Key Insights

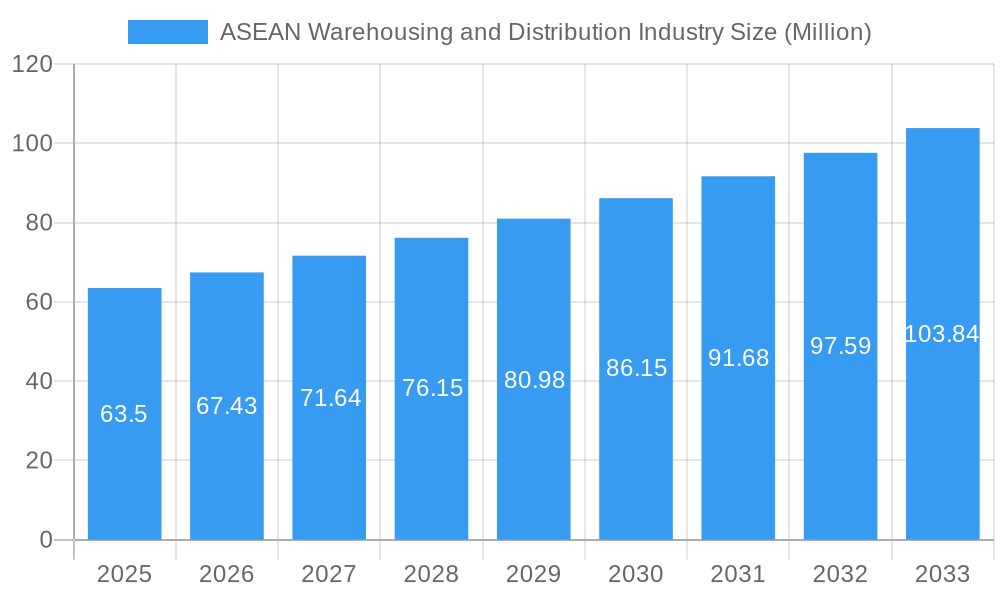

The ASEAN warehousing and distribution industry is experiencing robust growth, projected to reach a market size of $63.50 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in ASEAN necessitates efficient warehousing and distribution networks to manage the surge in online orders. Furthermore, the increasing adoption of advanced technologies like automation, robotics, and sophisticated warehouse management systems (WMS) is enhancing operational efficiency and driving down costs. Growth in key end-user industries such as retail & e-commerce, FMCG, and manufacturing further fuels demand. While challenges remain, such as infrastructure limitations in certain regions and skilled labor shortages, the overall outlook for the industry remains positive. The diverse range of services offered, including warehousing, distribution, and value-added services like packaging and labeling, caters to a wide spectrum of client needs. Competition is intensifying with both established global players like DHL Supply Chain, Kuehne + Nagel, and DB Schenker, and regional logistics providers vying for market share. Future growth will depend on companies' ability to adapt to evolving customer expectations, embrace technological advancements, and navigate regulatory complexities.

ASEAN Warehousing and Distribution Industry Market Size (In Million)

The ASEAN market is segmented by service type (warehousing, distribution, value-added) and end-user industry (retail & e-commerce, automotive, pharmaceutical & healthcare, FMCG, manufacturing, electronics). The retail & e-commerce segment is expected to dominate, driven by the region's rapidly expanding digital economy. Geographical expansion within ASEAN remains a key strategic priority for companies, with significant opportunities in countries experiencing rapid economic growth and urbanization. Companies are increasingly focusing on developing sustainable logistics solutions to meet growing environmental concerns. The focus on improving supply chain resilience and efficiency post-pandemic also remains a crucial factor shaping the industry's trajectory. The industry's growth is poised to continue strongly over the forecast period, driven by robust economic growth in the region and the ongoing evolution of the logistics landscape.

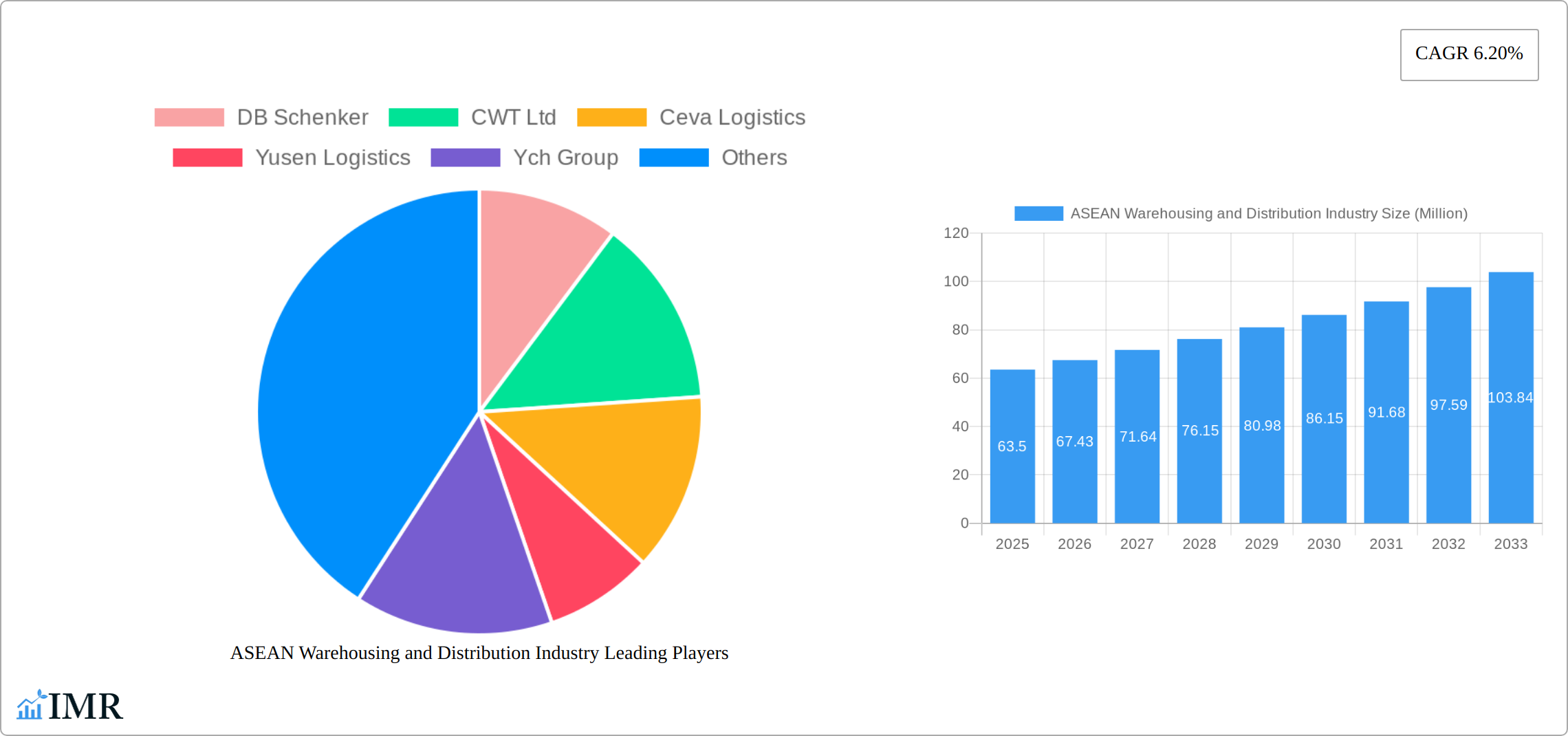

ASEAN Warehousing and Distribution Industry Company Market Share

ASEAN Warehousing and Distribution Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the ASEAN warehousing and distribution industry, covering market dynamics, growth trends, key players, and future opportunities. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for businesses operating in or planning to enter this rapidly evolving market.

ASEAN Warehousing and Distribution Industry Market Dynamics & Structure

The ASEAN warehousing and distribution market is experiencing significant growth driven by the rise of e-commerce, expanding manufacturing sectors, and improving infrastructure. Market concentration is moderate, with both large multinational corporations and smaller regional players competing. Technological advancements, such as automation and AI-powered solutions, are transforming operations, while regulatory frameworks vary across countries, impacting operational costs and efficiency. The industry is witnessing increased M&A activity, as highlighted by recent acquisitions like Maersk's acquisition of LF Logistics and Geodis' acquisition of Keppel Logistics. Substitute products are limited, primarily focusing on alternative transportation methods. End-user demographics are diverse, reflecting the varied economic landscapes across the region.

- Market Concentration: Moderate, with a mix of large multinationals and regional players. xx% market share held by top 5 players in 2024.

- Technological Innovation: Strong driver, with increasing adoption of automation, AI, and IoT solutions. Barriers include high initial investment costs and a skills gap.

- Regulatory Framework: Varies significantly across ASEAN countries, impacting compliance costs and operational efficiency.

- M&A Activity: Significant increase in recent years, driven by consolidation and expansion strategies. xx M&A deals recorded between 2019 and 2024, valued at xx Million units.

- End-User Demographics: Diverse, reflecting the varied economic development levels across the ASEAN region.

ASEAN Warehousing and Distribution Industry Growth Trends & Insights

The ASEAN warehousing and distribution market is experiencing robust growth, driven by several factors. The burgeoning e-commerce sector significantly boosts demand for warehousing and distribution services. Furthermore, the expansion of manufacturing activities across the region, coupled with growing consumerism, fuels demand. Technological disruptions, such as the adoption of automation and advanced analytics, are streamlining operations and enhancing efficiency. Consumer behavior shifts toward online shopping and faster delivery expectations further drive market expansion. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration for modern warehousing solutions is estimated at xx% in 2025.

Dominant Regions, Countries, or Segments in ASEAN Warehousing and Distribution Industry

Singapore and Indonesia stand as pivotal markets within the ASEAN warehousing and distribution landscape, fueled by sustained economic momentum, the pervasive adoption of e-commerce, and highly developed logistical infrastructure. The Retail & E-commerce segment is the undisputed leader, projected to capture a substantial XX% of the total market value in 2025. This is closely followed by the robust demand from the FMCG (Fast-Moving Consumer Goods) and Manufacturing sectors. Within the service typology, Warehousing Services commands the largest share, signifying its foundational role in the industry.

-

Key Growth Catalysts:

- Robust Economic Expansion: The consistently high GDP growth rates across key ASEAN economies directly translate into an escalating demand for comprehensive logistics and distribution services.

- E-commerce Revolution: The unparalleled and rapid expansion of online retail platforms is a significant driver, dramatically increasing the need for efficient warehousing, last-mile delivery, and sophisticated inventory management.

- Manufacturing Sector Advancement: The thriving growth and increasing complexity of manufacturing operations across the region are fueling a parallel demand for specialized warehousing and integrated supply chain solutions.

- Proactive Government Support: Supportive government policies, strategic investments in national and regional infrastructure development, and initiatives aimed at streamlining trade processes are crucial enablers of market expansion.

-

Factors Underpinning Market Dominance:

- Economic Scale: Larger and more developed economies, such as Singapore and Indonesia, naturally possess larger and more sophisticated warehousing and distribution markets due to their overall economic output and consumption levels.

- Advanced Infrastructure: The presence of world-class ports, efficient road and rail networks, and modern warehousing facilities are critical for enabling seamless and cost-effective logistics operations.

- High E-commerce Penetration: The widespread adoption and increasing reliance on online shopping by consumers across the region directly boost the demand for warehousing space, fulfillment centers, and efficient distribution networks.

ASEAN Warehousing and Distribution Industry Product Landscape

The product and service landscape within the ASEAN warehousing and distribution industry is remarkably diverse, encompassing a comprehensive suite of offerings. This includes core services like Warehousing (including general, bonded, and temperature-controlled storage), efficient Distribution networks, and a growing array of essential Value-Added Services such as specialized packaging, precise labeling, intricate kitting, and sophisticated inventory management solutions. A significant trend shaping this landscape is the rapid integration of cutting-edge Technological Advancements. This includes the deployment of automated systems, advanced Warehouse Management Systems (WMS), and intelligent Transportation Management Systems (TMS), all contributing to enhanced operational efficiency, reduced errors, and optimized supply chain performance. Key differentiators and unique selling propositions emerging in the market include the provision of specialized services tailored for Temperature-Sensitive Goods (cold chain logistics) and the development of highly Customized Solutions designed to meet the unique operational demands of specific industry verticals.

Key Drivers, Barriers & Challenges in ASEAN Warehousing and Distribution Industry

Key Drivers: The rising e-commerce sector, expanding manufacturing base, and government initiatives promoting infrastructure development are primary drivers. Technological advancements such as automation and AI are also boosting efficiency and reducing costs.

Challenges: High infrastructure costs, varying regulatory frameworks across different ASEAN countries, and skills shortages hinder growth. Competition, especially from large multinational companies, also presents a significant challenge. Supply chain disruptions due to geopolitical events impact the industry's stability. The impact of these challenges is estimated to reduce the market growth by xx% annually.

Emerging Opportunities in ASEAN Warehousing and Distribution Industry

Significant untapped potential exists within the ASEAN warehousing and distribution sector, particularly in the expansion of Cold Chain Logistics. This is driven by the escalating demand for temperature-sensitive products, including pharmaceuticals, fresh produce, and specialized food items, across the region. Furthermore, the growing imperative for environmental responsibility presents substantial growth opportunities through the widespread adoption of Sustainable Practices within warehousing operations and distribution networks, such as energy-efficient designs, waste reduction initiatives, and the use of eco-friendly transportation. The development of highly specialized services for niche industries, such as fine chemicals, luxury goods, or oversized equipment, also represents a promising avenue. Additionally, the exploration and integration of emerging technologies like Robotics for automated picking and packing, and Drones for inventory checks or last-mile delivery in specific contexts, are poised to unlock entirely new operational efficiencies and service models.

Growth Accelerators in the ASEAN Warehousing and Distribution Industry Industry

The ASEAN warehousing and distribution industry is poised for accelerated growth propelled by several key factors. Foremost among these are continuous Technological Advancements, including the adoption of AI, IoT, and automation, which are revolutionizing operational efficiency and data analytics. Strategic Partnerships and Collaborations between established logistics providers and burgeoning e-commerce companies are crucial for building integrated and responsive supply chains. The strategic Expansion into Less-Developed Areas within ASEAN countries presents a substantial opportunity to tap into new markets and serve underserved populations. Moreover, robust Government Support for Infrastructure Development, including the enhancement of ports, roads, and digital connectivity, directly facilitates smoother and more cost-effective logistics. Favorable Trade Policies and regional economic integration initiatives further bolster cross-border movement of goods, acting as significant growth catalysts for the industry.

Key Players Shaping the ASEAN Warehousing and Distribution Industry Market

- DB Schenker

- CWT Ltd

- Ceva Logistics

- Yusen Logistics

- Ych Group

- Gemadept

- WHA Corporation

- Kuehne + Nagel

- Singapore Post

- Agility

- Kerry Logistics

- CJ Century Logistics

- Tiong Nam Logistics

- Keppel Logistics

- DHL Supply Chain

Notable Milestones in ASEAN Warehousing and Distribution Industry Sector

- August 2022: Maersk's acquisition of LF Logistics expands its warehouse network by 223 facilities, totaling 549 facilities across 9.5 million square meters.

- April 2022: Geodis' acquisition of Keppel Logistics expands its presence in Southeast Asia, adding over 200,000 square meters of warehouse space.

In-Depth ASEAN Warehousing and Distribution Industry Market Outlook

The ASEAN warehousing and distribution market is poised for continued robust growth, driven by sustained economic expansion, increasing e-commerce penetration, and technological advancements. Strategic partnerships, investments in infrastructure, and the adoption of innovative solutions will further shape the market's trajectory. The potential for growth remains significant, presenting numerous opportunities for both established and emerging players.

ASEAN Warehousing and Distribution Industry Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Malaysia

- 1.4. Vietnam

- 1.5. Indonesia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Indonesia

- 6. Philippines

- 7. Rest of ASEAN

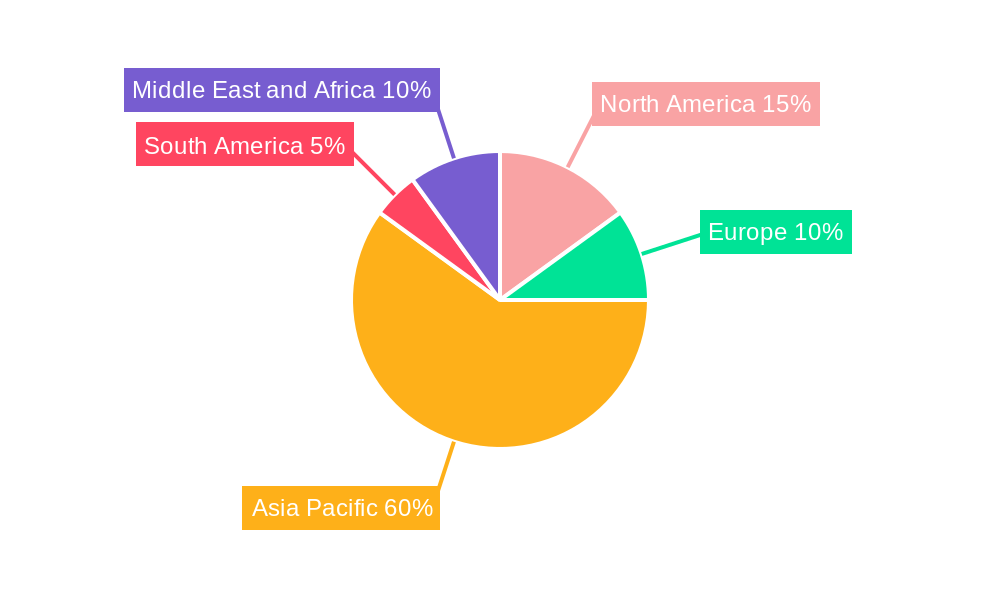

ASEAN Warehousing and Distribution Industry Regional Market Share

Geographic Coverage of ASEAN Warehousing and Distribution Industry

ASEAN Warehousing and Distribution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Cargo Restrictions

- 3.4. Market Trends

- 3.4.1. Increase in Warehousing Space in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Malaysia

- 5.1.4. Vietnam

- 5.1.5. Indonesia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Malaysia

- 5.2.4. Vietnam

- 5.2.5. Indonesia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Malaysia

- 6.1.4. Vietnam

- 6.1.5. Indonesia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Malaysia

- 7.1.4. Vietnam

- 7.1.5. Indonesia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Malaysia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Malaysia

- 8.1.4. Vietnam

- 8.1.5. Indonesia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Vietnam ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Malaysia

- 9.1.4. Vietnam

- 9.1.5. Indonesia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Indonesia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Malaysia

- 10.1.4. Vietnam

- 10.1.5. Indonesia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Malaysia

- 11.1.4. Vietnam

- 11.1.5. Indonesia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Malaysia

- 12.1.4. Vietnam

- 12.1.5. Indonesia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 DB Schenker

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CWT Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ceva Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Yusen Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ych Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gemadept

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 WHA Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kuehne + Nagel

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Singapore Post

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agility

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kerry Logistics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 CJ Century Logistics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Tiong Nam Logistics

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 DHL Supply Chain

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Warehousing and Distribution Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 15: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Warehousing and Distribution Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the ASEAN Warehousing and Distribution Industry?

Key companies in the market include DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, Ych Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, DHL Supply Chain.

3. What are the main segments of the ASEAN Warehousing and Distribution Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce.

6. What are the notable trends driving market growth?

Increase in Warehousing Space in Thailand.

7. Are there any restraints impacting market growth?

Cargo Restrictions.

8. Can you provide examples of recent developments in the market?

August 2022: A.P. Moller - Maersk (Maersk) announced the successful completion of its acquisition of LF Logistics, a logistics firm with premium capabilities in omnichannel fulfillment services, e-commerce, and inland shipping in the ASEAN region. Following the acquisition, Maersk will expand its warehouse network by adding 223 warehouses to its current network and increasing the total number of facilities, spread across 9.5 million square meters, to 549.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Warehousing and Distribution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Warehousing and Distribution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Warehousing and Distribution Industry?

To stay informed about further developments, trends, and reports in the ASEAN Warehousing and Distribution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence