Key Insights

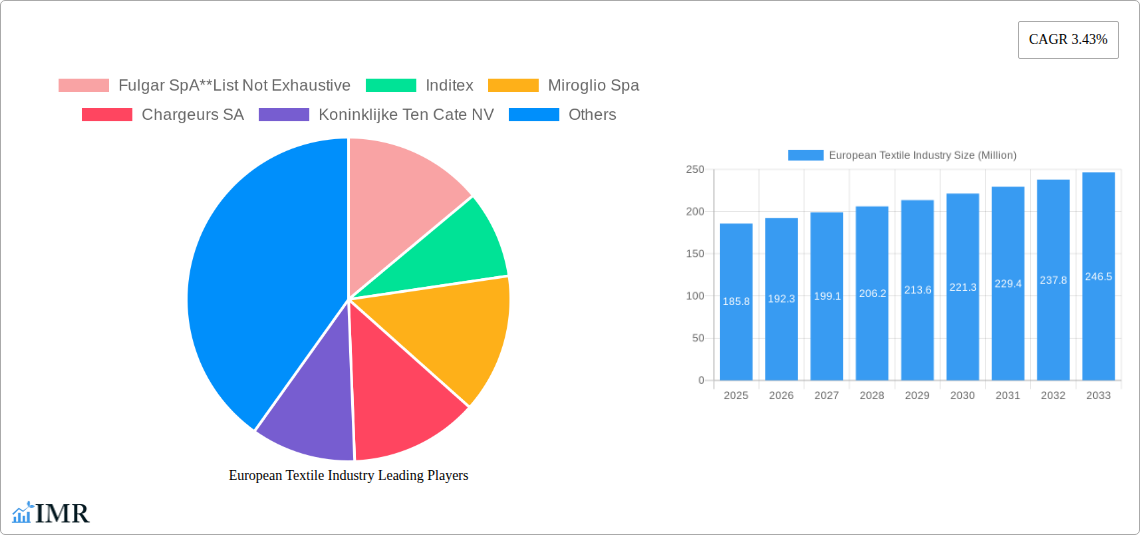

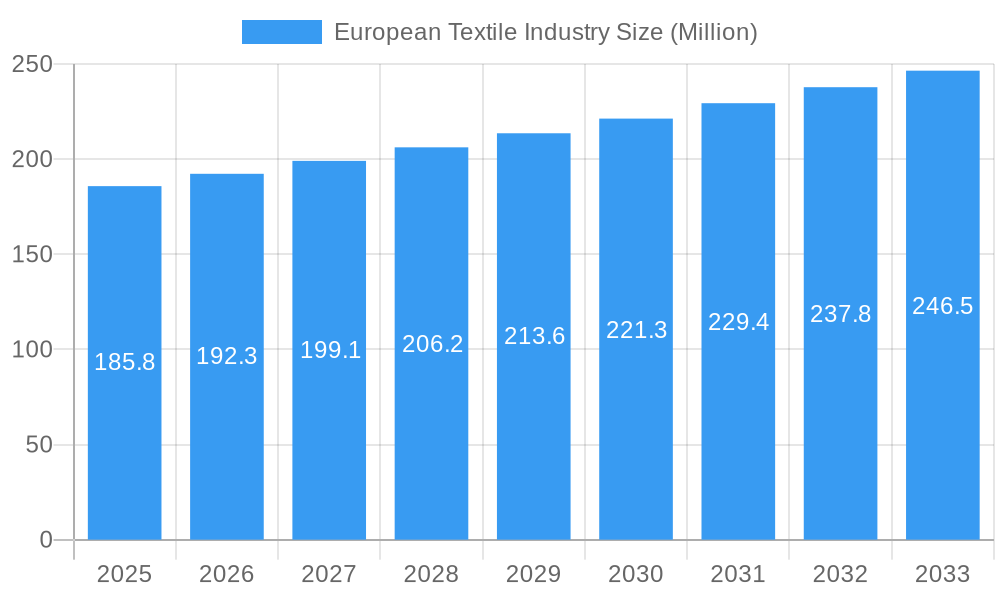

The European textile industry, valued at €185.80 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.43% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing demand for sustainable and eco-friendly textiles is fueling innovation in materials and processes, with a particular focus on recycled and organic options like organic cotton and recycled synthetics. Secondly, the resurgence of interest in traditional craftsmanship and locally sourced materials, especially within the clothing segment, is boosting demand for high-quality, niche textile products. Furthermore, technological advancements in weaving and non-woven processes are leading to increased efficiency and the creation of innovative textile solutions for various industrial and technical applications. The growth is further supported by the robust presence of established players like Inditex and smaller, specialized companies catering to specific niche markets, creating a diversified and dynamic market landscape.

European Textile Industry Market Size (In Million)

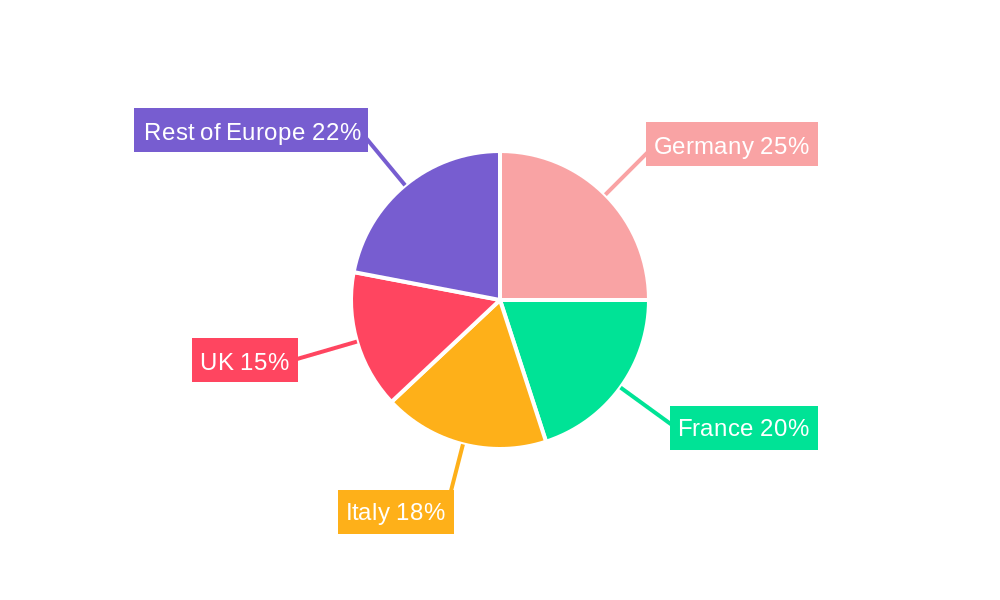

However, the industry faces certain challenges. Competition from low-cost producers in other regions poses a significant threat, particularly for mass-market textile products. Fluctuations in raw material prices, especially cotton and wool, also impact profitability. Additionally, stricter environmental regulations across Europe are increasing production costs and demanding greater investment in sustainable practices. The industry's success will depend on its ability to navigate these challenges through innovation, strategic partnerships, and a commitment to sustainability. Segments like high-performance technical textiles and luxury clothing are expected to demonstrate stronger growth rates compared to the overall market average due to their specialized nature and higher profit margins. Germany, France, and Italy remain key markets within Europe, reflecting a strong historical textile manufacturing base and considerable consumer spending power.

European Textile Industry Company Market Share

European Textile Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European textile industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on parent markets (Textiles) and child markets (Clothing, Industrial/Technical, Household applications; Cotton, Jute, Silk, Synthetics, Wool; Woven, Non-woven), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

European Textile Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the European textile industry. The market is characterized by a mix of large multinational corporations and smaller specialized firms. Market concentration is moderate, with a few dominant players holding significant market share, but numerous smaller companies specializing in niche segments. Technological innovation is a key driver, particularly in areas such as sustainable materials, smart textiles, and advanced manufacturing processes. However, barriers to entry, including high capital investment requirements and stringent environmental regulations, exist. Mergers and acquisitions (M&A) activity is relatively frequent, driven by efforts to consolidate market share, gain access to new technologies, and expand product portfolios.

- Market Concentration: Moderate, with xx% held by the top 5 players (2025 estimate).

- Technological Innovation: Driven by sustainability concerns and advancements in materials science.

- Regulatory Framework: Stringent environmental regulations impacting production and supply chains.

- Competitive Product Substitutes: Growing competition from alternative materials (e.g., bio-based polymers).

- End-User Demographics: Shifting consumer preferences towards sustainable and ethically sourced products.

- M&A Activity: xx deals recorded between 2019-2024, with an estimated xx million value.

European Textile Industry Growth Trends & Insights

The European textile market experienced a period of moderate growth during the historical period (2019-2024), impacted by economic fluctuations and evolving consumer preferences. However, the forecast period (2025-2033) projects a CAGR of xx%, driven by factors including increased demand for sustainable textiles, technological innovations in manufacturing processes, and the rising adoption of smart textiles. This growth is expected to be uneven across different segments, with certain materials and applications experiencing faster growth than others. Consumer behavior is shifting towards increased demand for sustainable and ethically produced products.

Dominant Regions, Countries, or Segments in European Textile Industry

Italy, Germany, and France are leading European countries in the textile industry. Within applications, Clothing is the largest segment, followed by Industrial/Technical and Household applications. In terms of material types, Synthetics dominate the market, followed by Cotton and Wool. Woven processes are currently prevalent but Non-woven materials are experiencing rapid growth, driven by technological advances and application expansion.

- Leading Region: Western Europe

- Leading Country: Italy (Market share: xx% in 2025)

- Leading Application Segment: Clothing (Market size: xx million in 2025)

- Leading Material Type: Synthetics (Market size: xx million in 2025)

- Leading Process: Woven (Market size: xx million in 2025)

Key Drivers for Growth: Strong domestic consumption, favorable government policies supporting the textile sector, robust export markets, innovation in manufacturing processes, and a skilled workforce.

European Textile Industry Product Landscape

The European textile industry is characterized by a wide range of products tailored to different applications. Innovation focuses on enhancing performance characteristics, such as durability, water resistance, and breathability, and developing sustainable and eco-friendly materials. Technological advancements include the use of advanced fibers, innovative manufacturing techniques (e.g., 3D printing), and smart textile technologies integrating electronics and sensors. Unique selling propositions often center on sustainability credentials, innovative designs, and superior performance characteristics.

Key Drivers, Barriers & Challenges in European Textile Industry

Key Drivers: Increased demand for sustainable textiles, technological advancements, and rising disposable incomes. Specific examples include the growth of eco-friendly fibers like organic cotton, the development of innovative recycling technologies, and the increasing use of automation in manufacturing.

Key Challenges: Intense competition from low-cost producers, rising raw material costs, stringent environmental regulations, and supply chain disruptions. The impact of these challenges is reflected in increased production costs, reduced profit margins, and the need for ongoing innovation to maintain competitiveness. Estimated cost increase due to raw materials is xx million annually (2025).

Emerging Opportunities in European Textile Industry

Emerging opportunities include the growth of functional textiles (e.g., smart fabrics for healthcare), the expansion into new applications (e.g., sustainable packaging), and the development of circular economy models for textile waste management. Untapped markets in Eastern Europe and developing countries present further growth potential. Evolving consumer preferences towards personalized and customized products create opportunities for bespoke manufacturing and on-demand production.

Growth Accelerators in the European Textile Industry Industry

Long-term growth is expected to be fueled by technological breakthroughs in materials science and manufacturing processes. Strategic partnerships and collaborations between textile manufacturers, technology providers, and brands will play a crucial role in driving innovation and market expansion. Focusing on sustainable and ethical practices, as well as tapping into emerging markets, are also key strategies for growth acceleration.

Key Players Shaping the European Textile Industry Market

- Fulgar SpA

- Inditex

- Miroglio Spa

- Chargeurs SA

- Koninklijke Ten Cate NV

- Aquafilslo S p a

- Tirotex

- Salvatore Ferragamo SpA

- Zorlu Holding

- Getzner Textil Aktiengesellschaft

Notable Milestones in European Textile Industry Sector

- December 2022: TextileGenesis™ acquisition by Lectra, enhancing traceability and sustainability in the textile industry.

- August 2022: Archroma's acquisition of Huntsman's Textile Effects business, strengthening the commitment to sustainable chemistry solutions.

In-Depth European Textile Industry Market Outlook

The European textile industry is poised for continued growth, driven by innovation, sustainability, and evolving consumer preferences. Strategic opportunities exist in developing high-performance, eco-friendly materials, expanding into niche markets, and embracing digital technologies to enhance efficiency and traceability. Companies that successfully adapt to the changing market landscape and prioritize sustainability will be best positioned to capitalize on future growth potential.

European Textile Industry Segmentation

-

1. Application Type

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process Type

- 3.1. Woven

- 3.2. Non-woven

European Textile Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Textile Industry Regional Market Share

Geographic Coverage of European Textile Industry

European Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of the Latest Fashion Trends Among the Young Generation

- 3.3. Market Restrains

- 3.3.1. High Wastage; Market Opportunities 4.; Increasing Trend of Smart Textiles

- 3.4. Market Trends

- 3.4.1. Rise in the Demand for Organic Textiles and Fabrics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process Type

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fulgar SpA**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Inditex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Miroglio Spa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chargeurs SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke Ten Cate NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aquafilslo S p a

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tirotex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Salvatore Ferragamo SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zorlu Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Getzner Textil Aktiengesellschaft

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fulgar SpA**List Not Exhaustive

List of Figures

- Figure 1: European Textile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Textile Industry Share (%) by Company 2025

List of Tables

- Table 1: European Textile Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: European Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: European Textile Industry Revenue Million Forecast, by Process Type 2020 & 2033

- Table 4: European Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: European Textile Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: European Textile Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: European Textile Industry Revenue Million Forecast, by Process Type 2020 & 2033

- Table 8: European Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark European Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Textile Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the European Textile Industry?

Key companies in the market include Fulgar SpA**List Not Exhaustive, Inditex, Miroglio Spa, Chargeurs SA, Koninklijke Ten Cate NV, Aquafilslo S p a, Tirotex, Salvatore Ferragamo SpA, Zorlu Holding, Getzner Textil Aktiengesellschaft.

3. What are the main segments of the European Textile Industry?

The market segments include Application Type, Material Type, Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 185.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of the Latest Fashion Trends Among the Young Generation.

6. What are the notable trends driving market growth?

Rise in the Demand for Organic Textiles and Fabrics.

7. Are there any restraints impacting market growth?

High Wastage; Market Opportunities 4.; Increasing Trend of Smart Textiles.

8. Can you provide examples of recent developments in the market?

December 2022: TextileGenesis™, a pioneering traceability platform custom-built for the textile ecosystem, was acquired by Lectra. Lectra is a company that offers consultancy and professional services to companies in many different sectors. This provides its customers with a vast collection of fashion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Textile Industry?

To stay informed about further developments, trends, and reports in the European Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence