Key Insights

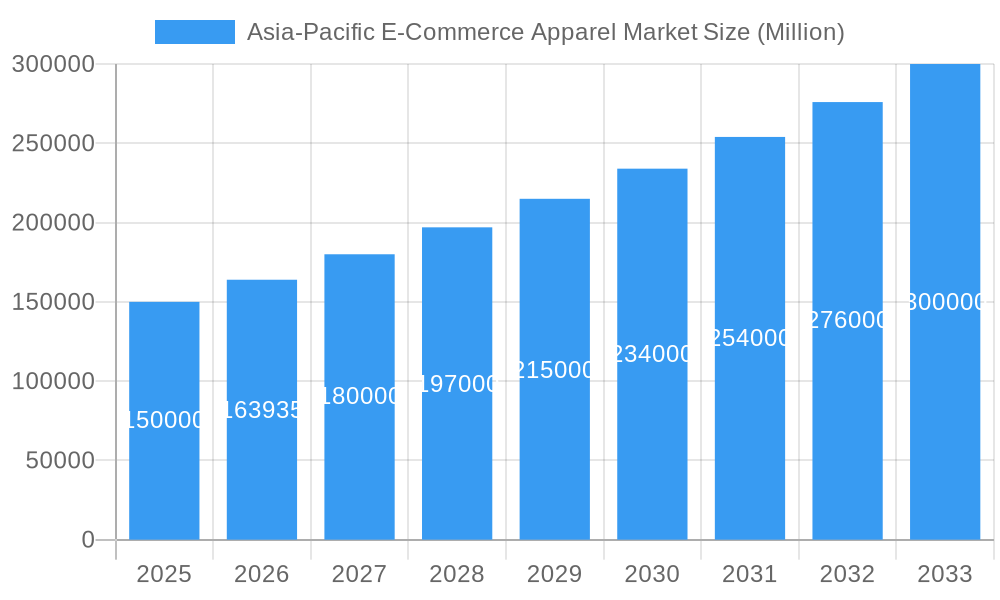

The Asia-Pacific e-commerce apparel market is poised for substantial expansion, fueled by increasing internet and smartphone adoption, a growing middle class with enhanced purchasing power, and a pronounced shift towards online shopping convenience. The market size is projected to reach $779.3 billion by 2025, reflecting a Compound Annual Growth Rate (CAGR) of 9.15%. This presents significant opportunities for both established international brands such as Adidas, Inditex, and Nike, and agile emerging players adept at catering to the region's diverse consumer preferences. Key growth drivers include men's and women's formal and casual wear, influenced by evolving fashion trends and a rising demand for personalized style. The proliferation of social commerce and influencer marketing further accelerates market expansion, although challenges persist in logistics infrastructure across certain areas and the complexities of cross-border e-commerce. The sustained CAGR of 9.15% indicates robust growth throughout the forecast period (2025-2033). The prevalence of third-party retailers underscores the critical importance of strategic partnerships and a strong online presence for apparel brands seeking to capture market share in the dynamic Asia-Pacific landscape. Intense competition necessitates a focus on innovative marketing, superior customer experience, and efficient supply chains for sustained success in this rapidly evolving market.

Asia-Pacific E-Commerce Apparel Market Market Size (In Billion)

Continued e-commerce proliferation across Asia-Pacific is a significant contributor to the apparel market's upward trajectory. Enhanced digital literacy, expanding mobile commerce capabilities, and the growing popularity of online marketplaces are pivotal drivers. Further segmentation by product categories, such as sportswear and sleepwear, and by end-user demographics, including children's wear, offers lucrative avenues for niche market players. However, potential restraints include concerns regarding product authenticity, the effectiveness of return policies, and the imperative for robust customer service to address potential issues proactively. Geographical variations within Asia-Pacific, characterized by differing market maturity and digital infrastructure, demand region-specific strategies, for instance, tailored approaches for China versus India. Effectively navigating these challenges and harnessing emerging technologies like augmented reality and personalized recommendation engines will be crucial for brands aspiring to achieve enduring success in this competitive and high-growth market.

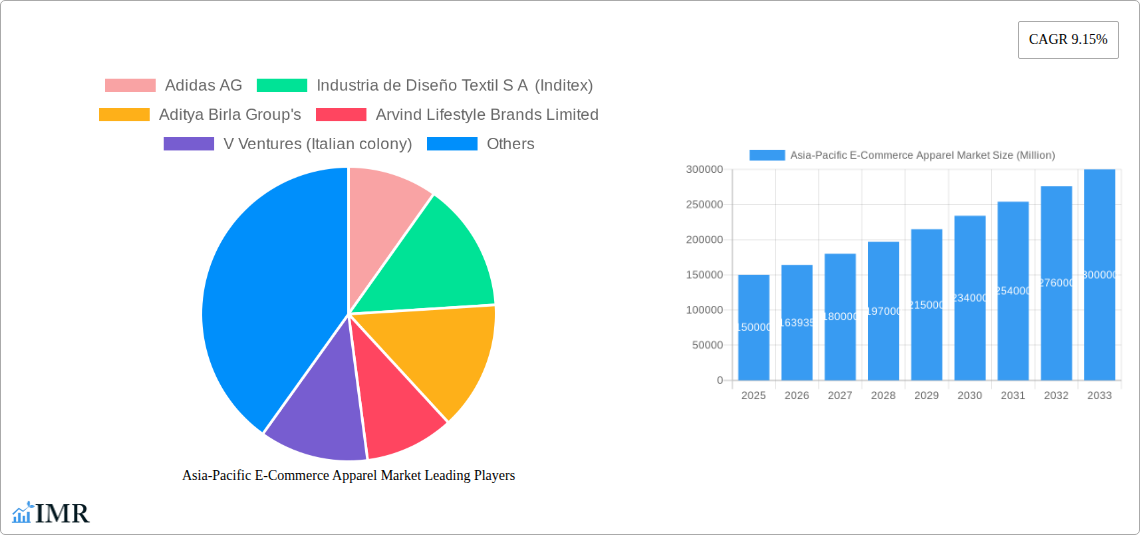

Asia-Pacific E-Commerce Apparel Market Company Market Share

Asia-Pacific E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific e-commerce apparel market, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report's detailed segmentation by product type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), end-user (Men, Women, Kids/Children), and platform type (Third Party Retailer, Company's Own Website) provides granular insights into market performance across various segments. The market size is presented in Million units.

Asia-Pacific E-Commerce Apparel Market Market Dynamics & Structure

The Asia-Pacific e-commerce apparel market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few large players dominating certain segments while numerous smaller businesses compete in niche areas. Technological innovation, particularly in areas like personalized recommendations, augmented reality try-ons, and improved logistics, is a key driver. However, regulatory frameworks concerning data privacy and consumer protection present challenges. Competitive pressures from both online and offline retailers are intense, necessitating continuous innovation and differentiation. The evolving demographics of the Asia-Pacific region, particularly the growth of the middle class and increasing internet penetration, are significant tailwinds. M&A activity in the sector remains strong, with larger companies seeking to expand their market share and product portfolios.

- Market Concentration: Moderate, with a few major players holding significant share, but a highly fragmented landscape as well.

- Technological Innovation: Strong driver; AR/VR try-ons, personalized recommendations, and improved logistics are key areas.

- Regulatory Framework: Data privacy and consumer protection regulations impact market operations.

- Competitive Substitutes: Strong competition from both online and offline retailers.

- End-User Demographics: Growing middle class and increasing internet penetration drive market expansion.

- M&A Trends: Significant activity, with larger companies consolidating market share. Estimated xx M&A deals in the past 5 years.

Asia-Pacific E-Commerce Apparel Market Growth Trends & Insights

The Asia-Pacific e-commerce apparel market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing smartphone penetration, rising disposable incomes, and changing consumer preferences. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This robust growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace. The adoption rate of online apparel shopping has surged, particularly amongst younger demographics. Technological disruptions, such as the rise of social commerce and live streaming shopping, are further fueling market expansion. Consumers are increasingly demanding seamless online experiences, personalized recommendations, and convenient delivery options, influencing the strategies of e-commerce apparel businesses. The market penetration rate for online apparel shopping is expected to reach xx% by 2033.

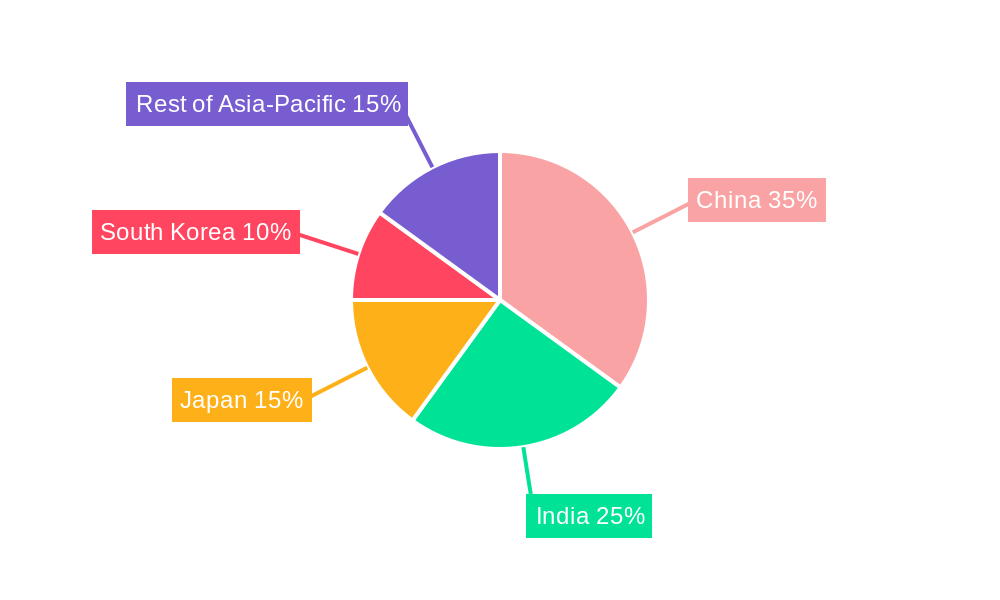

Dominant Regions, Countries, or Segments in Asia-Pacific E-Commerce Apparel Market

China and India are the dominant markets in the Asia-Pacific e-commerce apparel sector, owing to their large populations, rapidly growing middle classes, and increasing internet and smartphone penetration. Within product types, casual wear and sportswear enjoy the highest demand, followed by formal wear. The women's apparel segment holds a larger market share compared to men's and kids' apparel. Third-party retailers constitute the largest platform type, indicating the importance of established e-commerce marketplaces.

- Key Drivers:

- China & India: Large populations, rising middle class, high internet penetration.

- Casual & Sportswear: High demand driven by lifestyle and fitness trends.

- Women's Apparel: Larger market share due to higher purchasing power and diverse preferences.

- Third-party Retailers: Established platforms offering reach and convenience.

- Dominance Factors: Market size, growth rate, consumer preferences, and infrastructure development.

Asia-Pacific E-Commerce Apparel Market Product Landscape

The Asia-Pacific e-commerce apparel market showcases a diverse range of products, characterized by ongoing innovation in fabrics, designs, and functionalities. Sustainable and ethically sourced apparel is gaining traction, driven by increasing consumer awareness. Technological advancements are enabling personalized customization options, allowing consumers to tailor their clothing choices. Brands are leveraging data analytics to optimize product offerings and improve customer experiences. The focus is shifting toward providing a seamless omnichannel experience, blending online and offline interactions to enhance customer engagement.

Key Drivers, Barriers & Challenges in Asia-Pacific E-Commerce Apparel Market

Key Drivers:

- Rising disposable incomes and increased internet penetration across the region.

- Growing preference for online shopping convenience and wider selection.

- Technological advancements improving the online shopping experience.

Key Challenges:

- Intense competition among established players and new entrants.

- Logistical challenges related to delivery, returns, and inventory management.

- Concerns around product quality, sizing inconsistencies, and authenticity.

- xx% of returns are due to sizing issues.

Emerging Opportunities in Asia-Pacific E-Commerce Apparel Market

- Untapped Markets: Expansion into smaller cities and rural areas with increasing internet access.

- Innovative Applications: Integrating AR/VR for virtual try-ons and personalized style recommendations.

- Evolving Consumer Preferences: Catering to the demand for sustainable, ethically sourced, and inclusive fashion.

Growth Accelerators in the Asia-Pacific E-Commerce Apparel Market Industry

Strategic partnerships between apparel brands and e-commerce platforms are driving market growth, facilitating wider reach and enhanced customer engagement. Technological advancements, such as AI-powered personalization and improved logistics solutions, streamline operations and enhance the customer experience. Government initiatives promoting digital commerce and infrastructure development further fuel market expansion.

Key Players Shaping the Asia-Pacific E-Commerce Apparel Market Market

- Adidas AG

- Industria de Diseño Textil S A (Inditex)

- Aditya Birla Group's

- Arvind Lifestyle Brands Limited

- V Ventures (Italian colony)

- Forever 21 Inc

- PVH Corp

- Raymond Group

- Hennes & Mauritz AB

- Fast Retailing Co Ltd

- BIBA Fashion Limited

- LVMH Moët Hennessy Louis Vuitton

- Nike Inc

Notable Milestones in Asia-Pacific E-Commerce Apparel Market Sector

- February 2023: Forever 21 relaunched in Japan as an upscale brand, focusing on online sales and a pop-up store.

- March 2023: Italian Colony launched its online store in India, offering affordable Italian fashion.

- March 2023: UNIQLO collaborated with Attack on Titan for a new line of t-shirts in Japan.

- May 2023: Alessandro Vittore announced plans to launch its brand in the Indian market.

In-Depth Asia-Pacific E-Commerce Apparel Market Market Outlook

The Asia-Pacific e-commerce apparel market is poised for continued robust growth, driven by sustained increases in disposable incomes, internet penetration, and the adoption of innovative technologies. Strategic investments in technology, supply chain optimization, and brand building will be crucial for success. Opportunities abound in untapped markets, personalized offerings, and sustainable fashion, presenting significant potential for both established players and new entrants. The market is expected to reach xx Million units by 2033, signifying substantial growth potential.

Asia-Pacific E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

Asia-Pacific E-Commerce Apparel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Asia-Pacific E-Commerce Apparel Market

Asia-Pacific E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Brick-and-Mortar Retail

- 3.4. Market Trends

- 3.4.1. Strong Growth of Fashion Marketplaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industria de Diseño Textil S A (Inditex)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aditya Birla Group's

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arvind Lifestyle Brands Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 V Ventures (Italian colony)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Forever 21 Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVH Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raymond Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hennes & Mauritz AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fast Retailing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BIBA Fashion Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LVMH Moët Hennessy Louis Vuitto

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nike Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Asia-Pacific E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 9: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 19: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-Commerce Apparel Market?

The projected CAGR is approximately 9.15%.

2. Which companies are prominent players in the Asia-Pacific E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Industria de Diseño Textil S A (Inditex), Aditya Birla Group's, Arvind Lifestyle Brands Limited, V Ventures (Italian colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitto, Nike Inc.

3. What are the main segments of the Asia-Pacific E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 779.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media.

6. What are the notable trends driving market growth?

Strong Growth of Fashion Marketplaces.

7. Are there any restraints impacting market growth?

Competition from Traditional Brick-and-Mortar Retail.

8. Can you provide examples of recent developments in the market?

May 2023: Alessandro Vittore, a United Kingdom-based clothing company, announced its plans to launch the brand in Indian Market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence