Key Insights

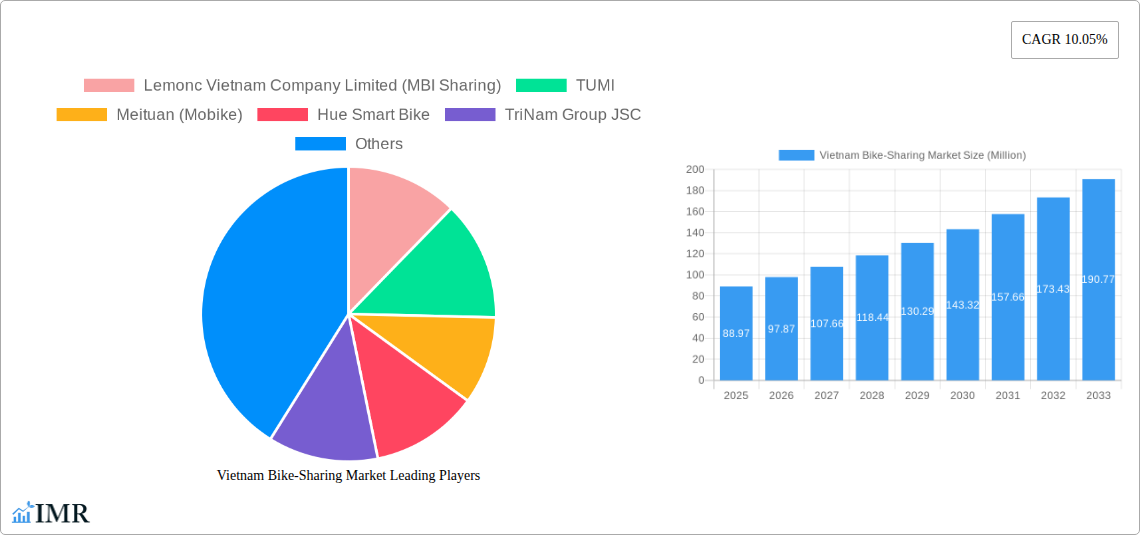

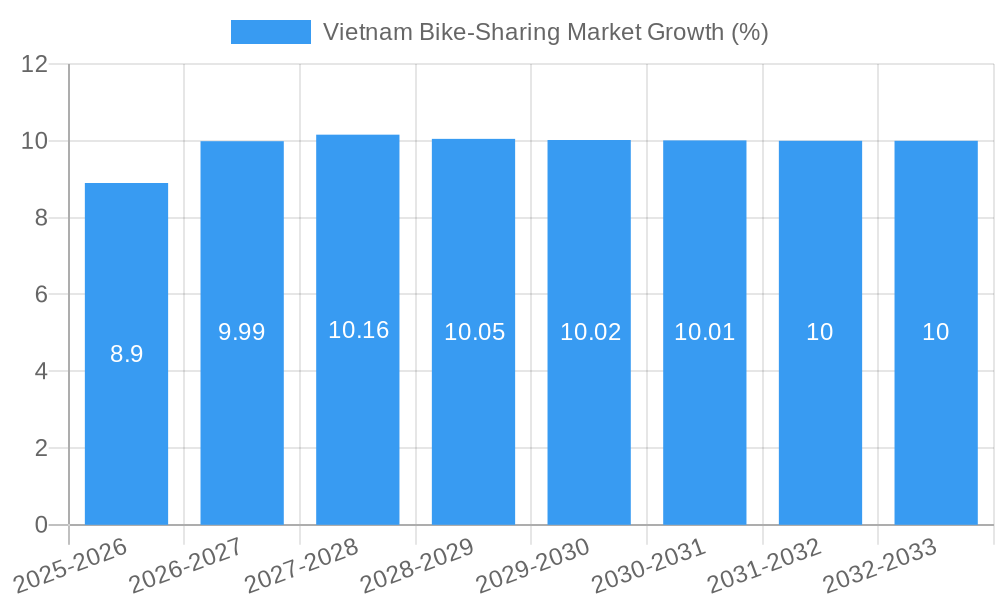

The Vietnam bike-sharing market, valued at $88.97 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.05% from 2025 to 2033. This surge is driven by several factors. Increasing urbanization in Vietnam leads to traffic congestion and parking difficulties, making bike-sharing an attractive, eco-friendly, and affordable alternative for short commutes and recreational activities. Government initiatives promoting sustainable transportation and reducing carbon emissions further bolster the market. The rising popularity of e-bikes, offering longer ranges and faster speeds, is a key segment driver, alongside the convenience of dockless systems which eliminate the need for fixed stations. Tourism also contributes significantly, with bike-sharing providing a convenient and enjoyable way for visitors to explore cities. However, challenges remain, including concerns about bike vandalism, operational costs associated with maintenance and fleet management, and the need for robust technological infrastructure to support efficient booking and payment systems. Competition among existing players, including both local companies like Lemonc Vietnam and larger international players like Meituan (Mobike), continues to intensify, resulting in price wars and innovative service offerings to attract and retain users.

The market segmentation reveals diverse opportunities. E-bikes are expected to witness the fastest growth due to their enhanced capabilities. Dockless systems, offering greater flexibility to users, are also gaining popularity over docked systems. Short-term rentals dominate the market, catering to the majority of users, although long-term rentals, particularly for commuters, are also seeing increasing adoption. Geographical variations are likely, with higher demand in densely populated urban areas and tourist hotspots. Future growth will hinge on overcoming existing operational and infrastructure challenges, as well as addressing consumer concerns related to safety and security. Strategic partnerships, technological advancements, and effective marketing campaigns are crucial for players seeking to capture a larger share of this rapidly evolving market.

Vietnam Bike-Sharing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Vietnam bike-sharing market, encompassing market dynamics, growth trends, key players, and future opportunities. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. This report is essential for investors, industry professionals, and anyone seeking to understand the dynamics of this rapidly expanding sector within the broader Vietnamese micromobility market.

Vietnam Bike-Sharing Market Dynamics & Structure

The Vietnam bike-sharing market, a subset of the larger micromobility market, is characterized by a moderately fragmented landscape with a mix of established players and emerging startups. Market concentration is relatively low, with no single dominant player controlling a significant majority of the market share. In 2025, the top 5 players are estimated to hold approximately xx% of the market, leaving ample room for new entrants and expansion. Technological innovation, particularly in e-bike technology and smart locking systems, is a key driver of market growth.

- Market Concentration: Low, with top 5 players holding approximately xx% market share (2025 Estimate).

- Technological Innovation: Focus on e-bikes, GPS tracking, smart locking, and mobile app integration.

- Regulatory Framework: Evolving regulations concerning infrastructure development and operational permits influence market expansion.

- Competitive Substitutes: Private vehicle ownership, public transportation, and ride-hailing services pose competition.

- End-User Demographics: Young professionals, students, and tourists constitute the primary user base.

- M&A Trends: A relatively low number of mergers and acquisitions have been observed in the historical period (2019-2024), with approximately xx deals recorded. Future consolidation is anticipated.

Vietnam Bike-Sharing Market Growth Trends & Insights

The Vietnam bike-sharing market has experienced significant growth over the historical period (2019-2024). Driven by increasing urbanization, rising environmental concerns, and government initiatives promoting sustainable transportation, the market is projected to continue its upward trajectory. The Compound Annual Growth Rate (CAGR) is estimated at xx% from 2025 to 2033, reaching a market size of xx million units by 2033. Increased adoption of e-bikes is a major contributor to this growth, along with the expansion of dedicated cycling infrastructure. Consumer behavior is shifting towards convenient, affordable, and eco-friendly transportation solutions, further fueling market expansion. Technological advancements are playing a vital role, offering enhanced user experiences and operational efficiencies.

Dominant Regions, Countries, or Segments in Vietnam Bike-Sharing Market

The Vietnam bike-sharing market shows robust growth across various segments. While data is limited for precise regional breakdowns, major cities like Hanoi and Ho Chi Minh City are expected to be the primary growth drivers. The e-bike segment is exhibiting faster growth compared to traditional bikes, driven by convenience and longer travel distances. Dockless systems are gaining popularity due to their flexibility, while short-term rentals dominate the market share. Regular commutes and recreation are the leading application segments. Tourism also contributes significantly in key tourist destinations.

- By Bike Type: E-bikes are the fastest-growing segment.

- By Sharing System: Dockless systems are gaining traction.

- By Sharing Duration: Short-term rentals are dominant.

- By Application: Regular commutes and recreation are leading applications.

- Key Drivers: Government initiatives promoting sustainable transportation, increasing urbanization, rising disposable incomes, and favorable demographics contribute to market dominance in major urban areas.

Vietnam Bike-Sharing Market Product Landscape

The market offers a range of bike-sharing options, from traditional bicycles to advanced e-bikes equipped with GPS tracking, smart locks, and mobile app integration. Key features include user-friendly mobile applications, convenient payment systems, and efficient bike maintenance programs. Innovation focuses on enhancing user experience through technological advancements and providing durable, reliable bikes. Competition focuses on unique selling propositions such as enhanced safety features, battery life for e-bikes, and broader coverage areas.

Key Drivers, Barriers & Challenges in Vietnam Bike-Sharing Market

Key Drivers:

- Government initiatives promoting cycling infrastructure and sustainable transportation.

- Rising environmental concerns and a push for eco-friendly alternatives.

- Increasing urbanization and traffic congestion in major cities.

- Growing adoption of smartphones and mobile payment systems.

Key Challenges & Restraints:

- Limited dedicated cycling infrastructure in some areas.

- Vandalism and theft of bikes remain a significant concern.

- Concerns about safety and security for bike-sharing users.

- Intense competition among providers and potential for market saturation in certain areas.

Emerging Opportunities in Vietnam Bike-Sharing Market

Untapped opportunities exist in expanding into smaller cities and towns, focusing on underserved communities. Integration with public transport systems can significantly boost convenience and adoption. Specialized bike-sharing programs for tourism, focusing on scenic routes, offer high growth potential. Subscription models and corporate partnerships can drive revenue streams. Further innovations in bike technology, such as improved battery technology for e-bikes and enhanced security measures, present ongoing market opportunities.

Growth Accelerators in the Vietnam Bike-Sharing Market Industry

Long-term growth will be driven by continued investment in cycling infrastructure, strategic partnerships between bike-sharing operators and local governments, and the expansion of services into new geographic markets. Technological advancements, particularly in battery technology for e-bikes and improved GPS tracking, will enhance user experience and service efficiency. Government policies promoting sustainable transportation and initiatives to address challenges like vandalism and theft are crucial for long-term market expansion.

Key Players Shaping the Vietnam Bike-Sharing Market Market

- Lemonc Vietnam Company Limited (MBI Sharing)

- TUMI

- Meituan (Mobike)

- Hue Smart Bike

- TriNam Group JSC

- Hyosung Group

- G-Bike (GCOO)

Notable Milestones in Vietnam Bike-Sharing Market Sector

- May 2023: Launch of technical guidelines for bicycling infrastructure design in urban areas, promoting the adoption of environmentally friendly transport.

- June 2023: UNDP workshop raising awareness on the effectiveness of electric-bicycle sharing models.

- February 2024: Hanoi Transport Department unveils plans for an exclusive bicycle lane along the To Lich River, boosting demand for bike-sharing services.

In-Depth Vietnam Bike-Sharing Market Market Outlook

The Vietnam bike-sharing market holds significant long-term growth potential. Continued government support for cycling infrastructure development, combined with technological advancements and the increasing preference for sustainable transport options, will fuel market expansion. Strategic partnerships and market expansion into underserved areas will be vital for sustained growth. The market is well-positioned to experience a period of strong growth, driven by a combination of governmental support and increasing consumer demand for eco-friendly transportation alternatives.

Vietnam Bike-Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Conventional Bikes

- 1.2. E-bikes

-

2. Sharing System

- 2.1. Docked/Station-based

- 2.2. Dock Less

- 2.3. Hybrid

-

3. Sharing Duration

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Regular Commutes and Recreation

- 4.2. Tourism

Vietnam Bike-Sharing Market Segmentation By Geography

- 1. Vietnam

Vietnam Bike-Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Consumer Preference toward Eco-friendly Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. Growing Incidents of Bike Damage and Theft

- 3.4. Market Trends

- 3.4.1. E-bikes Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Bike-Sharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Conventional Bikes

- 5.1.2. E-bikes

- 5.2. Market Analysis, Insights and Forecast - by Sharing System

- 5.2.1. Docked/Station-based

- 5.2.2. Dock Less

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Sharing Duration

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Regular Commutes and Recreation

- 5.4.2. Tourism

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lemonc Vietnam Company Limited (MBI Sharing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TUMI

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meituan (Mobike)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hue Smart Bike

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNam Group JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyosung Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 G-Bike (GCOO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Lemonc Vietnam Company Limited (MBI Sharing)

List of Figures

- Figure 1: Vietnam Bike-Sharing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Bike-Sharing Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Bike-Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Bike-Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 3: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing System 2019 & 2032

- Table 4: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing Duration 2019 & 2032

- Table 5: Vietnam Bike-Sharing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Vietnam Bike-Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Vietnam Bike-Sharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Vietnam Bike-Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 9: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing System 2019 & 2032

- Table 10: Vietnam Bike-Sharing Market Revenue Million Forecast, by Sharing Duration 2019 & 2032

- Table 11: Vietnam Bike-Sharing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Vietnam Bike-Sharing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Bike-Sharing Market?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Vietnam Bike-Sharing Market?

Key companies in the market include Lemonc Vietnam Company Limited (MBI Sharing), TUMI, Meituan (Mobike), Hue Smart Bike, TriNam Group JSC, Hyosung Group, G-Bike (GCOO.

3. What are the main segments of the Vietnam Bike-Sharing Market?

The market segments include Bike Type, Sharing System, Sharing Duration, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Consumer Preference toward Eco-friendly Medium of Transportation.

6. What are the notable trends driving market growth?

E-bikes Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Growing Incidents of Bike Damage and Theft.

8. Can you provide examples of recent developments in the market?

February 2024: The Hanoi Transport Department unveiled its plan to operate an exclusive bicycle lane along the To Lich River. The goal is to encourage consumers to use bicycles for short-distance travel, which can help reduce traffic congestion in the city. The 3 m bicycle path was explicitly developed for riders only, allowing non-electric bicycles to operate in the space. The transport department plans to expand its route to adjacent bicycle lanes along the To Lich River. Formulating dedicated bicycle lanes helps increase the demand for bicycle-sharing services nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Bike-Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Bike-Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Bike-Sharing Market?

To stay informed about further developments, trends, and reports in the Vietnam Bike-Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence