Key Insights

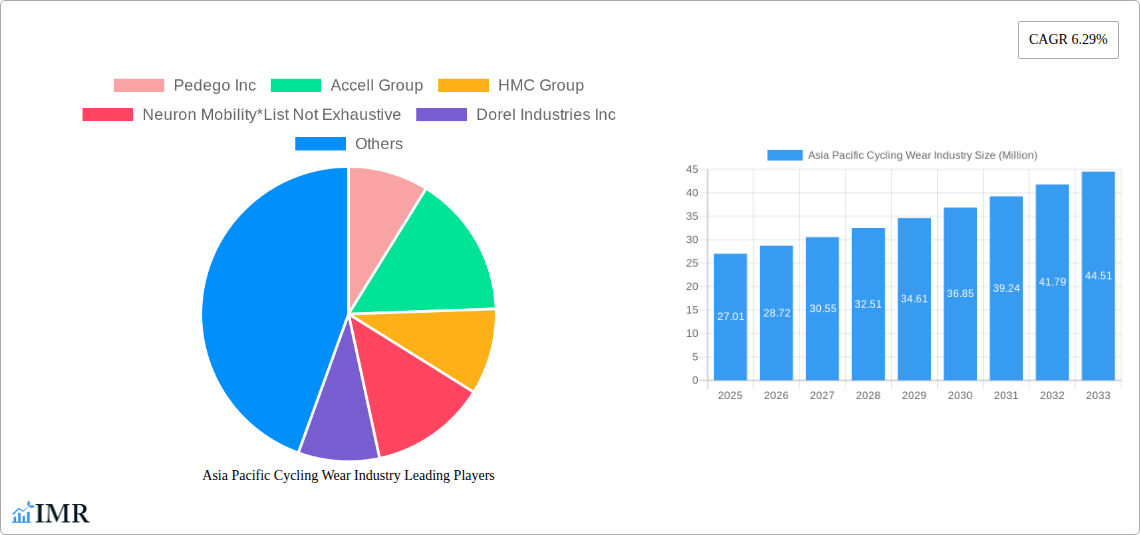

The Asia-Pacific cycling wear market, valued at $27.01 million in 2025, is projected to experience robust growth, driven by a rising health-conscious population embracing cycling as a fitness activity and eco-friendly mode of transportation. The region's burgeoning middle class, increasing disposable incomes, and a growing preference for outdoor recreational activities further fuel market expansion. This growth is particularly evident in countries like China, India, and Japan, where cycling infrastructure improvements and government initiatives promoting cycling are creating a favorable environment. The market segmentation reveals strong demand across various bicycle types, with road bicycles, hybrid bicycles, and e-bicycles leading the charge. Online retail channels are gaining traction, reflecting the growing preference for convenient and accessible purchasing options. However, challenges remain, including fluctuating raw material prices and intense competition among established and emerging brands. Successfully navigating these challenges requires brands to focus on product innovation, strategic partnerships, and targeted marketing campaigns that cater to the diverse needs and preferences of consumers across the Asia-Pacific region. This includes developing sustainable and ethically sourced materials to appeal to environmentally conscious cyclists. The forecast period (2025-2033) anticipates a continued upward trajectory, fueled by consistent CAGR growth, making it an attractive market for investment and expansion.

Asia Pacific Cycling Wear Industry Market Size (In Million)

The segment encompassing e-bicycles shows exceptional growth potential, driven by technological advancements and government incentives promoting sustainable transportation. The dominance of offline retail stores suggests significant opportunities for strengthening brand visibility through partnerships with established retailers. Meanwhile, the increasing penetration of e-commerce presents strategic avenues for online-focused growth strategies. Key players like Pedego Inc., Accell Group, and Giant Bicycles are well-positioned to leverage these market trends, while smaller, regional players may find niche success by focusing on specialized product offerings or catering to localized market demands. The continued rise in popularity of cycling as a recreational and commuting option ensures the long-term viability of the Asia-Pacific cycling wear market, albeit subject to global economic conditions and potential supply chain disruptions.

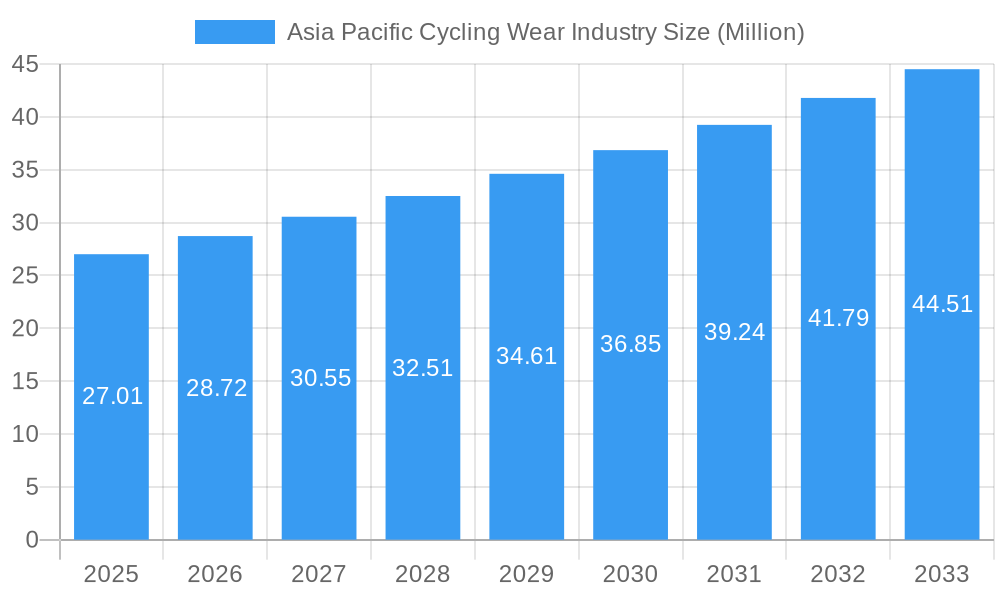

Asia Pacific Cycling Wear Industry Company Market Share

Asia Pacific Cycling Wear Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific cycling wear industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report examines market dynamics, growth trends, key players, and future opportunities within this rapidly evolving sector. The report utilizes a parent-child market approach, providing granular analysis of various bicycle types and distribution channels. Market values are presented in Million units.

Asia Pacific Cycling Wear Industry Market Dynamics & Structure

The Asia Pacific cycling wear market exhibits a moderately fragmented structure, with a mix of established international players and emerging local brands. Technological innovation, particularly in e-bike technology and smart cycling apparel, is a major growth driver. Stringent safety regulations and evolving consumer preferences influence market trends. Competitive substitutes include other forms of personal transportation, while the increasing popularity of cycling for fitness and commuting fuels market growth. Mergers and acquisitions (M&A) activity has been moderate, with strategic partnerships becoming increasingly common.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx (estimated).

- Technological Innovation: Focus on lightweight materials, improved aerodynamics, and integration of smart technologies. Innovation barriers include high R&D costs and the need for specialized manufacturing expertise.

- Regulatory Framework: Varying regulations across different countries in the region related to safety standards and e-bike usage.

- Competitive Substitutes: Public transport, private vehicles, and other fitness activities.

- End-User Demographics: Growing middle class, increasing health consciousness, and a preference for eco-friendly transportation are key drivers of demand.

- M&A Trends: Strategic alliances and joint ventures are more prevalent than large-scale acquisitions, with an estimated xx M&A deals in the last five years.

Asia Pacific Cycling Wear Industry Growth Trends & Insights

The Asia Pacific cycling wear market has experienced significant growth over the past few years, fueled by the increasing popularity of cycling for recreation, commuting, and fitness. The market size reached xx million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. This growth is driven by factors such as rising disposable incomes, increasing urbanization, and growing awareness of health and fitness. Technological advancements, such as the introduction of e-bikes and smart cycling apparel, are further accelerating market expansion. Changing consumer preferences towards sustainable transportation are also playing a crucial role in the growth of this sector. Market penetration is estimated to reach xx% by 2033, driven by increasing adoption of cycling in urban areas. This penetration is expected to be higher in specific countries with supportive government policies and well-developed cycling infrastructure.

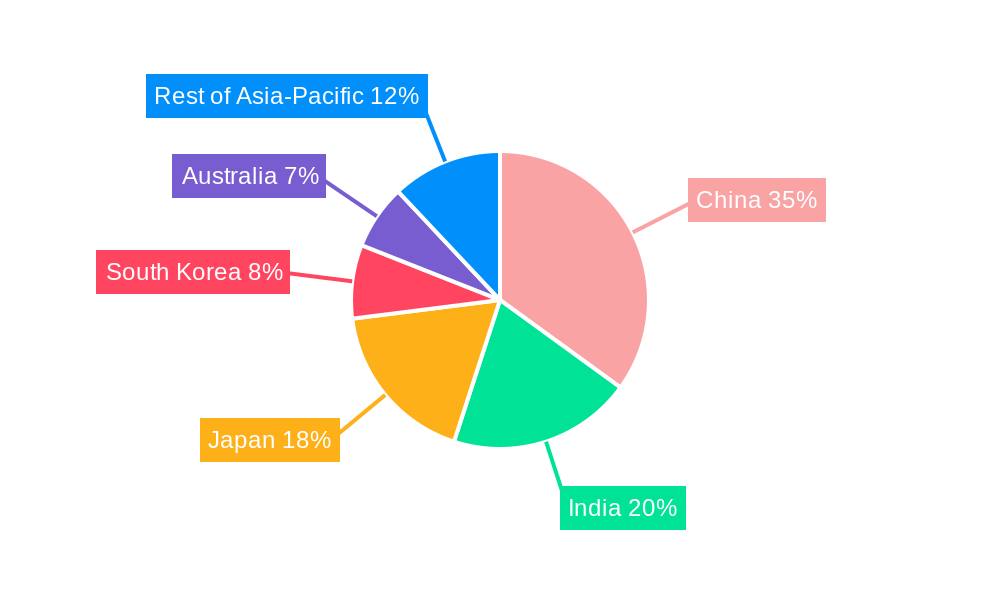

Dominant Regions, Countries, or Segments in Asia Pacific Cycling Wear Industry

China and Japan are currently the leading markets for cycling wear in the Asia Pacific region, followed by India, Australia, and South Korea. Within the product segments, e-bikes are experiencing the highest growth rates due to government incentives and technological advancements. Offline retail stores remain the dominant distribution channel, although online sales are steadily increasing.

Key Drivers:

- China: Strong domestic manufacturing base, large population, and increasing disposable incomes.

- Japan: High consumer spending power, advanced technological infrastructure, and a culture of cycling.

- India: Rapidly growing economy, increasing urbanization, and government initiatives promoting cycling infrastructure.

- E-Bikes: Government subsidies, technological improvements (longer range, better batteries), and convenience for urban commuting.

- Offline Retail Stores: Established distribution network, ability to physically examine products, and immediate access.

Dominance Factors: Strong consumer demand, supportive government policies, well-developed cycling infrastructure, and a large manufacturing base contribute to the dominance of specific regions and segments. Growth potential lies in expanding into less developed markets, promoting cycling as a primary means of transport, and focusing on e-bikes and smart apparel.

Asia Pacific Cycling Wear Industry Product Landscape

The cycling wear market showcases a wide array of products, encompassing road bicycles, hybrid bicycles, all-terrain bicycles, e-bicycles, and other types. Innovations include lightweight materials like carbon fiber, improved braking systems, and integrated technologies like GPS and smartphone connectivity. E-bikes are gaining significant traction, driven by advancements in battery technology and performance metrics such as range and speed. Unique selling propositions focus on performance, comfort, style, and technological features.

Key Drivers, Barriers & Challenges in Asia Pacific Cycling Wear Industry

Key Drivers: Increasing health consciousness, government initiatives promoting cycling infrastructure, growing urbanization, and technological advancements in e-bike technology are key drivers of market growth.

Challenges: Supply chain disruptions, competition from other modes of transportation, and the high initial cost of e-bikes pose significant challenges. Regulatory hurdles in certain countries, particularly concerning e-bike safety and usage, may also hinder market expansion. The impact of these challenges can be quantified through reduced sales volume and increased manufacturing costs.

Emerging Opportunities in Asia Pacific Cycling Wear Industry

Untapped markets in Southeast Asia, the growing demand for electric bicycles, and the increasing popularity of cycling tourism present significant opportunities for expansion. Innovation in sustainable materials, smart cycling apparel, and integrated fitness tracking technologies also holds substantial growth potential. The development of better charging infrastructure for ebikes is another key to market expansion.

Growth Accelerators in the Asia Pacific Cycling Wear Industry Industry

Technological advancements, strategic partnerships, and government support for cycling infrastructure are crucial growth accelerators. The development of more efficient and longer-lasting batteries for e-bikes is also set to play a significant role in future growth. This, combined with innovative marketing strategies targeted at specific demographics will strengthen market positions.

Key Players Shaping the Asia Pacific Cycling Wear Industry Market

- Pedego Inc

- Accell Group

- HMC Group

- Neuron Mobility

- Dorel Industries Inc

- Nixeycles

- Merida Bikes

- Giant Bicycles

- Benno Bikes LLC

- Avon Cycles Ltd

- Bridgestone Corporation

Notable Milestones in Asia Pacific Cycling Wear Industry Sector

- June 2022: Ninety One Cycles launched the Black Arrow 700C bike, featuring advanced components and technology.

- April 2022: Neuron Mobility launched a fleet of 250 e-bikes in Sydney, Australia, integrating Google Maps for enhanced rider experience.

- October 2021: Hero MotorCorp (HMC) formed a joint venture with Yamaha to produce electric motors for e-bikes.

In-Depth Asia Pacific Cycling Wear Industry Market Outlook

The Asia Pacific cycling wear market is poised for continued growth, driven by technological innovation, favorable government policies, and rising consumer demand. Strategic partnerships, focused marketing efforts, and expansion into new markets will be crucial to capitalizing on this significant potential. The market's future hinges on addressing challenges related to supply chain resilience, regulatory compliance, and ensuring affordable yet high-quality products to a broad consumer base.

Asia Pacific Cycling Wear Industry Segmentation

-

1. Type

- 1.1. Road Bicycles

- 1.2. Hybrid Bicycles

- 1.3. All-trrain Bicycles

- 1.4. E-bicycles

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Asia Pacific Cycling Wear Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Cycling Wear Industry Regional Market Share

Geographic Coverage of Asia Pacific Cycling Wear Industry

Asia Pacific Cycling Wear Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Continuation of Increasing Demand for Bicycles in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Cycling Wear Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Road Bicycles

- 5.1.2. Hybrid Bicycles

- 5.1.3. All-trrain Bicycles

- 5.1.4. E-bicycles

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pedego Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Accell Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HMC Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neuron Mobility*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dorel Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nixeycles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merida Bikes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giant Bicycles

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benno Bikes LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avon Cycles Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bridgestone Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Pedego Inc

List of Figures

- Figure 1: Asia Pacific Cycling Wear Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Cycling Wear Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Cycling Wear Industry?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the Asia Pacific Cycling Wear Industry?

Key companies in the market include Pedego Inc, Accell Group, HMC Group, Neuron Mobility*List Not Exhaustive, Dorel Industries Inc, Nixeycles, Merida Bikes, Giant Bicycles, Benno Bikes LLC, Avon Cycles Ltd, Bridgestone Corporation.

3. What are the main segments of the Asia Pacific Cycling Wear Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Continuation of Increasing Demand for Bicycles in India.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

In June 2022, Ninety One Cycles launched a new Black Arrow 700C bike. The features of the bike include a 7-speed EZ fire rear shifter, a hybrid fork for jerk absorption, and a Shimano 7-speed gear set. The cycle comes with 160mm disk brakes and high-traction nylon tires.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Cycling Wear Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Cycling Wear Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Cycling Wear Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Cycling Wear Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence