian power industry is being driven by government policies promoting renewable energy adoption, increasing private sector investment, and technological advancements leading to improved efficiency and cost reduction. Strategic partnerships between international companies and local players are also boosting growth.

Key Players Shaping the Tunisia Power Industry Market

- Tunisian Company of Electricity and Gas (STEG)

- Seeraj Energy

- Carthage Power Company

- Ansaldo Energia SpA

- Nur Energie Ltd

- General Electric Company

Notable Milestones in Tunisia Power Industry Sector

- July 2020: STEG and Qair partner on a 200kV floating photovoltaic solar farm pilot project.

- September 2020: Akuo Energy, HBG Holding, and Nour Energy sign a PPA with STEG for a 10 MWp solar plant in Gabès.

- May 2021: Nur Energie wins a contract to build a 10 MW solar PV park in Gabès Sudes.

In-Depth Tunisia Power Industry Market Outlook

The Tunisian power industry is poised for significant growth in the coming years, driven by a combination of factors including increasing energy demand, government support for renewable energy, and technological advancements. Strategic investments in grid infrastructure and energy efficiency measures will be crucial for ensuring a sustainable and reliable power supply. The market presents significant opportunities for both domestic and international players.

Tunisia Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Tunisia Power Industry Segmentation By Geography

- 1. Tunisia

Tunisia Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries

- 3.3. Market Restrains

- 3.3.1. 4.; The Technology's Exorbitant Costs and Environmental Impacts

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tunisia Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Tunisia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seeraj Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carthage Power Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ansaldo Energia SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nur Energie Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

List of Figures

- Figure 1: Tunisia Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Tunisia Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Tunisia Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Tunisia Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Tunisia Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Tunisia Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Tunisia Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Tunisia Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Tunisia Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Tunisia Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Tunisia Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Tunisia Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Tunisia Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Tunisia Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Tunisia Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Tunisia Power Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tunisia Power Industry?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the Tunisia Power Industry?

Key companies in the market include Tunisian Company of Electricity and Gas (STEG), Seeraj Energy, Carthage Power Company*List Not Exhaustive, Ansaldo Energia SpA, Nur Energie Ltd, General Electric Company.

3. What are the main segments of the Tunisia Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries.

6. What are the notable trends driving market growth?

Conventional Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technology's Exorbitant Costs and Environmental Impacts.

8. Can you provide examples of recent developments in the market?

In July 2020, the Société Tunisienne de l'Electricité et du Gaz (STEG) signed a partnership agreement with Qair to carry out a 200kV pilot project for a floating photovoltaic solar farm on the lake of Tunis and a study of the floating solar potential in Tunisia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tunisia Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tunisia Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tunisia Power Industry?

To stay informed about further developments, trends, and reports in the Tunisia Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence