Key Insights

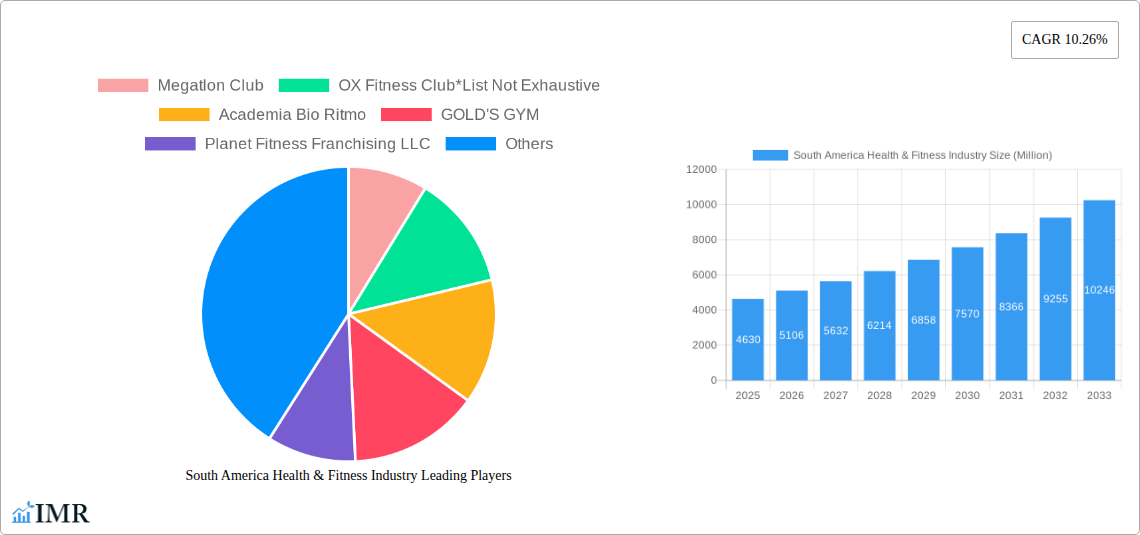

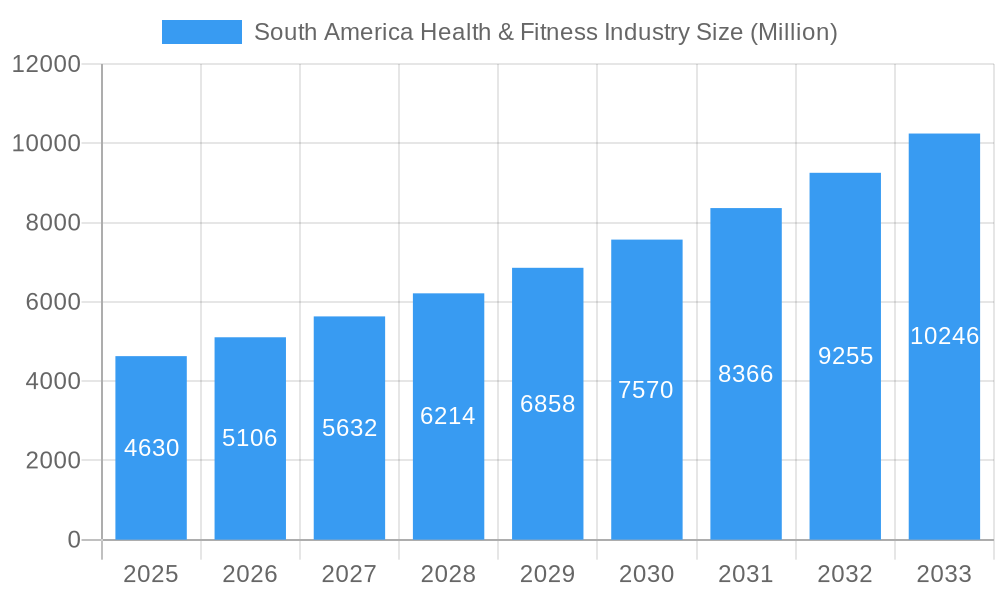

The South American health and fitness industry, currently valued at $4.63 billion (2025), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.26% from 2025 to 2033. This expansion is fueled by several key factors. Increasing health consciousness among consumers, coupled with rising disposable incomes in major economies like Brazil and Argentina, is driving demand for fitness services. The industry is witnessing a shift towards personalized fitness experiences, with a surge in popularity of personal training and specialized instruction. Furthermore, the proliferation of technologically advanced fitness equipment and innovative workout programs is contributing to market growth. Competition is intensifying, with established players like Megatlon Club and GOLDS' GYM alongside emerging boutique studios and fitness chains like Anytime Fitness vying for market share. This competitive landscape fosters innovation and ensures a wide range of options to cater to diverse consumer preferences and budgets.

South America Health & Fitness Industry Market Size (In Billion)

Despite the positive outlook, the market faces certain challenges. Infrastructure limitations in some regions might hinder the expansion of high-quality fitness facilities. Economic fluctuations can impact consumer spending on discretionary items like gym memberships. Moreover, the market needs to address potential disparities in access to fitness services across different socioeconomic groups. However, strategic investments in infrastructure development, targeted marketing campaigns, and the adoption of flexible pricing models can mitigate these constraints and sustain the industry's robust growth trajectory. The segmentation of services into membership fees, total admission fees, and personal training reflects the diversification of the market and offers opportunities for growth in various niches. The strong performance of key players indicates a healthy and competitive market environment.

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America health and fitness industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for industry professionals, investors, and anyone seeking to understand this dynamic market. The total market size in 2025 is estimated at XX Million.

South America Health & Fitness Industry Market Dynamics & Structure

This section analyzes the South American health and fitness market's structure, identifying key trends and influences. The market is characterized by a mix of large international chains and smaller, local businesses. Market concentration is moderate, with a few dominant players alongside a large number of smaller operators.

Market Concentration: The top 5 players account for approximately XX% of the market share in 2025. This is expected to slightly decrease to XX% by 2033 due to increased competition.

Technological Innovation: The industry witnesses continuous technological advancements, including fitness tracking apps, virtual reality fitness programs, and personalized workout plans. However, the adoption rate is influenced by factors such as internet penetration and affordability of technology.

Regulatory Framework: Regulations vary across countries, impacting aspects such as safety standards, licensing, and advertising. Inconsistencies across national frameworks represent a barrier to market consolidation and standardization.

Competitive Substitutes: Home workout programs, outdoor activities, and team sports provide competition. However, the convenience and comprehensive services offered by fitness centers maintain their market share.

End-User Demographics: The primary target demographic is the millennial and Gen Z population, showing a growing interest in health and fitness. However, the market also caters to other age groups, with tailored offerings.

M&A Trends: The historical period (2019-2024) witnessed XX M&A deals, primarily involving smaller companies being acquired by larger players to expand market reach. The forecast period anticipates a similar trend, with approximately XX deals anticipated by 2033.

South America Health & Fitness Industry Growth Trends & Insights

The South American health and fitness market demonstrates robust growth. Driven by increasing health awareness, rising disposable incomes, and the proliferation of fitness-related technology, the market exhibits a compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration is currently at XX% and is projected to reach XX% by 2033, indicating significant growth potential. Technological disruptions, such as the rise of online fitness platforms and wearable technology, are reshaping consumer behavior, promoting accessibility and convenience. Consumers are increasingly seeking personalized and digitally-integrated fitness solutions.

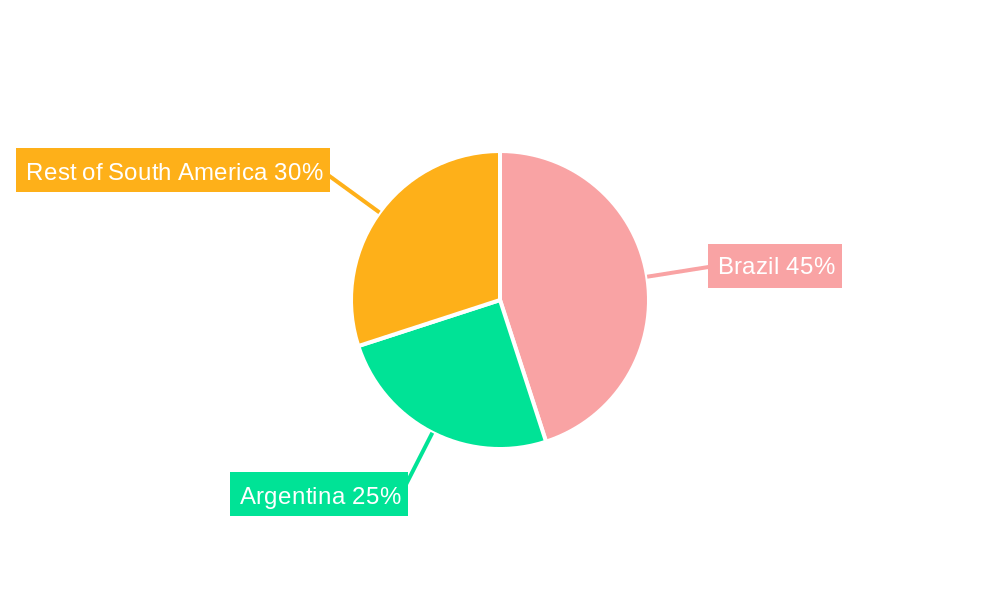

Dominant Regions, Countries, or Segments in South America Health & Fitness Industry

Brazil and Argentina are the dominant markets, accounting for approximately XX% and XX% of the total market revenue in 2025, respectively. Growth is driven by factors including:

- Brazil: High population density, expanding middle class, and government initiatives promoting health and wellness.

- Argentina: Increasing health consciousness and the emergence of boutique fitness studios.

By Service Type:

- Membership Fees: This segment holds the largest market share, projected at XX Million in 2025 and XX Million in 2033.

- Total Admission Fees: This segment is experiencing moderate growth, driven by the increasing popularity of drop-in classes and pay-per-visit options. Projected at XX Million in 2025 and XX Million in 2033.

- Personal Training and Instruction Services: This premium segment shows consistent growth, projected at XX Million in 2025 and XX Million in 2033 fueled by a demand for personalized fitness guidance.

South America Health & Fitness Industry Product Landscape

The product landscape encompasses a wide array of fitness equipment, training programs, and services. Innovation is focused on technology integration, personalized experiences, and convenient access. Fitness trackers, virtual reality fitness platforms, and personalized nutrition plans are gaining popularity. The unique selling propositions center on personalized fitness journeys, leveraging technology to enhance user experience and track progress.

Key Drivers, Barriers & Challenges in South America Health & Fitness Industry

Key Drivers:

- Rising disposable incomes and health consciousness are fueling market expansion.

- Technological advancements are enhancing the user experience and expanding accessibility.

- Government initiatives promoting health and wellness provide support.

Key Barriers and Challenges:

- Economic instability in some regions can impact consumer spending on fitness services.

- High infrastructure costs, especially in smaller cities, can hinder market expansion.

- Intense competition among established and new entrants puts pressure on profitability. This pressure is estimated to reduce average profit margins by XX% by 2033.

Emerging Opportunities in South America Health & Fitness Industry

Untapped markets in smaller cities and rural areas present substantial growth opportunities. The growing demand for specialized fitness programs, such as yoga, Pilates, and functional training, opens avenues for niche players. Furthermore, integrating technology to enhance personalization and convenience remains a significant opportunity.

Growth Accelerators in the South America Health & Fitness Industry

Technological advancements, strategic partnerships between fitness centers and healthcare providers, and expanding into underserved markets are key growth accelerators. The integration of wearable technology and AI-powered fitness apps will improve user experience and personalization, while strategic partnerships will expand service offerings.

Key Players Shaping the South America Health & Fitness Industry Market

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

Notable Milestones in South America Health & Fitness Industry Sector

- 2021-Q4: Launch of a major fitness app integrating AI-powered workout recommendations.

- 2022-Q2: Merger of two leading fitness chains, expanding market reach and service offerings.

- 2023-Q1: Introduction of a government initiative to subsidize fitness memberships in low-income communities.

In-Depth South America Health & Fitness Industry Market Outlook

The South American health and fitness market is poised for substantial growth over the next decade. Continued technological advancements, coupled with expanding health awareness and rising disposable incomes, will drive market expansion. Strategic partnerships and expansion into underserved markets will create opportunities for significant growth and profitability. The market is projected to reach XX Million by 2033.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence