Key Insights

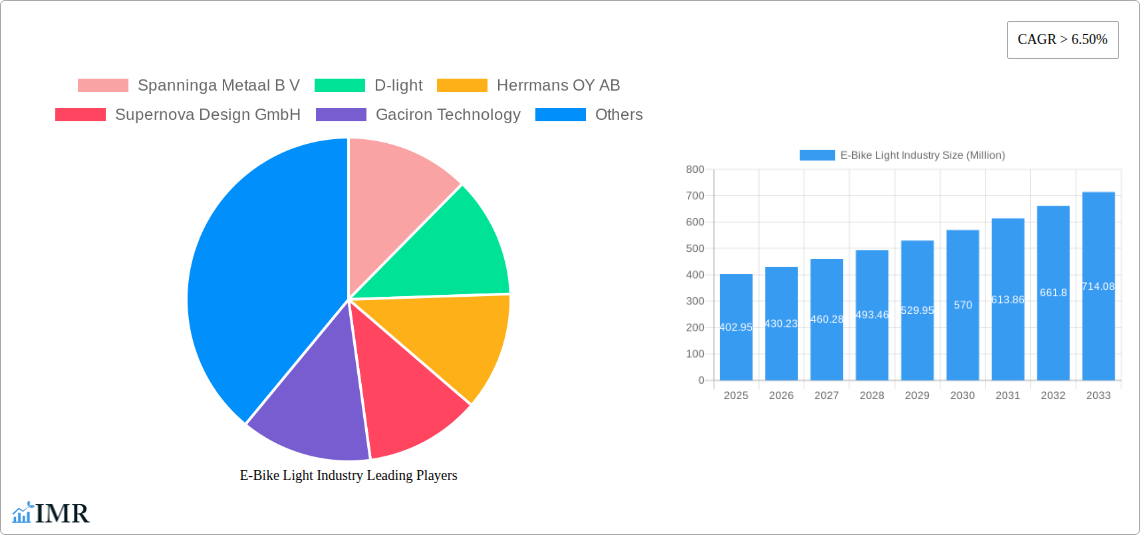

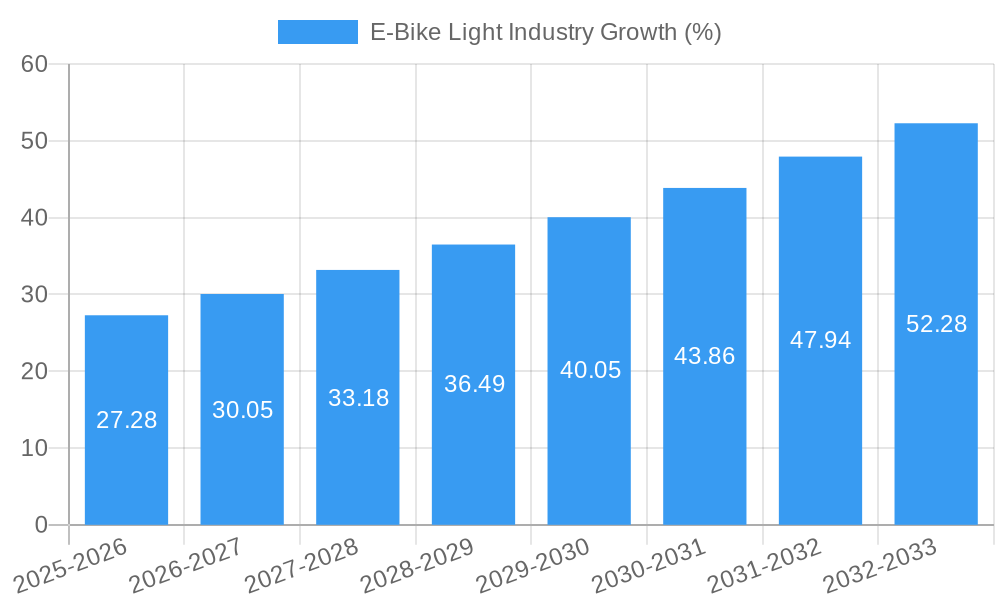

The global e-bike light industry, currently valued at $402.95 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2025 to 2033. This expansion is driven by several key factors. The increasing popularity of e-bikes as a sustainable and efficient mode of transportation is a primary catalyst. Government initiatives promoting cycling infrastructure and eco-friendly commuting further fuel market growth. Technological advancements, such as the development of brighter, more energy-efficient LED lights and integrated smart lighting systems, are enhancing product appeal and functionality. Furthermore, the growing demand for safety features, particularly in urban areas with limited visibility, is driving adoption of high-quality e-bike lighting solutions. The market is segmented by light mounting (headlights, rear safety lights), sales channel (offline and online stores), and end-user (aftermarket and stock fitting). The aftermarket segment is expected to show robust growth due to the increasing preference for customizable lighting options. Online sales channels are gaining traction due to their convenience and wider product selection.

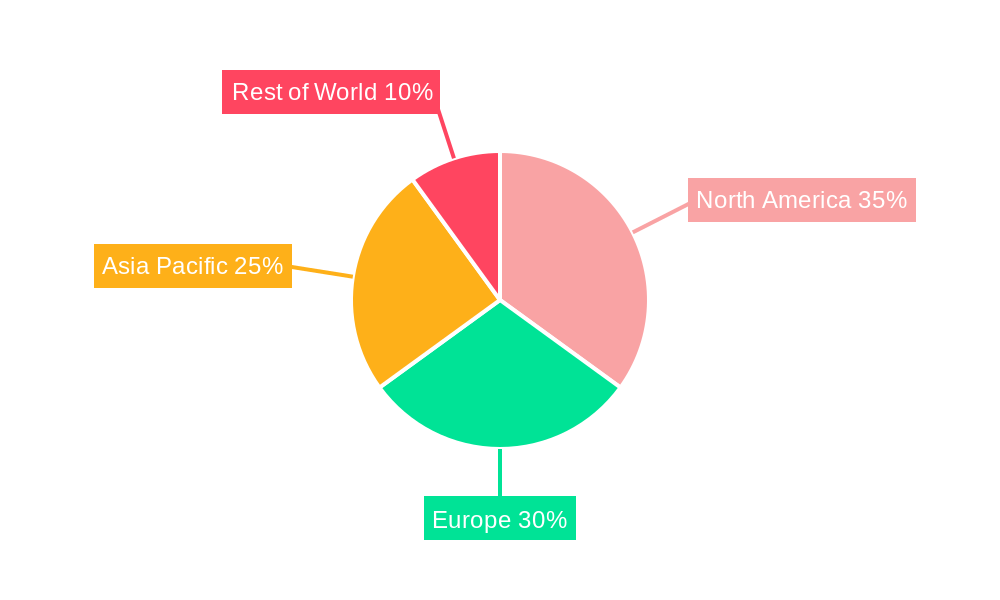

The geographical distribution of the market reveals strong growth potential across various regions. North America and Europe currently hold significant market share, driven by high e-bike adoption rates and robust regulatory frameworks promoting cyclist safety. However, the Asia-Pacific region is projected to experience substantial growth over the forecast period, fuelled by rising disposable incomes, increasing urbanization, and the expanding e-bike market in countries like China and India. Key players in the industry, including Spanninga Metaal B.V., D-light, and Supernova Design GmbH, are focusing on innovation and strategic partnerships to maintain their competitive edge. While challenges such as fluctuating raw material prices and intense competition exist, the overall outlook for the e-bike light industry remains positive, indicating a substantial expansion in the coming years.

E-Bike Light Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the E-bike Light industry, encompassing market dynamics, growth trends, regional performance, and key players. With a focus on the parent market (electric bike industry) and child market (e-bike lighting components), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market sizes are presented in million units.

E-Bike Light Industry Market Dynamics & Structure

The E-bike light market, a crucial component of the burgeoning electric bicycle industry, is characterized by moderate concentration with key players like Spanninga Metaal B V, D-light, and Supernova Design GmbH holding significant market share. Technological innovation, particularly in LED technology and integrated smart features, is a major driver. Stringent safety regulations across various regions influence product design and manufacturing. Competitive substitutes include traditional bicycle lights, though the increasing demand for e-bikes is boosting the adoption of specialized e-bike lights. The end-user demographic is diverse, including both individual consumers and Original Equipment Manufacturers (OEMs). The historical period (2019-2024) witnessed xx M&A deals, indicating a growing interest in consolidation within the sector. The forecast period (2025-2033) is predicted to see xx M&A deals.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: LED advancements, smart connectivity, improved battery life, and integrated designs are key drivers.

- Regulatory Framework: Stringent safety standards in Europe and North America impacting product development.

- Competitive Substitutes: Traditional bicycle lights pose limited competition due to specialized e-bike needs.

- End-User Demographics: Mix of individual consumers (aftermarket) and OEMs (stock fitting), with aftermarket segment growing faster.

- M&A Trends: Increasing consolidation as larger players seek to expand their market reach and product portfolio.

E-Bike Light Industry Growth Trends & Insights

The global e-bike light market experienced significant growth during the historical period (2019-2024), driven by the surging popularity of e-bikes. The market size increased from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. This growth is attributed to increasing consumer preference for safety features, rising environmental awareness, and government initiatives promoting e-bike adoption. Technological advancements, such as improved battery technology and brighter, more efficient LEDs, have further fueled market expansion. Consumer behavior shifts towards prioritizing safety and convenience are boosting demand for high-quality e-bike lights. The market penetration rate for e-bike lights stood at xx% in 2024, with projections indicating further expansion to xx% by 2033. This substantial growth is anticipated to continue into the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx million units by 2033.

Dominant Regions, Countries, or Segments in E-Bike Light Industry

Europe and North America currently dominate the e-bike light market, driven by high e-bike adoption rates, stringent safety regulations, and a strong preference for advanced features. Within these regions, Germany, the Netherlands, and the United States hold leading positions. The Aftermarket segment is experiencing faster growth than the Stock Fitting segment due to increasing e-bike ownership and the demand for upgrades and replacements. Online stores are gaining traction, but Offline stores still dominate due to the need for physical demonstration and immediate purchasing of lights. Headlights remain the largest segment by light mounting, followed by rear safety lights, reflecting safety concerns.

- Key Drivers:

- High e-bike adoption rates in Europe and North America.

- Stringent safety regulations promoting e-bike light usage.

- Growing preference for high-quality and feature-rich e-bike lights.

- Expanding online retail channels.

- Dominance Factors: High consumer disposable income, well-developed cycling infrastructure, and strong environmental consciousness contribute to market dominance in leading regions and segments.

E-Bike Light Industry Product Landscape

The e-bike light market showcases a diverse product landscape, encompassing headlights and rear safety lights with varying features and functionalities. Innovations include brighter LEDs, integrated daytime running lights (DRLs), smart connectivity features (e.g., Bluetooth integration for smartphone control), and improved battery life. Unique selling propositions include enhanced visibility, superior durability, and aesthetically pleasing designs. Technological advancements focus on improving light intensity, energy efficiency, and safety features, such as brake lights and turn signals.

Key Drivers, Barriers & Challenges in E-Bike Light Industry

Key Drivers:

- Rising e-bike sales globally.

- Increased consumer awareness of safety concerns.

- Technological advancements in LED and battery technology.

- Government regulations promoting e-bike usage and safety.

Key Challenges:

- Intense competition from numerous manufacturers.

- Supply chain disruptions impacting production and availability.

- Price pressure from budget-conscious consumers.

- Varying safety standards across different regions.

Emerging Opportunities in E-Bike Light Industry

- Untapped Markets: Growing e-bike markets in Asia and South America present significant opportunities for expansion.

- Innovative Applications: Integration of smart features, such as GPS tracking and theft prevention systems, offer new growth avenues.

- Evolving Consumer Preferences: Demand for eco-friendly and sustainable products opens opportunities for lights with recycled materials and efficient energy consumption.

Growth Accelerators in the E-Bike Light Industry

Technological breakthroughs in LED technology, battery life, and smart connectivity features are driving long-term growth. Strategic partnerships between e-bike manufacturers and lighting component suppliers are expanding market reach and enhancing product integration. Government initiatives promoting e-bike adoption and safety regulations are also acting as strong catalysts for industry growth. Market expansion into emerging economies is expected to drive further growth in the coming years.

Key Players Shaping the E-Bike Light Industry Market

- Spanninga Metaal B V

- D-light

- Herrmans OY AB

- Supernova Design GmbH

- Gaciron Technology

- Magicshine

- Limeforge Ltd

- Lezyne

- Lord Benex

Notable Milestones in E-Bike Light Industry Sector

- December 2022: Magicshine introduced the ME StVZO 100LUX E-BIKE LIGHT in India, showcasing advancements in LED technology.

- March 2023: Upway's launch in the US market signifies expanding e-bike refurbishment and sales, indirectly boosting the demand for replacement parts, including e-bike lights.

In-Depth E-Bike Light Industry Market Outlook

The e-bike light market is poised for substantial growth over the forecast period, fueled by technological advancements, rising e-bike adoption, and increasing focus on safety. Strategic partnerships, expansion into new markets, and the development of innovative features will create lucrative opportunities for players in this dynamic industry. The market’s future potential lies in the integration of smart technologies, sustainable materials, and enhanced safety features, catering to evolving consumer demands and industry regulations.

E-Bike Light Industry Segmentation

-

1. Light Mounting

- 1.1. Headlight

- 1.2. Rear Safety Light

-

2. Sales Channel

- 2.1. Offline Stores

- 2.2. Online Stores

-

3. End-User

- 3.1. Aftermarket

- 3.2. Stock Fitting

E-Bike Light Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

E-Bike Light Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sales of E-bikes

- 3.3. Market Restrains

- 3.3.1. High Cost of EV Solid-State Battery May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for E-bikes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Light Mounting

- 5.1.1. Headlight

- 5.1.2. Rear Safety Light

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Offline Stores

- 5.2.2. Online Stores

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Aftermarket

- 5.3.2. Stock Fitting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Light Mounting

- 6. North America E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Light Mounting

- 6.1.1. Headlight

- 6.1.2. Rear Safety Light

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Offline Stores

- 6.2.2. Online Stores

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Aftermarket

- 6.3.2. Stock Fitting

- 6.1. Market Analysis, Insights and Forecast - by Light Mounting

- 7. Europe E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Light Mounting

- 7.1.1. Headlight

- 7.1.2. Rear Safety Light

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Offline Stores

- 7.2.2. Online Stores

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Aftermarket

- 7.3.2. Stock Fitting

- 7.1. Market Analysis, Insights and Forecast - by Light Mounting

- 8. Asia Pacific E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Light Mounting

- 8.1.1. Headlight

- 8.1.2. Rear Safety Light

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Offline Stores

- 8.2.2. Online Stores

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Aftermarket

- 8.3.2. Stock Fitting

- 8.1. Market Analysis, Insights and Forecast - by Light Mounting

- 9. Rest of the World E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Light Mounting

- 9.1.1. Headlight

- 9.1.2. Rear Safety Light

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Offline Stores

- 9.2.2. Online Stores

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Aftermarket

- 9.3.2. Stock Fitting

- 9.1. Market Analysis, Insights and Forecast - by Light Mounting

- 10. North America E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Spanninga Metaal B V

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 D-light

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Herrmans OY AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Supernova Design GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gaciron Technology

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Magicshin

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Limeforge Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Lezyne

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Lord Benex

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Spanninga Metaal B V

List of Figures

- Figure 1: Global E-Bike Light Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 11: North America E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 12: North America E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 13: North America E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: North America E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 19: Europe E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 20: Europe E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 21: Europe E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 22: Europe E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 27: Asia Pacific E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 28: Asia Pacific E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 29: Asia Pacific E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 30: Asia Pacific E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 31: Asia Pacific E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Asia Pacific E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 35: Rest of the World E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 36: Rest of the World E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 37: Rest of the World E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 38: Rest of the World E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 39: Rest of the World E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Rest of the World E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E-Bike Light Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 3: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global E-Bike Light Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 27: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 29: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 34: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 35: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 44: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 45: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 46: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 53: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 54: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 55: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Middle East and Africa E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Bike Light Industry?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the E-Bike Light Industry?

Key companies in the market include Spanninga Metaal B V, D-light, Herrmans OY AB, Supernova Design GmbH, Gaciron Technology, Magicshin, Limeforge Ltd, Lezyne, Lord Benex.

3. What are the main segments of the E-Bike Light Industry?

The market segments include Light Mounting, Sales Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 402.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sales of E-bikes.

6. What are the notable trends driving market growth?

Growing Demand for E-bikes.

7. Are there any restraints impacting market growth?

High Cost of EV Solid-State Battery May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2023: Upway, the French refurbisher and reseller of electric bikes across various brands, launched in the United States. The company will focus its efforts on the Northeast region of the country. Still, its bikes will be available for shipping across the continental U.S. Upway already collaborates with major European e-bike brands such as VanMoof, Riese & Müller, and Gazelle. Still, it plans to extend its roster to include American bike brands such as Specialised, Cannondale, and Rad Power Bikes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Bike Light Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Bike Light Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Bike Light Industry?

To stay informed about further developments, trends, and reports in the E-Bike Light Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence