Key Insights

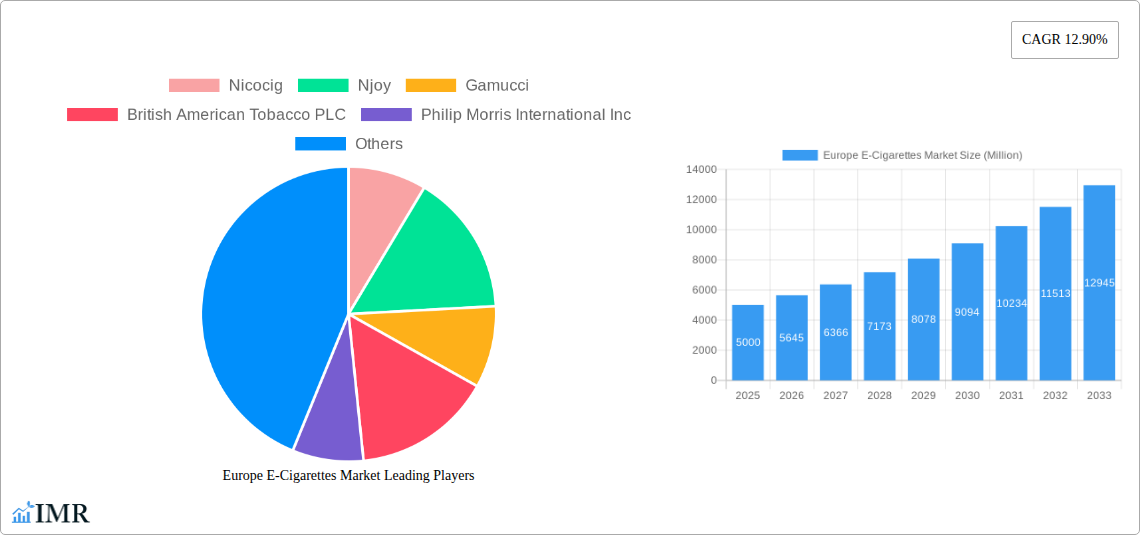

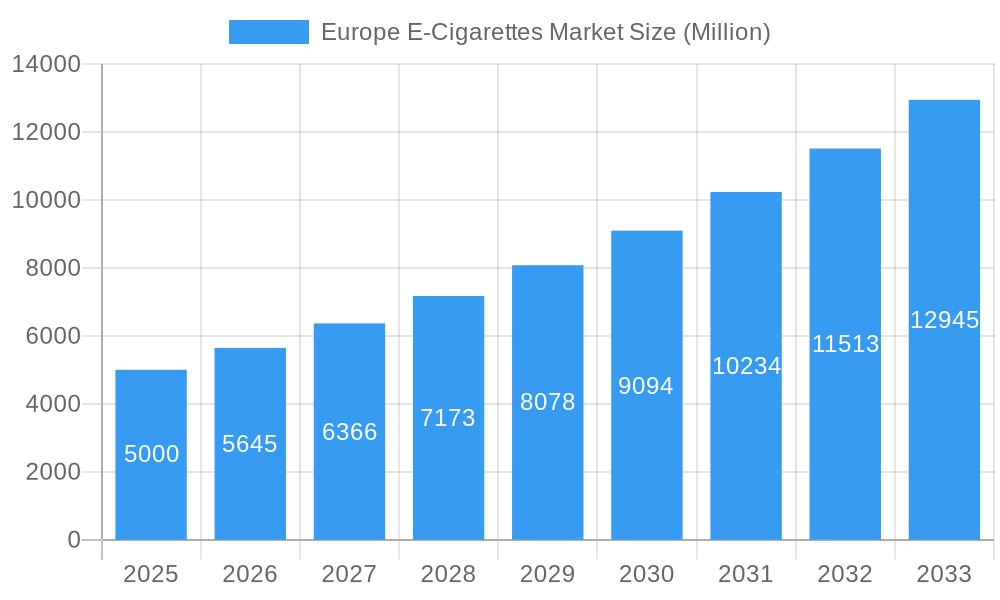

The European e-cigarette market is projected for robust expansion through 2033, driven by a Compound Annual Growth Rate (CAGR) of 12.9%. Growing awareness of e-cigarettes as a harm reduction alternative to traditional tobacco, alongside increasing adoption among younger demographics, fuels this market potential. A diverse product range, from disposable devices to personalized vaporizers, and segmentation by battery type (automatic and manual) cater to varied consumer needs. Key industry players like Nicocig, Njoy, Gamucci, British American Tobacco, Philip Morris International, and J Well France are instrumental in market evolution through innovation and strategic branding. Strong regional performance in Germany, France, the UK, and Italy significantly contributes to overall market growth. Future trajectory will be influenced by evolving regulations and public health initiatives. Despite ongoing concerns regarding nicotine addiction and long-term health effects, sustained market growth is anticipated, reflecting a significant shift in European smoking habits.

Europe E-Cigarettes Market Market Size (In Billion)

Key growth drivers include the increasing preference for vaping as a tobacco alternative and continuous technological advancements enhancing device performance and flavor innovation. Personalized vaporizers are expected to experience substantial growth due to demand for customized vaping experiences. However, stringent sales and marketing regulations, coupled with public health considerations, present significant challenges. The competitive landscape, featuring established tobacco companies and agile startups, fosters innovation and market dynamism. The European e-cigarette market size is estimated to reach $27.691 billion by 2025. Future projections are contingent on navigating regulatory complexities and sustained consumer demand.

Europe E-Cigarettes Market Company Market Share

Europe E-Cigarettes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe e-cigarettes market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals seeking to navigate the complexities of this rapidly evolving market. The report covers both parent markets (e.g., tobacco alternatives) and child markets (e.g., disposable e-cigarettes, heated tobacco products) for a complete understanding. Market values are presented in million units.

Europe E-Cigarettes Market Dynamics & Structure

The European e-cigarette market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with several major players alongside numerous smaller niche brands. Technological innovation, particularly in battery technology, flavor delivery, and reduced-harm products, is a key driver. Regulatory frameworks, varying across European nations, significantly impact market growth and product availability. Competitive substitutes include traditional cigarettes and other nicotine delivery systems. End-user demographics are shifting, with younger generations increasingly adopting e-cigarettes. M&A activity has been significant, with larger players acquiring smaller innovative companies to expand their product portfolios and market reach.

- Market Concentration: Moderate, with a few dominant players and numerous smaller competitors.

- Technological Innovation: Key driver, focusing on battery life, flavor profiles, and reduced-harm technologies.

- Regulatory Framework: Varies across countries, impacting market access and product offerings. Differing regulations significantly impact growth rates within each country.

- Competitive Substitutes: Traditional cigarettes, heated tobacco products, and nicotine pouches.

- End-User Demographics: Shifting towards younger demographics.

- M&A Activity: Significant, driven by expansion and diversification strategies. xx M&A deals recorded between 2019-2024.

Europe E-Cigarettes Market Growth Trends & Insights

The European e-cigarette market experienced substantial growth during the historical period (2019-2024), driven by increasing awareness of the potential risks associated with traditional smoking and the perception of e-cigarettes as a less harmful alternative. Adoption rates have varied across different countries due to differing regulatory environments and cultural factors. The market size has expanded from xx million units in 2019 to xx million units in 2024, with a projected CAGR of xx% from 2025-2033. Technological disruptions, such as the introduction of disposable e-cigarettes and heated tobacco products, have significantly impacted market dynamics. Consumer behavior shifts are evident, with increasing preference for more convenient and flavorful products. The market is projected to reach xx million units by 2033, driven by continued innovation and shifting consumer preferences. This growth is also expected to be influenced by evolving public health policies and changing consumer perceptions of vaping products. Market penetration is expected to reach xx% by 2033, highlighting the continued growth potential within the market.

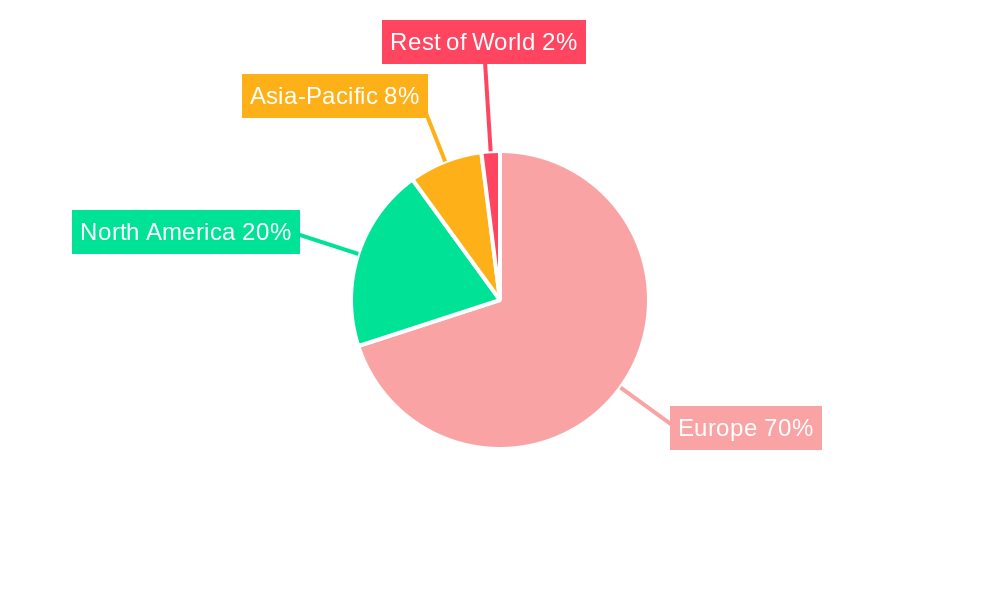

Dominant Regions, Countries, or Segments in Europe E-Cigarettes Market

The UK, Germany, and France are currently the leading markets in Europe, driven by high consumer demand, well-established distribution networks, and relatively less restrictive regulatory environments compared to other EU nations. Within product types, disposable e-cigarettes currently dominate due to affordability and convenience.

- Leading Region: Western Europe (UK, Germany, France)

- Dominant Product Type: Completely Disposable Model (xx million units in 2024)

- Fastest-Growing Segment: Rechargeable but Disposable Cartomizer (xx% CAGR projected from 2025-2033)

- Key Drivers: High disposable income in Western European countries, increasing awareness of public health risks related to traditional cigarettes, readily available distribution channels.

The dominance of these regions and segments is likely to continue in the coming years, although other regions may experience faster growth rates due to market penetration and expansion efforts.

Europe E-Cigarettes Market Product Landscape

The e-cigarette market showcases a diverse range of products, from completely disposable models offering convenience to personalized vaporizers providing customization options. Innovations are focused on enhancing user experience, improving battery life, and creating more sophisticated flavor delivery systems. Technological advancements include improved coil technology, larger battery capacities, and the introduction of new materials to enhance the overall vaping experience. The market is witnessing a move towards disposable devices and heated tobacco products that offer a reduced-harm approach. The unique selling propositions are mainly based on convenience, affordability, and improved taste profiles.

Key Drivers, Barriers & Challenges in Europe E-Cigarettes Market

Key Drivers:

- Increasing awareness of the health risks associated with traditional cigarettes.

- Growing preference for less harmful alternatives among smokers.

- Technological innovations leading to better products and more user-friendly devices.

- Expanding distribution channels and online availability.

Key Barriers & Challenges:

- Stringent regulations and evolving policies across different European countries.

- Concerns over the long-term health effects of e-cigarettes.

- Intense competition among numerous players, leading to price wars.

- Supply chain disruptions caused by global events and economic fluctuations. These have led to estimated price fluctuations of xx% in the past year.

Emerging Opportunities in Europe E-Cigarettes Market

- Expansion into less-penetrated markets within Eastern Europe.

- Development of innovative products targeting specific consumer segments (e.g., flavors and nicotine strengths).

- Leveraging digital marketing to improve brand awareness and reach younger consumers.

- Exploring partnerships with public health organizations to promote responsible vaping practices.

Growth Accelerators in the Europe E-Cigarettes Market Industry

Long-term growth in the European e-cigarette market is expected to be fueled by continued technological advancements, strategic partnerships between established tobacco companies and e-cigarette startups, and strategic market expansion into emerging regions. The development of innovative products with enhanced safety features, such as improved battery technology and reduced harmful chemicals, is crucial for sustaining growth. Collaboration with regulatory bodies to establish clear guidelines and build consumer trust will accelerate market maturation and solidify its position as a viable alternative to traditional cigarettes.

Key Players Shaping the Europe E-Cigarettes Market Market

- Nicocig

- Njoy

- Gamucci

- British American Tobacco PLC

- Philip Morris International Inc

- J Well France SARL

- Japan Tobacco Inc

- Aquios Labs

- BecoVape

- Blu Cigs

- Imperial Brands PLC

- Altria Group Inc

Notable Milestones in Europe E-Cigarettes Market Sector

- November 2021: Imperial Blue launched heated cigarette products in the Czech Republic, signaling a strategic shift towards next-generation products.

- March 2022: BAT launched Vuse Go disposable e-cigarettes in the UK, expanding its product portfolio in a key market.

- February 2023: Imperial Brands launched the Pulze 2.0 heated tobacco device, highlighting innovation in the reduced-harm segment.

- March 2023: Aquios Labs launched a water-based e-cigarette technology in partnership with Innokin Technology, introducing a novel approach to e-cigarette technology.

In-Depth Europe E-Cigarettes Market Market Outlook

The future of the European e-cigarette market appears promising, with continued growth driven by technological advancements, evolving consumer preferences, and the ongoing shift away from traditional cigarettes. Strategic partnerships and investments in research and development will play a critical role in shaping the market landscape. Opportunities exist for companies to innovate and offer products that cater to diverse consumer segments, driving market expansion and adoption rates. Successful navigation of the regulatory landscape and fostering public trust will be crucial for achieving sustained growth and establishing e-cigarettes as a widely accepted alternative to traditional smoking.

Europe E-Cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-Cigarette

- 2.2. Manual E-Cigarette

Europe E-Cigarettes Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe E-Cigarettes Market Regional Market Share

Geographic Coverage of Europe E-Cigarettes Market

Europe E-Cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Dual-Use E-Cigarette Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-Cigarette

- 5.2.2. Manual E-Cigarette

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-Cigarette

- 6.2.2. Manual E-Cigarette

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-Cigarette

- 7.2.2. Manual E-Cigarette

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-Cigarette

- 8.2.2. Manual E-Cigarette

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-Cigarette

- 9.2.2. Manual E-Cigarette

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-Cigarette

- 10.2.2. Manual E-Cigarette

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-Cigarette

- 11.2.2. Manual E-Cigarette

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Completely Disposable Model

- 12.1.2. Rechargeable but Disposable Cartomizer

- 12.1.3. Personalized Vaporizer

- 12.2. Market Analysis, Insights and Forecast - by Battery Mode

- 12.2.1. Automatic E-Cigarette

- 12.2.2. Manual E-Cigarette

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nicocig

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Njoy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gamucci

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 British American Tobacco PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philip Morris International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 J Well France SARL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Japan Tobacco Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aquios Labs

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BecoVape*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Blu Cigs

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Imperial Brands PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Altria Group Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nicocig

List of Figures

- Figure 1: Europe E-Cigarettes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 4: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 5: Europe E-Cigarettes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe E-Cigarettes Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 10: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 11: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 16: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 17: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 22: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 23: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 28: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 29: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 34: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 35: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 40: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 41: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 45: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 46: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 47: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Cigarettes Market?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Europe E-Cigarettes Market?

Key companies in the market include Nicocig, Njoy, Gamucci, British American Tobacco PLC, Philip Morris International Inc, J Well France SARL, Japan Tobacco Inc, Aquios Labs, BecoVape*List Not Exhaustive, Blu Cigs, Imperial Brands PLC, Altria Group Inc.

3. What are the main segments of the Europe E-Cigarettes Market?

The market segments include Product Type, Battery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.691 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Dual-Use E-Cigarette Among Consumers.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2023: Aquios Labs, a Britain-based company, announced its new innovation, where it developed a water-based technology and launched a commercial product in cooperation with Innokin Technology to offer smokers a better smoking experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Cigarettes Market?

To stay informed about further developments, trends, and reports in the Europe E-Cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence