Key Insights

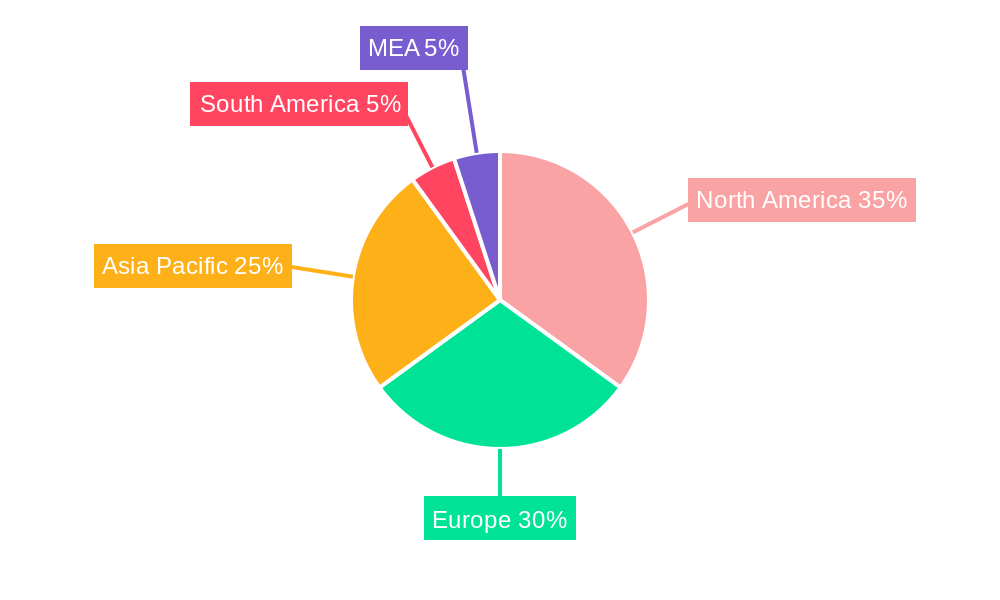

The Waste-to-Energy (WtE) technologies market is experiencing robust growth, driven by increasing urbanization, stringent environmental regulations aimed at reducing landfill waste, and the rising need for renewable energy sources. The market, currently valued at approximately $XX million (assuming a reasonable market size based on similar industry reports and the provided CAGR), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This growth is fueled by several key factors: a global push towards circular economy models, advancements in WtE technologies leading to increased efficiency and reduced emissions, and supportive government policies incentivizing renewable energy adoption and waste management solutions. Municipal Solid Waste (MSW) incineration remains a dominant technology segment, but pyrolysis and gasification are gaining traction due to their potential for producing valuable byproducts like biofuels and syngas. The market is geographically diverse, with North America and Europe currently holding significant market shares, but the Asia-Pacific region is anticipated to demonstrate substantial growth due to rapid industrialization and increasing waste generation. Key players, including Veolia Group, Suez Environnement, and Covanta Holding Corporation, are investing heavily in research and development, capacity expansion, and strategic partnerships to strengthen their market positions.

Competition in the WtE sector is intensifying, with established players facing challenges from emerging technology providers and local companies. Despite the positive outlook, the market faces restraints such as high capital investment requirements for WtE plants, the need for robust regulatory frameworks to support industry growth, and public perception concerning potential environmental impacts. However, technological advancements in emission control and public awareness campaigns are mitigating these concerns. The market segmentation by technology will evolve as innovation progresses, with promising technologies like anaerobic digestion and plasma gasification potentially capturing significant market share in the coming years. The forecast period of 2025-2033 anticipates a steady increase in market value driven by the factors mentioned above, reflecting a positive trajectory for the WtE industry's contribution to a sustainable future. Regional growth will be largely influenced by governmental policies, economic development, and the specific waste management challenges faced in each area.

This comprehensive report provides a detailed analysis of the Waste-to-Energy Technologies industry, encompassing market dynamics, growth trends, regional landscapes, and key players. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year. The report utilizes a robust methodology, incorporating both qualitative and quantitative data to offer actionable insights for industry professionals, investors, and policymakers. The market is segmented by technology (Municipal Solid Waste (MSW) Incineration, Co-processing, Pyrolysis and Gasification, Other Technologies) and further analyzed by key regions and countries globally.

Waste-to-Energy Technologies Industry Market Dynamics & Structure

The waste-to-energy (WtE) market is characterized by a moderately concentrated structure with several large multinational players holding significant market share. The industry is driven by technological innovation, particularly in improving efficiency, reducing emissions, and expanding feedstock versatility. Stringent environmental regulations, coupled with growing concerns about landfill capacity and waste management costs, are major growth drivers. Competitive product substitutes, such as anaerobic digestion, are also impacting market dynamics. The landscape is further shaped by mergers and acquisitions (M&A) activity, aiming for enhanced market penetration and technological capabilities.

- Market Concentration: The top 5 players account for approximately xx% of the global market in 2025 (estimated).

- Technological Innovation: Advancements in gasification, pyrolysis, and MSW incineration are key drivers. However, high upfront capital costs and technological complexities pose innovation barriers.

- Regulatory Frameworks: Government policies and incentives (e.g., carbon taxes, feed-in tariffs) play a crucial role in WtE plant development. Stringent emission standards drive technological advancements.

- Competitive Product Substitutes: Anaerobic digestion and other waste treatment methods pose competition, especially in specific niches.

- End-User Demographics: Primarily municipalities, industrial facilities, and energy producers are the key end-users. The rising urbanization and waste generation in developing economies offer significant growth opportunities.

- M&A Trends: The past 5 years have seen xx major M&A deals (2019-2024), primarily focused on consolidating market share and acquiring innovative technologies.

Waste-to-Energy Technologies Industry Growth Trends & Insights

The global waste-to-energy (WtE) market demonstrated significant growth from 2019 to 2024, achieving a compound annual growth rate (CAGR) of [Insert CAGR percentage]%. This expansion is fueled by several key factors: a dramatic rise in global waste generation, increasingly stringent environmental regulations designed to curb landfill reliance, and a continuously growing demand for sustainable energy sources. The market's robust growth trajectory is expected to continue throughout the forecast period (2025-2033), with projections indicating a market value of [Insert projected market value in millions] by 2033 and a projected CAGR of [Insert projected CAGR percentage]%. This positive outlook is underpinned by several key drivers. Technological advancements, specifically in advanced gasification and pyrolysis technologies, are leading to significant efficiency improvements and driving market expansion. A global shift in consumer preferences towards sustainable waste management practices further reinforces this positive trend. The increased adoption of WtE technologies is particularly pronounced in regions facing challenges with limited landfill capacity and energy deficits. Market penetration is projected to reach [Insert projected market penetration percentage] by 2033.

Dominant Regions, Countries, or Segments in Waste-to-Energy Technologies Industry

The European Union currently holds the largest market share in the WtE sector, driven by mature infrastructure, stringent environmental regulations, and supportive government policies. Asia-Pacific is exhibiting the fastest growth rate, fueled by rapid urbanization, increasing waste generation, and government initiatives to promote renewable energy sources. Within technology segments, Municipal Solid Waste (MSW) Incineration dominates the market, owing to its established technology and widespread adoption. However, pyrolysis and gasification technologies are gaining traction due to their potential for higher energy recovery and resource recovery.

- Key Drivers in Europe: Stringent environmental regulations, well-developed infrastructure, and high energy costs.

- Key Drivers in Asia-Pacific: Rapid urbanization, rising waste generation, and government support for renewable energy.

- Market Share: Europe holds approximately xx% of the market in 2025 (estimated), while Asia-Pacific is expected to reach xx% by 2033.

- Growth Potential: Asia-Pacific presents the highest growth potential due to its large and rapidly growing population and increasing waste generation.

Waste-to-Energy Technologies Industry Product Landscape

The WtE technology landscape is diverse, encompassing a broad spectrum of solutions. These range from established technologies like traditional municipal solid waste (MSW) incineration plants to cutting-edge advanced gasification and pyrolysis systems. Recent innovations are characterized by a focus on optimizing energy efficiency, minimizing environmental impact through emission reduction, and maximizing resource recovery by extracting valuable materials from waste streams. Key technological features include significantly improved combustion efficiency, sophisticated air pollution control systems, and the integration of advanced waste sorting and processing technologies. The unique selling propositions of these technologies often include reduced greenhouse gas emissions, reliable energy generation, and the valuable recovery of resources. Continuous technological advancements are consistently improving both the efficiency and the environmental performance of these systems.

Key Drivers, Barriers & Challenges in Waste-to-Energy Technologies Industry

Key Drivers:

- Rising global waste generation and limited landfill capacity.

- Stringent environmental regulations and the need for sustainable waste management solutions.

- Increasing energy demand and the drive for renewable energy sources.

- Government incentives and supportive policies promoting WtE technologies.

Key Challenges and Restraints:

- High capital costs associated with WtE plant construction and operation.

- Public perception and concerns about potential environmental impacts.

- Technological complexities and the need for skilled workforce.

- Supply chain disruptions impacting the availability of critical components. This resulted in a xx% increase in project delays in 2022 (estimated).

Emerging Opportunities in Waste-to-Energy Technologies Industry

- Untapped markets in developing countries with high waste generation and limited waste management infrastructure.

- Innovative applications for waste-derived fuels in industrial processes.

- Increased demand for combined heat and power (CHP) systems from WtE plants.

- Growing interest in advanced resource recovery technologies to extract valuable materials from waste.

Growth Accelerators in the Waste-to-Energy Technologies Industry Industry

Long-term growth in the WtE sector will be driven by technological advancements, particularly in advanced gasification and pyrolysis, which offer higher energy efficiency and resource recovery. Strategic partnerships between technology providers, waste management companies, and energy producers will accelerate market penetration. Expanding into new geographic markets, particularly in developing economies, presents significant opportunities. Government support, including subsidies and favorable regulations, will play a key role in stimulating market growth.

Key Players Shaping the Waste-to-Energy Technologies Industry Market

- Veolia Group

- Suez Environnement

- Amec Foster Wheeler PLC

- Babcock & Wilcox Volund AS

- Abu Dhabi National Energy Company PJSC (Taqa)

- Covanta Holding Corporation

- Ramboll Group AS

- Babcock & Wilcox Enterprises Inc

- Hitachi Zosen Inova AG

- China Everbright International Limited

Notable Milestones in Waste-to-Energy Technologies Industry Sector

- July 2022: Completion of Delhi's fourth waste-to-energy plant nearing completion, with a capacity of 25 MW.

- April 2022: Construction of one of Europe's most modern WtE plants in Wiesbaden, Germany (240,000 ton/year capacity).

- December 2022: Thailand's plan to build 79 waste-to-energy facilities (619.28 MW total installed capacity) announced.

In-Depth Waste-to-Energy Technologies Industry Market Outlook

The future outlook for the WtE market is exceptionally promising, driven by a confluence of factors. These include the ever-increasing generation of waste, growing global environmental concerns, and the urgent need for sustainable and reliable energy solutions. Strategic partnerships, continuous technological innovations, and supportive government policies will continue to shape the industry's trajectory. The market presents substantial opportunities for companies focused on the development and deployment of advanced WtE technologies, particularly in emerging markets. The increasing emphasis on resource recovery and the broader adoption of circular economy principles will further drive market growth and foster the creation of innovative new business models.

Waste-to-Energy Technologies Industry Segmentation

-

1. Technology

- 1.1. Municipal Solid Waste (MSW) Incineration

- 1.2. Co-processing

- 1.3. Pyrolysis and Gasification

- 1.4. Other Technologies

Waste-to-Energy Technologies Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Waste-to-Energy Technologies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-Ion Battery Prices4.; Increasing Adoption Of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Safety Concerns Related To Lithium-Ion Battery

- 3.4. Market Trends

- 3.4.1. Municipal Solid Waste Incineration (MSWI) as a Prominent Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Municipal Solid Waste (MSW) Incineration

- 5.1.2. Co-processing

- 5.1.3. Pyrolysis and Gasification

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Municipal Solid Waste (MSW) Incineration

- 6.1.2. Co-processing

- 6.1.3. Pyrolysis and Gasification

- 6.1.4. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Asia Pacific Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Municipal Solid Waste (MSW) Incineration

- 7.1.2. Co-processing

- 7.1.3. Pyrolysis and Gasification

- 7.1.4. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Municipal Solid Waste (MSW) Incineration

- 8.1.2. Co-processing

- 8.1.3. Pyrolysis and Gasification

- 8.1.4. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Municipal Solid Waste (MSW) Incineration

- 9.1.2. Co-processing

- 9.1.3. Pyrolysis and Gasification

- 9.1.4. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Municipal Solid Waste (MSW) Incineration

- 10.1.2. Co-processing

- 10.1.3. Pyrolysis and Gasification

- 10.1.4. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Waste-to-Energy Technologies Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Veolia Group

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Suez Environnement

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Amec Foster Wheeler PLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Babcock & Wilcox Volund AS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Abu Dhabi National Energy Company PJSC (Taqa)*List Not Exhaustive

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Covanta Holding Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Ramboll Group AS

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Babcock & Wilcox Enterprises Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Hitachi Zosen Inova AG

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 China Everbright International Limited

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Veolia Group

List of Figures

- Figure 1: Global Waste-to-Energy Technologies Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Waste-to-Energy Technologies Industry Revenue (Million), by Technology 2024 & 2032

- Figure 15: North America Waste-to-Energy Technologies Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 16: North America Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Waste-to-Energy Technologies Industry Revenue (Million), by Technology 2024 & 2032

- Figure 19: Asia Pacific Waste-to-Energy Technologies Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 20: Asia Pacific Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Waste-to-Energy Technologies Industry Revenue (Million), by Technology 2024 & 2032

- Figure 23: Europe Waste-to-Energy Technologies Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 24: Europe Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Waste-to-Energy Technologies Industry Revenue (Million), by Technology 2024 & 2032

- Figure 27: South America Waste-to-Energy Technologies Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 28: South America Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: South America Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Waste-to-Energy Technologies Industry Revenue (Million), by Technology 2024 & 2032

- Figure 31: Middle East and Africa Waste-to-Energy Technologies Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 32: Middle East and Africa Waste-to-Energy Technologies Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East and Africa Waste-to-Energy Technologies Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa Waste-to-Energy Technologies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 50: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 52: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 56: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 58: Global Waste-to-Energy Technologies Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste-to-Energy Technologies Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Waste-to-Energy Technologies Industry?

Key companies in the market include Veolia Group, Suez Environnement, Amec Foster Wheeler PLC, Babcock & Wilcox Volund AS, Abu Dhabi National Energy Company PJSC (Taqa)*List Not Exhaustive, Covanta Holding Corporation, Ramboll Group AS, Babcock & Wilcox Enterprises Inc, Hitachi Zosen Inova AG, China Everbright International Limited.

3. What are the main segments of the Waste-to-Energy Technologies Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-Ion Battery Prices4.; Increasing Adoption Of Electric Vehicles.

6. What are the notable trends driving market growth?

Municipal Solid Waste Incineration (MSWI) as a Prominent Technology.

7. Are there any restraints impacting market growth?

4.; Safety Concerns Related To Lithium-Ion Battery.

8. Can you provide examples of recent developments in the market?

As of July 2022, the construction of Delhi's fourth waste-to-energy plant in Tehkhand, southeast Delhi, was nearing completion. According to a senior Municipal Corporation of Delhi (MCD) official, the plant will generate 25 megawatts (MW) of power by utilizing 2,000 ton of municipal solid waste (MSW) discharged at the Okhla landfill site daily.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste-to-Energy Technologies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste-to-Energy Technologies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste-to-Energy Technologies Industry?

To stay informed about further developments, trends, and reports in the Waste-to-Energy Technologies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence