Key Insights

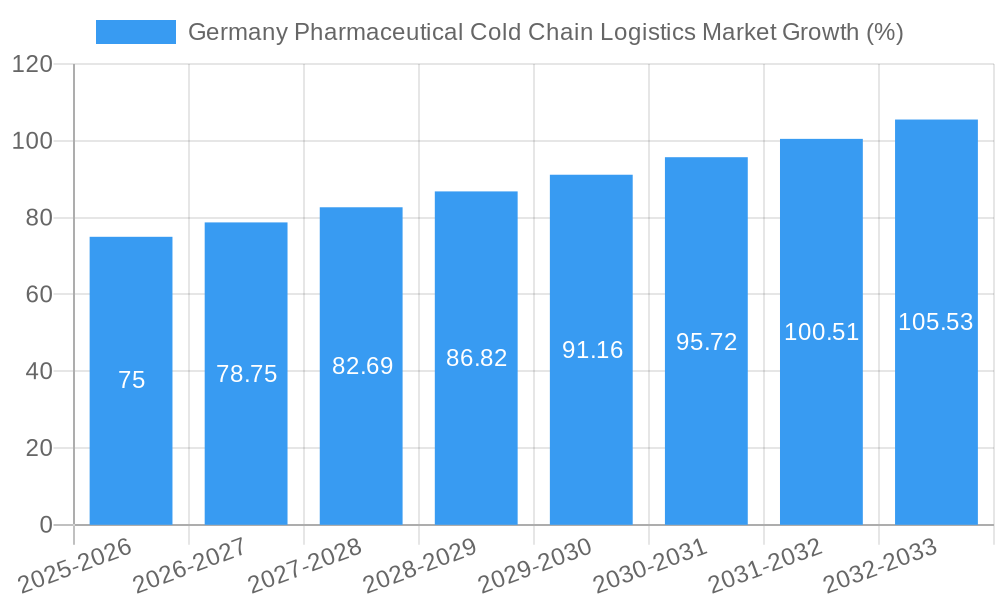

The German pharmaceutical cold chain logistics market is experiencing robust growth, fueled by a confluence of factors. The increasing demand for temperature-sensitive pharmaceuticals, driven by the rise of biologics and specialized medications, is a primary driver. Germany's strong pharmaceutical manufacturing base and its position as a major European hub for drug distribution further contribute to market expansion. The market is segmented by application (biopharma, chemical pharma, specialized pharma), service (storage, transportation, value-added services), temperature type (chilled, frozen, ambient), and product (generic and branded drugs). The presence of established logistics providers like DHL, DB Schenker, and Kuehne + Nagel, alongside specialized pharmaceutical logistics companies, indicates a mature and competitive market landscape. However, stringent regulatory compliance and the need for sophisticated infrastructure to maintain the integrity of temperature-sensitive products pose challenges. Furthermore, maintaining consistent cold chain integrity across various transportation modes and geographical locations presents complexities that impact operational efficiency and cost. The market’s CAGR exceeding 5% suggests a consistent upward trajectory, projected to continue through 2033. This positive outlook is reinforced by the growing emphasis on patient safety and the expanding reach of pharmaceutical companies across Germany's diverse regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse. Significant investments in technology, such as real-time temperature monitoring and data analytics, are expected to further streamline operations and improve efficiency within the German pharmaceutical cold chain logistics sector in the coming years.

The regional concentration within Germany reflects established pharmaceutical clusters and distribution networks. The forecast period (2025-2033) promises continued expansion, driven by the projected increase in pharmaceutical production and distribution within the country. However, companies will need to navigate potential challenges including rising fuel costs, fluctuations in global supply chains, and the ongoing need for robust regulatory compliance. The market's growth will depend on ongoing investment in infrastructure and technological advancements to ensure the safe and efficient transportation of temperature-sensitive pharmaceuticals across Germany. This necessitates a strong focus on innovation, strategic partnerships, and a proactive approach to risk management to capitalize on this substantial market opportunity.

Germany Pharmaceutical Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany pharmaceutical cold chain logistics market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this vital sector. The market is segmented by application (Biopharma, Chemical Pharma, Specialized Pharma), service (Storage, Transportation, Value-added Services), temperature type (Chilled, Frozen, Ambient), and product (Generic Drugs, Branded Drugs).

Germany Pharmaceutical Cold Chain Logistics Market Dynamics & Structure

The German pharmaceutical cold chain logistics market is characterized by a moderately concentrated structure, with key players such as DB Schenker, DHL, Kuehne + Nagel, and FedEx Logistics holding significant market share. The market size in 2025 is estimated at xx Million. However, several smaller, specialized firms also contribute significantly, particularly in niche areas like ultra-low temperature storage. Technological innovation, driven by the need for enhanced temperature control, tracking, and data management, is a major growth driver. Stringent regulatory frameworks, including GDP guidelines, ensure product quality and safety, shaping market practices. The competitive landscape is further influenced by the availability of substitute solutions and the ongoing consolidation through mergers and acquisitions (M&A). Over the historical period (2019-2024), the M&A activity resulted in an estimated xx number of deals, contributing to market concentration.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Innovation: Focus on IoT, AI, and real-time tracking systems.

- Regulatory Framework: Stringent GDP compliance and data security regulations.

- Competitive Substitutes: Limited direct substitutes, but alternative logistics models are emerging.

- End-User Demographics: Primarily pharmaceutical manufacturers, distributors, and hospitals.

- M&A Trends: Consolidation expected to continue, driven by efficiency and scale advantages.

Germany Pharmaceutical Cold Chain Logistics Market Growth Trends & Insights

The German pharmaceutical cold chain logistics market exhibits robust growth, driven by factors including increasing pharmaceutical production, rising demand for temperature-sensitive drugs (including biologics and vaccines), and growing e-commerce penetration in the healthcare sector. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is fueled by technological disruptions, such as the adoption of smart packaging and advanced monitoring systems, and shifts in consumer behavior, with increased preference for home-delivered medications. Market penetration of advanced cold chain solutions is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Germany Pharmaceutical Cold Chain Logistics Market

The German pharmaceutical cold chain logistics market shows strong growth across all major segments. However, the Biopharma segment demonstrates particularly high growth potential, driven by the increasing prevalence of biologics and advanced therapies. Similarly, the value-added services segment, encompassing specialized handling, packaging, and labeling, is experiencing significant expansion due to increasing demand for enhanced quality control and regulatory compliance. Within temperature types, the frozen segment is expanding rapidly alongside the growth in the biologics market. Geographically, major urban centers and industrial hubs exhibit higher market concentration due to the presence of major pharmaceutical manufacturers, distribution centers, and hospitals.

- Leading Segment (by Application): Biopharma, driven by the rise of biologics and specialized therapies.

- Leading Segment (by Service): Value-added services, reflecting the need for enhanced quality control.

- Leading Segment (by Temperature Type): Frozen, linked to the increasing use of temperature-sensitive drugs.

- Regional Dominance: Major urban centers and industrial hubs.

- Key Growth Drivers: Expansion of biologics market, stringent regulatory compliance, and focus on patient convenience.

Germany Pharmaceutical Cold Chain Logistics Market Product Landscape

The product landscape is characterized by a diverse range of solutions, including passive and active temperature-controlled containers, specialized vehicles, and advanced monitoring systems. Innovations focus on enhancing temperature control precision, improving data security, and streamlining logistics processes. Unique selling propositions often revolve around real-time tracking, data analytics, and customized solutions tailored to specific drug types and transportation routes. Technological advancements such as IoT sensors and blockchain technology are transforming the industry, offering enhanced visibility and security.

Key Drivers, Barriers & Challenges in Germany Pharmaceutical Cold Chain Logistics Market

Key Drivers:

- Increasing demand for temperature-sensitive pharmaceuticals.

- Stringent regulatory requirements driving adoption of advanced technologies.

- Growing investment in cold chain infrastructure.

Challenges & Restraints:

- High initial investment costs for advanced cold chain technologies.

- Maintaining consistent temperature control during transit and storage.

- Potential supply chain disruptions and geopolitical risks. These disruptions could cause a xx% increase in logistics costs.

Emerging Opportunities in Germany Pharmaceutical Cold Chain Logistics Market

Emerging opportunities lie in the expansion of personalized medicine, the development of novel drug delivery systems, and the growing demand for specialized cold chain solutions for emerging markets. The rise of e-commerce in healthcare creates opportunities for home delivery of temperature-sensitive medications, demanding innovation in last-mile logistics. Untapped potential exists in the development of sustainable and eco-friendly cold chain solutions to address environmental concerns.

Growth Accelerators in the Germany Pharmaceutical Cold Chain Logistics Market Industry

Long-term growth is driven by technological advancements in temperature control, real-time tracking, and data analytics. Strategic partnerships between logistics providers and pharmaceutical companies enable the development of integrated and efficient solutions. Market expansion into new therapeutic areas and geographic regions, particularly in Eastern Europe, also fuels growth.

Key Players Shaping the Germany Pharmaceutical Cold Chain Logistics Market Market

- DB Schenker

- DHL

- Eurotranspharma

- Ceva Logistics

- GDP Network Solutions GmbH

- Transmed Transport GmbH

- Kuehne + Nagel

- Trans-o-flex (ThermoMed)

- Biotech and Pharma Logistics

- Pfenning Logistics

- Rhenus Logistics

- MSK Pharma Logistics

- FedEx Logistics

Notable Milestones in Germany Pharmaceutical Cold Chain Logistics Market Sector

- August 2022: DHL Supply Chain expands its life sciences and healthcare campus in Florstadt, Germany, adding a 344,000-square-foot logistics center with temperature-controlled zones.

- July 2022: Logistics 4Pharma GmbH invests in ultra-deep-freeze warehousing (-80°C to +25°C), expanding its service portfolio for highly sensitive medicines.

In-Depth Germany Pharmaceutical Cold Chain Logistics Market Market Outlook

The German pharmaceutical cold chain logistics market presents substantial growth potential, driven by technological innovation and increasing demand for temperature-sensitive pharmaceuticals. Strategic partnerships, expansion into new markets, and the adoption of sustainable practices will be crucial for long-term success. The market's future hinges on adapting to evolving regulatory landscapes and effectively addressing supply chain complexities. The projected market value in 2033 positions this sector as an attractive investment opportunity for both established players and new entrants.

Germany Pharmaceutical Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

-

1.2. Transportation

- 1.2.1. Road

- 1.2.2. Rail

- 1.2.3. Air

- 1.2.4. Sea

- 1.3. Value-added Services

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Product

- 3.1. Generic Drugs

- 3.2. Branded Drugs

-

4. Application

- 4.1. Biopharma

- 4.2. Chemical Pharma

- 4.3. Specialized Pharma

Germany Pharmaceutical Cold Chain Logistics Market Segmentation By Geography

- 1. Germany

Germany Pharmaceutical Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Online Pharmacies to Aid Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.2.1. Road

- 5.1.2.2. Rail

- 5.1.2.3. Air

- 5.1.2.4. Sea

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Generic Drugs

- 5.3.2. Branded Drugs

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Biopharma

- 5.4.2. Chemical Pharma

- 5.4.3. Specialized Pharma

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North Rhine-Westphalia Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Pharmaceutical Cold Chain Logistics Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurotranspharma**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ceva Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GDP Network Solutions GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Transmed Transport GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kuehne + Nagel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trans-o-flex (ThermoMed)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biotech and Pharma Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfenning Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rhenus Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MSK Pharma Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FedEx Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Germany Pharmaceutical Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Pharmaceutical Cold Chain Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2019 & 2032

- Table 4: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 5: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North Rhine-Westphalia Germany Pharmaceutical Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Bavaria Germany Pharmaceutical Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Baden-Württemberg Germany Pharmaceutical Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Lower Saxony Germany Pharmaceutical Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Hesse Germany Pharmaceutical Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2019 & 2032

- Table 15: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Germany Pharmaceutical Cold Chain Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Pharmaceutical Cold Chain Logistics Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Germany Pharmaceutical Cold Chain Logistics Market?

Key companies in the market include DB Schenker, DHL, Eurotranspharma**List Not Exhaustive, Ceva Logistics, GDP Network Solutions GmbH, Transmed Transport GmbH, Kuehne + Nagel, Trans-o-flex (ThermoMed), Biotech and Pharma Logistics, Pfenning Logistics, Rhenus Logistics, MSK Pharma Logistics, FedEx Logistics.

3. What are the main segments of the Germany Pharmaceutical Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Growing Popularity of Online Pharmacies to Aid Market Expansion.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

August 2022: DHL Supply Chain, a logistics company that operates within Deutsche Post DHL Group, has further expanded its life sciences and healthcare (LSH) campus in Florstadt, near Frankfurt am Main, Germany. The new branch adds a third, over 344,000-square-foot logistics center to the multi-user campus, specializing in pharma and medical products. There are several temperature-controlled zones available, including ambient-cooled and freezer areas with temperatures as low as -20 °C.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Pharmaceutical Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Pharmaceutical Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Pharmaceutical Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Germany Pharmaceutical Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence