Key Insights

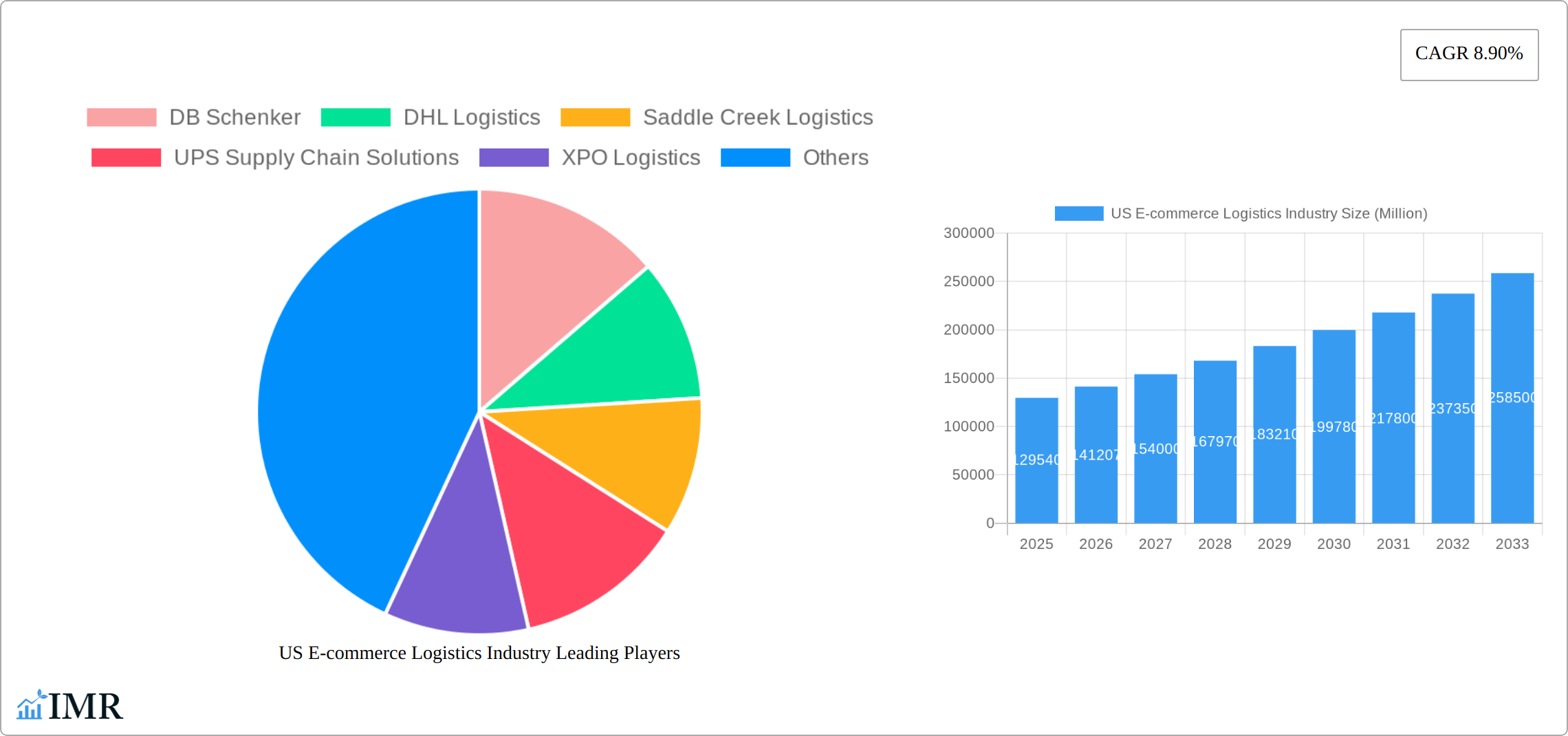

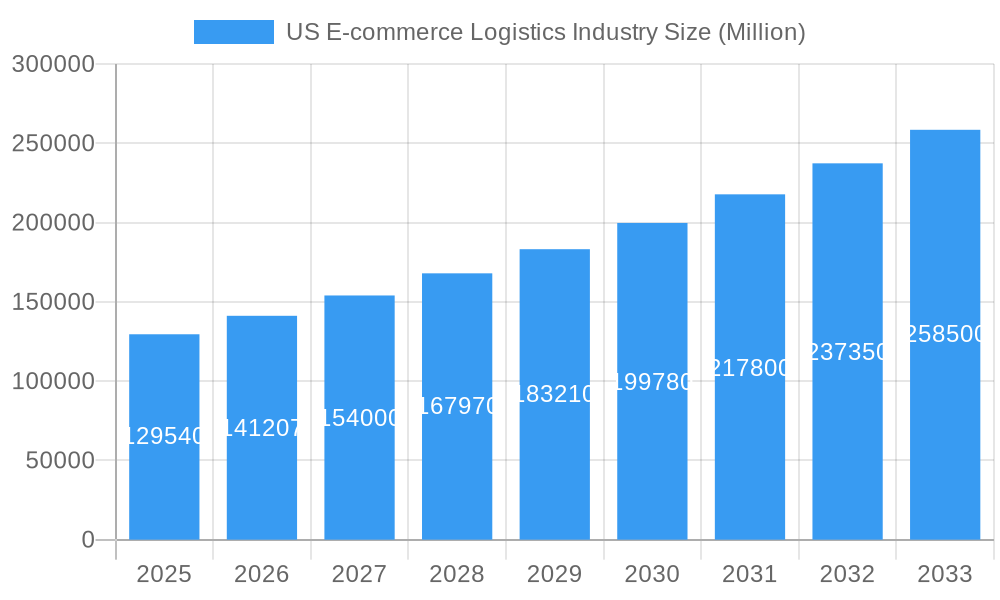

The US e-commerce logistics industry is experiencing robust growth, projected to reach a market size of $129.54 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 8.90% from 2025 to 2033. This expansion is fueled by several key drivers. The surge in online shopping, particularly during and post-pandemic, continues to propel demand for efficient and reliable delivery services. Consumers increasingly expect faster shipping options, such as same-day or next-day delivery, pushing logistics providers to invest heavily in advanced technologies like automation, AI-powered route optimization, and sophisticated warehouse management systems. Furthermore, the growth of omnichannel retail strategies, where businesses integrate online and offline sales, necessitates robust logistics networks capable of handling complex fulfillment processes. The market segmentation reveals a diverse landscape, with significant contributions from B2C transactions, domestic deliveries, and products like fashion & apparel, consumer electronics, and home appliances. Competition is fierce, with major players like DHL, FedEx, UPS, and others vying for market share through strategic partnerships, technological innovation, and expanded service offerings. Challenges include the rising costs of fuel and labor, supply chain disruptions, and the need to adapt to evolving consumer expectations and regulatory changes. The industry's future hinges on its ability to enhance efficiency, improve sustainability practices, and leverage technological advancements to meet the ever-increasing demands of the rapidly growing e-commerce sector.

US E-commerce Logistics Industry Market Size (In Billion)

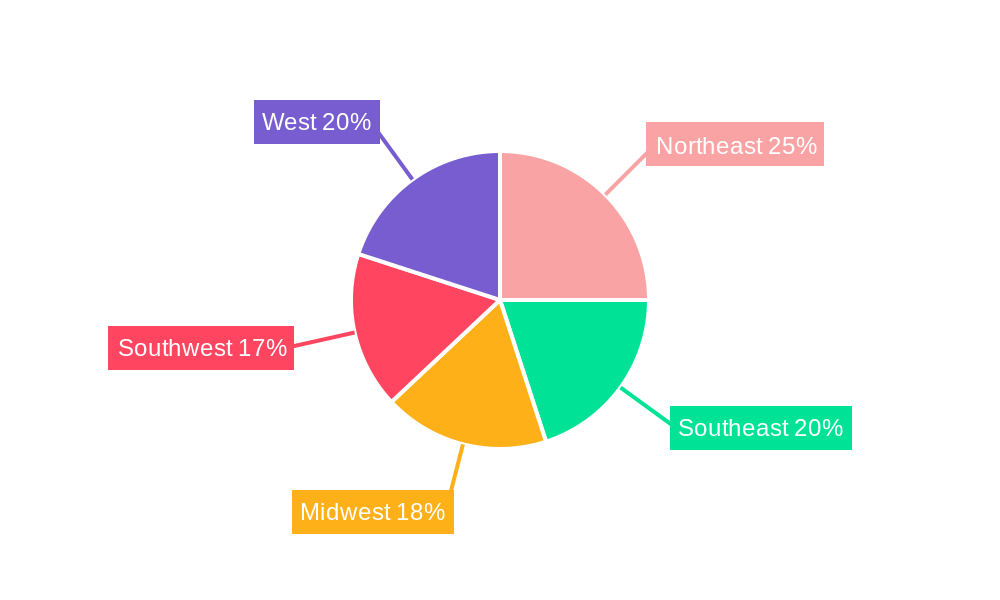

Growth within specific segments shows promise. While B2C dominates, the B2B segment is experiencing notable growth, driven by businesses shifting towards e-procurement and digital supply chain management. Within product categories, the demand for fast and reliable delivery for perishable goods (such as food products) and high-value items (consumer electronics, home appliances) is creating specialized niches within the industry. Regional variations also exist, with higher population density areas such as the Northeast and West Coast showing higher demand and potentially higher margins for logistics providers. Future expansion is likely to be spurred by further technological advancements such as drone delivery, autonomous vehicles, and improved last-mile delivery solutions. The industry must address challenges such as labor shortages, infrastructure limitations, and the environmental impact of deliveries to ensure sustainable, long-term growth.

US E-commerce Logistics Industry Company Market Share

US E-commerce Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US e-commerce logistics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by service (Transportation, Warehousing & Inventory Management, Value-added Services), business type (B2B, B2C), destination (Domestic, International/Cross-border), and product type (Fashion & Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty & Personal Care, Other Products). The report utilizes data in million units.

US E-commerce Logistics Industry Market Dynamics & Structure

The US e-commerce logistics market is a dynamic and intensely competitive landscape, significantly shaped by relentless technological innovation, an evolving regulatory framework, and shifting consumer expectations. While moderate market concentration exists, with dominant players continuously vying for supremacy, a vibrant ecosystem of specialized providers caters to niche demands. The pervasive influence of automation, artificial intelligence (AI), and sophisticated data analytics is revolutionizing operational efficiency, optimizing complex supply chains, and enabling unprecedented levels of precision in forecasting and resource allocation. However, substantial upfront capital investments and the complexities of integrating new technologies present considerable barriers to entry for emerging businesses. The regulatory environment, encompassing labor laws, environmental mandates, and data privacy concerns, plays a crucial role in dictating operational strategies and influencing overall cost structures. Furthermore, the rise of direct-to-consumer (DTC) models and other agile fulfillment strategies presents a continuous competitive challenge to established logistics providers, necessitating constant adaptation and innovation.

- Market Concentration: Moderate, with top 10 players projected to hold approximately 65-75% market share in 2025 (estimated). This indicates a significant, but not fully consolidated, market dominated by a few key entities.

- M&A Activity: Over 50 significant merger and acquisition deals have been recorded in the last 5 years. These transactions are predominantly driven by strategic imperatives such as expanding service portfolios into new e-commerce segments (e.g., cold chain, reverse logistics) and achieving broader geographical coverage across the US.

- Technological Innovation: Substantial investments are being channeled into cutting-edge automation, including advanced robotics for warehousing, AI-powered route optimization for enhanced delivery efficiency, and sophisticated data analytics for predictive modeling of demand and inventory. A growing emphasis is also placed on green logistics initiatives to reduce environmental impact.

- Regulatory Framework: The industry is increasingly influenced by stringent regulations pertaining to data privacy (e.g., CCPA), evolving labor practices (e.g., gig economy worker classification), and ambitious environmental sustainability standards. These factors directly impact operational costs, supply chain design, and strategic decision-making.

- End-User Demographics: The sustained growth is propelled by the ever-increasing e-commerce penetration across a wide spectrum of demographics. Millennial and Gen Z consumers, characterized by their digital-native habits and preference for convenience, are particularly influential drivers of this expansion.

US E-commerce Logistics Industry Growth Trends & Insights

The US e-commerce logistics market has experienced significant growth over the past few years, driven by the explosive expansion of online retail. The market size is estimated at xx million units in 2025 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising consumer demand, increasing adoption of e-commerce across various product categories, and the ongoing shift towards omnichannel retail strategies. Technological disruptions, including the rise of last-mile delivery solutions, autonomous vehicles, and drone delivery, are reshaping the landscape and optimizing supply chain efficiency. Consumer behavior shifts, such as increased preference for faster delivery options and personalized experiences, are driving innovation and investment in logistics technologies.

Dominant Regions, Countries, or Segments in US E-commerce Logistics Industry

The US e-commerce logistics market exhibits considerable regional disparities in growth and demand. Densely populated metropolitan areas and major urban centers consistently demonstrate the highest demand for logistics services due to their concentrated consumer bases and robust retail ecosystems. California, Texas, and the New York metropolitan area stand out as leading regional markets, consistently driving a significant portion of the overall market activity.

By Service: Warehousing and inventory management currently commands the largest market share, a testament to the critical need for efficient storage, fulfillment, and stock control in the e-commerce era. This is closely followed by transportation services, which are vital for timely delivery, and value-added services that enhance customer experience. The escalating demand for sophisticated inventory management solutions and increasingly rapid delivery options are the primary catalysts for segment growth.

By Business: The Business-to-Consumer (B2C) segment remains the dominant force, directly mirroring the explosive growth of online retail catering to individual consumers. Concurrently, the Business-to-Business (B2B) logistics sector is experiencing robust expansion, fueled by the widespread adoption of e-procurement platforms and the proliferation of digital marketplaces for business transactions.

By Destination: Domestic logistics constitutes the overwhelming majority of the market share, reflecting the immense size and geographical diversity of the US market. However, the burgeoning growth of cross-border e-commerce is steadily driving significant expansion and investment within the international logistics segment, connecting US businesses with global consumers and vice versa.

By Product: Fashion and Apparel, Consumer Electronics, and Home Appliances consistently emerge as the leading product categories driving e-commerce logistics demand. This is attributed to inherent consumer preferences for purchasing these items online and their general suitability for e-commerce fulfillment and transportation.

- Key Drivers: The continued surge in overall e-commerce sales remains the paramount driver. This is complemented by substantial investments in logistics infrastructure development, the ongoing integration of advanced technological solutions, and supportive government initiatives aimed at fostering digital commerce and supply chain modernization.

US E-commerce Logistics Industry Product Landscape

The US e-commerce logistics industry offers a comprehensive suite of solutions designed to meet the intricate demands of online retail. This includes traditional, robust transportation services, sophisticated Warehouse Management Systems (WMS) that optimize inventory flow and order fulfillment, and a growing array of value-added services. These value-added offerings often encompass customized packaging, intricate kitting, specialized labeling, and product personalization, all aimed at enhancing the customer unboxing experience and streamlining operations. Technological advancements are at the forefront of innovation, with the deep integration of AI and machine learning for dynamic route optimization, predictive analytics for highly accurate demand forecasting, and the deployment of automated sorting systems that significantly boost efficiency and delivery speed. The unique selling propositions that distinguish providers in this competitive market frequently revolve around speed of delivery, unwavering reliability, transparent traceability throughout the supply chain, and a growing commitment to sustainability, all of which are critical customer expectations in today's e-commerce environment.

Key Drivers, Barriers & Challenges in US E-commerce Logistics Industry

Key Drivers: The rapid growth of e-commerce, increasing consumer demand for faster and more convenient delivery, technological advancements in automation and data analytics, and government initiatives supporting infrastructure development are key drivers of growth.

Key Challenges: Rising labor costs, increased fuel prices, supply chain disruptions, intense competition, and evolving regulatory requirements present challenges. For instance, labor shortages in certain regions can negatively impact delivery times and operational efficiency.

Emerging Opportunities in US E-commerce Logistics Industry

The US e-commerce logistics sector is ripe with emerging opportunities. A significant area of growth lies in the expansion of last-mile delivery solutions, driven by strategic partnerships with micro-fulfillment centers to reduce delivery times and costs, and the innovative integration of autonomous delivery vehicles for increased efficiency and reduced labor dependency. The burgeoning trend of omnichannel logistics, seamlessly integrating online and physical retail experiences, presents substantial opportunities for flexible and responsive fulfillment networks. Furthermore, there is a rapidly escalating demand for sustainable and environmentally friendly logistics solutions, encouraging the adoption of electric vehicles, optimized routing to minimize emissions, and eco-conscious packaging. Untapped markets also represent significant potential, including the development of robust logistics infrastructure for underserved rural areas and the creation of specialized logistics solutions tailored for niche product categories that require unique handling or fulfillment requirements.

Growth Accelerators in the US E-commerce Logistics Industry Industry

Technological breakthroughs in automation, AI, and data analytics are accelerating market growth, leading to improved efficiency, reduced costs, and enhanced customer experience. Strategic partnerships among logistics providers, retailers, and technology companies are creating synergistic opportunities and driving innovation. Expansion into underserved markets and the integration of sustainable practices are also significant growth catalysts.

Key Players Shaping the US E-commerce Logistics Industry Market

- DB Schenker

- DHL Logistics

- Saddle Creek Logistics

- UPS Supply Chain Solutions

- XPO Logistics

- Rakuten Super Logistics

- FedEx

- Geodis Logistics

- Kenco Logistics Services

- Kuehne and Nagel Logistics

Notable Milestones in US E-commerce Logistics Industry Sector

- August 2023: DHL eCommerce opens a new 352,000 sq ft distribution center in Melrose Park, Illinois, equipped with an automated sorter capable of handling 40,000 parcels per hour. This reflects a significant investment in capacity expansion and automation.

- April 2023: DHL Express launches GoGreen Plus, expanding sustainable shipping options for US SMEs. This highlights the growing importance of environmental sustainability in the industry.

In-Depth US E-commerce Logistics Industry Market Outlook

The US e-commerce logistics market is poised for continued robust growth, driven by ongoing technological innovation, increasing e-commerce penetration, and the evolving needs of consumers. Strategic opportunities exist for companies that can offer innovative solutions, such as last-mile delivery optimization, sustainable logistics services, and integrated technology platforms. The market’s future success hinges on adapting to changing consumer preferences and maintaining agility in the face of evolving market dynamics.

US E-commerce Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory management

- 1.3. Value-added services (Labeling, Packaging, etc)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

US E-commerce Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US E-commerce Logistics Industry Regional Market Share

Geographic Coverage of US E-commerce Logistics Industry

US E-commerce Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Cross Border Logistics; Upgrade e-commerce with new supply chain technology

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Warehousing and Inventory management

- 3.4. Market Trends

- 3.4.1. Upgrade e-commerce with new supply chain technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory management

- 5.1.3. Value-added services (Labeling, Packaging, etc)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Inventory management

- 6.1.3. Value-added services (Labeling, Packaging, etc)

- 6.2. Market Analysis, Insights and Forecast - by Business

- 6.2.1. B2B

- 6.2.2. B2C

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International/cross-border

- 6.4. Market Analysis, Insights and Forecast - by Product

- 6.4.1. Fashion and Apparel

- 6.4.2. Consumer Electronics

- 6.4.3. Home Appliances

- 6.4.4. Furniture

- 6.4.5. Beauty and Personal Care Products

- 6.4.6. Other Products (Toys, Food Products, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Inventory management

- 7.1.3. Value-added services (Labeling, Packaging, etc)

- 7.2. Market Analysis, Insights and Forecast - by Business

- 7.2.1. B2B

- 7.2.2. B2C

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International/cross-border

- 7.4. Market Analysis, Insights and Forecast - by Product

- 7.4.1. Fashion and Apparel

- 7.4.2. Consumer Electronics

- 7.4.3. Home Appliances

- 7.4.4. Furniture

- 7.4.5. Beauty and Personal Care Products

- 7.4.6. Other Products (Toys, Food Products, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Inventory management

- 8.1.3. Value-added services (Labeling, Packaging, etc)

- 8.2. Market Analysis, Insights and Forecast - by Business

- 8.2.1. B2B

- 8.2.2. B2C

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International/cross-border

- 8.4. Market Analysis, Insights and Forecast - by Product

- 8.4.1. Fashion and Apparel

- 8.4.2. Consumer Electronics

- 8.4.3. Home Appliances

- 8.4.4. Furniture

- 8.4.5. Beauty and Personal Care Products

- 8.4.6. Other Products (Toys, Food Products, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Inventory management

- 9.1.3. Value-added services (Labeling, Packaging, etc)

- 9.2. Market Analysis, Insights and Forecast - by Business

- 9.2.1. B2B

- 9.2.2. B2C

- 9.3. Market Analysis, Insights and Forecast - by Destination

- 9.3.1. Domestic

- 9.3.2. International/cross-border

- 9.4. Market Analysis, Insights and Forecast - by Product

- 9.4.1. Fashion and Apparel

- 9.4.2. Consumer Electronics

- 9.4.3. Home Appliances

- 9.4.4. Furniture

- 9.4.5. Beauty and Personal Care Products

- 9.4.6. Other Products (Toys, Food Products, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Inventory management

- 10.1.3. Value-added services (Labeling, Packaging, etc)

- 10.2. Market Analysis, Insights and Forecast - by Business

- 10.2.1. B2B

- 10.2.2. B2C

- 10.3. Market Analysis, Insights and Forecast - by Destination

- 10.3.1. Domestic

- 10.3.2. International/cross-border

- 10.4. Market Analysis, Insights and Forecast - by Product

- 10.4.1. Fashion and Apparel

- 10.4.2. Consumer Electronics

- 10.4.3. Home Appliances

- 10.4.4. Furniture

- 10.4.5. Beauty and Personal Care Products

- 10.4.6. Other Products (Toys, Food Products, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saddle Creek Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UPS Supply Chain Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XPO Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rakuten Super Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Geodis Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kenco Logistics Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kuehne and Nagel Logistics**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global US E-commerce Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 5: North America US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 6: North America US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 7: North America US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 8: North America US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 9: North America US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 13: South America US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 15: South America US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 16: South America US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 17: South America US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 19: South America US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: South America US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Europe US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Europe US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 25: Europe US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 26: Europe US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 27: Europe US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 28: Europe US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 29: Europe US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Europe US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 33: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 34: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 35: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 36: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 37: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 39: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 40: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 43: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 44: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 45: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 46: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 47: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 48: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 49: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 50: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global US E-commerce Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 16: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 17: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 23: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 24: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 25: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 37: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 38: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 39: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 48: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 49: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 50: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 51: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US E-commerce Logistics Industry?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the US E-commerce Logistics Industry?

Key companies in the market include DB Schenker, DHL Logistics, Saddle Creek Logistics, UPS Supply Chain Solutions, XPO Logistics, Rakuten Super Logistics, FedEx, Geodis Logistics, Kenco Logistics Services, Kuehne and Nagel Logistics**List Not Exhaustive.

3. What are the main segments of the US E-commerce Logistics Industry?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 129.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Cross Border Logistics; Upgrade e-commerce with new supply chain technology.

6. What are the notable trends driving market growth?

Upgrade e-commerce with new supply chain technology.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Warehousing and Inventory management.

8. Can you provide examples of recent developments in the market?

August 2023: A new distribution center has been opened by DHL eCommerce as part of its five-year strategic growth plan. The new facility, located in the city of Melrose Park in Illinois, encompasses a total area of 352,000 square feet. In addition to capacity enhancement, the facility is equipped with an Automated Honeywell Cross-belt Loop Sorter, which is capable of handling up to forty thousand parcels and packages an hour. As part of the logistics provider's recent expansion, 11 warehouses have been constructed or relocated, and seven more are expected to be finished at some point in the near future, as reported by the sources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US E-commerce Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US E-commerce Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US E-commerce Logistics Industry?

To stay informed about further developments, trends, and reports in the US E-commerce Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence