Key Insights

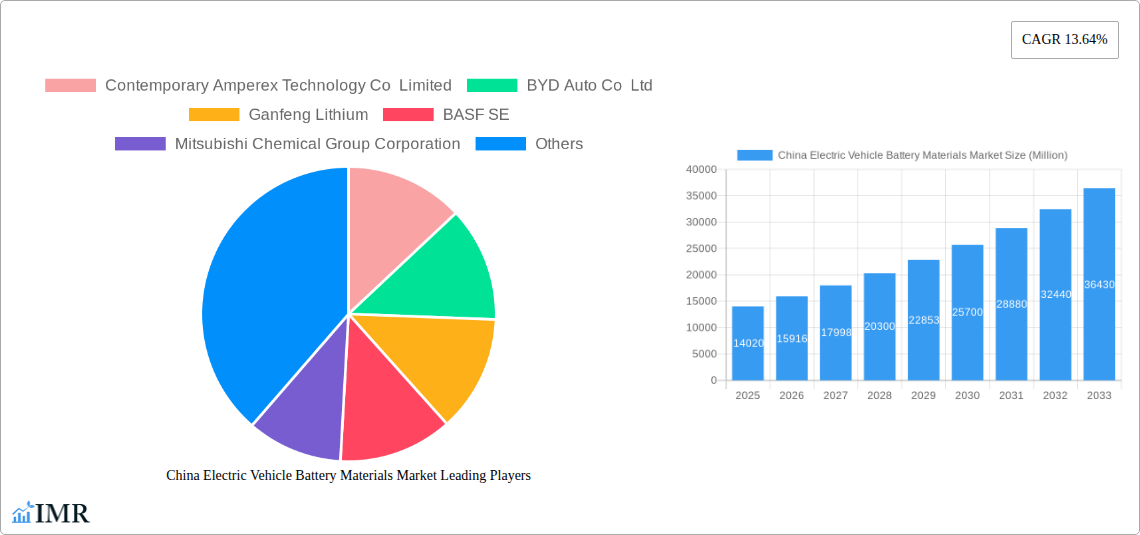

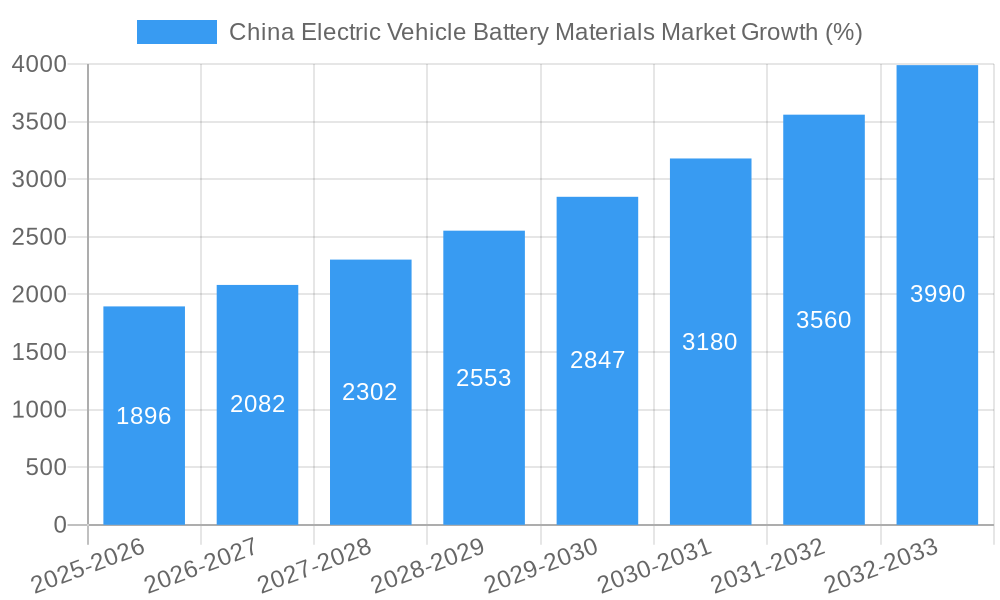

The China electric vehicle (EV) battery materials market is experiencing robust growth, fueled by the nation's aggressive push towards electric mobility and significant government support. With a market size of $14.02 billion in 2025 and a compound annual growth rate (CAGR) of 13.64%, the market is projected to reach substantial heights by 2033. This expansion is driven by several key factors. Firstly, the increasing demand for EVs in China, driven by stringent emission regulations and consumer preference for greener transportation, is a primary catalyst. Secondly, advancements in battery technology, particularly in lithium-ion battery chemistries like lithium iron phosphate (LFP) and nickel-manganese-cobalt (NMC), are enhancing energy density and extending vehicle range, further bolstering market demand. Finally, substantial investments in domestic battery material production and refining capabilities are ensuring a secure and cost-effective supply chain within China. Key players like Contemporary Amperex Technology Co Limited (CATL), BYD Auto Co Ltd, and Ganfeng Lithium are strategically positioned to capitalize on this growth, leveraging their established market presence and technological expertise.

However, the market also faces certain challenges. The volatile pricing of raw materials, particularly lithium and cobalt, poses a significant risk to profitability. Furthermore, ensuring the sustainable sourcing of these materials and minimizing environmental impact are crucial concerns for long-term market sustainability. Competition from international players is also intensifying, necessitating continuous innovation and efficiency improvements to maintain a competitive edge. Despite these challenges, the overall outlook for the China EV battery materials market remains positive, with the potential for substantial growth driven by continued EV adoption and technological advancements. The market's segmentation is likely diverse, encompassing various materials like lithium carbonate, cobalt salts, nickel sulfate, and graphite, each with its own growth trajectory and market dynamics. Detailed regional analysis would further illuminate the nuances of market penetration across different provinces within China.

China Electric Vehicle Battery Materials Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming China Electric Vehicle (EV) Battery Materials market, encompassing the parent market of EV batteries and the child market of its constituent materials. From market dynamics and growth trends to key players and emerging opportunities, this study offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period, using 2025 as the base year. All values are presented in million units.

China Electric Vehicle Battery Materials Market Dynamics & Structure

This section analyzes the intricate structure of the Chinese EV battery materials market, examining market concentration, technological innovation, regulatory landscapes, and competitive dynamics. We delve into the impact of mergers and acquisitions (M&A) activities and explore the evolving end-user demographics influencing market growth.

- Market Concentration: The market exhibits a [xx]% concentration ratio, with the top 5 players controlling approximately [xx]% of the market share in 2024. This is expected to [increase/decrease] to [xx]% by 2033 due to [reason].

- Technological Innovation: Significant investments in R&D are driving innovation in battery chemistries (e.g., LFP, NMC, solid-state), enhancing energy density, lifespan, and safety. Innovation barriers include [list specific challenges].

- Regulatory Framework: Government policies promoting EV adoption and domestic battery material production significantly shape market dynamics. Stringent environmental regulations also play a crucial role.

- Competitive Landscape: Intense competition exists among domestic and international players, leading to price wars and continuous technological advancements. The number of M&A deals in the sector reached [xx] in 2024.

- End-User Demographics: The expanding EV market in China, driven by rising consumer demand and government incentives, fuels the growth of the battery materials market.

China Electric Vehicle Battery Materials Market Growth Trends & Insights

This section provides a comprehensive analysis of the market's evolution, examining historical data and projecting future growth trajectories. Key factors influencing market size, adoption rates, technological disruptions, and consumer behavior changes are explored using data analytics and market research methodologies. The market experienced a CAGR of [xx]% during 2019-2024 and is projected to grow at a CAGR of [xx]% from 2025 to 2033, reaching [xx] million units by 2033. The increasing adoption of EVs, particularly in urban areas, is driving market expansion. Technological advancements in battery technology are further contributing to growth by improving efficiency, range, and safety.

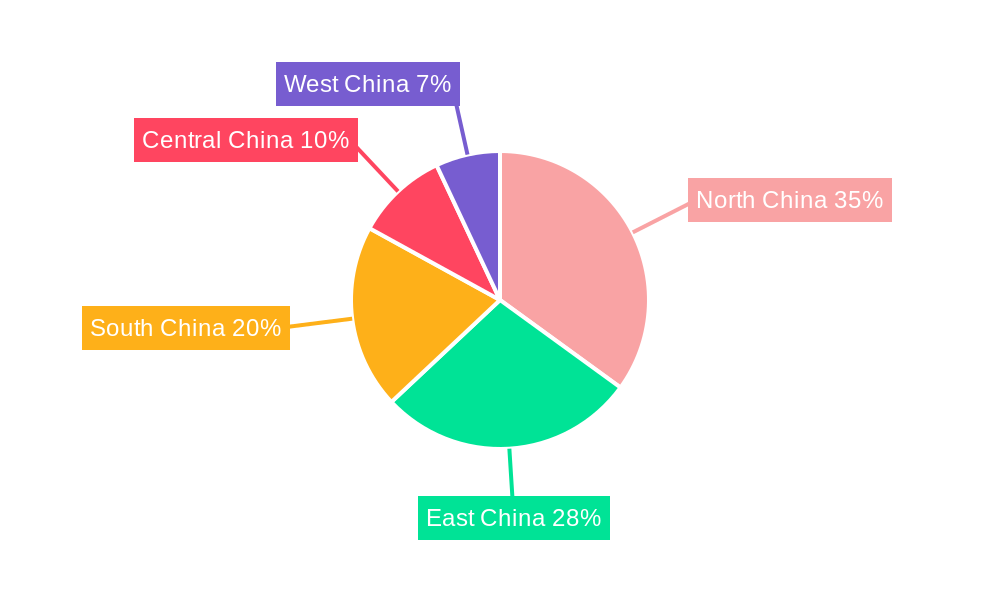

Dominant Regions, Countries, or Segments in China Electric Vehicle Battery Materials Market

This section pinpoints the key regions and segments driving market expansion within China. The analysis identifies the factors contributing to their dominance, including economic policies, infrastructure development, and regional demand patterns. [Insert 600 words analyzing specific regions within China, and highlighting the key drivers influencing market growth. Use bullet points for regional breakdowns and factors contributing to their leadership position.]

China Electric Vehicle Battery Materials Market Product Landscape

The Chinese EV battery materials market offers a diverse range of products, including lithium-ion battery materials (cathode, anode, electrolyte), solid-state battery materials, and other advanced battery materials. Ongoing innovation focuses on enhancing energy density, extending battery lifespan, and improving safety features. These advancements aim to address range anxiety and boost consumer confidence in EVs.

Key Drivers, Barriers & Challenges in China Electric Vehicle Battery Materials Market

Key Drivers:

- Government incentives and subsidies promoting EV adoption.

- Rapid growth of the Chinese EV market.

- Investments in R&D for advanced battery technologies.

- Increasing demand for high-performance battery materials.

Key Barriers & Challenges:

- Fluctuations in raw material prices (lithium, cobalt, nickel).

- Supply chain disruptions and geopolitical risks impacting raw material availability.

- Stringent environmental regulations and safety standards.

- Intense competition and price pressures. This has led to a [xx]% decrease in average profit margins for top producers in the last year.

Emerging Opportunities in China Electric Vehicle Battery Materials Market

- Development and commercialization of solid-state batteries.

- Growing demand for high-energy density battery materials for long-range EVs.

- Opportunities in recycling and reuse of EV battery materials.

- Expansion into new applications beyond EVs (e.g., energy storage).

Growth Accelerators in the China Electric Vehicle Battery Materials Market Industry

Technological breakthroughs, particularly in solid-state battery technology and improved battery management systems, are driving significant growth. Strategic partnerships between battery material manufacturers and EV makers are further accelerating market expansion, facilitating the development and adoption of advanced battery technologies. Expansion into new markets and applications, leveraging China's extensive manufacturing capabilities and infrastructure, will solidify its position as a global leader in this sector.

Key Players Shaping the China Electric Vehicle Battery Materials Market

- Contemporary Amperex Technology Co Limited

- BYD Auto Co Ltd

- Ganfeng Lithium

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- BTR New Material Group Co Ltd

- Shanshan Co

- *List Not Exhaustive

Notable Milestones in China Electric Vehicle Battery Materials Market Sector

- May 2024: China announces a 6 billion yuan (USD 845 million) investment in next-generation EV battery technologies, focusing on all-solid-state batteries (ASSBs) and supporting companies like CATL, BYD, and Geely.

- July 2024: Chinese researchers unveil a cost-effective solid-state lithium battery with performance comparable to leading next-generation technologies.

In-Depth China Electric Vehicle Battery Materials Market Outlook

The future of the Chinese EV battery materials market is exceptionally promising, driven by continuous technological advancements, supportive government policies, and the surging demand for electric vehicles. Strategic investments in R&D, coupled with expanding production capacities and collaborations across the value chain, will further propel market growth. The market presents substantial opportunities for both domestic and international players to capitalize on the increasing demand for high-performance, cost-effective, and sustainable battery solutions.

China Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

China Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. China

China Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Contemporary Amperex Technology Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BYD Auto Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ganfeng Lithium

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Chemical Group Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UBE Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Umicore SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Chemical Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BTR New Material Group Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shanshan Co *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: China Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Electric Vehicle Battery Materials Market Share (%) by Company 2024

List of Tables

- Table 1: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 5: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 11: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: China Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 13.64%.

2. Which companies are prominent players in the China Electric Vehicle Battery Materials Market?

Key companies in the market include Contemporary Amperex Technology Co Limited, BYD Auto Co Ltd, Ganfeng Lithium, BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, BTR New Material Group Co Ltd, Shanshan Co *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the China Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Battery Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

May 2024: China plans to invest approximately 6 billion yuan (USD 845 million) in advancing next-generation battery technologies for electric vehicles (EVs). The country is planning to support six companies, including CATL, BYD, and Geely, to pioneer the development of all-solid-state batteries (ASSBs). Notably, EV battery manufacturer CATL stands out as a key recipient of government support for its next-generation technology initiatives.July 2024: Chinese researchers unveiled a solid-state lithium battery, achieving performance levels comparable to leading next-gen battery contenders, yet costing under 10% of their price. This advancement aligns with China's strategic plan to spearhead the future of rechargeable battery technology, a shift poised to transform the electric vehicle landscape. By substituting the liquid electrolytes found in traditional lithium batteries with a solid-state variant, the potential emerges for quicker charging, enhanced performance, and heightened safety standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the China Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence